Table of Contents

Non-Farm Payroll Trading Strategies

What is NFP? Non-farm payroll employment of NFP is a summation of payroll jobs available within the non-farm payroll classification (the compiled name for goods, construction, and manufacturing companies in the US) as designated by the Bureau of Labor Statistics. The report features information regarding the number of employees, the unemployment rate, and more. The report excludes government and non-profit employees. Currency pairs that involve the USD witness price movements following the release of the non-farm payrolls report. These currency pairs fluctuate after the report is issued on the first Friday of every month.

This report can create colossal volatility in trading the US market and be an exciting opportunity to trade either short-term or long-term.

Day Trading Non-Farm Payrolls Strategy

Day trading on the Forex market requires unique strategies to maintain position and stay successful. The non-farm payroll report is a highly regarded piece of analytical information. It includes information on the most critical aspects of the market. The report is released at 8:30 ET on the first Friday of each month in the year (see following Non-farm payroll dates and times).

How to trade Non-farm payroll news releases?

Step 1: Close all positions 10 minutes before NFP

It is recommended that traders close all positions 10 minutes before the official NFP report release. This is a strategy commonly used among advanced and experienced traders. Traders mustn’t be active on the market when data is set to be released. During the initial move, where the price dramatically increases or decreases, traders mustn’t make any moves. There are many reasons why the NFP report holds high significance when trading. Some traders use a one-minute USD and EUR chart. These types of charts can be helpful for new, experienced, and advanced traders alike. The report affects every market aspect, so it has been highly regarded over the years of Forex trading.

Step 2: Decide which currency pair you will trade during the NFP report.

This is very important for day traders. Day traders who understand the basic principles of Forex trading should take advantage of these times. It is also essential to note that the USD and EUR currencies are regarded as the most frequently traded currencies globally. USD and EUR also hold a substantial value in the market. These currencies provide the smallest overall spread and price movements for finalizing trades. Trading another pair other than USD and EUR is not recommended during the release of the NFP report.

EURUSD is not always a good choice. Spread is essential, but picking a weak but strong currency is the best practice. How do you do this?

Scenario 1: The market (NFP forecast before release) expects excellent dollars from the NFP report. USD currency should go up.

In this scenario, we need to pick any primary currency, such as JPY, CAD, EUR, AUD, NZD, or GBP, that is very weak or strong to combine with USD.

If we have a CAD report simultaneously, we must create several scenarios for that case.

I use any simple indicator for this. For example, you can use simple indicators that only compare all currency pairs based on daily open prices. Simple_Currency_Strength_Indicator.

For example, USD and EUR are strong (weaker than JPY, CAD, GBP, etc.). Therefore, I plan to SELL EURUSD.

Scenario 2: The market (NFP forecast before release) expects bad dollars from the NFP report. USD currency should go down.

In this scenario, we need to pick any primary currency, such as JPY, CAD, EUR, AUD, or NZD, which is currently weak or strong enough to combine with USD.

For example, USD is weak, and CAD is strong (the strongest from JPY, CAD, AUD, NZD, etc.). Therefore, I plan to SELL USDCAD.

Step 3: 5 minutes after the NFP release, enter into the trade:

When the initial move is more significant after the NFP report’s release, the trades for that day are more meaningful and facilitate better trading conditions. The initial move after the report determines the trade direction, which can be long or short. Occasionally, the pullback will not always produce a tread line that helps signal a specific entry. Alternative entry may be used in the next scene to ensure strategic and adequately evaluated moves.

How to enter? See results from the report on non-farm payroll dates. After news and results, you have 5 minutes to decide what you want to trade.

Scenario 1: The market didn’t react to the NFP report. In that case, I will wait 1 hour to enter the trade, or I will ultimately be flat.

Scenario 2: The USD report is excellent for the dollar. Prices started to go up. In that case, let us assume that we trade dollar chart:

BUY 5 minutes bullish candle close, stop loss daily low, target open.

Scenario 3: The USD report is terrible. The price for the USD dollar started to go down.

SELL 5 minutes bearish candle close, stop loss daily high, target open.

Example:

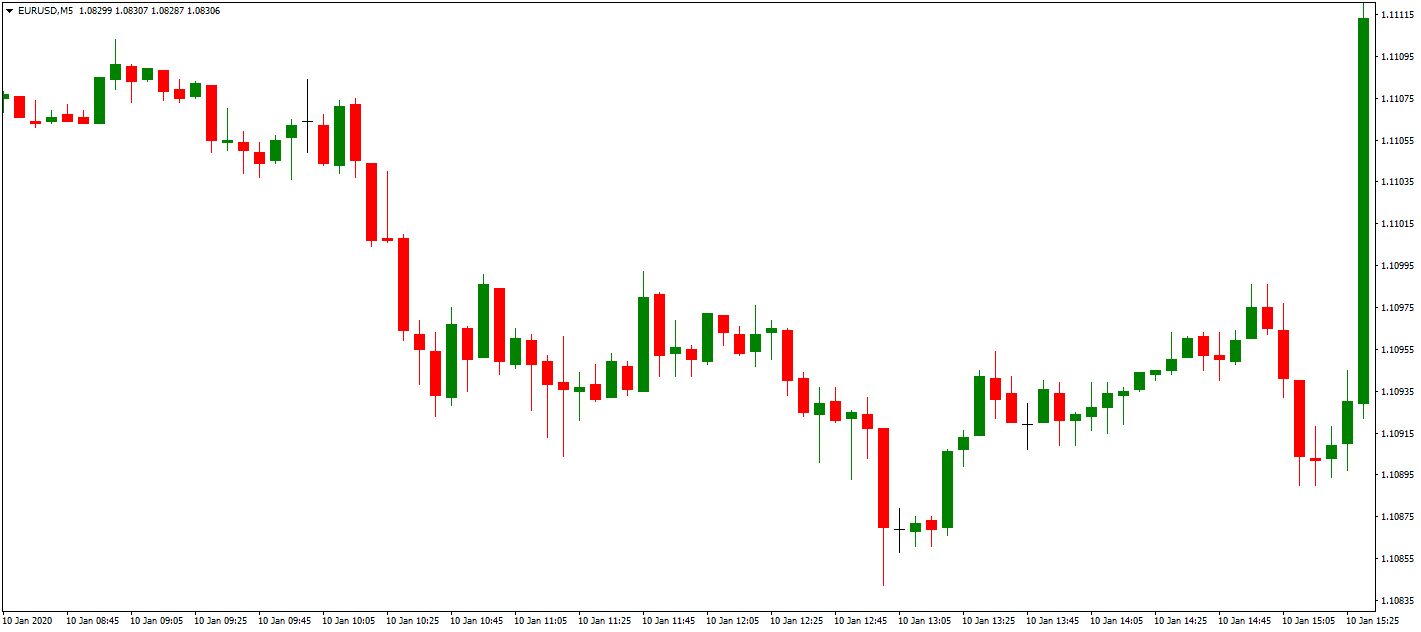

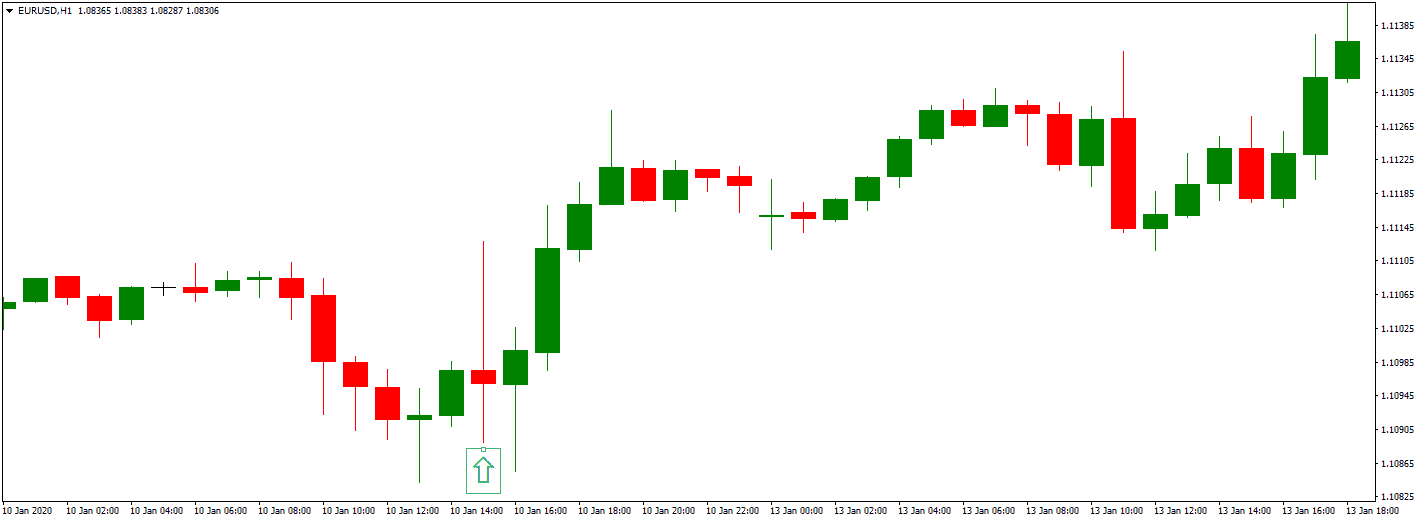

This year, on January 10., there was an NFP report.

The forecast was 160K, and the results were terrible at 145 K. At that moment, the USD and the EUR were weak.

Later, the price started to go up several days in a row.

Weekly NFP trading strategy

While the NFP generally moves the market, data like CPI (inflation), Fed funds rates, and GDP growth are essential data releases. So, if the USD dollar has performed well in the last several days, with excellent fundamental results, a bullish price, and additional NFP report areas like previous reports, there could be room for more USD gains. And the opposite.

I like to trade the NFP report every week. So, my idea is to wait 1 hour after release, enter the trade, and keep the trade overnight next week. My stop loss is Friday’s low for a Buy trade and Friday’s high for a sell trade. Then, I would like to wait for the price to go above Monday’s high next week to take some profit and stop the loss.

Problems in trading Non-farm payroll

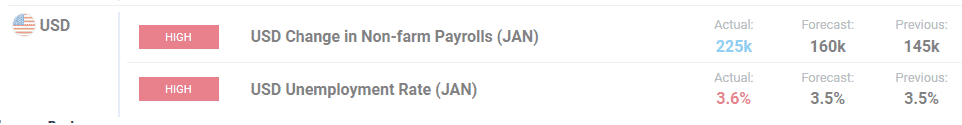

The main problem is mixed trade results. Sometimes, like in February 2020, we can have this:

As you can see, the employment report is good, and the unemployment report is terrible. Unemployment reports very often have a significant impact on the US dollar. In that case, the trader needs to be careful and thoughtful. The most intelligent decision can often be flat when the NFP report has mixed results.

Waiting several minutes after the Non-Farm Payrolls (NFP) report to trade can be an intelligent strategy due to the market’s typical behavior during high-impact news events. Here’s why:

1. Initial Volatility and Spikes

- The NFP report is one of the most significant economic indicators, and it often causes substantial volatility in the forex market. The market reacts quickly when the report is released, leading to significant price spikes and erratic movements. These initial movements can be unpredictable, as high-frequency traders, algorithms, and immediate market reactions to the news drive them.

2. False Breakouts

- The initial spikes can create false breakouts, where the price appears to break through a significant level (support, resistance, trendline) but then quickly reverses. Trading during this period can be risky because it’s difficult to distinguish between a genuine trend and a short-lived reaction to the news.

3. Spreads and Slippage

- During the moments immediately following the NFP release, spreads (the difference between the bid and ask prices) often widen significantly. This can lead to higher trading costs. Additionally, slippage (the difference between the expected price of a trade and the actual price at which the trade is executed) is more likely to occur, especially with market orders.

4. Market Stabilization

- Waiting a few minutes after the NFP report allows the initial volatility to settle. This waiting period gives the market time to digest the information and move in a more stable direction. The price action becomes more apparent, and the risk of false signals decreases. At this point, it becomes easier to identify genuine trends or reversals, allowing for more informed and strategic trading decisions.

5. Avoiding Emotional Trading

- The immediate aftermath of the NFP release can be emotionally charged for traders. The excitement and pressure to react quickly can lead to impulsive decisions. Waiting allows for a calmer and more calculated approach, reducing the risk of making hasty trades based on fear or greed.

Conclusion

Waiting several minutes after the NFP report is a prudent approach to avoid the initial chaos and capitalize on more reliable market movements. This strategy can help traders reduce risk, avoid costly mistakes, and improve their chances of making profitable trades.