Table of Contents

If you’re interested in trading Forex, creating an account on MetaTrader 4 (MT4) or MetaTrader 5 (MT5) is essential. MetaTrader is a robust platform that allows you to trade in financial markets, manage your trades, and analyze market trends. This guide will take you through the process of creating a MetaTrader account.

I created a video with detailed instructions below:

Step 1: Choose a Forex Broker

To begin, you must select a Forex broker that supports MetaTrader. Brokers serve as intermediaries between traders and the financial markets. When choosing a broker, consider factors such as leverage, minimum deposit, and overall reliability.

For a more comprehensive guide, check out the article “Best Forex Brokers of 2024,” which lists top brokers with detailed descriptions. Some popular choices include:

- HFM: Known for its high leverage of up to 1:2000.

- FXPro: A reputable broker with various account types.

- IC Markets: Offers low spreads and flexible leverage.

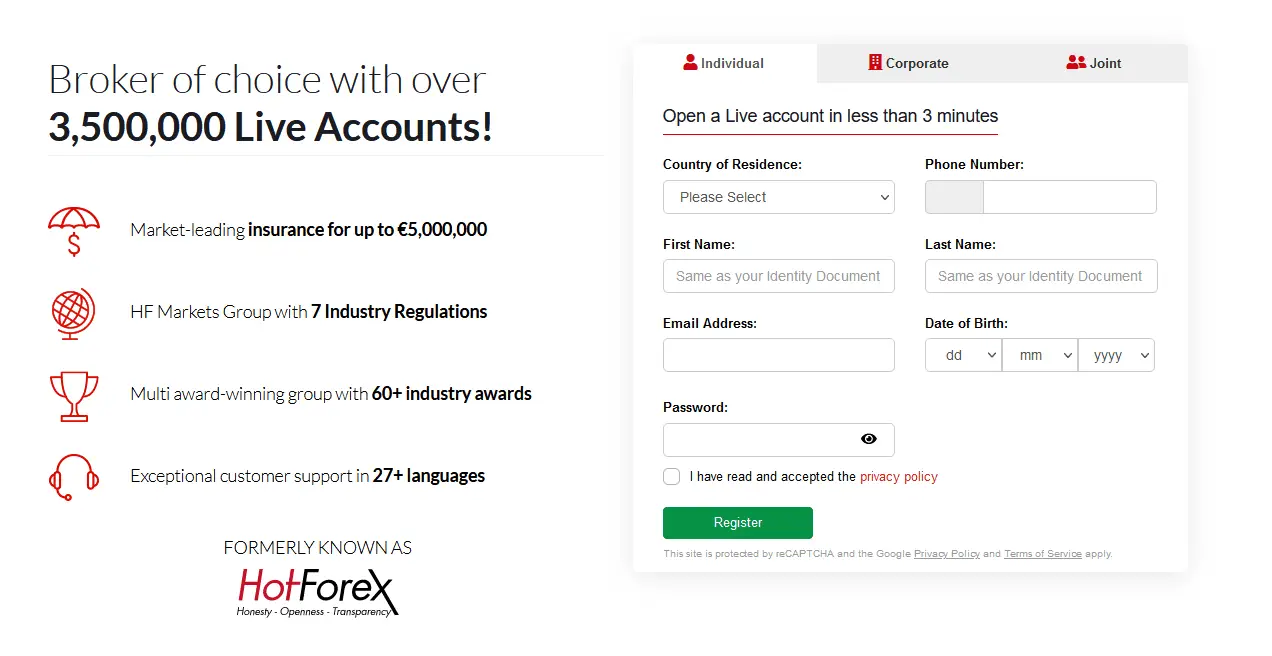

Step 2: Register on the Broker’s Website

After selecting your preferred broker, the next step is to create an account on their platform. Here’s what you typically need to provide:

- Country of residence: Some countries, such as the USA, may have stricter regulations. Make sure the broker supports your country.

- Personal details: First name, last name, email, and phone number.

- Experience level: Brokers often ask if you’re a beginner or an experienced trader to tailor their services.

Once you’ve filled out the necessary information, the broker will likely email you to verify your account.

Step 3: Complete the Verification Process

Before you can start trading, brokers will require identity verification to comply with legal regulations. You’ll need to upload:

- A passport or government ID to confirm your identity.

- A proof of residence, such as a utility bill, to verify your address.

The verification process usually takes a couple of days. This step is crucial to ensure that you are eligible to trade and to confirm that you’re over 18.

Step 4: Configure Your MetaTrader Account

Once you’re verified, you can create a new trading account. Log in to your broker’s dashboard and select the option to create an account. Most brokers offer flexibility in setting up your account:

- Platform: Choose between MetaTrader 4 or MetaTrader 5.

- Account type: Options include standard, pro, and even zero-spread accounts.

- Leverage: Select your leverage based on your trading strategy. For beginners, starting with lower leverage is wise, as higher leverage increases both risk and reward.

Some brokers offer leverage as high as 1:2000, but it’s essential to be cautious with such high leverage, especially if you’re new to trading.

Step 5: Deposit Funds

For live accounts, you’ll need to deposit funds. Different brokers have varying minimum deposit requirements. For example:

- Standard accounts often require a deposit of $100–$200.

- Micro accounts may only need as little as $10.

- Pro accounts usually come with higher minimum deposits, offering lower spreads in return.

Depending on your trading style, you can opt for low spreads with commissions or standard accounts with higher spreads without commissions.

Step 6: Start Trading on MetaTrader

After setting up your account, you’ll receive your MetaTrader login credentials, including a username and password. Here’s how to start trading:

- Download MetaTrader 4 or MetaTrader 5 from the broker’s or official MetaTrader websites.

- Log in using the credentials provided by your broker.

- Set up your chart and begin analyzing the market.

- You can place your first trade by selecting the desired asset, setting the trade size, and choosing whether to buy or sell.

If you’re starting, opening a demo account first to practice trading without risking real money is a good idea. Demo accounts let you get familiar with the platform, and you can switch to a live account once you feel confident.

Final Thoughts

Creating an MT4 or MT5 account is straightforward, but select a reliable broker, verify your account correctly, and configure the correct settings for your trading style. Whether you’re a beginner or an experienced trader, following the steps above will set you up for success in the financial markets.