Table of Contents

The majority of traders lose money in trading. Usually, a high-risk strategy leads to disaster. Another problem is that traders start trading with $1000 or $500, while professional traders can pay the bills only if they trade with more than $100 000. So, profitable traders trade with more than $100K, achieve 20% annual profit, and risk 1% per trade. You must consider taxation if you are in a group of profitable traders.

In the first part of this article, we will analyze US forex trading taxation and then the UK. After that, we will provide information about forex taxation worldwide and a corporate tax table by country.

Do forex traders pay tax in the USA?

Yes, forex traders in the US pay taxes. Forex traders can pay tax in the following ways:

- If you trade forex as CFD (Contract for difference) in the US, you will pay tax as capital income. The current US capital income rates are 0%, 15%, or 20%, depending on your tax bracket for that year. If you make a loss when you trade forex CFD, you can not subtract the amount of the loss from your profits.

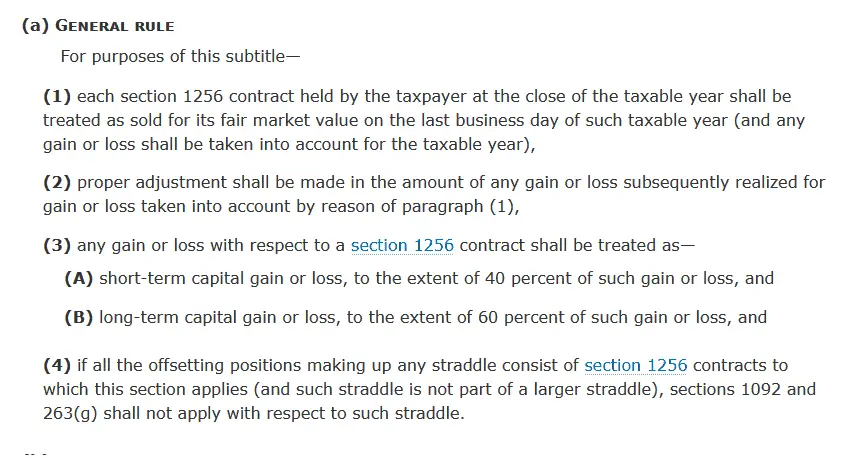

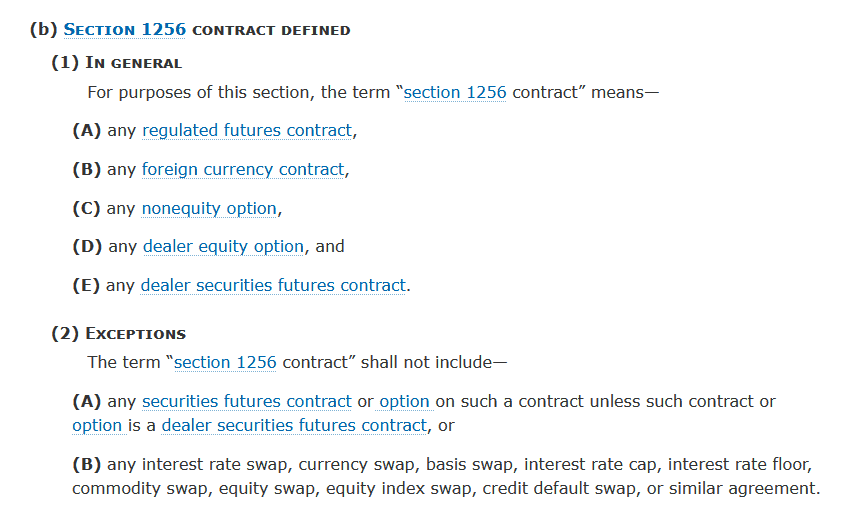

- You will pay taxes based on 1256 contracts if you trade forex futures and options. In that case, you will be taxed based on the 60/40 rule. Therefore, if you make a profit or loss, 60% of gains or losses are treated as long-term capital gains and 40% as short-term.

- If you trade forex spot as a business entity, you can pay taxes, either regular commodities 1256 contracts ( 60/40 rule) or under the special rules of IRC Section 988 for currencies.

Taxing is simple if you are an individual trader; you will pay tax based on the 60/40 rule (1256 contract). Usually, you will get from your US broker a 1099 form; you will choose the 60/40 rule and pay taxes.

See screenshots from the Law:

Let us give you a few examples of how to pay taxes if you are a forex trader in the US.

Example 1: You are an individual trader who made a $5000 profit this year trading forex. You have an additional income of $4000 for this year. However, you will not pay any tax for this year because you have less than 10K annual income, and your bracket is 0% for this year.

Example 2: You have an LLC trading company and work as a self-entrepreneur. You had a 1 million dollars investment this year. You traded futures and options this year and made a $100 000 profit. Therefore you will be paying taxes of $60 000 as long-term capital and $40 000 as short-time capital.

How to report forex income on tax returns in the US?

If you had a loss in the previous year as a forex trader, the best approach is to report tax using IRS Section 988 rules and tax Form 1040 because there is no capital-loss limitation. However, if you had a profit last year, you can use Form 6781 and file taxes using Section 1256 as standard 60/40 capital gains tax treatment.

Your US broker will provide you with form 1099 to help you to calculate your gains or losses!

Because of the USD’s robustness, foreign investors have discovered several opportunities. There is much to learn about money, particularly the tax restrictions the United States has for dealing with currency outside the country. The truth is that the tax system in the United States is complicated to understand. Before you begin trading, you need to know how this organization functions and the various laws and regulations that regulate it. This is required before you can start trading.

First, you need to be aware that the United States considers trading in foreign currencies the same as engaging in business, which means that any gains you make will be subject to taxation. It would help to assume whether you are eligible for any tariff elimination or credits connected to your trade activities.

This can depend on your case’s circumstances or the trading company you decide to do business with. If you want to be successful as a foreign currency trader, you shouldn’t only concentrate on generating money. It would help if you got ready for potential issues like taxes.

The trading of foreign currency (FX) in the United States (US) is subject to taxation, and traders in the US must comply with several laws to avoid having their earnings subject to taxation. Continue reading to learn more about the taxes on trading foreign currencies in the United States.

Regulating currency exchange is nothing new for the US. Although the legal foundation for forex exchange in the United States is intricate, the Internal Revenue Service has issued various decisions to simplify its tax treatment of the industry. Foreign exchange (Forex) market trading is subject to the same regulations as any other trading.

You must declare that information on your tax yield whenever you gain or lose money. When filing your due profit, you must claim the gross income from any overseas exchange affair, whether you made them by purchasing or selling, using either Form 1040 or Form 1040NR.

The Internal Revenue Service (IRS) will handle profits and losses in a manner distinct from regular revenue and deprivation if you engage in tax sheltering via methods like prevarication or program trading.

Are forex losses tax deductible in the US?

Forex losses can be tax deductible or nondeductible, which depends on how you file your taxes. If you have forex trading losses, you can file taxes using form 1040 and use IRS Section 988 rules that deduct your losses without limit, unlike capital losses. However, if you have profitable forex trades and income at the end of the year, you can use Form 6781 and file taxes using Section 1256 as standard 60/40 capital gains tax treatment.

Foreign exchange (FX) traders in the United States would do well to familiarize themselves with applicable tax rules before making any significant investments. It’s natural to feel overwhelmed by the sheer amount of information presented. The worthy update is that you may get professional assistance in understanding the tax implications of forex trading in the United States from tax advisors and forex trading experts.

Do forex traders pay tax in the UK?

Yes, forex traders pay tax in the United Kingdom. If you trade CFD (forex) or spot, you need to pay taxes of 10% if you earn less than £50,000 or 20% for profits above £50,000 (the tax-free limit is £12,000). However, if you have spread betting profits, you will not pay any tax because spread betting is nontaxable.

While not as lucrative, spread betting in the U.K. is tax-free!

Forex traders may prefer the U.K. to the U.S. because of the different tax laws. In the U.K., profits from spread betting on forex are not subject to income tax or capital gains tax, whereas, in the U.S., trading forex is considered self-employment income and, therefore, subject to both taxes. This makes it easier for U.K.-based traders to profit without worrying about high taxes eating into their earnings. Additionally, U.K.-based brokers often offer more competitive spreads, which can significantly impact a trader’s bottom line. Despite this, all forex traders must educate themselves on the specific tax laws in their jurisdiction and plan accordingly, as rules can vary significantly among countries and even within regions like the European Union.

Now let us see worldwide taxation in the forex industry.

Do forex Traders Pay Tax?

Yes, forex traders pay taxes. If you are a registered trader, you pay taxes using the corporate tax percentage defined by your country (see Table ). However, if you trade as an individual trader, you pay tax as “income from other sources.” In that case, only if you have a profit above the nontaxable amount do you need to pay a proper tax.

Let us see how forex traders pay taxes worldwide if they have registered businesses.

Below is presented corporate tax (excluded dividends) by country Table:

Worldwide Corporate Tax Table

| Country | Corporate tax rate (%) |

|---|---|

| Afghanistan | 20.0 |

| Angola | 25.0 |

| Albania | 15.0 |

| United Arab Emirates | 0.0 |

| Argentina | 35.0 |

| Armenia | 18.0 |

| Antigua and Barbuda | 25.0 |

| Australia | 30.0 |

| Austria | 25.0 |

| Azerbaijan | 20.0 |

| Burundi | 30.0 |

| Belgium | 25.0 |

| Benin | 30.0 |

| Burkina Faso | 28.0 |

| Bangladesh | 32.5 |

| Bulgaria | 10.0 |

| Bahrain | 0.0 |

| Bahamas | 0.0 |

| Bosnia and Herzegovina | 10.0 |

| Belarus | 18.0 |

| Belize | 25.0 |

| Bolivia (Plurinational State of) | 25.0 |

| Brazil | 34.0 |

| Barbados | 5.5 |

| Brunei Darussalam | 18.5 |

| Bhutan | 25.0 |

| Botswana | 22.0 |

| Central African Republic | 30.0 |

| Canada | 26.2 |

| Switzerland | 19.7 |

| Chile | 10.0 |

| China | 25.0 |

| Cameroon | 33.0 |

| Democratic Republic of the Congo | 30.0 |

| Congo | 28.0 |

| Colombia | 31.0 |

| Cabo Verde | 22.0 |

| Costa Rica | 30.0 |

| Cuba | 35.0 |

| Cyprus | 12.5 |

| Czechia | 19.0 |

| Germany | 29.9 |

| Djibouti | 25.0 |

| Dominica | 25.0 |

| Denmark | 22.0 |

| Dominican Republic | 27.0 |

| Algeria | 26.0 |

| Ecuador | 25.0 |

| Egypt | 22.5 |

| Eritrea | 30.0 |

| Spain | 25.0 |

| Estonia | 20.0 |

| Ethiopia | 30.0 |

| Finland | 20.0 |

| Fiji | 20.0 |

| France | 28.4 |

| Gabon | 30.0 |

| United Kingdom of Great Britain and Northern Ireland | 19.0 |

| Georgia | 15.0 |

| Ghana | 25.0 |

| Guinea | 35.0 |

| Gambia | 27.0 |

| Guinea-Bissau | 25.0 |

| Equatorial Guinea | 35.0 |

| Greece | 24.0 |

| Grenada | 28.0 |

| Guatemala | 25.0 |

| Guyana | 25.0 |

| China, Hong Kong Special Administrative Region | 16.5 |

| Honduras | 25.0 |

| Croatia | 18.0 |

| Haiti | 30.0 |

| Hungary | 9.0 |

| Indonesia | 22.0 |

| India | 30.0 |

| Ireland | 12.5 |

| Iran (Islamic Republic of) | 25.0 |

| Iraq | 15.0 |

| Iceland | 20.0 |

| Israel | 23.0 |

| Italy | 27.8 |

| Jamaica | 25.0 |

| Jordan | 20.0 |

| Japan | 29.7 |

| Kazakhstan | 20.0 |

| Kenya | 30.0 |

| Kyrgyzstan | 10.0 |

| Cambodia | 20.0 |

| Saint Kitts and Nevis | 33.0 |

| Republic of Korea | 27.5 |

| Kuwait | 15.0 |

| Lao People's Democratic Republic | 20.0 |

| Lebanon | 17.0 |

| Liberia | 25.0 |

| Libya | 20.0 |

| Saint Lucia | 30.0 |

| Sri Lanka | 24.0 |

| Lesotho | 25.0 |

| Lithuania | 15.0 |

| Luxembourg | 24.9 |

| Latvia | 20.0 |

| China, Macao Special Administrative Region | 12.0 |

| Morocco | 31.0 |

| Republic of Moldova | 12.0 |

| Madagascar | 20.0 |

| Maldives | 15.0 |

| Mexico | 30.0 |

| The former Yugoslav Republic of Macedonia | 10.0 |

| Mali | 30.0 |

| Malta | 35.0 |

| Myanmar | 25.0 |

| Mongolia | 25.0 |

| Mozambique | 32.0 |

| Mauritania | 25.0 |

| Mauritius | 15.0 |

| Malawi | 30.0 |

| Malaysia | 24.0 |

| Namibia | 32.0 |

| Niger | 30.0 |

| Nigeria | 30.0 |

| Nicaragua | 30.0 |

| Netherlands | 25.0 |

| Norway | 22.0 |

| Nepal | 25.0 |

| New Zealand | 28.0 |

| Oman | 15.0 |

| Pakistan | 29.0 |

| Panama | 25.0 |

| Peru | 29.5 |

| Philippines | 30.0 |

| Papua New Guinea | 30.0 |

| Poland | 19.0 |

| Puerto Rico | 37.5 |

| Portugal | 31.5 |

| Paraguay | 10.0 |

| Qatar | 10.0 |

| Romania | 16.0 |

| Russian Federation | 20.0 |

| Rwanda | 30.0 |

| Saudi Arabia | 20.0 |

| Sudan | 35.0 |

| Senegal | 30.0 |

| Singapore | 17.0 |

| Solomon Islands | 30.0 |

| Sierra Leone | 30.0 |

| El Salvador | 30.0 |

| Serbia | 15.0 |

| Sao Tome and Principe | 25.0 |

| Suriname | 36.0 |

| Slovakia | 21.0 |

| Slovenia | 19.0 |

| Sweden | 20.6 |

| Swaziland | 27.5 |

| Seychelles | 33.0 |

| Syrian Arab Republic | 28.0 |

| Chad | 35.0 |

| Togo | 27.0 |

| Thailand | 20.0 |

| Tajikistan | 23.0 |

| Turkmenistan | 8.0 |

| Tonga | 25.0 |

| Trinidad and Tobago | 30.0 |

| Tunisia | 15.0 |

| Turkey | 20.0 |

| Taiwan | 20.0 |

| United Republic of Tanzania | 30.0 |

| Uganda | 30.0 |

| Ukraine | 18.0 |

| Uruguay | 25.0 |

| United States of America | 25.8 |

| Uzbekistan | 7.5 |

| Saint Vincent and the Grenadines | 30.0 |

| Venezuela (Bolivarian Republic of) | 34.0 |

| Viet Nam | 20.0 |

| Vanuatu | 0.0 |

| Samoa | 27.0 |

| Yemen | 20.0 |

| South Africa | 28.0 |

| Zambia | 35.0 |

| Zimbabwe | 24.7 |

Suppose you’ve been working in the foreign exchange market for any time. In that case, curious newcomers probably ask this question more than once: “Do you recompense duty on forex exchange United States marketplace?” I said it was correct.

Gains from trading foreign currencies must be taxed. Since the Internal Revenue Service treats forex trading as a business, all earnings matter to taxation. If you are a foreign exchange dealer who has moved to the US, you must pay returns dues by U.S. law.

Profits made in foreign exchange by U.S. citizens trading forex with overseas brokers are subject to United States taxation. This is the case even if the broker never physically visits the US and does all of their business using an offshore internet broker.

A trader’s foreign currency profits are viewed as profits once transformed to United States dollars, nevertheless as a loss when re-exchanged. When changing foreign currency into the greenback, the amount of profit or loss is subject to taxation based on the current exchange rate.

Once marketing loses position in the foreign exchange market due to fair instability or other situations, such as the economic failure of the agent business holding the trader’s account, the trader may be subject to capital gains tax.

Taxation Categories That Affect Brokers

Though it is of the utmost importance to be knowledgeable about the tax implications of US forex trading, it is likewise a good idea to have a working knowledge of the specific kinds of taxes that are most relevant to forex sellers. Because of this, it will be feasible for you to learn budgetary details and how to file your taxes correctly. Traders in foreign exchange are subject to a total of four different forms of dues, which are as follows:

Taxes on Earnings

Trading in foreign currencies can result in gains, considered taxable income. Because it is regarded as personal income, its tax rate is higher than the tax rate used for income from standard employment.

When assessing a person’s tax liability connected to trading in foreign currency, the total yearly earnings made in foreign currency are multiplied by the person’s income tax bracket marginal rate. This helps determine the amount of tax the person is responsible for.

Tax on Corporations

The corporate income tariff is a due that is levied on the earnings that companies make. Following the payment of income tax at the rate that applies to individuals, companies are next subject to the amount of the corporation tax.

The Foreign Exchange Trading Corporation Tax applies to all types of corporations, regardless of whether or not they participate in currency trading. Its fees change depending on the kind of organization, the identity of the dealing, and the foundation of the revenue being processed.

Inheritance Tax

When an investment is sold at retail for a profit, the profit made from that sale is referred to as capital gain. The second meaning of the term “capital advance” refers to the profit made by selling an item at a more excellent price than initially purchased.

Investors and brokers who have sold assets and made a profit may be required to pay capital gains tax. This is because the forex market offers significant profit potential. The amount of this tax is often computed as a percentage of the overall earnings from the transaction, as this is the standard method of doing so.

In most nations, the effective rate of taxation applied to profits made from capital investments falls between 29 and 36 percent.

Tax Reserve on Stamps

A tax levied in the United States, called the Foreign Exchange Stamp Duty Backup Tax, is applied to the value of any business agreements not denominated in US Dollars. The value of the contracts is used to calculate the amount of tax due.

The tax is charged on all transactions that involve options, swaps, and hedging in interest rates and currencies, regardless of whether or not the corporation in issue is qualified as a registered investment company under the Investment Company Act of 1940. The tax is levied on all such transactions. The tax also applies to transactions involving debentures, commercial paper, or bonds issued in a different nation than the one where the transaction took place.

How do American Forex Traders get taxed?

In the United States, foreign exchange (Forex) merchants’ taxation varies significantly from one business to another. This is because there is a wide variety of possible deals in the forex market, each with its own set of tax consequences. The IRS takes in money from foreign exchange in a few different ways:

- Currency traders who use an exchange to conduct their business must treat their trades as though they were being paid money and pay taxes. This consists of the exchange’s first account setup cost. For tax purposes, the Internal Revenue Service will also look at how much time you spend dealing internationally. If you’re a beginner trader looking to split profits 50/50 without paying an exchange charge, Audacity Capital may be a good option.

- Regarding contracts, since purchasing and marketing exchange agreements are considered commerce in the supreme nation-states, you will be required to report and repay dues on your annual gains and losses.

- The excess is considered taxable income if the commissions you pay your broker to trade exchanges surpass a specific threshold.

- Additionally, US forex traders can file their due yields following either Internal Revenue Code Section 988 or Section 1256.

Reporting Foreign Exchange Trading Profits and Losses under Internal Revenue Code Section 988

Previously, those participating in the foreign trade marketplace must recompense dues on their earnings. They are eligible to report their income under Code Section 988. Gains from the foreign exchange market are taxable as regular income under current legislation.

It’s also worth noting that there is a distinct difference between enduring and temporary forex advances under the US tax rules. Therefore, your fees will be calculated based on your yearly salary. Long-term capital gains tax rates can be as low as 0% or 20%.

Regulatory Framework for Foreign Exchange Transactions Under Section 1256

You need not file your taxes under Internal Revenue Code Section 988. You can use IRS Code Section 1256 to report your gains and losses without penalties. A 15% flat rate will be applied to the remaining 60% of your yearly profits under this provision. Contrarily, 40% may be subject to taxes, reliant on your circumstances. Investors in the 22 percent tax rate can benefit from using Code Section 1256.

Currency Exchange Tax Considerations

Trading foreign exchange successfully calls for self-control, tolerance, insight, and commitment. You’ll need more than just hard work and concentration to succeed with foreign exchange taxation, though. Such things could include;

Observe the Time Limit

Starting in the trading world, you shouldn’t forget to submit your taxes immediately. If you want to avoid a fine for paying late or not at all, you should have your tax documents for an IRS audit.

Make Sure You Have Clean Slates

Filing your taxes once probable following the expiration of the due year is the easiest method to maintain accurate financial documentation. Filing early guarantees that the IRS’s processing of your return and subsequent payments will be complete and accurate. Contacting an auditor or duty adviser for advice on handling problems with these expenses is a good idea if you have any doubts about how to proceed.

Don’t forget to send in your tax payment!

When day trading with a US broker, how to minimize tax liability? Tax evasion is a common tactic used by many traders. It’s only necessary to file annually if your salary is very high. In a positive turn of events, there are lawful means of evading taxation. One way to do this is to employ cost-cutting measures and reduce your overall trade budget.

The Internal Revenue Service (IRS) is relentless, so it’s probably not a good idea to avoid paying them. Therefore, filing your taxes on time is essential to preventing problems and fines.

What’s the most important thing you must distinguish about foreign exchange taxation?

Tax Considerations for Forex Trading if you are starting in the forex market, US legislation may seem daunting. The most critical information is your trading status and the associated taxation requirements. Furthermore, knowing your tax bracket is essential for calculating the approximate annual amount that will be withheld from your salary.

Use a patented exchange business like Audacity Capital if you feel stressed about the FX taxation procedure. On condition that you have the necessary trading abilities, the tenet will make exchange assets and cash available to you.