In the trading industry, commodities are raw materials or primary agricultural products that can be bought, sold, or traded on various markets. These goods are typically standardized, meaning they are interchangeable regardless of who produces them, allowing for a more fluid trading process. Commodities are divided into two main categories: hard commodities, mined or extracted, like gold, oil, and natural gas, and soft commodities, which are grown, such as wheat, coffee, and cotton.

Traders and investors engage in the commodities market to hedge against inflation, diversify their portfolios, or speculate on price movements. Global supply and demand dynamics, geopolitical events, and economic indicators influence the prices of commodities. Examples of commonly traded commodities include crude oil, natural gas, gold, silver, corn, and soybeans.

Here’s a list of common commodities trading symbols:

- Coffee – KC (Coffee C Futures on ICE)

- Gold – GC (Gold Futures on COMEX)

- Silver – SI (Silver Futures on COMEX)

- Crude Oil (WTI) – CL (West Texas Intermediate Crude Oil Futures on NYMEX)

- Natural Gas – NG (Natural Gas Futures on NYMEX)

- Corn – C (Corn Futures on CBOT)

- Wheat – W (Wheat Futures on CBOT)

- Soybeans – S (Soybean Futures on CBOT)

- Copper – HG (Copper Futures on COMEX)

- Cotton – CT (Cotton No. 2 Futures on ICE)

Here are the symbols for common commodities as they might appear in CFD (Contract for Difference) trading platforms:

- Coffee – COFFEE or COFFEE-C

- Gold – XAU/USD or GOLD

- Silver – XAG/USD or SILVER

- Crude Oil (WTI) – USOIL or WTI

- Brent Crude Oil – UKOIL or BRENT

- Natural Gas – NATGAS or NGAS

- Corn – CORN or CORN-C

- Wheat – WHEAT or WHEAT-C

- Soybeans – SOYBN or SOYBEAN-C

- Copper – COPPER or COPPER-C

- Cotton – COTTON or COTTON-C

Steps of How to Trade Commodities?

Trading commodities involves buying and selling raw materials or primary agricultural products on various exchanges to profit from price movements. Here’s a step-by-step overview of how to trade commodities:

- Understand the Market: Start by gaining a solid understanding of the commodities market, including the types of commodities (such as metals, energy, and agricultural products) and the factors influencing their prices, such as supply and demand, geopolitical events, and economic data.

- Choose a Trading Method: Decide whether to trade commodities through futures contracts, options, ETFs (Exchange-Traded Funds), or CFDs (Contracts for Difference). Futures contracts are the most direct way to trade commodities but require significant capital and experience. CFDs and ETFs are more accessible and allow trading with smaller amounts of capital.

- Select a Broker: Choose a reputable broker that offers the commodity trading method you prefer. Ensure the broker provides access to the necessary trading platforms, research tools, and resources.

- Analyze the Market: Use technical analysis, fundamental analysis, or a combination of both to predict price movements. Technical analysis focuses on historical price data and chart patterns. In contrast, fundamental analysis examines the underlying factors affecting commodity prices, such as weather conditions for agricultural products or OPEC decisions for oil.

- Develop a Trading Plan: Create a trading plan outlining your strategy, including entry and exit points, risk management techniques (such as stop-loss orders), and the amount of capital you are willing to risk on each trade.

- Execute the Trade: Place your trade through your chosen platform. Monitor the trade closely, making adjustments as necessary based on market movements and your trading plan.

- Manage Risk: Commodity prices can be volatile, so managing risk effectively is crucial. Use stop-loss orders to limit potential losses, and never risk more capital than you can afford to lose.

- Close the Trade: Once your target price is reached or the market moves against you, close the trade according to your plan. Review the trade to learn from the outcome and refine your strategy for future trades.

Trading commodities can be lucrative but requires knowledge, discipline, and a well-thought-out strategy.

How to Trade Commodities (Strategy)?

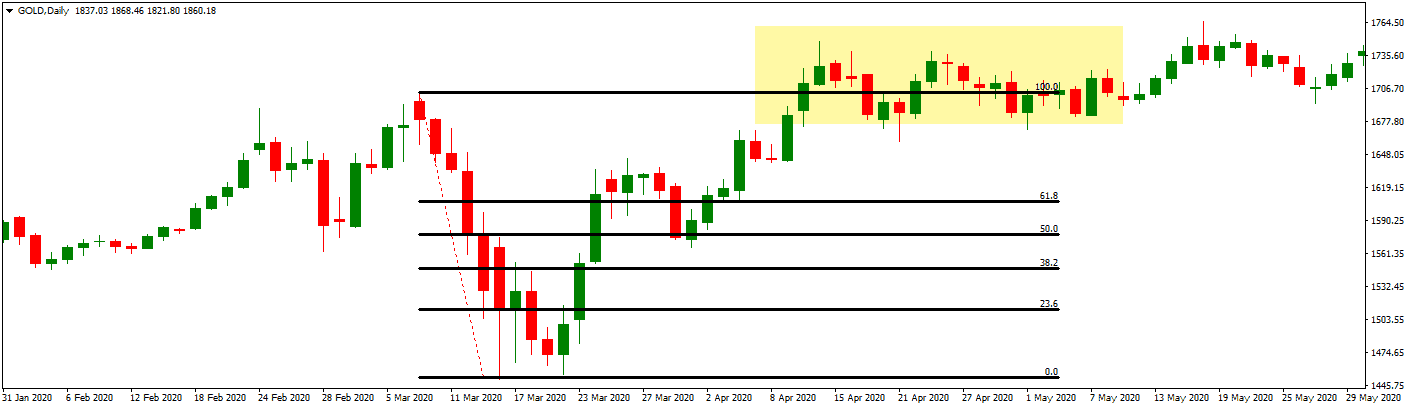

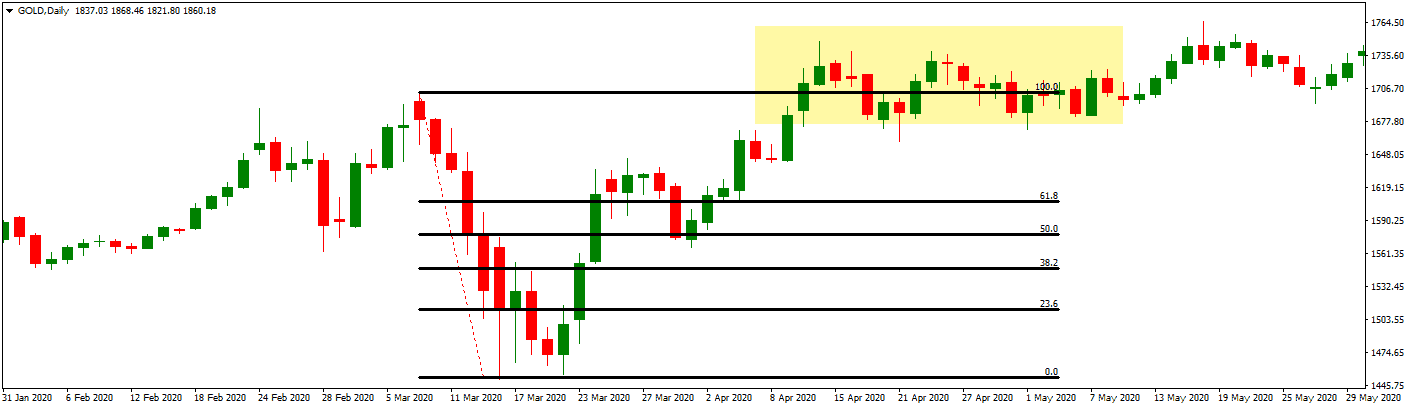

The best strategy to trade commodities involves using previous high and low price levels, such as daily and weekly highs and lows, as crucial entry and exit points. These levels often act as strong support and resistance, helping traders identify potential turning points in the market.

The best strategy to trade commodities involves analyzing historical price levels, specifically daily and weekly highs and lows, to determine entry and exit points. These levels are significant because they often serve as solid support and resistance zones, where price reversals or consolidations can occur. By observing how prices behave around these historical levels, traders can identify potential turning points in the market.

For example, if a commodity price approaches a previous high and starts to struggle, it might signal resistance and a potential opportunity to sell. Conversely, if the price nears a previous low and shows signs of bouncing back, it may indicate support and a buying opportunity. This approach helps traders capitalize on predictable price behavior based on historical trends.

Traders must closely monitor the US dollar when trading commodities due to the strong correlation between the two. Here’s a detailed explanation of why this is important:

- Inverse Relationship: Many commodities, especially those traded globally, like oil, gold, and silver, are priced in US dollars. Generally, there is an inverse relationship between the value of the US dollar and commodity prices. Commodities become more expensive in other currencies when the US dollar strengthens, leading to decreased demand and lower prices. Conversely, when the US dollar weakens, commodities become cheaper for foreign buyers, potentially increasing demand and increasing prices.

- Impact on Pricing: Commodities are often quoted in dollars per unit (e.g., dollars per barrel of oil, dollars per ounce of gold). A rising dollar means that the same commodity is worth fewer dollars, which can lead to lower commodity prices. On the other hand, a falling dollar increases the dollar value of the commodity, potentially leading to higher prices.

- Economic Indicators: The strength of the US dollar is influenced by various economic indicators, such as interest rates set by the Federal Reserve, inflation data, and economic growth reports. Traders need to monitor these indicators because they can impact the dollar’s value and, consequently, commodity prices.

- Geopolitical and Market Sentiment: Global economic events and geopolitical developments can affect the US dollar and commodity prices. For instance, a crisis in a central oil-producing region can drive up oil prices and potentially impact the US dollar’s value. Traders must consider how these factors might influence the dollar and the commodities they are trading.

- Hedging and Speculation: Traders often use the US dollar to hedge against commodity price fluctuations. For example, if traders anticipate a strengthening dollar, they might hedge their commodity positions to mitigate potential losses. Similarly, speculative positions in the US dollar can affect commodity trading strategies.

- Technical Analysis: Technical analysis of the US dollar’s strength, often measured by the US Dollar Index (DXY), can provide insights into potential trends and reversals in commodity prices. Traders use charts and technical indicators to forecast dollar movements and adjust their commodity trading strategies accordingly.

Conclusion

Trading commodities effectively involves leveraging historical price levels, such as daily and weekly highs and lows, to identify key entry and exit points. These historical levels often act as significant support and resistance, providing valuable insights into potential price reversals or continuations.

By analyzing how commodities interact with these price levels, traders can make informed decisions and improve their chances of capitalizing on market trends. Incorporating this strategy into a broader trading plan and considering market conditions and economic factors can enhance overall trading success and risk management.

Trader at Leanta Capital

Igor has been a trader since 2007. Currently, Igor works for several prop trading companies.

He is an expert in financial niche, long-term trading, and weekly technical levels.

The primary field of Igor's research is the application of machine learning in algorithmic trading.

Education: Computer Engineering and Ph.D. in machine learning.

Igor regularly publishes trading-related videos on the

Fxigor Youtube channel.

To contact Igor write on:

igor@forex.in.rs