The Dow Jones Industrial Average, also known as the US30 or simply the Dow, is a stock exchange index of 30 large companies listed on the New York Stock Exchange (NYSE). Charles Henry Dow created the Dow Index in 1896, one of the oldest stock market indices.

The Dow index measures the performance of these 30 blue-chip stocks chosen to represent the broader U.S. economy. It reflects how well these 30 large companies are financially and is considered an influential gauge of overall market sentiment. The components included in the index are calculated using a price-weighted average, meaning stocks with higher prices will have more influence over the average than those with lower prices.

The current list of components for the Dow includes some of the largest companies in America, such as Apple, Microsoft, JPMorgan Chase, Walmart, and Home Depot. The index is reviewed quarterly by a committee at S&P Global, which may change its composition if necessary. As such, it can act as a barometer for gauging how well corporations within the U.S. economy perform compared to other markets. It can also give investors an idea of where to allocate their resources.

In terms of historical performance, the average has experienced quite a few long stretches where it went up over time yet experienced various drops during inevitable recessions or crises, such as those seen in 1987 or 2008, respectively. Despite these occasional drops, overall trends have been positive since its creation, and it has grown significantly since then despite recent instability due to global events such as Brexit or elections taking place around the world.

Interestingly enough, reports suggest that only 17% of Americans own any stocks at all, which means that this index holds even greater importance for those who do invest because it can give them an idea about what direction they should take when deciding whether or not to buy or sell something on an individual basis instead of relying on macroeconomic analysis alone.

This article will teach us how to count pips on US30 (DOW).

To learn how to count pips for various assets, visit our article. For example, on our website, you can learn how to calculate pips on gold or how to count pips on silver.

How to Calculate US30 Pips?

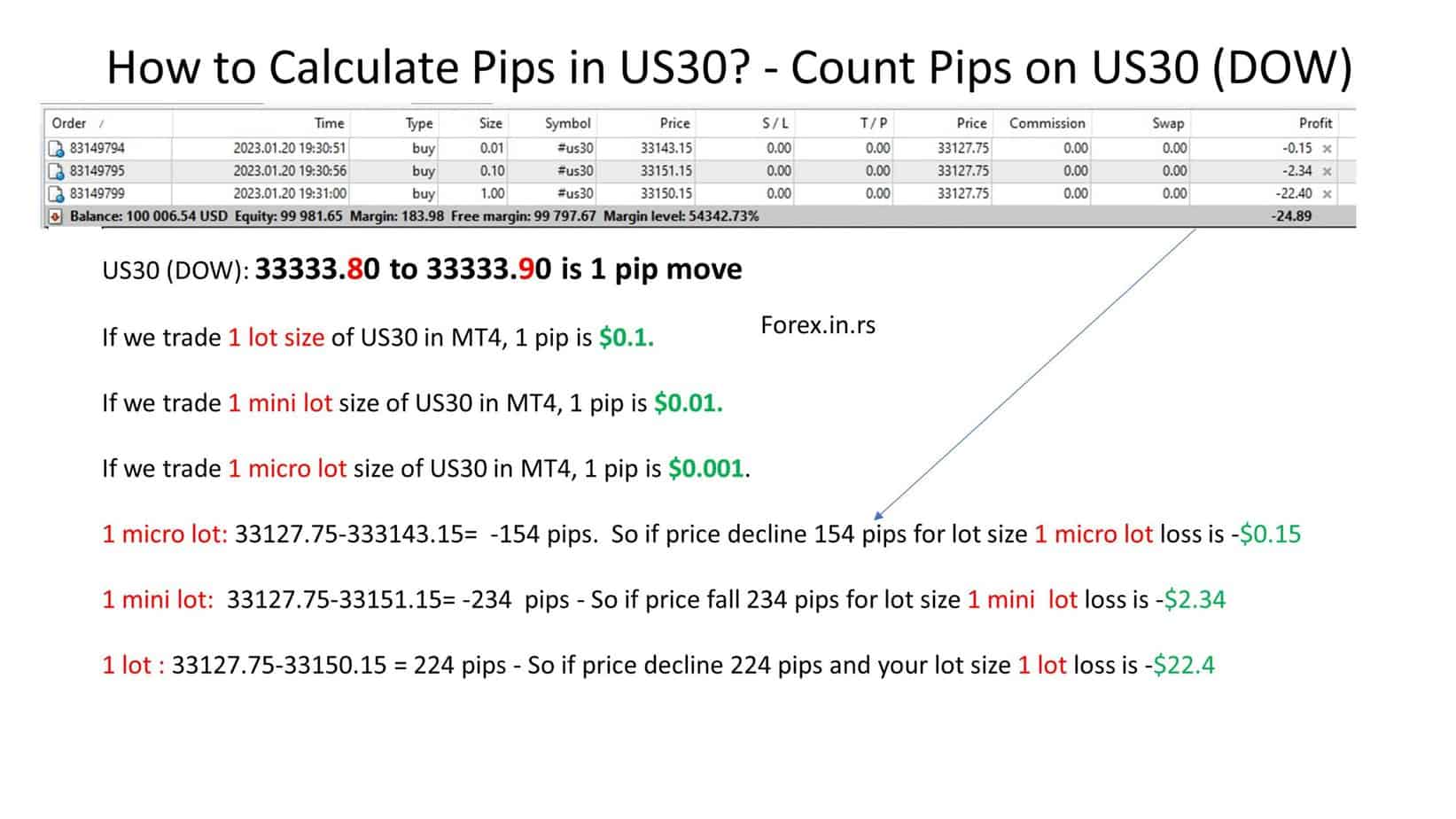

To count pips on US30, you must remember that a 0.1 difference in price is one pip. The US30 price gain from 33000.00 to 33000.10 is one pip difference on USD30. If you add 25 pips on 33000.00 US30 prices, you will get 33002.5.

- If we trade one lot size of US30 in MT4, one pip is $0.1.

- If we trade one mini lot size of US30 in MT4, one pip is $0.01.

- If we trade one micro lot size of US30 in MT4, one pip is $0.001.

If you have your example, visit the US30 Pip calculator.

Please see my video about this topic:

For example, if we trade one lot size and the price goes from 33500.00 till 33575.00, 250 pips gain or $25 in the MT4 platform.

I will create one live trading example where I will open three trades: one micro lot size, mini lot size, and one lot size. See the image below:

Now, I will show you how to calculate pips in the MT4 platform in this practical case:

Let us calculate pips and dollars for each trading size:

- One micro lot: 33127.75-333143.15= -154 pips. So if the price declines 154 pips for lot size one micro lot loss is -$0.15

- One mini lot: 33127.75-33151.15= -234 pips – So if the price falls 234 pips for lot size, one mini lot loss is -$2.34

- One lot: 33127.75-33150.15 = 224 pips – So if the price declines 224 pips and your lot size one lot loss is -$22.4

Please remember that some brokers can change lot sizes/pips in dollars. Based on that, always try to test the platform using a demo account.