One of the primary motivations for traders entering the world of prop trading is the aspiration to grow their accounts rapidly. The allure of prop trading lies in the potential for significant financial gains within a relatively short period. Traders desire to achieve financial independence, attain substantial profits, and establish a successful career in the competitive trading world.

You can grow your account quickly only if you avoid overtrading and make a couple of daily trades following a major intraday trend. Additionally, I like to make two trades for each session (EU and US session), one at an equal distance from the target and stop loss and another when my price is near the stop loss (sell on the resistance and buy on the support).

See my video for a full explanation:

Let us describe everything using bullet points:

- Divergence on RSI/Chart:

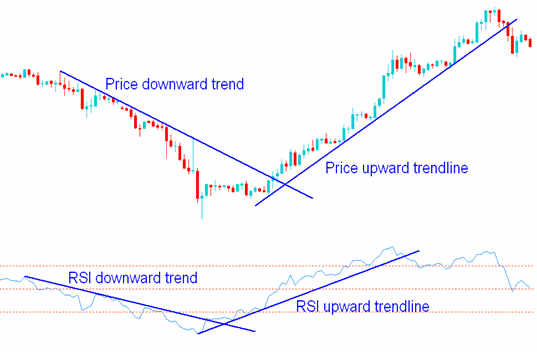

- Identify Divergence: Look for divergences between the RSI indicator and the price action on the chart. A divergence occurs when the price moves in one direction while the RSI moves in the opposite direction.

- Confirm Trend Reversal: Use divergence as a signal for potential trend reversals. For example, if the price is higher but the RSI is lower, it might indicate a bearish reversal.

- Entry Points: Use the point of divergence as an entry point for trades. I usually enter into trade between the RSI 50 and RSI 60 levels on the m30 chart time frame.

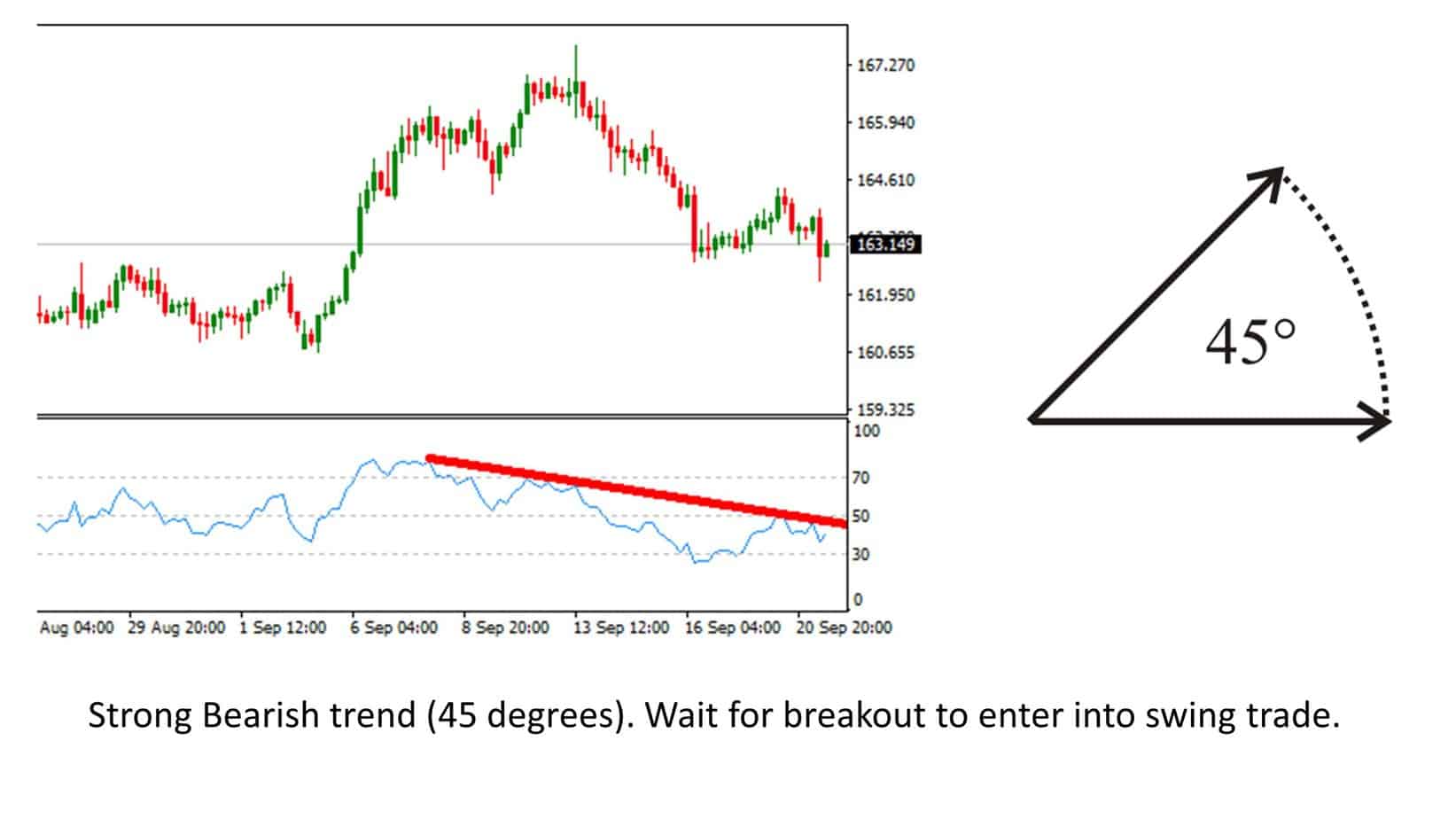

- Trendline on M30 Chart Breakout:

- Draw Trendlines: Identify and draw trendlines on the M30 chart to define support and resistance levels.

- Monitor Breakouts: Watch for breakouts of these trendlines, as they often signal strong movements in the direction of the breakout.

- Confirm with Volume: Ensure that the breakout is confirmed with increased volume, indicating stronger conviction behind the move.

- Set Entry Orders: Place entry orders just above the trendline for a breakout trade to maximize your chances of entering the trade at the right moment.

- Risk Management:

- Position Sizing: Implement strict position sizing to manage risk effectively. I risk 0.05% of the account when I trade for prop companies and 1% for my own.

- Stop Loss Orders: I use stop-loss orders a few pips above resistance for sell trades and a few pips below support for buy trades, usually risking between 15 and 25 pips on average.

- Profit Targets: I usually use a 1:1 risk-reward for the first trade and a 1:5 RR for the second trade (see video).

An RSI trendline breakout strategy on a 30-minute chart timeframe is effective for several reasons. Firstly, the RSI (Relative Strength Index) is a widely used momentum oscillator that helps identify overbought and oversold conditions, clearly indicating potential trend reversals or continuations.

When trendlines are drawn on the RSI, they highlight the underlying momentum trends, offering additional insight beyond price action alone. A breakout of these RSI trendlines can signal a shift in momentum before it becomes evident on the price chart, allowing traders to enter trades early.

The 30-minute chart balances capturing significant intraday moves and filtering out the noise found in shorter timeframes, making the signals more reliable. Additionally, using a 30-minute timeframe allows for timely decision-making, as it provides enough data to confirm trends without the delays associated with longer timeframes. Combining RSI trendline breakouts with the 30-minute chart enhances the ability to spot high-probability trading opportunities with manageable risks.

For example, it looks perfect case (see image below) when the RSI trendline angle is 45 degrees. Usually, most profitable breakouts are on this kind of trendline.

Trading one position in the Euro session and another in the US session is a prudent risk management strategy for several reasons. Firstly, it allows traders to capitalize on the high volatility and liquidity in these significant trading sessions, increasing the potential for profitable trades.

By limiting trades to one per session, traders can avoid overexposure and reduce the risk of significant losses arising from multiple simultaneous positions. This approach also encourages disciplined trading, as it requires selecting only the best opportunities rather than trading impulsively.

Moreover, focusing on two sessions helps traders manage their time more effectively, preventing burnout and maintaining a clear, focused mindset. Lastly, by diversifying trades across two sessions, traders can take advantage of distinct market conditions and trends, further balancing risk and enhancing the potential for consistent gains.