Table of Contents

In our previous post, we defined stop-loss order.

What is Stop-Loss Order?

A Stop-loss order is an instruction placed with a broker to buy or sell a security by setting a stop loss level, a specified amount of pips away from the entry price. The Stop-loss order aims to prevent additional losses if the price goes against the trading position.

Trading involves and minimizes several risks; various trading platforms offer several tools. One such tool is the stop-loss order. It acts as a protective shield for a trader’s capital. It prevents excessive exposure of the trader’s investment. Before the commencement of trade, every trader decides how much money they are willing to risk should they incur a loss. Then, traders put a stop-loss order at that amount and open a position. If the market moves against their speculations, they will be automatically given the exit when the losses hit the stop-loss.

Just like every other tool, stop-loss orders have their disadvantages as well. They can protect you against unwanted losses but are helpful only when the market moves in the opposite direction to your prediction. In other words, they cannot cover your losses. For example, you invest $500 and put a stop-loss order at $300. Assume you profit from $100 during one trading day, but the market moves in the opposite direction the next day. The stop-loss order will close your position by $300, but it will not be able to protect your $100.

So, what’s the alternative? The answer is trailing stops.

What is the trailing stop order?

A trailing stop order is an order in the trading platform that adjusts the stop price at a fixed percent or the number of points below (for buy position) or above (for sell position) the market price of an asset (forex, stock, commodity, etc.).

A trailing stop order is a type used in trading designed to help traders limit potential losses and lock in profits. With a trailing stop order, a trader sets a stop-loss order at a certain percentage or dollar amount below the market price for a long position or above the market price for a short position. However, unlike a regular stop-loss order, the trailing stop order moves with the market price, always maintaining a distance of a certain percentage or dollar amount.

For example, suppose a trader buys a currency pair at $1.00 and sets a trailing stop order with a distance of 10 cents. If the market price drops to $0.90, the trailing stop order will be triggered, and the position will be automatically sold to limit the loss. However, if the market price rises to $1.10, the trailing stop order will increase to $1.00, maintaining the 10-cent distance from the market price. This allows the trader to lock in profits as the market price rises.

Trailing stop orders can be set as a percentage or dollar amount, depending on the trader’s preference. The advantage of using a trailing stop order is that it allows traders to capture profits as the market price rises while minimizing potential losses if it falls. However, it is essential to note that trailing stop orders do not guarantee losses, and traders should always use them in conjunction with other risk management strategies.

How does a trailing stop work?

Using trailing stop traders, define trail amount (fixed number of pips or percentage) for stop loss. When the trader sets a trailing stop on the “Buy” open position, the stop price rises by the trail amount as the market price increases. When the trader sets a trailing stop on the “Sell” open position, the stop price falls by the trail amount as the market price falls. If the asset price goes in the opposite direction, the stop-loss price doesn’t change. When the price reaches the trailing stop loss level, the trailing stop will close the position.

Unlike a stop-loss order, trailing stops can protect your profits as well. After considering the prevailing market prices, you can set them at an absolute pip number or a defined percentage. Trailing stops work on a similar model but in a different manner. First, you put a trailing stop on your profits. This means the trade will continue if the market prices move in your preferred direction. The trailing stop will close the position once it starts to move in the opposite direction and reaches your defined percentage or pip number. This helps protect the profits as this tool does not wait for losses to begin.

Let’s consider an example for a better understanding.

Trailing stop example: Imagine that you are following a bullish trend. Here, your trailing stop will go higher whenever a new high is in the market. The trailing finish trails the price if it moves in the desired direction. It will maintain the desired percentage or pip distance that you have selected. If the costs begin to move in the opposite direction, the trailing stop will hold your last profitable position until the prices hit it. Then, it will start to trail the prices again if they move higher.

The notable difference between a trailing stop and stop-loss is that the latter is placed with a server while the former is with a client terminal. What does this mean? You will lose your trailing stop order once your terminal is closed. This will leave you unprotected. This does not apply to stop orders, as they remain active through and through.

How To Set a Trailing Stop on MT4

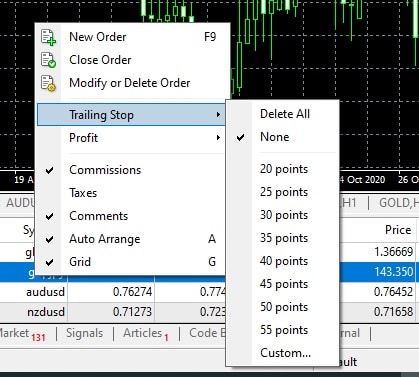

To set a trailing stop on MT4, go to the terminal and right-click on the already open position. Then, choose the trailing stop option and custom set the trailing number of pips or select a predetermined number of pips.

As we can see in the image above, to set a trailing stop on MT4, you have three following steps:

- First, you need to select the order that you wish to protect. Next, go to the terminal and right-click on it. This will open the context menu. Next, scroll to find the Trailing Stop option.

- A pop-up window will surface, allowing you to choose a pip distance to the prevailing market prices. These pip distances are predetermined.

- You can choose the one you are comfortable with or create a new one by clicking on ‘Custom.’ You only get one trailing stop for one position.

Let us sum up:

Set MT4 trailing stop:

- Open the MT4 Trading Platform: Open the MT4 trading platform on your computer or mobile device and log in to your account.

- Open a Position: Open a position by placing a buy or sell order on a currency pair or other financial instrument. The position will appear in the terminal window of the MT4 platform.

- Right-click on the Position: In the terminal window, right-click on the position you want to set a trailing stop.

- Select Trailing Stop: From the menu that appears, select “Trailing Stop.”

- Choose Trailing Stop Value: Choose a value for the trailing stop. You can enter a custom number of pips or choose a predetermined number from the list. For example, if you select a trailing stop of 20 pips and the currency pair’s price increases by 20 pips, the trailing stop will activate, moving the stop-loss order 20 pips above the current market price.

- Confirm Trailing Stop: Once you have selected the trailing stop value, click “OK” to confirm the trailing stop. The trailing stop will now be activated for the position, and the stop-loss order will move up or down with the market price, maintaining the distance you selected.

- Monitor and Adjust: As the market price moves, the trailing stop will move with it, helping you to lock in profits and minimize potential losses. Therefore, monitoring the market and adjusting the trailing stop is essential to ensure that there are at an appropriate distance from the market price.

Once your trailing stop is placed, it will be monitored by the terminal. A break-even stop-loss will be employed automatically when the prices reach the desired level. From this point forth, the positive movement of the costs will be chased by the trailing stop. Your trailing stop will hold the fort and protect your profits if the action is in the undesired direction.

To remove the trailing stop, you can open the menu and select the ‘None’ option. You can also select ‘Delete All’ to remove all the trailing stops from your open and pending orders.

How to set the trailing stop in MT4 iPhone or any cell phone?

How to use the trailing stop on MT4 mobile?

Unfortunately, MT4 mobile apps do not allow setting the trailing stop. However, traders can open positions and set trailing stop loss using a desktop computer.

Download the trailing stops loss indicator and trailing stop loss EA

You can download the Download Trailing stop loss if you need to print on the chart trailing stop loss indicator.

If you need an Expert advisor to close trades automatically using trailing stop loss: Download automatic trailing stop loss EA.

Setting a trailing stop in MT4 is easy. But is it hard with other platforms?

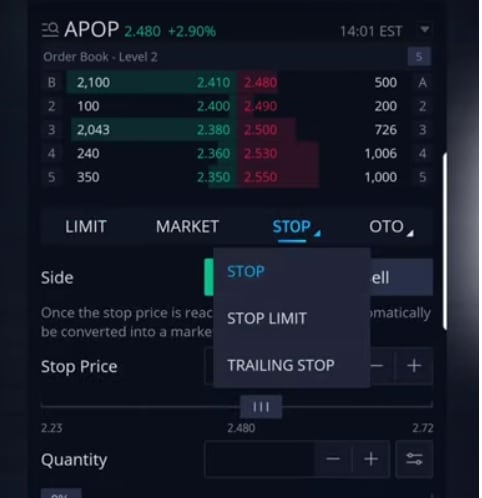

Does Webull have a trailing stop loss?

Yes, Webull has a trailing stop loss; you can find it when you press the “STOP” dropdown button. You will get options to set an ordinary stop, stop limit, or trailing stop. In addition, Webull will offer you to select the Trail amount in dollars or trail percentage as trailing stop loss.