The US30 (also known as the Dow Jones Industrial Average) is one of the world’s most famous stock market indices. It is a price-weighted average of 30 significant stocks listed on the New York Stock Exchange and NASDAQ, with each stock carrying a proportional weighting in the index. The US30 was first calculated by Charles Dow, who combined 12 stocks in 1884 to form what would later become the Dow Jones Industrial Average – an essential measure of American economic performance.

Over time, the number of stocks included in the index has changed to reflect changing markets and industry trends. Today, companies such as Apple Inc., Microsoft Corporation, and JPMorgan Chase & Co. are all represented on this important index. Despite its reputation as a reliable benchmark for evaluating economic health, volatility remains a crucial factor when investing in or following the US30.

Volatility can be defined as the rate at which an asset’s price changes over time, either increasing or decreasing, with fluctuations in market prices and expectations. Volatility measures how fast returns can change daily or during various trading periods. Since its inception, there has been significant volatility associated with the US30 – sometimes rising dramatically before dropping sharply again within days or weeks; other times seeing steady climbs up until dramatic losses occur suddenly due to external events such as recessions or wars. In 2008, for example, during one of the worst global financial crises in history, US30 lost more than half its value between late October 2007 and March 2009 – indicating extreme volatility during those months.

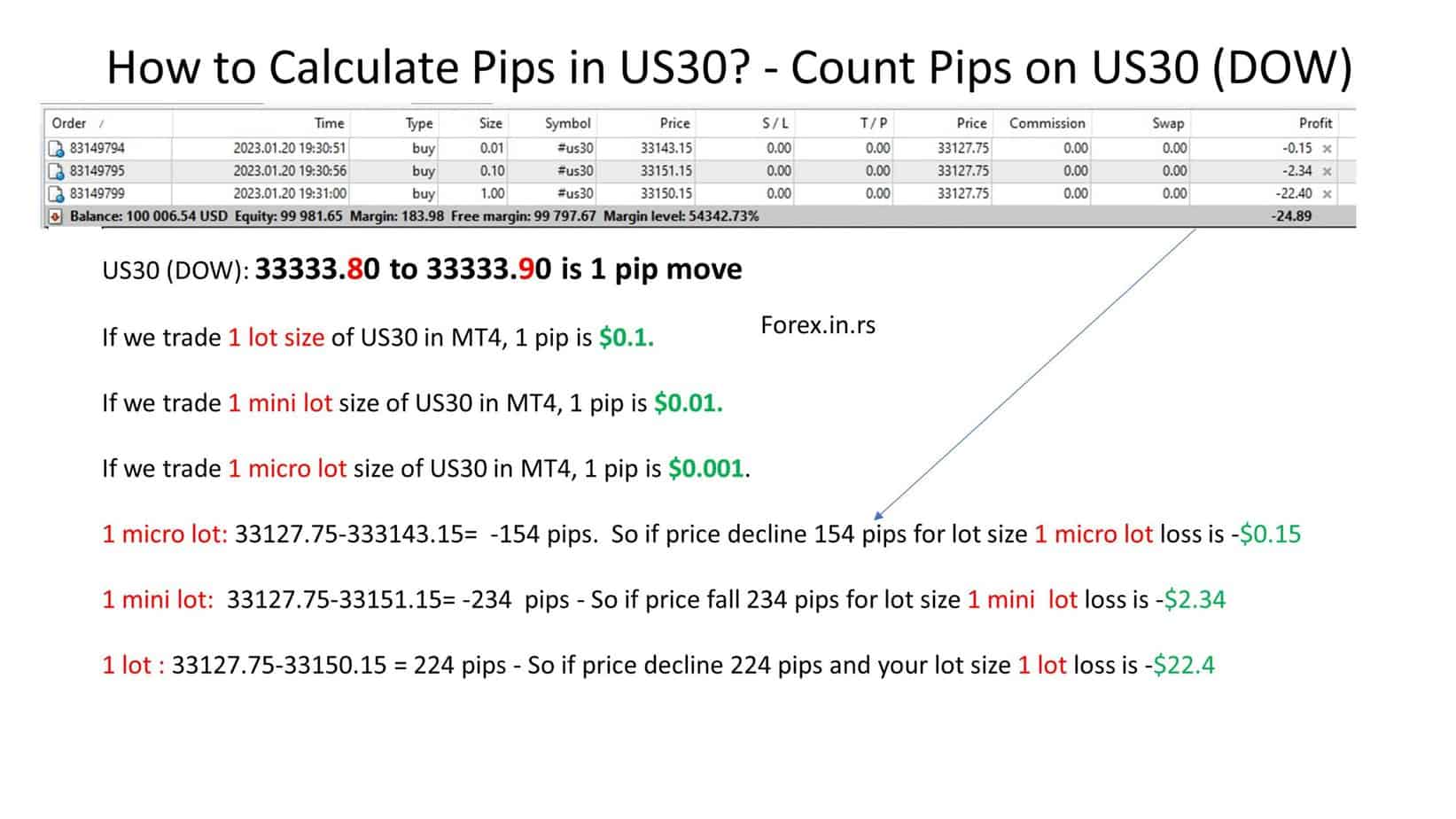

Please see how you can calculate volatility on the Dow (US30) index:

From

From this example, we see that:

US30 (DOW): 33333.80 to 33333.90 is one pip move

How Many Pips Does US30 Move Daily?

On average, US30 or DOW industrial moves daily 5640 pips (564 points) based on research for 2022. The lowest yearly low was 28660.94, while the highest high was 35824.28, representing a difference of 71633 pips.

For example, yesterday’s high was 33381.95 while the low was 32948.93, representing daily volatility of 4330 pips.

Let us research more about the US30 index.

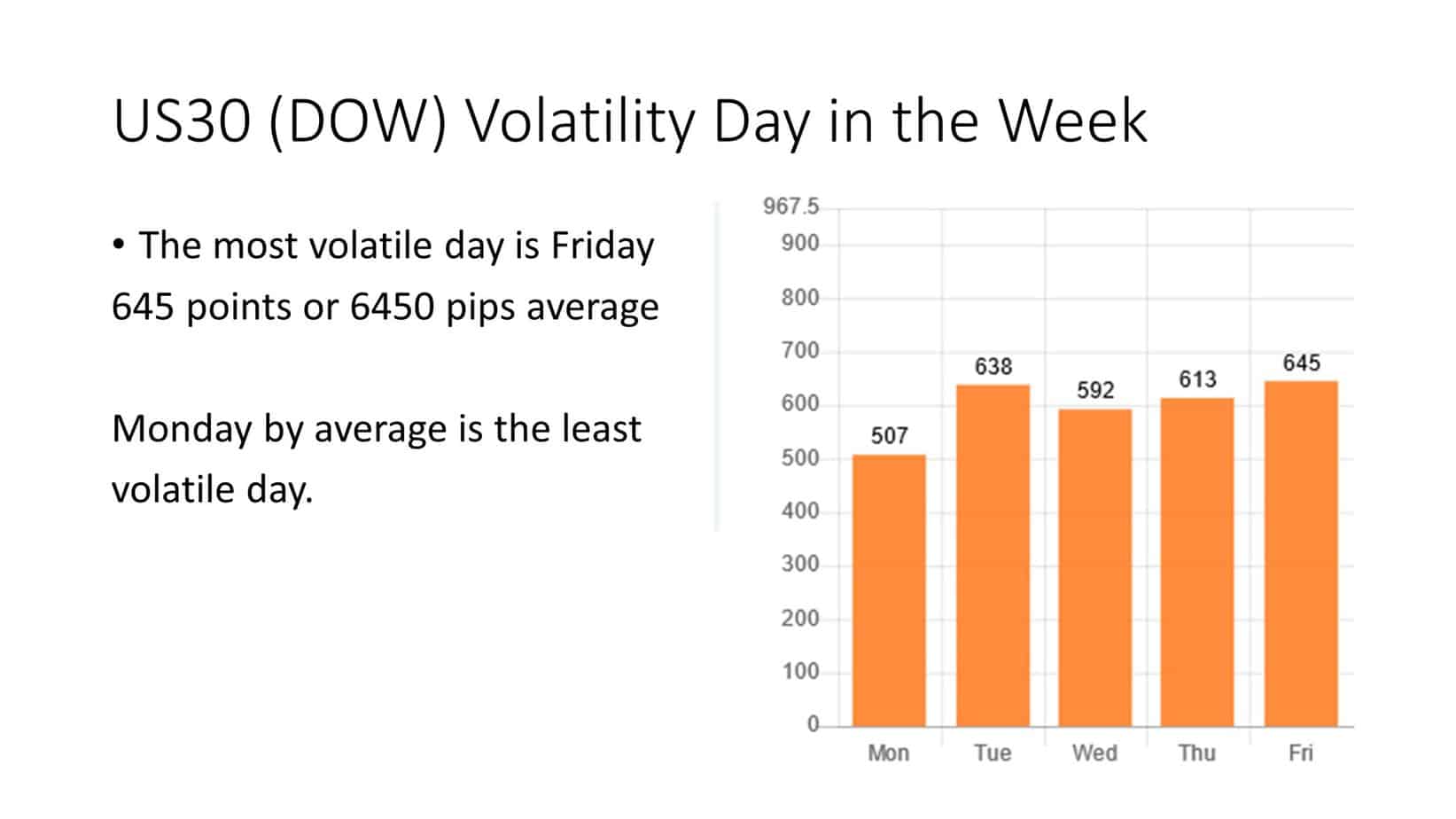

The most volatile day for the DOW US30 index is Friday (on average, age 645 points or 6450 pips or 2%). The least volatile day for US30 is Monday which is 507 points or 5070 pips by average or 1.6%) On the end, let us see DOW volatility by hours :

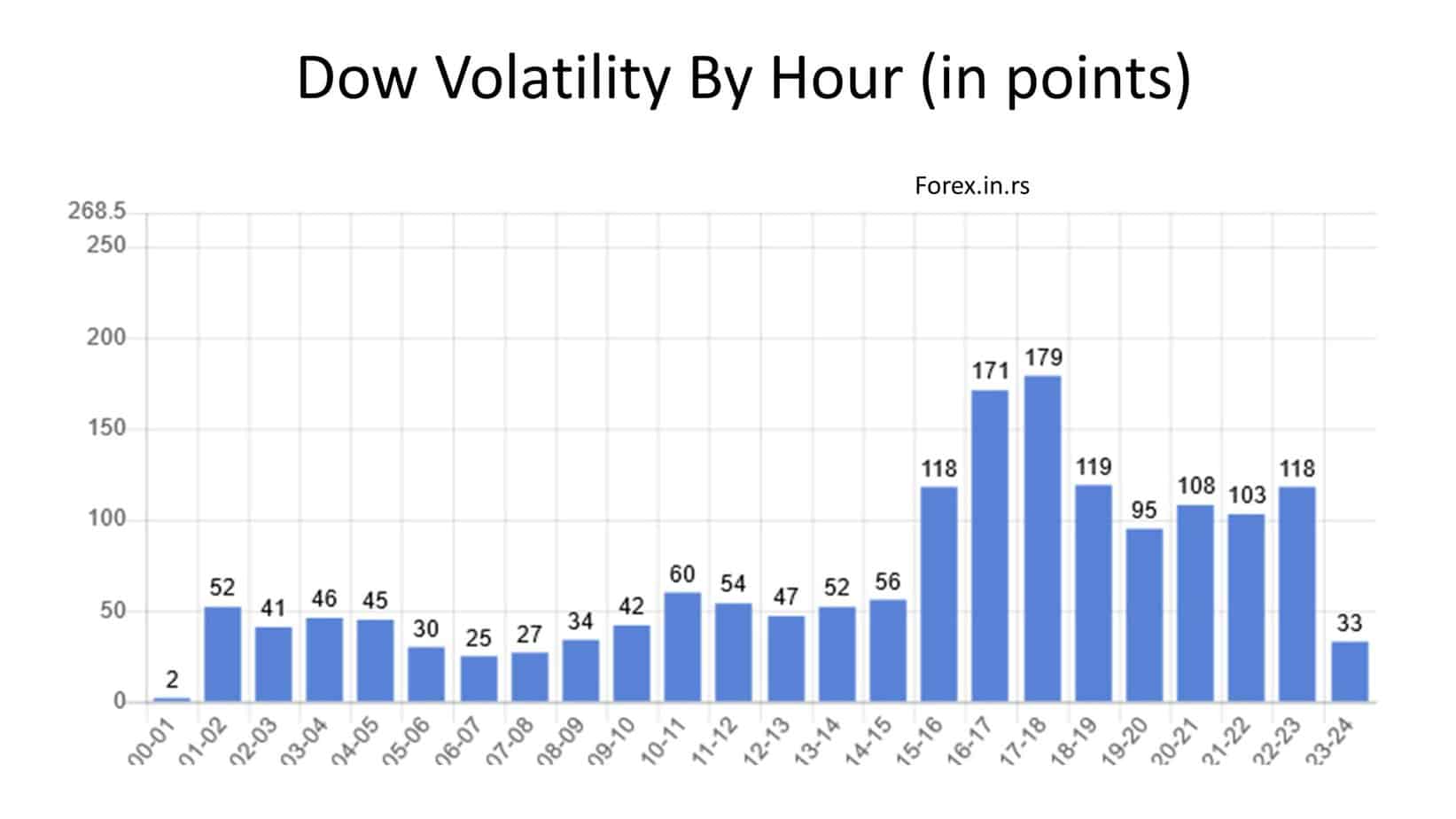

Here we can see tent when the US market opens, its most significant volatility in trading for US30 (DOWh is often four times bigger than during the Asian session.