Bitcoin Pips Calculator

Bitcoin is a decentralized form of digital currency, also known as cryptocurrency. It was created in 2009 by an anonymous individual or group of individuals under the pseudonym Satoshi Nakamoto. The purpose behind its creation was to provide people with an alternative source of money that isn’t subject to traditional financial rules and regulations.

Unlike traditional currencies, Bitcoin cannot be printed or created through government intervention. The only way to acquire it is through mining, which involves complex algorithms and expensive computer equipment. Bitcoin transactions occur peer-to-peer over the internet, eliminating the need for third-party involvement in financial transactions, such as banks and other financial institutions.

For traders, one of the most convenient platforms for trading BTCUSD (Bitcoin vs. US Dollar) is MetaTrader 4 (MT4). This popular platform offers advanced charting tools, automated trading signals, and access to hundreds of technical indicators that can help traders make more informed decisions when trading BTCUSD pairs.

When setting up MT4, traders must first open an account with a broker that supports BTCUSD pair trading on MT4. Once their account is active, they must download the MT4 platform onto their computer or mobile device; this should take no more than fifteen minutes. After logging into their MT4 account, they can access the full range of features by MetaTrader 4, including charting tools, live market data feeds, and automated trading signals explicitly tailored for the BTCUSD pair.

To execute trades with explicitly tailored needs to log into their account via the desktop platform or mobile device app, select “New Order” from the menu bar at the top of their screen, then enter all relevant details before submitting a buy or sell order on any currency pair broker’s list of tradable instruments including BTC/USD.

Traders should keep in mind that due to the Volatility associated with crypto markets such as the bitcoin/US dollar, there are higher risks associated with other asset classes; always make sure you understand how high leverage affects your ability to manage risk before entering positions within these markets. As with any online investment activity, please ensure you do all necessary regarding regulator requirements, given your geographical location, before opening an account with any online broker offering bitcoin/US dollar trading activities.

How to Calculate Pips on Bitcoin?

To calculate the BTCUSD number of pips, remember that one pip size of BTCUSD is $0.01. So the bitcoin price gain from 21000.94 to 21000.95 is one pip difference on BTCUSD (bitcoin).

Below, you can check my video where I explained how we can calculate pips on Bitcoin step by step:

To learn how to count pips for various assets, visit our article. For example, on our website, you can learn how to calculate pips on gold or how to count pips on silver.

So how to calculate bitcoin pips:

The one pip value of bitcoin (BTC/USD) per 1 lot is 0.01 USD.

Next, the one pip value of bitcoin (BTC/USD) per 1 mini lot is 0.001 USD.

Finally, the one pip value of bitcoin (BTC/USD) per 1 micro lot is 0.0001 USD.

- If we trade one lot in MT4 and the bitcoin price rises from 27000.00 to 27001.00, we will gain 100 pips or $1.

- If we trade one mini lot in MT4 and the bitcoin price rises from 27000.00 to 27001.00, that’s a 100-pips gain or $0.1.

- If we trade one micro lot in MT4 and the bitcoin price rises from 27000.00 to 27001.00, 100 pips gain or $0.01.

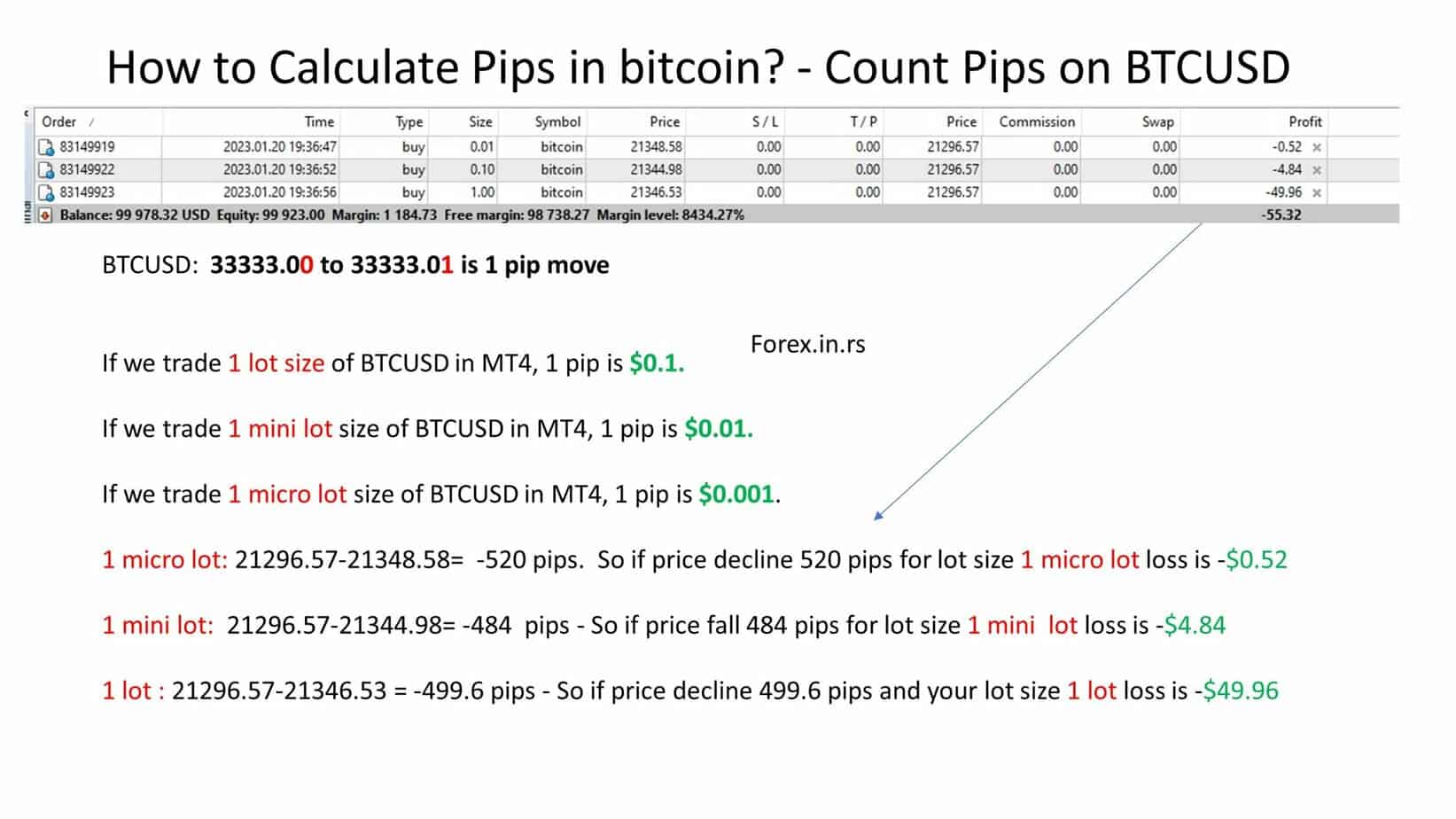

Now, I will make one test to show you how to count pips on BTCUSD. I will create three orders with three different position sizes. One trade will be one micro lot size order, one position lot size, and finally, the last trade one lot size.

Please see the image below:

Now, I will present the calculation on the next slide:

Now let us calculate pips and dollars for each order:

- One micro lot: 21296.57-21348.58= -520 pips. So if the price declines 520 pips for lot size one micro lot loss is -$0.52

- One mini lot: 21296.57-21344.98= -484 pips – So if the price falls 484 pips for lot size, one mini lot loss is -$4.84

- One lot: 21296.57-21346.53 = -499.6 pips – So if the price declines 499.6 pips and your lot size one lot loss is -$49.96