Foreign exchange trading, also known as forex trading, is a global market where participants trade one currency for another. Forex trading is the simultaneous buying of one currency and selling of another. Foreign exchange traders aim to make money from fluctuations in the exchange rates between currencies. Foreign exchange markets exist wherever one currency is traded for another and are always active, with prices constantly changing due to economic and political factors.

Forex trading or foreign exchange trading is a business based on speculating on the fluctuating values of currencies between two countries. The trading goal is to profit by converting one country’s currency into another country’s currency. Forex trading includes all aspects of buying, selling, and exchanging currencies at current or determined prices.

The foreign exchange market consists of two main types of participants: speculators and hedgers. Speculators are typically investors who buy or sell a currency to profit from its movements on the open market. Hedgers are generally large corporations or institutions that need to protect their investments from potential losses due to adverse changes in exchange rates.

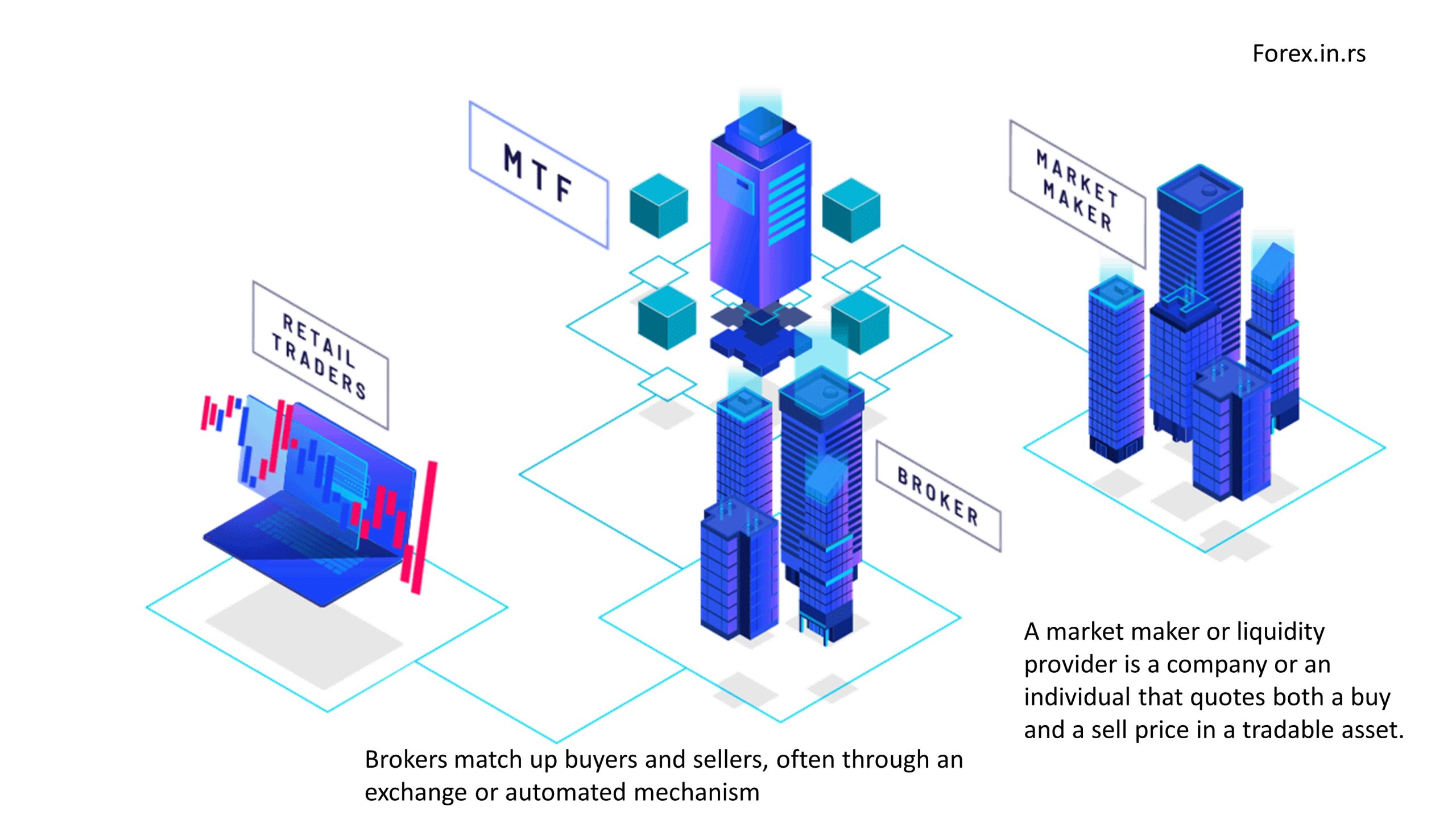

Forex trades occur over-the-counter (OTC), meaning they occur directly between two parties that have agreed upon the terms of the transaction rather than through an organized marketplace like a stock exchange. Trades take place all over the world, 24 hours a day during weekdays because there is always some part of the world’s financial markets open at any given time.

Each country has its currency, and when a country’s currency is traded or exchanged with the currency of a foreign country, this is called foreign exchange (forex trading). Investors and traders interested in Understanding forex should know that the forex brokers decide the currency pairs. These brokers may not offer a match for the currency pair a trader is interested in.

Trading activity is driven by four major groups: commercial banks, central banks, investment firms, and retail forex traders (individuals). Commercial banks conduct most foreign exchange transactions because they provide services such as loans and letters of credit for international businesses and receive payments from customers around the globe.

Central banks intervene in forex markets when there is an imbalance in supply and demand to stabilize their domestic economies by keeping their currencies competitively priced against other currencies. Investment firms facilitate speculative trades on behalf of their clients. At the same time, retail forex traders seek to profit from short-term price movements in individual currencies using similar strategies employed by professional traders, such as technical analysis or trend-following strategy based on technical indicators supplied by brokerages or independent data providers.

Regarding executing trades, forex can be traded manually or through automated systems known as expert advisors or robots. Manual trading requires more experience with financial markets. In contrast, computerized systems require less effort. Still, they may not be as profitable if misused due to unpredictable market conditions caused by economic news releases or political events that can lead to dramatic price swings even before human reactions occur.

The primary benefit of trading forex over other asset classes is liquidity — investors can enter and exit positions quickly without having to wait for someone else to accept their offer since there will always be buyers and sellers available for each currency pair at any given time throughout global business hours regardless of market conditions outside those hours – this ensures that investors never miss out on any opportunities arising during times where they otherwise might not be able available trade manually. Additionally, brokers offer low spreads, which makes it easier for investors to reduce costs with minimal impact on profits when compared to investing in other asset classes, such as stocks or commodities, which tend to have wider bid-ask spreads making it harder for small investors who have limited capital reserves at their disposal.

In conclusion, foreign exchange trading offers many benefits, including low transaction costs, access to deep liquidity pools across different countries, and greater flexibility when choosing when to enter trades. These advantages make foreign exchange trading an attractive option for aspiring traders looking to get involved with financial markets without having too much experience or access to capital reserves required to start trading other asset classes, such as stocks or commodities, which could otherwise prove costly mistakes if done incorrectly due lack knowledge these product’s nuances risks associated them respectively.

Forex is the trading of currency pairs. One of the most popular currency pairs is the EUR/USD, where EUR or EURO is the European currency, and USD is the united states dollar. The forex pair’s value will increase when the Euro value increases compared to the dollar and vice versa. When the trader buys EURUSD, he believes that EUR will rise against the US dollar.

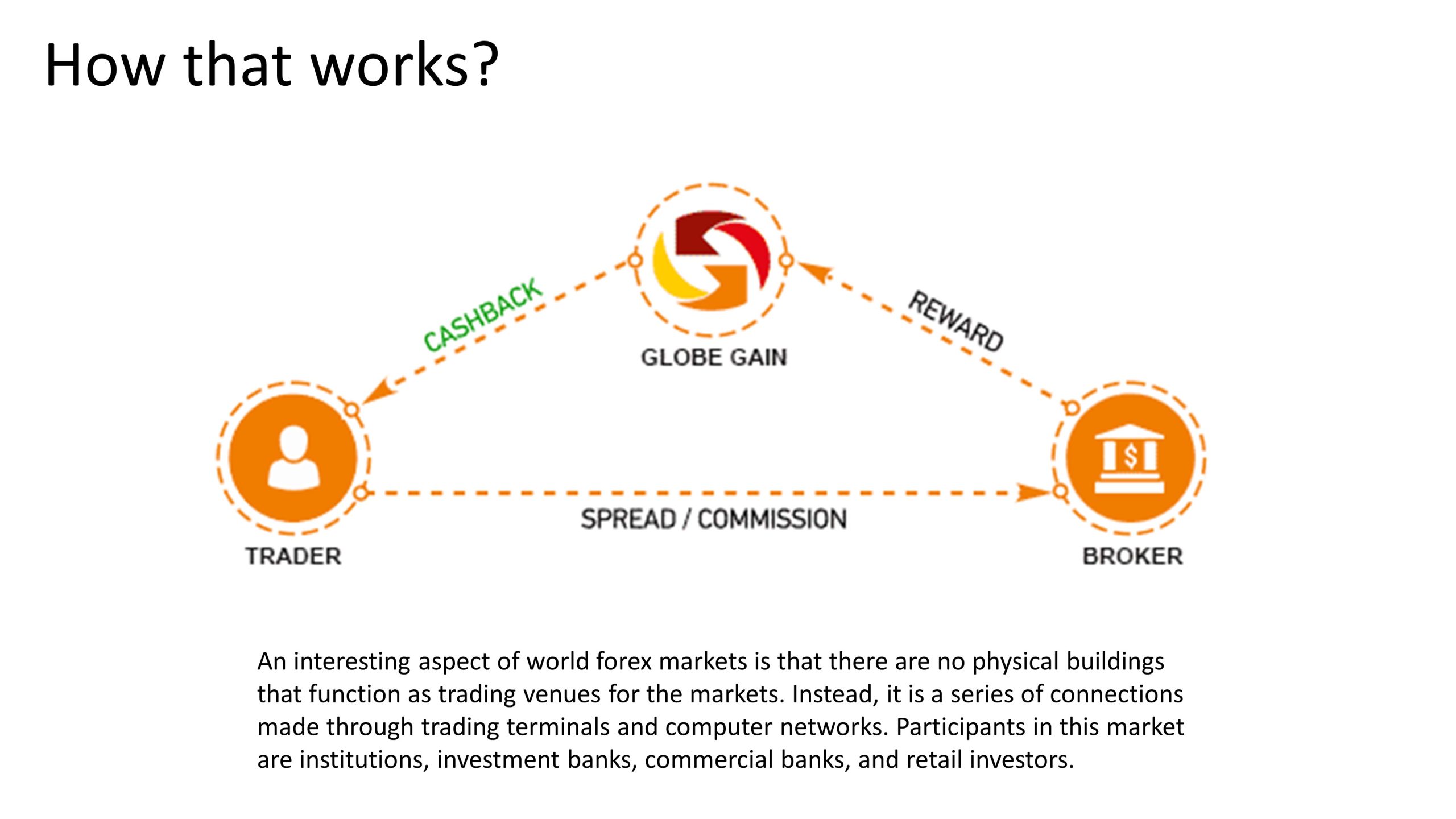

If a trader speculates that the USD value will decrease compared to the Euro, they will invest in the EUR/USD and wait. This kind of trading is called going long. If the dollar value is likely to increase, the trader will go short on the same pair. All trading is routed through forex brokers, who are intermediaries, executing the trade in the open market. Since there is no centralized market for forex trading, the rates offered by the different forex brokers may vary at any time. The forex brokers place their orders using the networks of the major banks. The orders are executed electronically within a fraction of a second after they are placed.

Forex trading is all about buying and selling currency pairs. Forex market is a network of buyers and sellers, and they transfer currency between each other at an agreed price.

For forex trading, each trader must have a forex account and basic technical and fundamental analysis knowledge. The essential advantages of foreign exchange are high liquidity, 24 hours market, and small transaction costs. Forex is a legit business where more than 5 trillion dollars each day fluctuate in the forex market. Forex trading is not a scam – it is as same as trading stocks or any other asset.

Leverage in forex trading

For most people, the primary purpose of trading forex online is to make money. Large companies may trade in forex for a purchase planned in the future or for offsetting a contract that they bagged. Retail traders hope to make money from forex trading due to the changes in the currencies they deal with. Forex brokers offer to offer traders leverage while trading. Leverage allows the trader to trade for amounts more significant than the balance in his account—the forex broker benefits from leverage since the fees will be directly proportional to the amount being traded. The forex broker collects an amount called the spread for each trade.

Leverage in forex represents the ability to make more significant positions with a smaller amount of actual trading funds using borrowed capital from the broker.

However, there are some disadvantages to using leverage. Many inexperienced traders use the maximum leverage available., They often make losses and use up all the money in their account. Hence new traders should spend some time learning forex trading and using the least amount of leverage while trading initially to reduce their losses.

The most important thing is risk in forex trading. Forex offers high leverage where traders can conduct trades in the market by using more significant sums of money than what their accounts possess.

Risk in forex trading needs to be minor, and managing risk is one of the essential jobs for each trader.

But the person would yet hold power to engage in the controlling and trading on the market with a currency in the amount of two thousand dollars. This can be dangerous because new traders may be eager to commence trading instantly with a leverage set at 50.1. But they may not give any preparation concerning the consequences that may ensue.

It sounds like a fun experience to trade with access to leverage. This can increase the chances for one to make good money. However, there is not much talk about the fact that this can also present a higher risk of devastating losses.

When someone trades at a rate of 50:1 with the sum of one thousand dollars in their account, this indicates that the person would be changing fifty thousand dollars on the market. Each pip is, therefore, worth about five dollars. When the move for the daily average about the price of a currency pair is set at 70 to 100 pips, this would mean that the average loss could equate to three hundred and fifty dollars. If one engaged in conducting a reasonably poor trade, this could result in the loss of a complete account in three days if there are normal conditions.

No, forex trading is not a highly profitable business because of the high risks, low percentage of successful traders, and highly predictable market.

So when we talk about profit, 95% of traders lose their money because of high-risk trading, overtrading, and lack of risk management plan.

See Table below:

Many new traders hold a lot of optimism, believing they could see their accounts doubling in only a few days. Yet, visiting your account undergoes many severe fluctuations can indicate that it will be difficult for your account to fold quickly. Many people commence with the assumption that they can endure this scenario. Yet, they are not often able to handle the scenario, they make grave mistakes in their forex trading efforts, and no money remains in their accounts.

Though one may not fall prey to the trap of leverage, the significant difficulty is controlling one’s emotions. One must be able to be in control of their feelings when conducting trades on the forex market because this market can be wild as a roller coaster, and it takes a solid drive to be able to accept the losses at the proper time and not make the blunder of grasping onto trades for too long a period.

How does the forex market work, in simple words?

The forex market works like one big money exchange office. Every second, some buyer buys the currency, and some other sellers sell the same currency. Because there are millions of algorithms, millions of traders, and billions of positions around the globe, forex markets do not allow some strategy becomes forever profitable.

This is the most common beginner question. Value is determined by what people are willing to pay. Forex is a zero-sum game, and when you place your order and lose money, your investment creates price value. When you buy an asset, on the other side, someone sells an asset. Buyers and sellers make price value, and that is only the most important in forex!