Table of Contents

FxPro is one of the oldest and most reputable forex brokers worldwide. This review will inform you about bonuses, low forex fees, free deposit and withdrawal options, trading assets, and tools.

What is FxPro?

FxPro is the leading online CFD broker, launched in 2006 and headquartered in the UK. It is a world-leading brand that offers forex, commodities, and equities CFDs worldwide.

The FxPro group owns, manages, and operates the company through subsidiaries worldwide.FxPro specializes in offering online trading services to financial markets twenty-four hours a day and five days a week.

Please watch my full FxPro review video:

A trader can trade with over 250 financial instruments across up to seven varieties of asset classes. FxPro is a full-service company with six members. They have excellent customer support service with connections and telephones to over twenty locations. This makes it easier for the traders associated with FxPro.

I gave a high rank to the FxPro broker in our best Forex brokers review.

The leverage ratio can be fixed at 1:1 as a minimum and increased to a maximum of about 1:500. You can read more about the fxpro leverage policy in the FxPro website section.

FxPro is offering a demo account for users to analyze whether FxPro is what they are looking for. Established in 2007, FxPro has its headquarters located in London, UK. If you want to trade with FxPro, you must open an account with at least $500. The least volume you can deal with FxPro is one micro lot, but you can leverage 500 times your deposited money. FxPro is multilingual and has many languages, such as German, Chinese, Japanese, English, Spanish, etc. Cysec, Asis, Mifid, and FSA have regulated FxPro for trading.

FxPro’s minimum deposit is $100 for all payment methods.

FxPro is approved and managed by the Financial Conduct Authority. The FCA is a non-legislative autonomous body yet has statutory forces by the UK’s Financial Services and the Markets Act of 2000. Additionally, FxPro is approved and managed by the Cyprus Securities and Exchange Commission and accomplished the “Speculators in People” Standard.

FxPro Regulation:

Is FxPro legit?

FxPro is a legit broker, and different authorities regulate the company in other jurisdictions. For instance, in the United Kingdom, the platform is regulated by the UK’s FCA (Financial Conduct Authority) and managed through FxPro UK Limited. FxPro is regulated by the Exchange Commission and Cyprus Securities (license number 078/07), the UK Financial Conduct Authority FCA (registration number 509956), the South Africa Financial Sector Conduct Authority (number 45052), and the Securities Commission of The Bahamas (SIA-F184).

The FSB (South Africa Financial Services Board) regulates and permits the company to operate in South Africa. In the Middle East, it operates under a subsidiary named FxPro Global Markets Limited.

FxPro UK headquarters is at HQ 13-14 Basinghall Str., London, EC2V 5BQ, United Kingdom.

FxPro Restricted Countries List

FxPro broker does not accept clients from the following countries:

- Afghanistan

- Bosnia and Herzegovina

- Myanmar

- Canada

- Cote d’Ivoire

- Cuba

- Democratic People’s Republic of Korea (DPRK) (North Korea)

- Congo

- Iran

- Iraq

- Liberia

- Libya

- Myanmar

- Northern Marianna Islands

- Palestine Occupied Territory

- Puerto Rico

- Somalia

- Sudan

- South Sudan

- Syria

- Tunisia

- Trinidad and Tobago

- Vanuatu

- Yemen

- Zimbabwe

- United States (USA)

FxPro Reliability

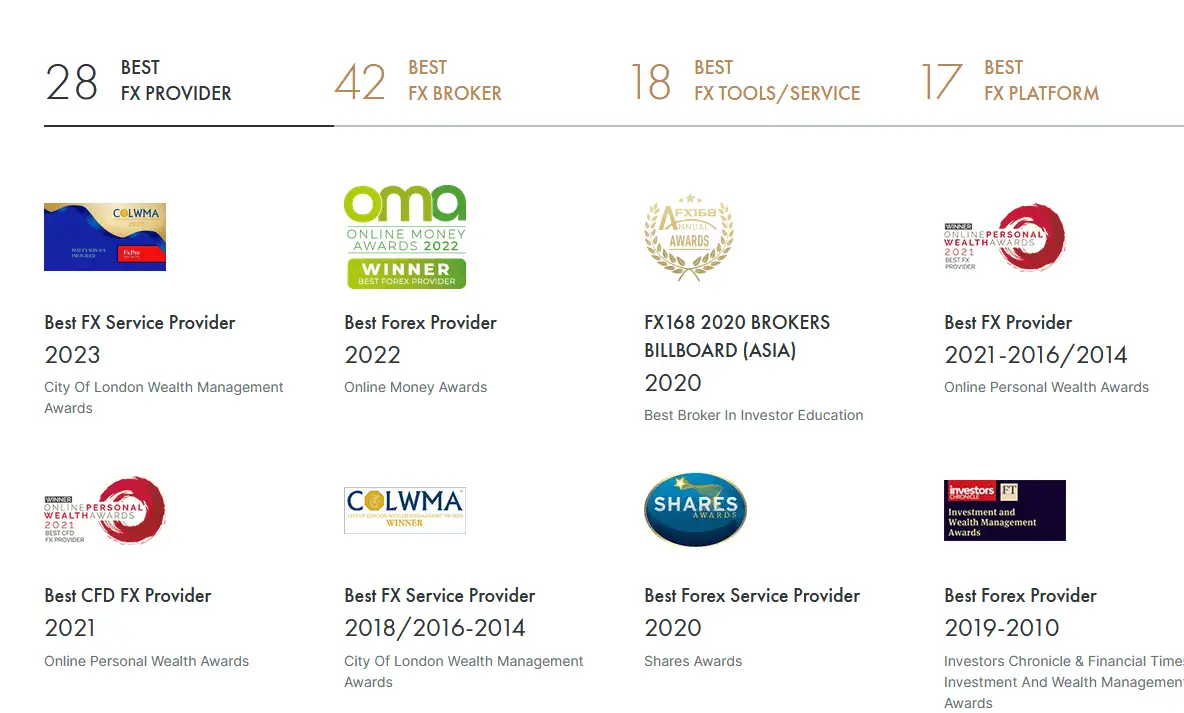

The broker firm has proven to be reliable and professional over the years it has been operating. The enormous number of users signed with the broker firm proves this. The broker firm has also won several recognitions and numerous awards for the high-quality services it provides its clients.

For example, in 2023, FxPRo won the Best FX Service Provider reward:

As an assurance and further evidence of reliability, traders from the Middle East and the UK are protected by the Scheme of Investors Compensation in the UK and FSCS (Financial Services Compensation Scheme) in the Middle East. Trading with a broker that clients can rely on is essential for success. There are scams and frauds in the forex trading industry. The broker firm maintains its website’s most extensive regulatory independent database. The company has created a 1 to 100 proprietary score of trustworthiness that they call the trust score.

FxPro Facts

- FxPro is a well-established company founded in 2006 and headquartered in London, UK.

- It is regulated by recognized bodies, including the Financial Conduct Authority (FCA) and the Cyprus Securities and Exchange Commission (CySEC).

- FxPro offers many tradable assets such as Forex, Stocks, Futures, Indices, Metals, Energies, and Cryptocurrencies.

- Two types of accounts are provided: Demo Account and Live Account, enabling practice and real trading experiences.

- The minimum deposit required is relatively low, at only $100, making the platform accessible to traders with different budgets.

- It provides a maximum leverage of 1:200, which can increase potential profits and risks.

- Deposit and withdrawal methods are diverse and convenient, including Bank Transfer, Credit/Debit Cards, Pay, Skrill, Neteller, China UnionPay, mPay, FasaPay, and Webmoney.

- FxPro supports several trading platforms, such as MetaTrader 4, MetaTrader 5, cTrader, and the proprietary FxPro Trading Platform, catering to various trading styles and preferences.

- Customer support is multilingual and can be reached through Phone, Email, and Live Chat, ensuring comprehensive assistance for global users.

- FxPro offers a wide range of educational resources, including webinars, articles, videos, eBooks, and tutorials, which benefit both beginners and experienced traders.

- The average spreads on FxPro MT4 and MT5 accounts are competitive, at 1.6 (fixed) and 1.4 (variable).

- Market execution is available on the MT5 account, although it may come with the possibility of slippage.

- Despite additional fees per lot, the cTrader platform provides very low spreads, starting from 0.10 for specific pairs, which may benefit frequent traders.

Is FxPro an ECN broker?

No, FxPro is not an ECN broker because this broker acts as a No Dealing Desk (NDD) Execution broker, which means that it executes client orders without any intervention from a dealing desk.

In traditional brokerage models, a dealing desk is an intermediary between the client and the liquidity providers. The dealing desk may execute trades by taking the opposite position of the client’s trade or routing the order to external liquidity providers. This can result in potential conflicts of interest, such as the dealing desk profiting from clients’ losses or manipulating order execution to their advantage.

However, as an NDD Execution broker, FxPro aims to eliminate these conflicts by executing client orders directly in the market without intervention. When a client places a trade, FxPro’s systems automatically match the order with the best available prices and liquidity from its pool of liquidity providers, which may include central banks, financial institutions, and other market participants.

Is FxPro Market Maker?

FxPro broker is a market maker broker because it is a counterparty to their clients’ trades. As a result, FxPro can profit from setting the bid/ask spread and commissions. In addition, FxPro, as the broker, may benefit from any Client losses.

Read more in our article Is FxPro a Market Maker?

Does FxPro accept US clients?

Yes, FxPro accepts US clients as long as they reside outside the US. Clients can confirm their US tax identification number during the account registration process. Additionally, FxPro can provide a client-specific form where the client can indicate a US tax identification number.

FxPro Execution, Transparency, and Trading Conditions

The broker firm strongly supports fairness and transparency in forex trading. FxPro has tried to eradicate conflicts between clients and brokers and is committed to giving its customers and traders full support and reporting.

The company posts its slippage statistics on its websites monthly. In addition, traders can choose between market execution and instant execution, a characteristic that most forex brokers do not provide. The broker firm also constantly upgrades its execution and order-matching technologies.

How to trade on FxPro?

To trade on FxPro, you need to register on the FxPro website. Traders can trade on FxPro using different trading platforms such as Mt4, FxPro MetaTrader 5, and the cTrader platform. FxPro is dedicated to four smartphone platforms. You can select the web trader platform and the MT4 platform offered by FxPro.

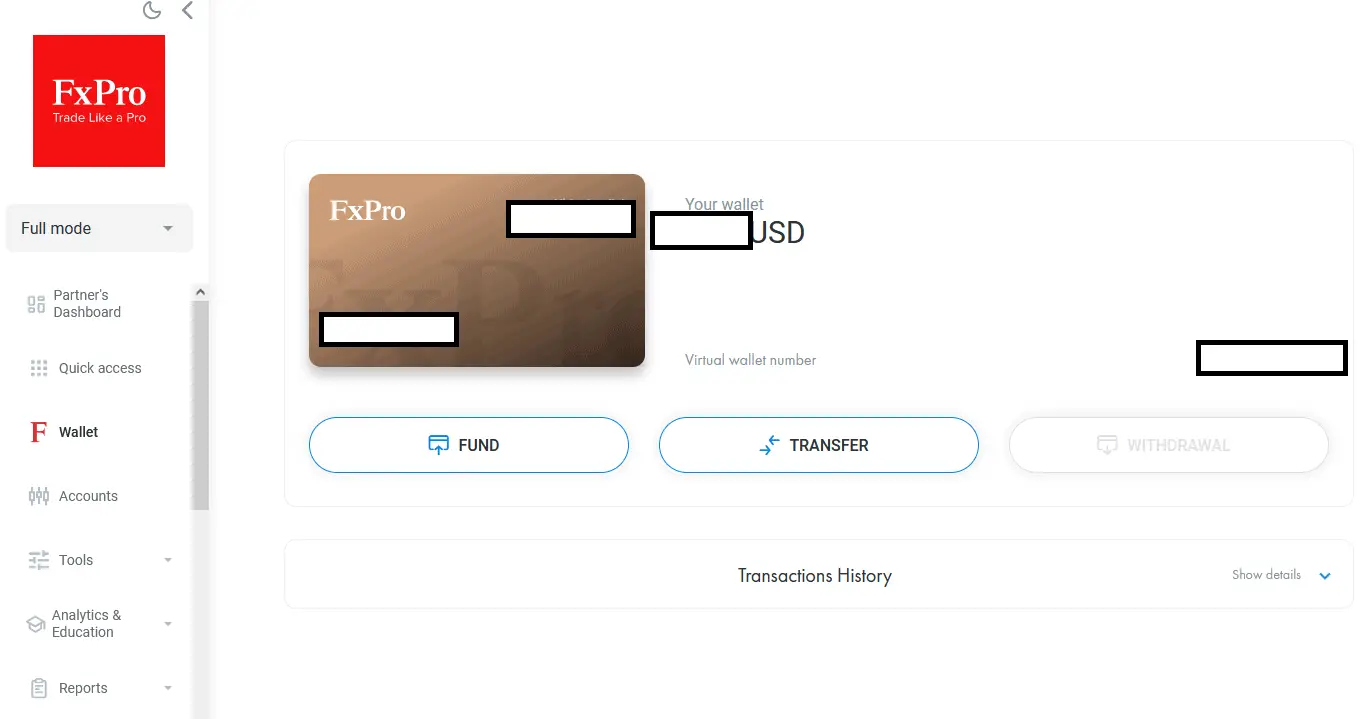

Fxpro has an excellent user dashboard that is easy to navigate. Below is presented my personal FxPro dashboard:

If you are a beginner in trade, web trading will be the best platform. This is mainly because this platform will not confuse beginners with more charts and trend graphs. Another critical aspect of FxPro is that you do not need a downloadable platform, but you can trade with any PC and easily switch between different platforms.

Any coin has two sides, and so does the web trader platform. The web trader platform is too crowded, and it is also intuitive. The shapes present in web traders are partially covered and partially not. But, if the user wants to resize the figures, it is also possible. Also, if you use the cTrader platform, you can quickly switch to it.

How do I download the FxPro program on my computer?

To download the FxPro program on your computer, Visit the FxPro MT4 platform download section (FxPro MT4 free download) and download Mt4, FxPro MetaTrader 5, and the cTrader platform (download FxPro MT4 for PC and mobile).

How do I install the FxPro program on my computer?

Run the Exe file and follow the app screen. The mt4 platform will be installed very fast and ready to use. Log into the account using your username, password, and server ID.

FxPro Platforms and Spreads

FxPro offers a variety of trading platforms, each with its unique features, tailored to meet different trading needs. Here are the details:

- FxPro MetaTrader 4 (MT4):

- MT4 is a standard in the forex trading industry, known for its comprehensive tools and features.

- It supports multiple languages, allowing traders to use the platform in their preferred language.

- MT4 can support several types of orders.

- It enables automatic trading, where traders can program MT4 to execute trades automatically based on set parameters.

- Spreads can be fixed or variable, with an average fixed spread of 1.6 and a variable spread of 1.4.

- MT4 offers both Instant and Market Execution. While Instant Execution might involve requotes during volatile periods, Market Execution can lead to slippage due to the applied VWAP (volume-weighted average price) system.

- FxPro MetaTrader 5 (MT5):

- MT5 is an upgraded version of MT4, possessing similar functionalities with additional upgraded features.

- It can support multiple timeframes and provide traders with in-depth information about markets.

- MT5 offers only variable spreads with an average of 1.4 pips.

- Like MT4, MT5 also uses Market Execution, meaning slippage can occur.

- FxPro cTrader:

- The cTrader platform offers only variable spreads but is generally low, with an average of 0.3 pips.

- This platform also charges a commission of $4.50/lot round turn (or equivalent), making it suitable for high-volume traders.

- Like the MT4 and MT5 accounts, cTrader offers Market Execution, which can result in slippage.

- FxPro Mobile Trading:

- Acknowledging the growing trend of smartphone usage, FxPro offers mobile-optimized trading platforms.

- These mobile apps are free for download from the Apple App Store or Google Play Store.

- With the FxPro mobile trading apps, traders can execute trades directly from their smartphones, enabling trading on the go.

FxPro Trading Accounts

Let us analyze FxPro Accounts:

- FxPro MT4 Account

- Best for Forex traders

- Access to over 2100 assets

- Regulated by CySEC, FCA, SCB

- Spreads from 0.6 pips, $3.50 commission per lot

- MetaTrader 4 platform

- Minimum deposit: $100+

- FxPro MT5 Account

- Best for non-Forex traders

- Access to over 2100 assets

- Regulated by CySEC, FCA, SCB

- Spreads from 0.6 pips

- MetaTrader 5 platform

- Minimum deposit: $100+

- FxPro cTrader Account

- Best for scalpers

- Access to over 300 assets

- Regulated by CySEC, FCA, SCB

- Spreads from 0 pips, $3.50 per lot commission

- cTrader platform

- Minimum deposit: $100+

- FxPro Spread Betting Account

- Exclusive for UK clients

- Access to over 350 assets

- Regulated by FCA

- Spreads from 0 pips, $4.50 per lot commission

- FxPro Edge platform

- Minimum deposit: £100

- FxPro VIP Account

- Best for high-deposit traders

- Access to over 2100 assets

- Regulated by CySEC, FCA, SCB

- Varies spreads and commissions, free VPS

- MetaTrader 4, MetaTrader 5, and cTrader platforms

- Minimum deposit: $50,000

- FxPro Corporate Account

- Best for companies

- Access to over 400 assets

- Regulated by CySEC, FCA, SCB

- Varies spreads and commissions

- MetaTrader 4, MetaTrader 5, and cTrader platforms

- Contact FxPro’s support to open

- FxPro Islamic Account

- Designed for Muslim traders

- Access to over 400 assets

- Regulated by CySEC, FCA, SCB

- Spreads from 0.6 pips, no rollover fees

- MetaTrader 4, MetaTrader 5, and cTrader platforms

- Contact FxPro’s support to open; minimum deposit: $100+

FxPro Instruments

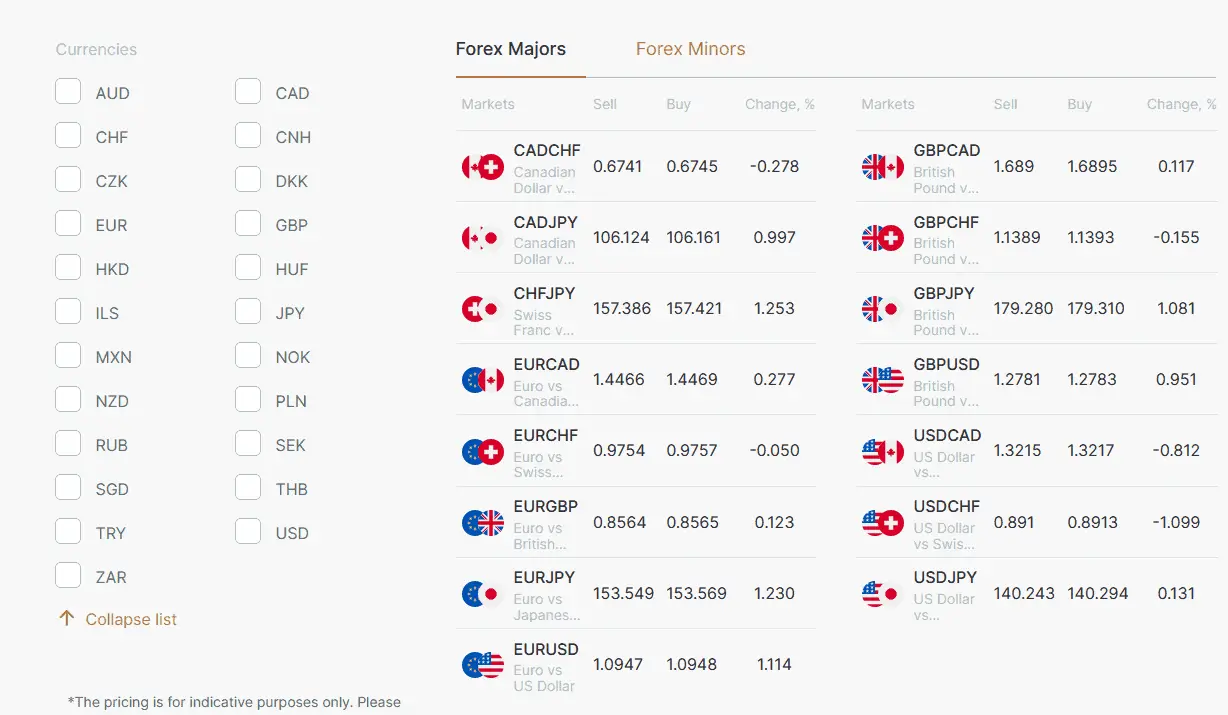

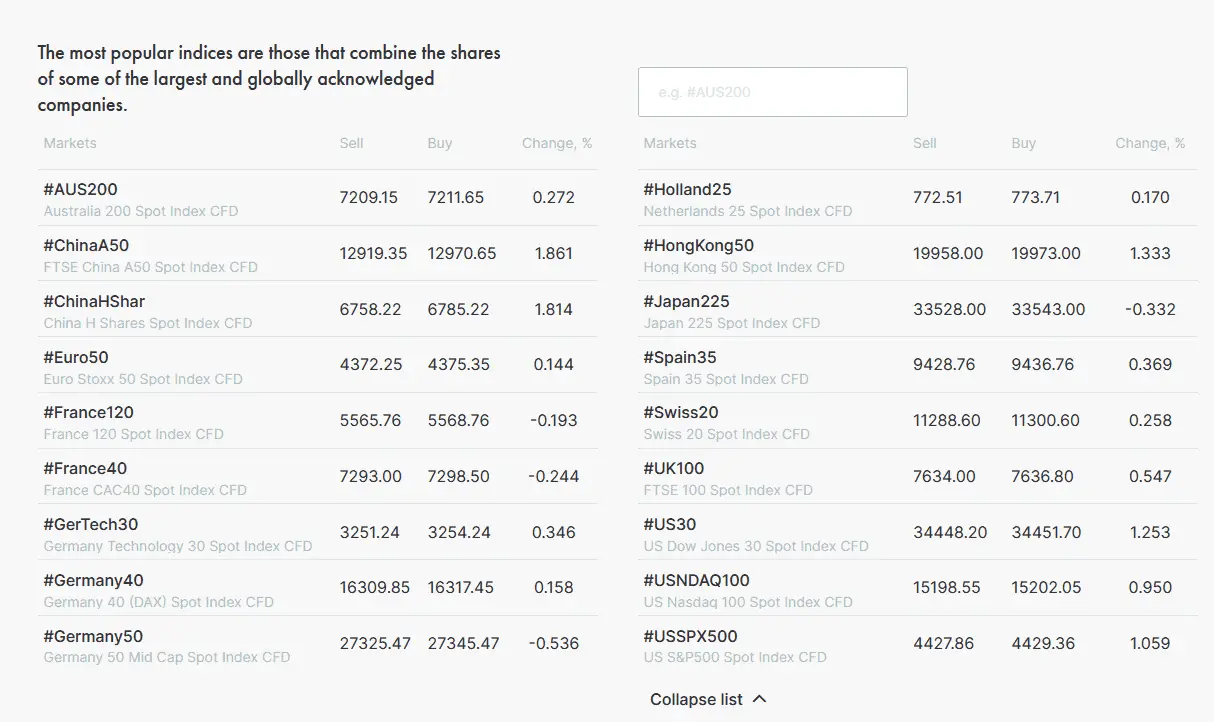

A trader can trade CFDs and spot forex with FxPro. The asset classes are market indices, futures, commodities, and stocks for CFDs. So, is FxPro suitable for indexes and commodities? Of course, you can trade forex, indexes, commodities, and primary USA and UK shares. Currently, the markets cover 20 future contracts, two precious metals, 29 market indices, three energy commodities, 70 currency pairs, and over 160 stock types.

For example, this is the screenshot of forex instruments in summer 2023:

Is FxPro suitable for indexes and commodities?

Yes, FxPro offers the most popular 20 worldwide indices, hard commodities such as crude oil, silver, gold, and platinum, and soft commodities such as wheat, coffee, corn, and sugar. Because of fast execution and meager commissions, you can use FxPro to trade items and indices.

Below are presented indices:

FxPro Tools

How does FxPro work? The FxPro broker company offers a balanced range of markets, trading assets, and pricing options. It caters to beginners and those who have developed or used automated trading systems. The company provides a standard Windows Mt4 platform and a web-based version of MetaTrader 4 that can be accessed through all Java-enabled web browsers. The broker firm’s web-based cTrader platform has advanced charting tools and a smooth layout design.

This layout features only narrow spreads with commission-based pricing. The cTrader web version leverages HTML 5 for its responsive and straightforward structure to navigate. It is seamless to move across the platform’s sections and guide the categories the platform possesses.

The cTrader desktop version runs on Windows 10 smoothly and has algorithmic trading functionality through its cBots feature. It also displays trading ideas within the charts as visual targets. In addition, this platform version has more features than the web-based version. The features include equity charts, journal tabs, and trading statistics within the right bottom quadrant’s default layout platform.

Is FxPro compatible with hedging Expert Advisors? Yes, because there are no FIFO rules for FxPro accounts. You can easily use all indicators and expert advisors for mt4 and mt5 in FxPro Metatrader.

User-Friendly Interface

Customer service is the key to success, and FxPro has understood this. The customer care executives of FxPro are professionals. But they are also very patient, so they will try to explain things to you even if you ask a fundamental question in layperson’s terms. The user interface designed for the registration process is fantastic, as it takes you to a specific place if you forget to fill in some information. The frustrating part of FxPro is the account verification procedure, which is somewhat confusing. FxPro allows you to transfer your currency from Skrill (Moneybookers), Paypal, and Neteller online accounts and use your credit card and net banking.

Withdrawals and Deposits Options at FxPro

How to withdraw funds from FxPro?

How do I get my money out of my FxPro account? The broker firm has made its platform to support six methods of payment. One can withdraw or deposit using PayPal, Skrill, UnionPay, Credit Cards, Bank Wire Transfer, and Net Teller. Withdrawals take a maximum of a business day to process and are entirely free. However, the withdrawal process can take up to five business days.

What is the FxPro withdrawal limit?

The maximum FxPro withdrawal limit is $1 million for bank wire transfers, and the minimum FxPro withdrawal limit is $100 for bank wire transfers. However, there is no minimum withdrawal limit if you use payment wallets like Skrill. The maximum FxPro withdrawal limit for wallets is $25,000.

Promotions and Bonus at FxPro

The fxPro bonus offer doesn’t exist currently.

FxPro does not provide promotional offers or bonuses because of its current regulatory requirements.

FxPro Education

FxPro’s educational resources are meticulously crafted and segmented into two interactive levels to cater to the needs of various traders.

Basics: This level is an ideal starting point for beginners. It introduces foundational trading concepts, offers beginners tips, and provides insights into fundamental analysis.

Advanced knowledge: This level delves into trading’s technical analysis, offering in-depth knowledge for seasoned traders. It also introduces the role of psychology in trading, helping traders understand the impact of emotions on their trading decisions.

In addition to these levels, FxPro provides trading tests for self-evaluation and video tutorials catering to beginners and advanced traders. The broker also organizes webinars and events, providing traders with opportunities to learn from experts in the field.

News & Analysis

FxPro provides powerful informational support to help traders stay updated with market movements and trends.

The Economic Calendar details the schedule of major global data publications, while the Earnings Calendar provides crucial information for shareholders. The Market Holidays section informs traders about days off on global exchanges.

The FxPro Market News offers intelligent analytics for active traders, keeping them abreast of crucial market changes and opportunities. Moreover, FxPro provides all its clients with technical analysis by Trading Central, delivering valuable trading signals to guide trading decisions.

Trading Tools

FxPro equips its traders with valuable tools that aid in informed decision-making.

The Trader’s Dashboard offers a comprehensive view of all trading widgets in one place, while the FxPro Calculators help traders manage their numbers.

The FxPro Direct App allows traders to manage their trading accounts on the go, offering flexibility and convenience.

For traders who use Expert Advisors, FxPro provides a Virtual Private Server (VPS), offering a 24/7 server to execute automated trading strategies efficiently.

Lastly, the Download Centre allows traders to choose and download their preferred trading platforms, further customizing their trading experience.

There is a trading academy for FxPro that teaches the basics of forex trading to those who are starting and helps them prepare for the challenges involved in trading in the current world of currency markets. FxPro has an extensive video library and provides insightful short videos regarding the topic’s basics. The videos aim to improve the overall performance of an individual’s trading. Unlike other forex videos on other brokers’ websites, the videos also load quickly. The videos also include general strategies for trading and some tips on using the trading platform. The platform also offers an economic calendar that educates a trader and plans their trading day. The traders can be in a position to view all reports about the economy.

Customer Support at FxPro

FxPro has comprehensive customer support. The support team is available twenty-four hours a day, five days a week. They can be reached by mail, telephone, live chat, and other means. The support service is localized and multilingual so that the broker firm can handle its diverse base of clients. Over 30 countries are currently supported by its customer service on a localized level.

The Pros and Cons of FxPro

Pros of FxPro:

- Reputation and Regulation: FxPro has built a strong reputation in the industry since its establishment in 2006. It is regulated by reputable financial authorities, including the Financial Conduct Authority (FCA) in the UK and the Cyprus Securities and Exchange Commission (CySEC). This regulatory oversight provides traders with security and trustworthiness.

- Multiple Trading Platforms: FxPro offers a variety of trading platforms, including the popular MetaTrader 4 (MT4) and MetaTrader 5 (MT5). These platforms are widely used and appreciated by traders due to their user-friendly interfaces, advanced charting tools, and extensive range of indicators. FxPro also provides its proprietary platform, cTrader, which is known for its advanced trading features.

- Range of Instruments: FxPro offers a diverse range of trading instruments, including principal, minor, and exotic currency pairs, as well as contracts for difference (CFDs) on commodities, indices, and shares. This wide selection allows traders to diversify their portfolios and explore various trading opportunities.

- Execution and Order Types: FxPro is known for its efficient trade execution and competitive pricing. It provides market execution, which means trades are executed at the prevailing market price. Additionally, FxPro supports various order types, including limit orders, stop orders, and trailing stops, allowing traders to implement their preferred trading strategies.

Cons of FxPro:

- No Bonus Offerings: One of FxPro’s notable disadvantages is the absence of bonus programs or promotions. Some brokers in the industry offer deposit bonuses or other incentives to attract new clients or reward existing ones. However, FxPro does not provide such bonus schemes, which may be a drawback for traders seeking additional benefits.

- Potentially Large Spreads: FxPro’s spreads can vary depending on market conditions and the chosen trading account type. While the broker claims to offer competitive spreads, there have been instances where traders have experienced wider spreads, particularly during periods of high market volatility. Larger spreads can impact trading costs and profitability, especially for frequent traders.

FxPro Support

It is a known fact that FxPro offers customer service that is considered the best among forex trading consultants. The bases established by FxPro to provide customer service to its customers are spread across 22 different countries, and you can request a call from them for any support on a 24/5 basis. If you browse the Contact Us section of the FxPro website, you can access the contact details of all the departments, including their email IDs and contact phone numbers.

This ensures you are reaching the right person for the proper concern. We tried to contact them using the Contact Us form on the Contact Us page to check their customer service. And to our surprise, they responded promptly within 20 minutes of our query reaching them.

The chat feature on their website also works great with a person always waiting to answer your queries. Even though we tried to confuse the customer care representative with a complex question, the query was transferred to the technical team, and we got the exact response to our query in no time. This is the fastest response from any customer care executive we have ever called.

My opinion:

Is FxPro a good broker?

Yes, FxPro is a good broker for high-deposit traders. It provides many features intended to simplify the trading experience. Statistics show that most traders invest more than $5000 at FxPro, and many accounts are more significant than $100000.

We find their extensive video library engaging as it allows for short and perceptive videos about general topics to improve trading performance. The videos are loaded in no time. The videos are about available trading methods and techniques, not only dealing with the trading platform.

During the FxPro review, the company’s spreads were listed clearly, and we appreciate the company’s effort to provide competitive spreads. MT4 traders can enjoy trading EURUSD from 0.6 pips spread with leverage up to 1:500 and fee-free trading. Traders can enjoy comparable spreads with up to 1:500 leverage. In addition, MT4 traders can benefit from expert advisors and fractional prices.

FxPro also provides regular trading tools like Forex news and technical analysis. Most of these are within each platform and not on the FxPro website. Finally, it provides classic calculators like a margin calculator, a pip calculator, and a currency converter.

In the end, FxPro’s characteristics are not especially rare and unusual. However, they were displayed professionally and helpfully to help any trader sufficiently.

I like trading platforms, live chat, excellent support, and easy deposit and money withdrawal. Because of its powerful brand and TV presence, FxPro has worldwide recognition.

Based on my past research (see the section about the top forex brokers on the ranking list), FxPro is among the best based on visitors’ polls. This forex broker has been an example of trust, excellent communication, great tools, and tight spreads for several years.

VISIT FXPRO