Table of Contents

Forex trading is a changing market, and when you have an open position at the end of the trading day, you can either get paid or be charged hefty interest on that open position. This mainly depends on the underlying rates of interest on the two currencies in your pair. Your interest rate would also depend on how long you can hold a forex position.

How long can you keep a forex position open?

A trader can hold a position for a few seconds (or less) to a few years in the forex market. There is no limit in the position holding period in forex. However, traders keep traders open until they reach a stop loss or hit the target.

Factors for holding a forex position

How long can you hold a position in forex? We have mentioned a few examples below, presenting the most accurate ways of calculating the total amount that needs to be charged or credited. While you might only factor in the broker’s commission and interest rates, there are many other factors on which the storage for holding an overnight position would depend.

The answer is that you can do it as long as you want! There wouldn’t be any limits for a time, but there are many things to consider, as these would be swaps and many other fees your broker carries that hinder some held profits.

The thing here to look out for is swaps. By swaps, we mean a small fee charged for held trades, which can differ from a normal fee. This can also work well in your favor, as you’re simply making more money off the swaps. There is a lot of other info on swaps as well. Various other factors to consider here are the time frame you’ve entered or the analysis you did.

Different strategies and market conditions dictate varying holding periods. The most critical factor determining how long a position should be held is the trader’s planned target or trading plan, which should align with their risk management strategy and market analysis.

Typical Holding Times Based on Entry Points

the decision on how long to hold a position varies significantly based on the trader’s strategy and the type of entry point they utilize. Here’s a deeper look into typical holding times for three common trading strategies: intraday, swing, and macro (long-term) trading.

Intraday Trading (Day Trading)

Definition: Intraday trading involves entering and exiting positions on the same day. Traders capitalize on small price movements and avoid holding positions overnight to sidestep potential risks from market gaps and overnight news events.

Typical Holding Times:

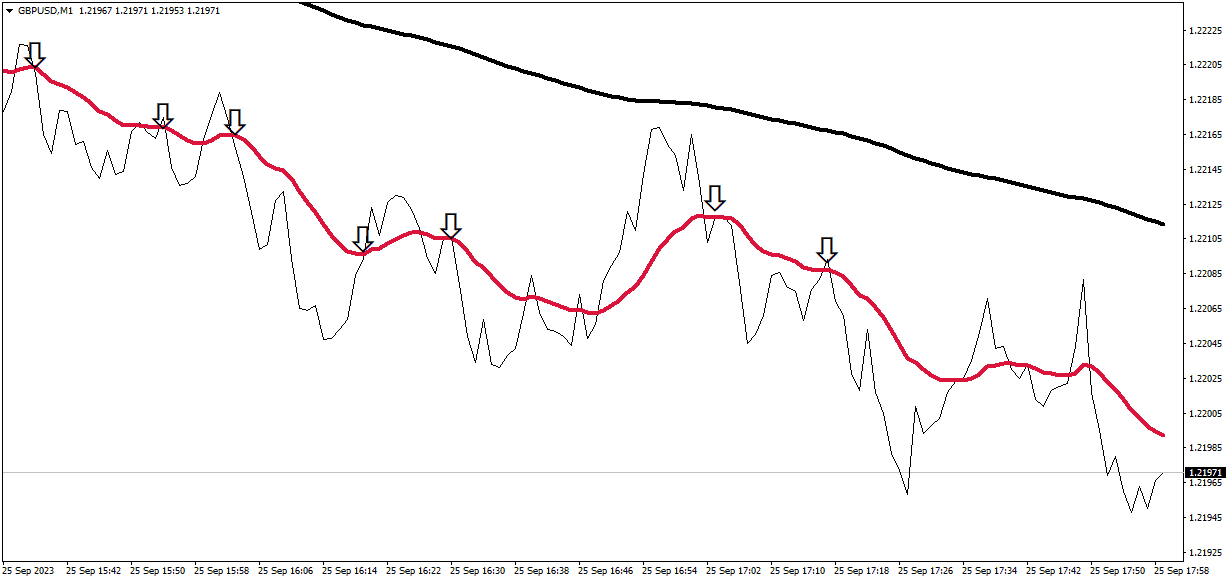

- Short-Term Scalping: Positions may last from a few seconds to several minutes. Scalpers aim to make numerous trades throughout the day, gaining small pips in each trade.

- Day Trading: Here, trades can last from several minutes to the entire trading day, often closing before the market shuts to avoid overnight risk. The holding time can stretch from a few hours to a day, depending on market volatility and the trader’s objectives.

Swing Trading

Definition: Swing trading involves holding positions for several days to capitalize on expected intermediary price moves. This strategy is less intense than intraday trading but requires holding through some overnight periods, exposing the trades to overnight risk.

Typical Holding Times:

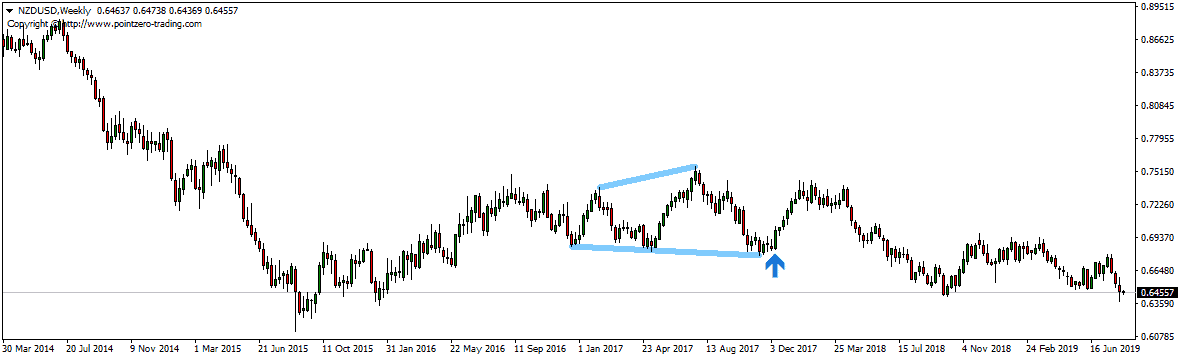

- Multi-Day Holds: Positions are typically held from a few days to several weeks. Swing traders utilize technical analysis to identify “swings” in market prices and ideally close their positions when they forecast a trend reversal.

- Week to Week: Some swing trades may extend into the next week if the expected price movement does not materialize within the anticipated time frame. The extended duration allows traders to capture more significant price shifts than day trading.

Macro Trading (Long-Term Positions)

Definition: Based on fundamental economic trends and forecasts, macro trading strategies involve holding positions for long periods—ranging from several weeks to years. Traders often use this approach to capitalize on shifts in economic policies, interest rates, or other significant economic indicators.

Typical Holding Times:

- Several Months to Years: Traders might enter a position based on a long-term economic outlook, such as betting on a currency’s recovery or exploiting persistent economic disparities between countries. For example, buying EUR/USD based on expectations of a more robust Eurozone recovery compared to the U.S. could be a typical macro trade.

- Interest Rate Cycles: Positions can also be held through several interest rate cycles to capitalize on the broader economic changes impacting currencies. Such positions are usually backed by thorough research and a substantial understanding of global economic trends.

The holding period in forex trading depends significantly on the trader’s strategy and market analysis. Intraday traders focus on short-term fluctuations and avoid overnight risks, while swing traders hold positions for several days to weeks to benefit from more significant price changes. Macro traders commit to positions for months or years based on fundamental economic trends and policy shifts. Each strategy requires a different level of market analysis, risk tolerance, and capital management.

Considerations for Long-Term Trading

For currency pairs like GBP/USD or EUR/USD, traders might hold positions for extended periods, from several days to weeks. This strategy is usually based on more significant economic trends or events expected to unfold over a longer duration. Long-term trading benefits traders from significant shifts in economic fundamentals and interest rate differentials between currencies.

Utilizing Stop Loss and Profit Targets

To manage risk effectively, traders must utilize stop-loss orders and profit targets. A stop-loss order ensures that a trade is exited at a specific price level if the market moves against the trader’s position, thus limiting potential losses. Moving the stop loss to lock in profits as the trade progresses is a common tactic used to secure gains while still allowing the position room to grow.

The Role of News and Economic Events

Monitoring news and economic events is crucial for forex traders. Significant news events can cause high volatility, leading to rapid and substantial price movements. Traders must know about upcoming economic releases or geopolitical events affecting their open positions and adjust their trading strategies accordingly.

Emotional Considerations and Trading Psychology

Trading psychology is vital in how long a trader can and should hold a position. Emotional resilience is required to withstand the psychological pressures of market fluctuations. Traders need to maintain discipline and not let emotions dictate their trading decisions, which can lead to premature exits or unnecessary risks.

Conclusion

In conclusion, deciding how long to hold a forex position depends heavily on the initial trading plan, market analysis, and the trader’s risk tolerance. Whether it’s a short-term day trade or a long-term position based on fundamental economic trends, understanding the appropriate holding period for each trade is essential for managing risk and maximizing potential returns. Always remember that trading on demo accounts is advised when testing new strategies, ensuring that traders are well-prepared without risking natural capital.