Table of Contents

You must evaluate the market and execute an effective trading plan to become a profitable trader. So, where do you begin? How do you place your goals to the test before risking actual cash? Well, trading simulators serve this purpose.

The trick to profitability is practice if you’ve been trading forex, stocks, commodities, or cryptocurrency. A forex exchange or equity markets simulation is perfect for practicing financial trading markets. Users can also sign up to test free Forex simulator software! Just choose the proper simulator application, learn how and when to use the trading application, assess your forex plan, and enjoy trading!

Free Forex Simulator Software Download

Free Forex simulator can be downloaded below, and visit the Njnjatrader external website.

Free forex simulator download (external link to Njinjatrader website)

We’ve always learned that repetition improves and mastering talent takes thousands of hours. Buying and selling are no exception, and the amount of time a dealer spends separates forex novices from experienced traders. That emphasizes the importance of experience over conceptual expertise. The encouraging sentiment is that you’re there with the help of an online financial markets simulator.

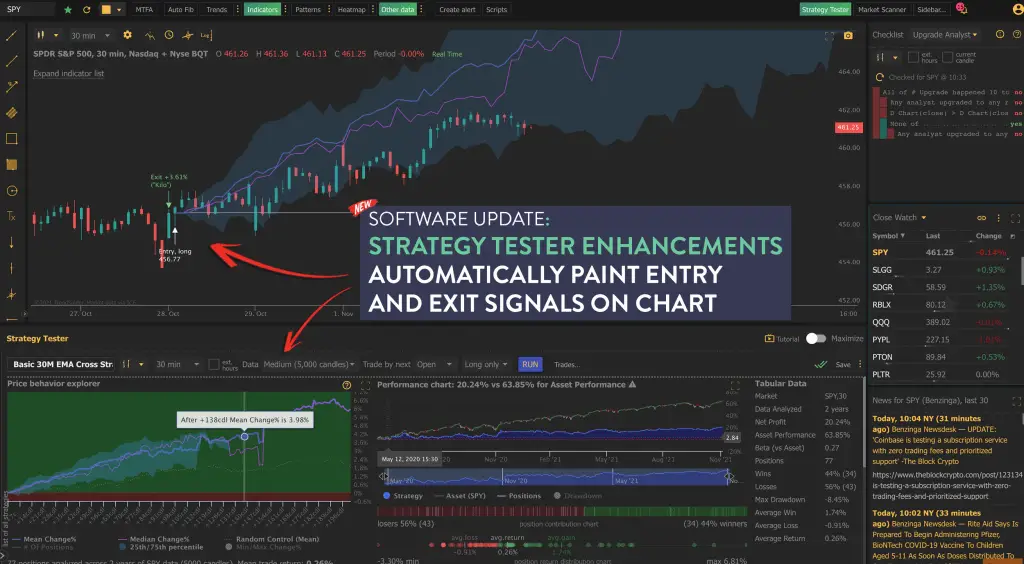

TrendSpider Forex Simulator and Strategy Testing Platform

TrendSpider represents an online platform for backtesting, chart analysis, strategy development, and fundamental and technical analysis that uses machine learning algorithms to detect trends. In the Trendspider platform review, we detect excellent visual chart presentations that traders can use to increase trading efficiency.

MetaTrader Strategy Tester

Users wouldn’t like to waste money when obtaining the practice they need. Using simulation tools on a trial account ensures they gain experience without losing their hard-earned cash. Next, we’ll examine what a trading simulator is, some advantages of using a forex exchange and virtual stock market simulator, an overview of the various simulation software, how to pick the proper simulator application, and more in the post.

How Does a Forex Trading Simulator Work?

A foreign exchange or share market simulator is a program that “imitates” real-world market trends. Investors may use simulated money to exchange and refine their techniques before putting their talents to testing on the live platform.

Such simulation models use a basic algorithm to simulate more comprehensive market action. In addition, some exchange networks use real-time market information to have a more accurate experience in this field. Even if both could be helpful, the latter is even more so.

The following are some of the most significant characteristics of Foreign exchange simulation software:

- Price updates, including the live simulator.

- A risk-free investment on a demo trading account.

- Certain trade functionalities are included.

- The freedom to put every Forex plan to the examination.

- Most financial sector simulators have a simulated balance of 5,000 to 100,000 euros. Investors will then swap stocks, bonds, forex, indexes, commodities, and cryptos on various financial exchanges.

- Share market simulation models (stocks), Foreign exchange simulation models (Forex), binary trading simulators (binary options), etc., are all examples of simulation software named just after the tool they enable you to transact.

Many businesses can call their simulation software after the system that they use.

- Simulator for iPhone Trading

- Trading Simulator for PC

- MAC trading simulation

- Android Trading Simulation

- iPad trading emulation

As a result, instead of relying on the title, any trading simulator’s features should be prioritized.

Each trading simulation model should have the same features as a real brokerage account, such as access, alter, and exit trades. In addition, it covers premiums, spreads, derivatives, and other payments paid on a real account. Since share market commissions can significantly impact your profit margin, using them in every free trade modeling portfolio is essential.

Simulation Software Platforms vs. Trading Simulation Software

It can be tough to realize what you’ve been joined up for with several brands flying everywhere. Mixing up demo accounts and trade simulators with actual simulation platforms is possible.

Below is a short rundown of the distinctions:

- Trial accounts become essential if you want to start trading in current markets and want to test your new skills or tactics. However, because business dynamics are continually changing, even though the plan succeeds in a demo mode, it would not promise to achieve in a real account.

- Trading simulators mimic the experiences of many other traders. A user aims to learn from dealers as they progress through the diverse scales and obstacles that every different level presents.

The Strengths and Drawbacks of Trade Simulators

Understanding the positives and negatives of having a trading simulator is critical before looking for the right one in the marketplace. What are all the benefits and drawbacks of using a stock exchange or forex simulator?

The following are just several of the benefits:

- One may understand how and when to utilize a trading platform to prevent typical blunders like accidentally putting trades.

- When using a sample brokerage account, one can try trading ideas without losing cash; people don’t lose anything whenever a tactic fails. If something succeeds, you’ve got yourself a live trading strategy.

- Using an actual stock market simulator, one can achieve an incredible view of the financial system and the tools they choose to participate.

Before entrusting your hard-earned capital to an electronic machine, one should use a stock market and a forex market simulator for free to check electronic trading tools.

The biggest drawback with using a free forex simulator software or free forex simulator for MT4 is that it may not replace real-world trading practice. There are a whole number of considerations that can affect the investing choices while dealing with actual cash:

- Risk and financial planning strategies

- The initial funding

- Your investor profile and risk tolerance

- The horizon of investment

- The country’s taxation

As a result, traders, particularly new traders, make decisions distinct from what they might make if they were trading fundamental markets. For instance, we discovered that traders take excessive chances to achieve the best results and hold the title in free trading competitions.

Share market simulators and the trial account could be used to research trading strategies and new techniques, not just for this reason.

How do you pick the most suitable forex simulator?

When you’re about to learn forex trading or even the equity markets with a trading simulation model, remember a few points while selecting the right simulator app for yourself.

- Is the Application Accurate in Simulating the Real-world Business Environment?

To understand how and when to exchange forex and shares digitally, you need a website that gives you market information to monitor market volatility.

Users could see how often trading options exist for live results, and if you’re a day trader, you may know how much of a difference keeping a position open for an additional day or two creates. On the other hand, if you’re just a scalper, you see how a couple of hours and even minutes can cause a problem.

Users can sometimes see how a deal would have done in some real account if they had used a Foreign exchange or stock market simulation since the price fluctuations in the simulator are similar to that in the market – only one distinction is that they will be interacting with digital cash.

The best strategy to promote and improve transact is to trade live market results. If you don’t, the trading choices will not be focused on how well the live market reacts, and you’ll spend a lot of time training without developing the Currency trading capabilities.

Notice that this app aims to get you ready to make cash; therefore, the best trading simulators include actual market data.

- Is There a Deposit Sum that can be Adjusted in the Simulation Model?

Digital deposits from EUR 5,000 to EUR 100,000 are available in several free trading simulation software. Though this could seem to be a fantastic way to have a lot more trading experience, the fact is also that you won’t be replicating actual trading environments until you intend to invest those funds in a real account.

Remember this: if you already have EUR 100,000 on a trial account, you will earn many bad trades and still have plenty of simulated cash left over to experiment with. Unless you start a live account with an investment of EUR 1,000, you need to treat the money more wisely so you have nothing to fear.

Regrettably, since you were learning, albeit on a larger initial deposit, you may not have learned risk mitigation, financial planning, or investing techniques suitable for your current limited balance in the real account.

This is why, if you continue dealing in a real account, you can start virtual trading with only a balance similar to your initial planned deposit. So, for example, if you’d like to deal with EUR 10,000, you’ll also need to begin with a simulated cap of EUR 10,000.

- What Functionality and Resources are Provided with the Simulator Software?

Several stocks and foreign exchange trading simulation models are available, each with many characteristics and compatibility. Unfortunately, when you stick to some of the most limited or common platforms, you eventually need to update due to missed functionality.

It is preferable to select the more sophisticated and comprehensive platform to lay a solid basis for potential trading, to put it another way. Don’t waste your time with binary traders simulation software that offers fast money.

That’s why, throughout the long run, beginning with a more advanced platform such as MetaTrader Supreme Edition may save you energy. You’ll need a specialized online brokerage account to be an intraday foreign exchange trader. But if you’re a long-term investor who does not require a thorough daily review, you will choose the highly open platform.

Nonetheless, the primary platform should still give you many currency prices and other needed features for long-term investment returns.

While analyzing stock market simulation software, manually validate the investment strategy using historical data, which is recognized as backtesting.

An advantage of this strategy is that you can identify particular market incidents to evaluate trading techniques instead of scrambling for a similar occurrence and wasting precious practice time.

Just try searching for standard techniques and putting those to the test. You’ll not know how successful these techniques are unless you put them to the test.

- Does a Credible Broker offer the Forex Live Simulator?

Virtual traders offer stock market simulators or trading simulation tools. Also, as a consequence, it’s vital to ensure that the brokerage you chose is credible because that will be your channel of choice after you’ve acquired more exposure on a trial account.

Virtual brokers come in various channels, instruments, trade prices, and customer service.

While selecting a broker, weigh the following factors:

- Have they got any regulatory authority involved?

- What other kinds of tools do they have available? Is it only about foreign exchange? Is it all securities? Or perhaps a combination of the two?

- Can they keep client funds separate?

- Do they have a trading site and techniques?

- Will they have customer support in your area? What is the easiest way to get in touch with them?

- How much does it cost to trade?

Forex Simulator Review– Which Trading Simulation Model is the Best?

You may be thinking more about the trading simulation we advised now that you understand what an FX trading simulator seems to be, the advantages of that, or what to aim toward.

The MT trading platform, a specialized forex paper trading software, has been among the most powerful trading simulation software. It has been the most widely traded site on the web. It has a comprehensive support network and the most extra digital Forex or CFD trading features. It makes it the perfect choice for anyone who wishes to begin trading digitally on a free trading simulator.

MetaTrader’s trail user’s account features usually involve:

- Via a centralized website, you can trade loads of global financial markets, like forex, bonds, benchmarks, assets, cryptos, etc.

- One can sell long, indicating you believe the value of an asset would rise, and in short contexting, you accept the value of an investment would fall, meaning you assume that the value of an asset would reduce.

- Since MetaTrader is among the most widely used websites, many assistance services are online, like forums and an online trading resource marketplace.

- Micro lots are accessible for several instruments, allowing you to make small trades while studying the basics.

- The graphs are filled with market info, including prices, personalized metrics, notes, trendlines, etc.

- The MT platform helps one perform one-click trades like scalping for short periods.

- Over Fifty technical metrics are included in the unified platform for in-depth research.

- Trading Central provides specialized technical research software and integrated trading concepts.

- A comprehensive indicator kit of over Sixteen measures to help clients improve their trading.

- Interactive global perception widget to assist clients in determining market volatility.

- Widgets for Mini Terminals and Exchange Terminals to make trade management more accessible than ever.

- Tick Chart Trader allows clients to monitor their chart moves and select the optimal entry or exit points.

- Real-time stock news means that customers do not lose any investment opportunities.

- A market simulator allows clients to experiment with innovative trading techniques.

- Mini graphs allow clients to display several timescales and chart formats at once.

Where can you get the MT4 or MT5 simulators for free?

Use the MetaTrader 4 Supreme (external link to admiral markets broker) forex simulator or forex simulator mt5, accessible with Mt4 and MT5.

The measures are as follows:

- First, sign up for a free trial account.

- Then, review your inbox for information about your brokerage account.

- Update the MetaTrader brokerage account on the computer; we suggest the forex simulator MT5 for a broader number of financial marketplaces.

- Access MetaTrader and insert the trial market account information from your inbox on your device.

You can now begin trading via virtual resources in the simulation model!

Where do I Get a Copy of the MetaTrader Supreme Version?

Although a MetaTrader preview platform seems to be all you want to get started with trading simulations, MT Supreme Version (MetaTrader 4 Supreme (external link to admiral markets broker)) has extra valuable functionality for more sophisticated computer models.

Take these measures to install and update the MT Supreme Version:

- Shut MetaTrader if it is already active on the screen.

- Get software.

- Open the installation file and run it.

- Access MetaTrader and search for the specialized functionality under Metrics and Specialist Advisors in the Navigator browser.

Forex Trade Simulation Software: the Step-by-step Tutorial

The trading technique tester, which helps compare financial products against price history records, is one of two valuable Forex & stock market simulation software included in MT Supreme Version. At the same time, the very day trading simulation is required to assess day trading techniques.

The most refined CFD model for simulated markets is the strategy tester in the MT Supreme version. You would use it to assess portfolio and Foreign exchange trading techniques in the following ways:

- After activating the MTSE application, press Ctrl+R and the link to get started.

- Depending on the technique you choose to try, pick your favorite model.

- Choose your desired period and double-check if you have adequate statistical evidence. Begin with three years of observation for a regular graph approach. Six to twelve months of information would suffice for many intraday tactics.

- Change your initial deposit to reflect the amount you want in the live account.

- When you’re ready, press the Start icon.

- You can apply the following settings for quality as well as speed.

| Visual Mode: | Check it |

| Model: | For open rate or tick |

| Spread: | Current |

| Period: | You are supposed to choose a period for your strategy |

- The process of visual backtesting can be sped up or slowed down using the slider a little after the visual mode selection.

- If you’re backtesting your Currency plan using the Every Tick system, please remember that it could take some time.

- It is precise but still the slowest to use.

- Backtest, backtest, backtest – before you find configurations that are lucrative.

- When you’ve completed the visual backtest, go to the ‘Results’ or ‘Report section to see the performance. The Master Candle strategy yielded a 6.72 percent Return On Investment (ROI) mainly during the testing phase; fantastic.

You can post or print the findings when you’ve completed your testing.

What is the Simulation System for Day Trading?

By tapping the chart, we can position market and pending orders, establish trailing stops, change the stop loss, take gain on orders, save intricate order concepts as prototypes, shut all open orders quickly, and reach several other features unavailable in MT4.

The day trading simulation model can run via the bar’s prices bar after picking the historical details and manually halting it to position a transaction. Also, this would total specific trades inside a Profit and Loss statement after a time cycle. Once you download a free forex trading simulator, follow the steps below.

This is how it’s done:

- Launch MT4.

- Press on the icon/press Ctrl+R to start the strategy tester.

- Select a trading product and period.

- If you’re unsure which testing model to implement, consistently implement Open Prices. With sufficient experience, users can get other modes as well.

- Then, pick your desired time frame, ensuring sufficient historical information.

- Change the preliminary account balance shown in the EA settings to fit the real account and make the simulator appear realistic. Then, go to the Expert Properties and the Testing page inside the simulation screen.

- Use the following adjustments to confirm that the day trading simulator runs quickly.

| Visual Mode: | Check it |

| Model: | For open rate or tick |

| Spread: | Current |

| Period: | You are supposed to choose a period for your strategy |

- After this, perhaps you should experiment with various models, add metrics, or trade regularly to see how your plan succeeded. The opportunity to backtest the strategies over different periods is a considerable benefit of day trading simulation software.

- When you click the ‘Analyze’ key in the Mini Chart window, the daily trading simulator will help you deeply evaluate your investor sentiment.

Tools and Recommendations for the MTSE Test

Smart Lines

Intelligent Lines is a technique that uses line structures depicted on a Metatrader 4 graph as stop-loss and takes gain points for positions. There are three critical components to it:

- Stop-loss or gain profit) on the trend line.

- Some limited stops at various price points, such as partial shut at different prices.

- Stops that are timed, for example, shut all the open positions by evening.

- This same Smart Lines method can be utilized with a trading simulator to create manual trades that the simulation model can monitor.

- Look at the instructions below to build an intelligent line.

- On a graph, construct a vertical, horizontal, or trend axis.

- While pressing on the line, keep the Alt button down.

- Another window will be displayed, enabling you to select the line’s behavior.

The speed factor variable, which slows the simulator, seems to be another helpful feature in the MT Supreme Version. The model will take longer if the value is more significant. The slider beside the Visual Mode box, which has values ranging from 1 to 32, is the primary means of adjusting the simulator’s rate.

The following factors determine the slider’s impact:

- The device’s computing power.

- The number of metrics you use in the simulation model.

- For each virtual strip, how many ticks are there?

- The slider value 32 should be straightforward.

- The periods for values 28 to 31 would be 10 to 20 times quicker than in real life.

- Factors 20 to 27 would be 2 to 5 times faster than they are.

- Speeds shorter than ten would be similar to real-life speeds.

- Users can play around with the sliders and see what settings work better on the machine and how much they want to have the simulator function. The EA’s SpeedFactor attribute also allows you to tweak the speed of the simulation.

- The Value attribute in this Inputs section changes after pressing the Expert Properties button throughout the technique tester.

Trading Games and Online Trading Simulator

Apart from a trial account on a website such as MT, trade games can be a foreign exchange simulation.

Consider the following:

This market simulation model begins from $25,000, and therefore,e you can create a portfolio of over 60,000 securities and cryptos. A finance news feed is included as well.

It is an iOS and Android application that allows $1,000 virtually (‘Bux’) for online trading, especially on renowned firms such as Alphabet, Tesla, etc. In addition, the application provides real-time market statistics, and after you’ve tried the digital alternative, you may switch to a real account.

This application lets you control a digital portfolio or position real-time transactions using virtual currency.

The financial sector simulator includes a financial media stream and social platforms. The service is free, but specific data requires payment.

The stock & Forex Trading Game allows you to bet on international markets while betting against your mates. The game is geared toward newcomers through quiz questions and animations, and all trade simulations are conducted in actual environments.

Although Forex gaming can become a fantastic way to start trading, the best approach is with the tools you’ll have while trying to trade on a real account. The simplest form of doing that is to open a trial account, a Forex simulation software with a dealer providing live trading.

MetaTrader systems seem to be the most widely used Currency exchange services worldwide and are more innovative for digital currency markets. So, as a result, after using the free simulation software, you’re likely to persist in participating in a real MetaTrader account.

How Early Can You Trade on a Real Trading Account?

Although trading simulation models such as forex or stock trading provide a fantastic way to practice trading, it is best to avoid performing on too many demo services. What is the reasoning behind this? Since it’s far too tempting to use a trial account as a comfort blanket, preventing you from having actual trading expertise.

That’s one explanation: most marketers’ simulation models have an expiration date, usually 30 days just after a trial account is opened.

The first step in switching to a real account after selecting the forex simulator app would be to make a plan: what would you like to accomplish in the trial account before moving to a real account? One could aim for a market return of 3% in a month or a $5,000 gain for three consecutive months without any damages.

And, when you’re about to trade in a real account, do not fear losing. Losses are common among traders, especially at the start of the profession. However, you will better handle risks and possibly prevent them entirely if your risk management techniques are in place.

Several examples of investors struggled at one stage but made large profits later. For instance, Jesse Livermore gained fame after earning a wealth short selling stocks in 1929. He saw significant success and embarrassment throughout his business endeavors, declaring bankruptcy thrice and simultaneously appearing as a Wall Street legend after building a $100 million empire from risky trades.

It’s not like every investor’s tale is as gripping as Livermore’s. But If you’re afraid of losing, the Forex trading simulation software would aid you in gaining expertise and motivation. Gaining skill before trading forex safely is critical, hopefully not incurring losses. As stated in this blog, we could learn about financial markets and put what we learn into practice by trial trading accounts.

Conclusion

Dealing in a foreign exchange simulator is crucial not to be terrified of loss. Many traders, we’ve seen, open a trade and then open a new trial account to regenerate their original fund in case of losses. That’s not the way to act on a real account, so it indicates that you are still unwilling to face the possible risk that comes from trading.

Your purchasing decision should not be affected by using a free trade simulator. Instead, we always recommend that you trade as if in a real market.

Making a plan should be the next thing to think of. Yet, traders often consider making trades on a live account daunting since investing without a trading plan is dangerous and difficult. We hope our tips for progressing in the forex market will help you.

VISIT TRENDSPIDER