Nano lots, also known as nano contracts or nano trades, are a type of forex trading position size where the order size is just 100 units of base currency or 0.01 lots in Metatrader 4 (MT4) trading platform terminology. As such, they are the smallest trade size available and are particularly attractive for traders who want to manage their risk and capital exposure by trading smaller sizes. Unfortunately, however, HF Markets does not offer nano lot trading in its accounts.

You can read the HF Markets review to get all the information about this excellent broker.

Does HF Markets Offer Nano Lots For Trading?

No HF markets do not offer nano lots trading in their accounts. You can use only micro, mini, and lot position size in trading.

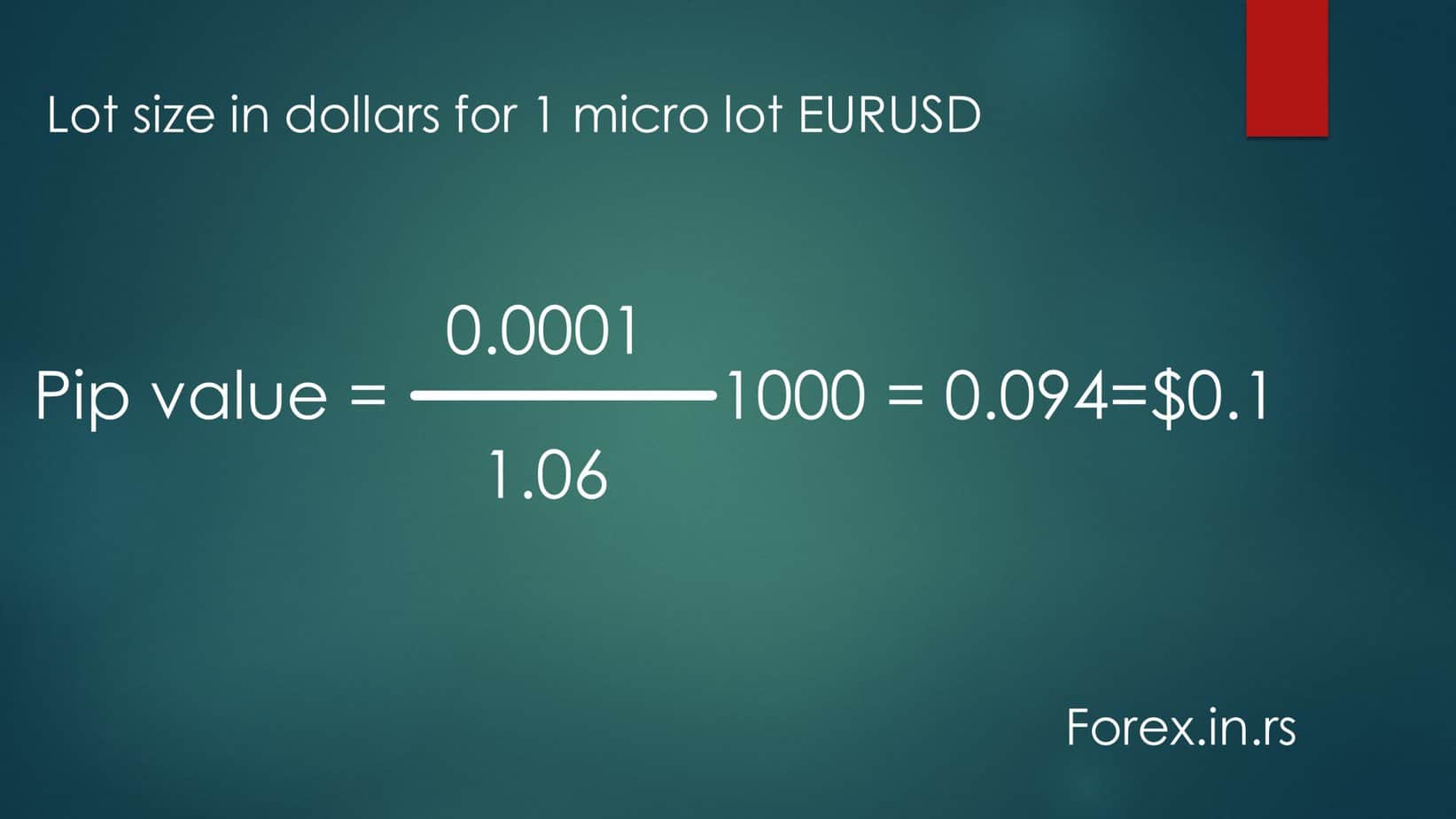

Instead of nano lots, HF Markets offers three other size options: micro lots (1,000 units of currency), mini lots (10,000 units of currency), and standard lots (100,000 units of currency). These are much bigger than a nano lot and offer more flexibility when managing risk and finding an entry point at the right price level.

In my opinion, forex brokers avoid to offer nano lots because commissions, earnings and profit are too small for traders and brokers in the same time.

It’s important to note that while HF Markets doesn’t offer nano lot trading directly through its platform, some third-party forex brokers may have access to MT4 accounts that offer such trades. However, many traders find this setup inconvenient because they must open an account with two separate brokers to access the more significant positions offered by HF Markets and the smaller ones offered through third-party brokers.

One way around this issue is for traders to use leverage instead of nano lots to reduce their risk exposure when trading with HF Markets. Leverage allows traders to borrow money from their broker to boost the size of their positions without depositing additional funds into their accounts. This can be especially useful if you’re looking for tighter stop loss levels but don’t have enough funds in your account for a small position size like a nano lot. Of course, leveraging up comes with risks, so it should always be done responsibly and cautiously.

Ultimately, it’s evident that if you’re looking for a broker that offers nano lot trading, then HF Markets isn’t your best option — you’ll need to look elsewhere or use leverage instead to reduce your risk exposure when trading with them. But on the plus side, they offer three other position sizes, which still give you plenty of flexibility when managing your risk and capital exposure when placing trades through their platform.