Table of Contents

Traders are often attracted to the USD/ZAR currency pair because of its high volatility, offering numerous opportunities for profit from substantial price movements. The historically higher interest rates in South Africa than in the U.S. make it a potential choice for carry trades, where traders benefit from the interest rate differential.

South Africa’s rich mineral resources, especially gold and platinum, also tie the ZAR’s value to global commodity prices. Consequently, traders with insights into these markets or geopolitical events in South Africa might find lucrative trading opportunities with the USD/ZAR.

However, traders usually have problems calculating USDZAR pips because of huge pair fluctuations.

How to Calculate Pips for USDZAR?

To calculate pips for USDZAR, use logic that a 0.0001 difference is one pip. Therefore, if USDMXN rises from 19.0000 to 19.00001, it is one pip difference. Usually, during the day, USDZAR volatility from daily open to daily close is around 1900 pips, which is 15 times bigger than for major forex pairs.

- If we trade one lot size of USDMXN in MT4, one pip is $0.525.

- If we trade one mini lot size of USDMXN in MT4, one pip is $0.0524.

- If we trade one micro lot size of USDMXN in MT4, one pip is $0.00524.

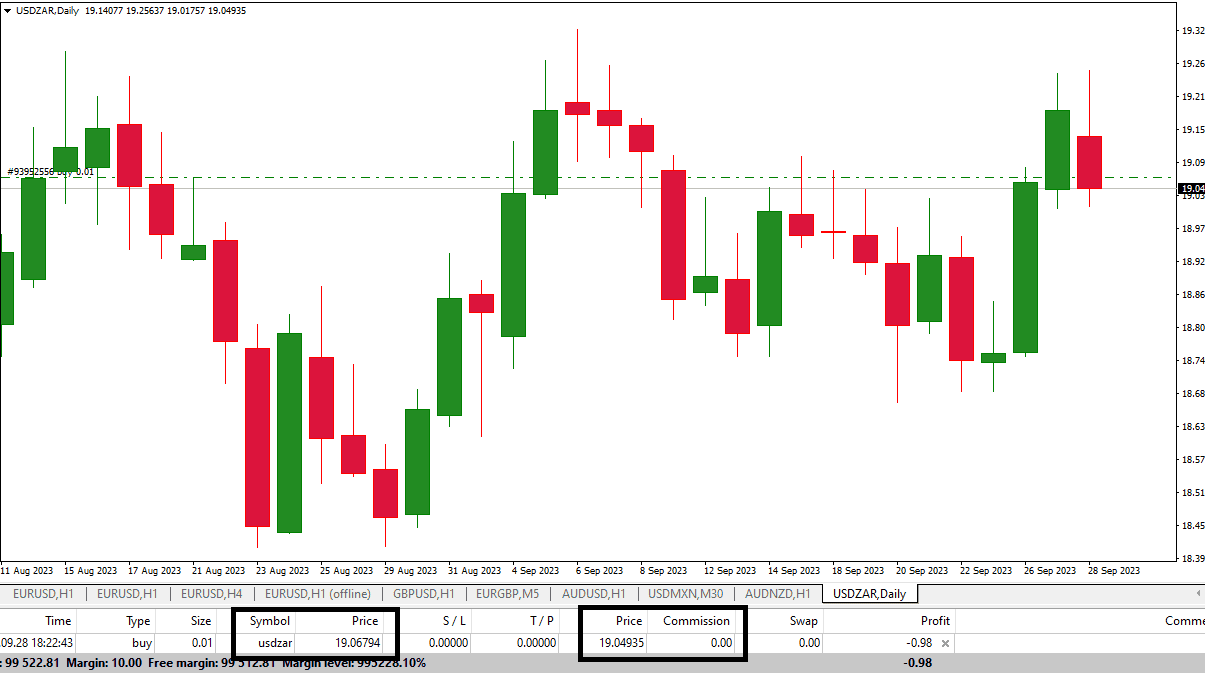

Calculate USDZAR pips for 1 Micro Lot Example.

The difference between the entry and the close price is 19.06794 – 19.04935 = 0.01859

This suggests that for this particular pair, USD/ZAR, in this context, the value of 1 pip for 1 micro lot isn’t the standard $0.01.

To find the pip value in this context:

Profit/Loss ÷ Number of pips = Pip value for one micro lot -$0.98 ÷ 185.9 pips = -$0.00524 (approximately)

So, for this specific scenario with USD/ZAR, the value of 1 pip for one micro lot is approximately $0.00524.

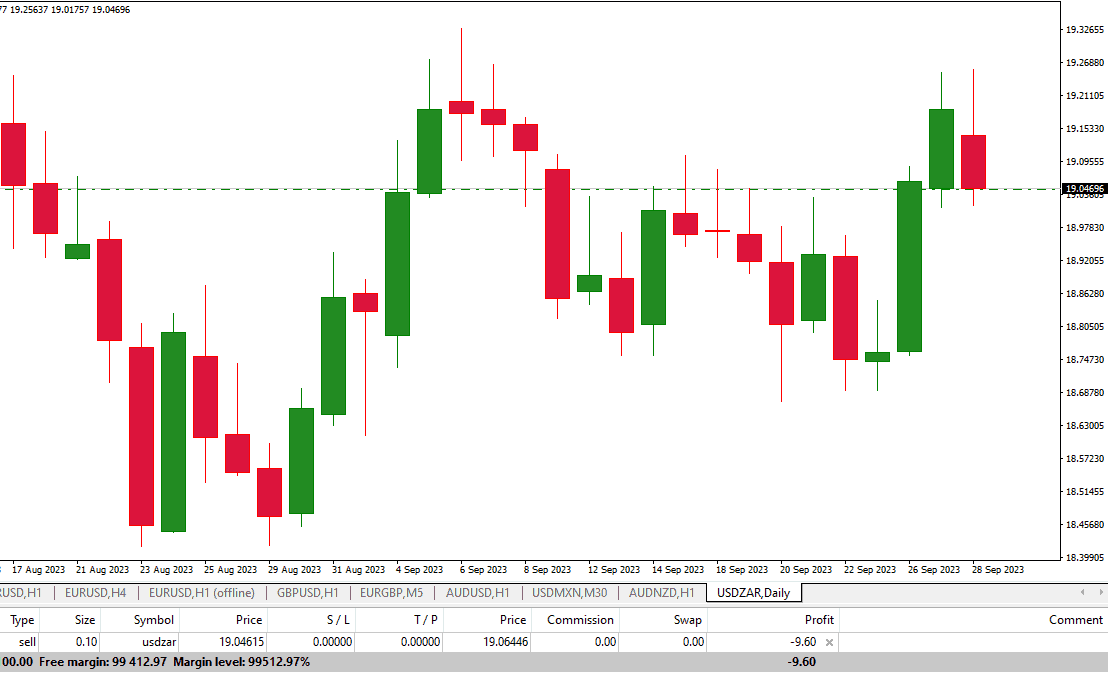

Calculate USDZAR pips for 1 Mini Lot Example.

For a sell trade, we’ll consider the entry price minus the close price: 19.04615 – 19.06446 = -0.01831

This difference translates to a negative movement of 183.1 pips (or a loss of 183.1 pips).

Given your loss was -$9.6 and the movement was 183.1 pips, we can determine the value of 1 pip for 1 mini lot in this context:

Profit/Loss ÷ Number of pips = Pip value for one mini lot: -$9.6 ÷ 183.1 pips = -$0.0524 (approximately)

So, for this specific scenario with USD/ZAR, the value of 1 pip is approximately -$0.0524 when selling one mini lot.

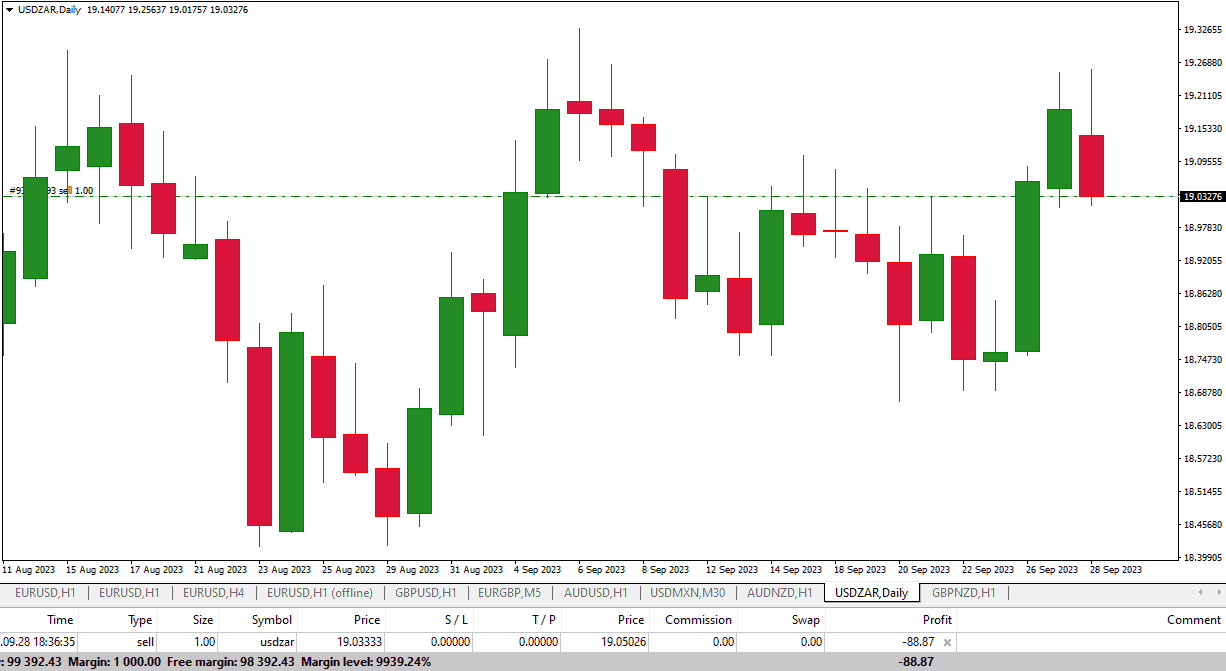

Calculate USDZAR pips for 1 Lot Example.

Since it’s a sell trade, the calculation would involve subtracting the close price from the entry price: 19.03333 – 19.05026 = -0.01693

This difference translates to a negative movement of 169.3 pips (or a loss of 169.3 pips).

Given your loss was -$88.87 and the movement was 169.3 pips, we can determine the value of 1 pip for 1 lot in this context:

Profit/Loss ÷ Number of pips = Pip value for one lot: -$88.87 ÷ 169.3 pips = -$0.525 (approximately)

So, for this specific scenario with USD/ZAR, when selling 1 lot, the value of 1 pip is approximately -$0.525.

In conclusion, with an entry price of 19.03333 and a close price of 19.05026, you faced a movement against your position of about 169.3 pips. Given the pip value in this context, your total loss was approximately -$88.87 when trading 1 lot.