Table of Contents

While the question may seem straightforward, the reality is quite striking: 99% of people who trade forex fail to make money, with only 1% achieving success. The same pattern holds for stock trading. This discrepancy isn’t due to the type of asset being traded—whether it’s forex, stocks, futures, or options—but rather stems from issues in money management.

How to Trade Forex and Make Money?

To trade forex and make money, you need a valid brokerage or prop company account, good money management skills, and consistency in trading. For example, if you purchase a $ 200,000 prop trading account (a $1000 investment) and earn an average of 2% per month, you can make around $4000.

We will discuss several steps every trader needs to take to make money in the forex industry.

Trade forex and make money, but first invest in learning

The allure of quick profits can be enticing, leading many novice traders to dive in without adequate preparation. However, the forex market is complex and can be unforgiving to those without a thorough understanding of its mechanics. Investing in education is crucial for anyone serious about making money in forex trading. Try to learn from university books and legitimate YouTube channels.

Key Areas to Focus On

- Market Fundamentals: The first step is understanding the basic principles of the forex market. This includes knowledge of significant currency pairs, market participants, and the factors that drive currency price movements.

- Technical Analysis: This involves studying price charts and using technical indicators to forecast future price movements. Reading and interpreting these charts is essential for identifying trading opportunities and making informed decisions.

- Fundamental Analysis: Beyond technical analysis, traders must also consider economic indicators, such as interest rates, inflation, and employment data, which can significantly impact currency values. Keeping abreast of global news and understanding how these factors affect the market is crucial.

- Risk Management: Effective risk management strategies are vital for long-term success in forex trading. This includes setting stop-loss orders to limit potential losses, managing leverage carefully, and maintaining a diversified trading portfolio.

- Psychological Discipline: Trading can be emotionally taxing, and maintaining psychological discipline is critical to avoiding impulsive decisions based on fear or greed. Regardless of short-term market fluctuations, developing and sticking to a trading plan helps maintain consistency and control.

Resources for Learning

Numerous resources are available for aspiring forex traders to enhance their knowledge and skills. Online courses, webinars, and tutorials offer flexible learning options. Many brokers provide educational materials and demo accounts, allowing traders to practice without risking real money. Books written by experienced traders and financial analysts can also provide valuable insights and strategies.

Get a brokerage trading account.

Positional trading in forex is a strategy where traders hold positions for several weeks or months, aiming to capitalize on long-term market trends. This approach uses fundamental and technical analysis to make informed trading decisions.

Fundamental analysis evaluates economic indicators, interest rates, political events, and other macroeconomic factors influencing currency values. Positional traders pay close attention to factors like GDP growth rates, employment data, central bank policies, inflation rates, and geopolitical developments. They use this information to identify currencies likely to appreciate or depreciate over the long term.

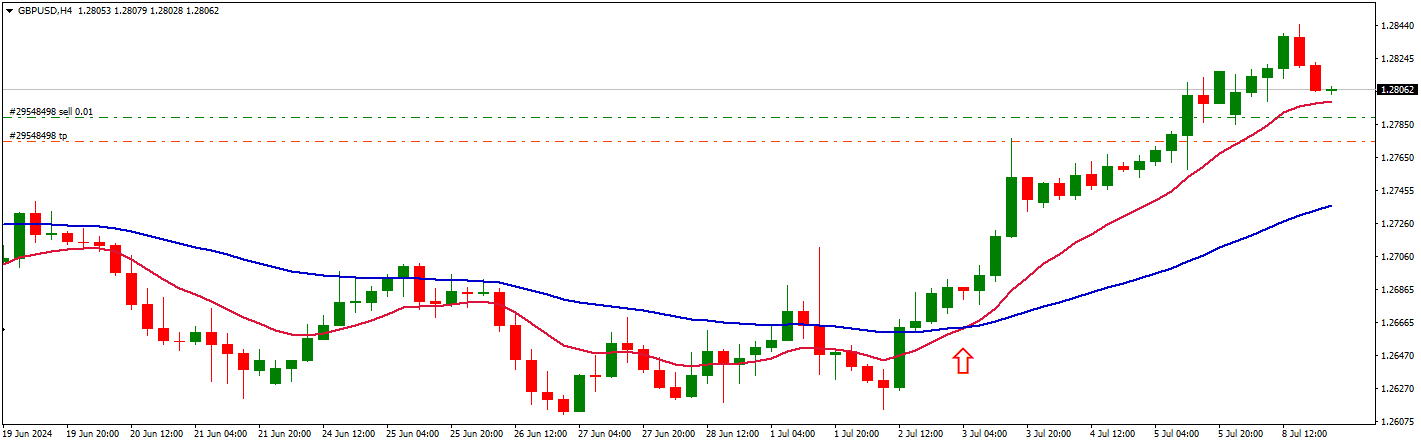

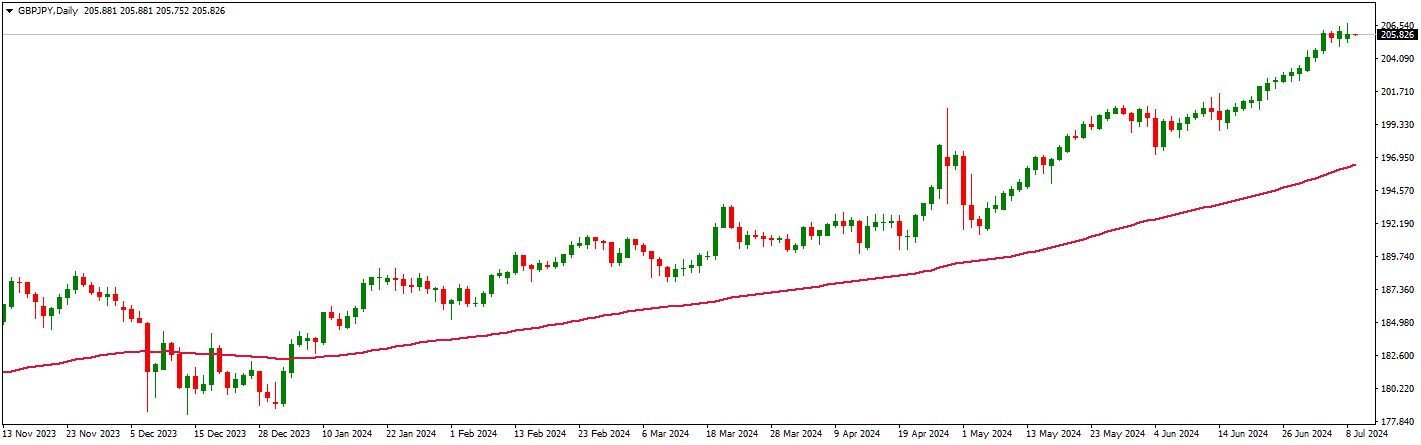

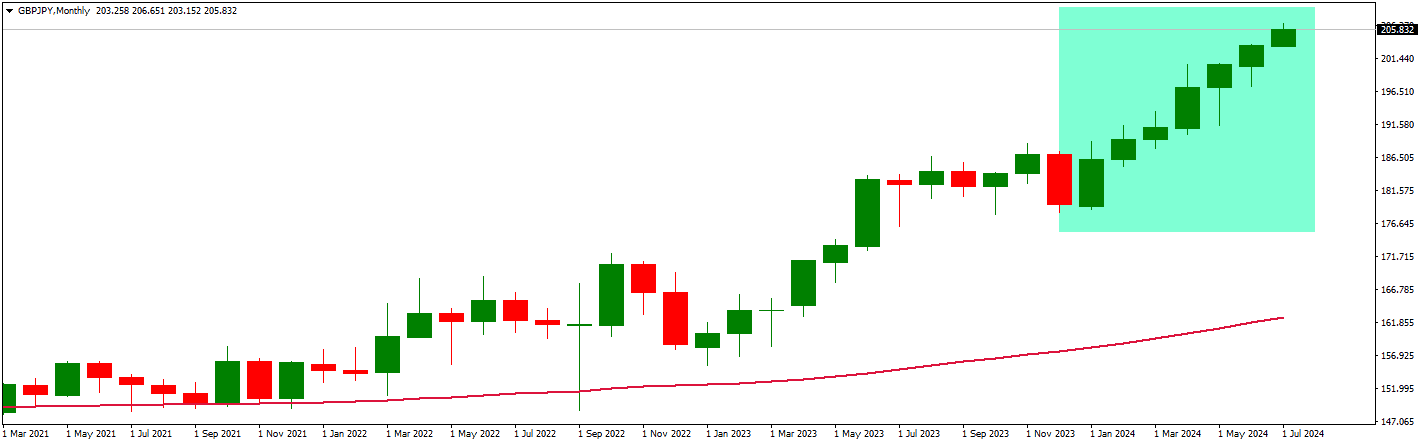

You can make position trades in forex using fundamentals and make extraordinary profits. For example, the interest rate for JPY is around 0, and GBP 5.25. Because of the vast difference, GBPJPY is in a solid bullish trend :

If we check the monthly chart, we can see that each month in 2024 was bullish:

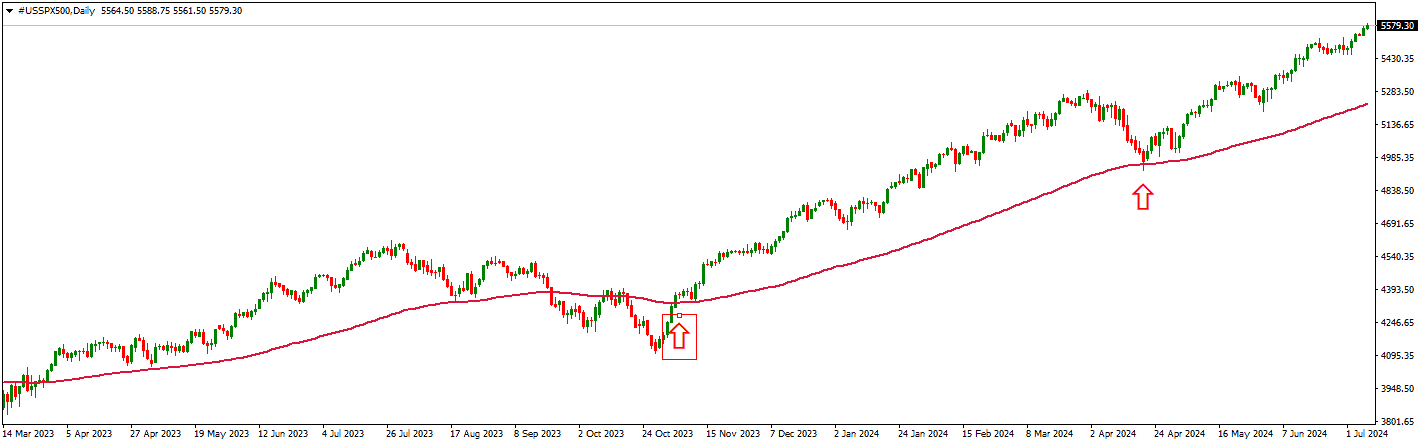

Technical analysis, on the other hand, involves studying historical price charts and using technical indicators to forecast future price movements. Positional traders rely on tools such as moving averages, trend lines, support and resistance levels, and chart patterns to identify entry and exit points. They look for solid and sustained trends and avoid short-term market noise.

For example, you can see only 2 trades this year where traders can make extraordinary profit trading indices such as the S&P500:

One key advantage of positional trading is that it reduces the impact of short-term volatility and market noise, allowing traders to focus on broader market trends. This strategy requires patience and discipline, as trades are held for extended periods, often facing temporary drawdowns before reaching the desired profit targets.

Make money in forex using Swing trading!

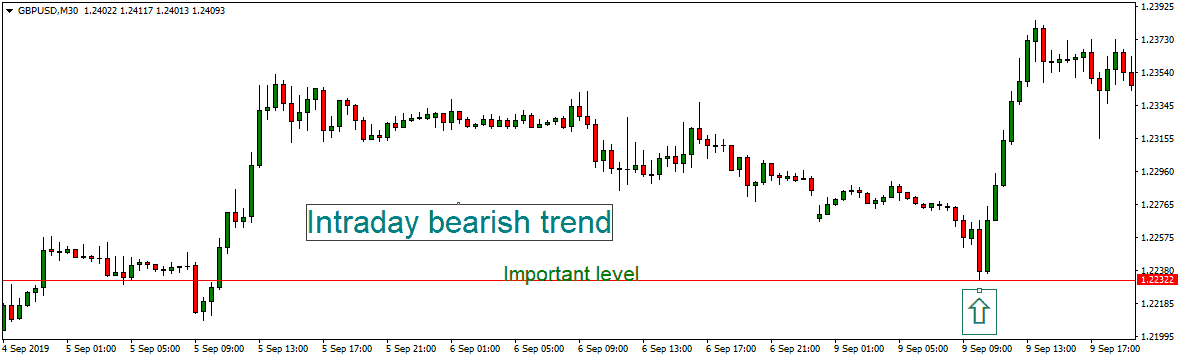

Intraday or day trading is a strategy where traders open and close positions within the same trading day. One specific intraday trading strategy involves opening one trade per Euro session or one trade per US session, aiming to capture 20-25 pips daily (around 25% of the daily average true range).

In this strategy, traders first identify the key market sessions. The Euro session typically runs from 7 AM to 4 PM GMT, while the US session runs from 12 PM to 8 PM GMT. Each session has distinct characteristics and volatility patterns, which traders can exploit.

Traders start by analyzing the market before the session begins to identify potential entry points. They use technical analysis tools such as support and resistance levels, trend lines, and technical indicators like the Moving Average Convergence Divergence (MACD), Relative Strength Index (RSI), and Bollinger Bands. The goal is to find setups where the price will likely move in their favor by at least 20-25 pips. Economic news can make huge spikes, and traders must monitor them and pick the right timing for trades.

Once a potential setup is identified, traders place a single trade with a well-defined entry point, stop-loss, and take-profit level. The stop-loss limits potential losses if the market moves against the trade, while the take-profit secures the desired 20-25 pips profit.

Risk management is crucial in this strategy. Traders risk a small percentage of their trading capital on each trade to avoid significant losses. This helps ensure they can continue trading even if a few trades do not go as planned.

Throughout the trading session, traders monitor their positions but avoid making impulsive decisions based on short-term price fluctuations. They stick to their trading plan and trust their analysis.

Conclusion

Making money in forex requires knowledge, strategy, discipline, and risk management. Successful traders understand the importance of technical and fundamental analysis in making informed trading decisions. They select strategies that suit their personal style and market conditions, whether in positional trading, swing trading, or intraday trading.

Consistency and patience are crucial, as is managing risk through proper use of stop-loss orders and position sizing. Emotional control is also vital to avoid impulsive decisions leading to significant losses. Continuous learning and adapting to market changes help traders stay ahead. Ultimately, making money in forex is about winning more than losing trades and managing those trades wisely to maximize profits and minimize losses.