Table of Contents

IC Markets is one of the leading forex brokers in the global financial market, renowned for its transparent and efficient trading environment. This in-depth article will focus on the key aspects distinguishing IC Markets as a premium forex broker, including its trading platform, account types, regulation, customer service, and more.

What is IC Markets?

IC Markets is an Australian CFD broker founded in 2007 that offers various trading assets, such as currencies, stocks, commodities, futures, bonds, and digital assets. Regarding daily trade volume, IC Markets broker is one of the largest forex CFD providers globally.

IC Markets is a regulated broker, providing traders an extra layer of security and peace of mind. It is regulated by multiple financial authorities, including the Australian Securities and Investments Commission (ASIC), the Cyprus Securities and Exchange Commission (CySEC), and the Seychelles Financial Services Authority (FSA). The regulatory compliance ensures that IC Markets adheres to strict financial transparency and investor protection standards. Client funds are kept in segregated accounts, separate from the company’s operational funds, further enhancing client funds’ security.

IC Markets Advantages

- Spreads: IC Markets is known for its very low spreads, which can be especially beneficial for day traders and scalpers. Using the Raw IC Markets account, you will have around $3.5 commission for one lot.

- Regulation: IC Markets is regulated by several central financial authorities worldwide, including the Australian Securities and Investments Commission (ASIC), the Seychelles Financial Services Authority (FSA), and the Cyprus Securities and Exchange Commission (CySEC), which adds a level of trust and security for traders.

- Variety of Instruments: Traders can access various trading instruments, including forex, CFDs on indices, commodities, stocks, futures, and even cryptocurrencies.

- Trading Platforms: IC Markets offers multiple platforms, including MetaTrader 4, MetaTrader 5, and cTrader, giving traders a choice based on preference.

- Leverage: High leverage is available for those who understand and wish to utilize it, though it’s important to remember that higher leverage also means increased risk. You can use up to 1:500 leverage.

- Execution Speed: IC Markets typically provide fast execution speeds, which can be important for traders relying on quick entry and exit.

- Customer Support: IC Markets is known for reliable and responsive customer service and is available 24/7.

- Account Types: IC Markets offers various account types, including standard, raw spread, and cTrader raw, allowing traders to choose the best fit for their needs and trading style.

- Educational Resources: They provide comprehensive educational resources for traders, including webinars, tutorials, and blog posts.

- Demo Account: IC Markets offers a free demo account, allowing new traders to practice their strategies before risking real money.

- Global Access: They offer services to various countries, making them accessible for international traders.

- Deposit and Withdrawal: They have various deposit and withdrawal options, including bank transfer, credit/debit cards, and popular e-wallets, making the process convenient for users.

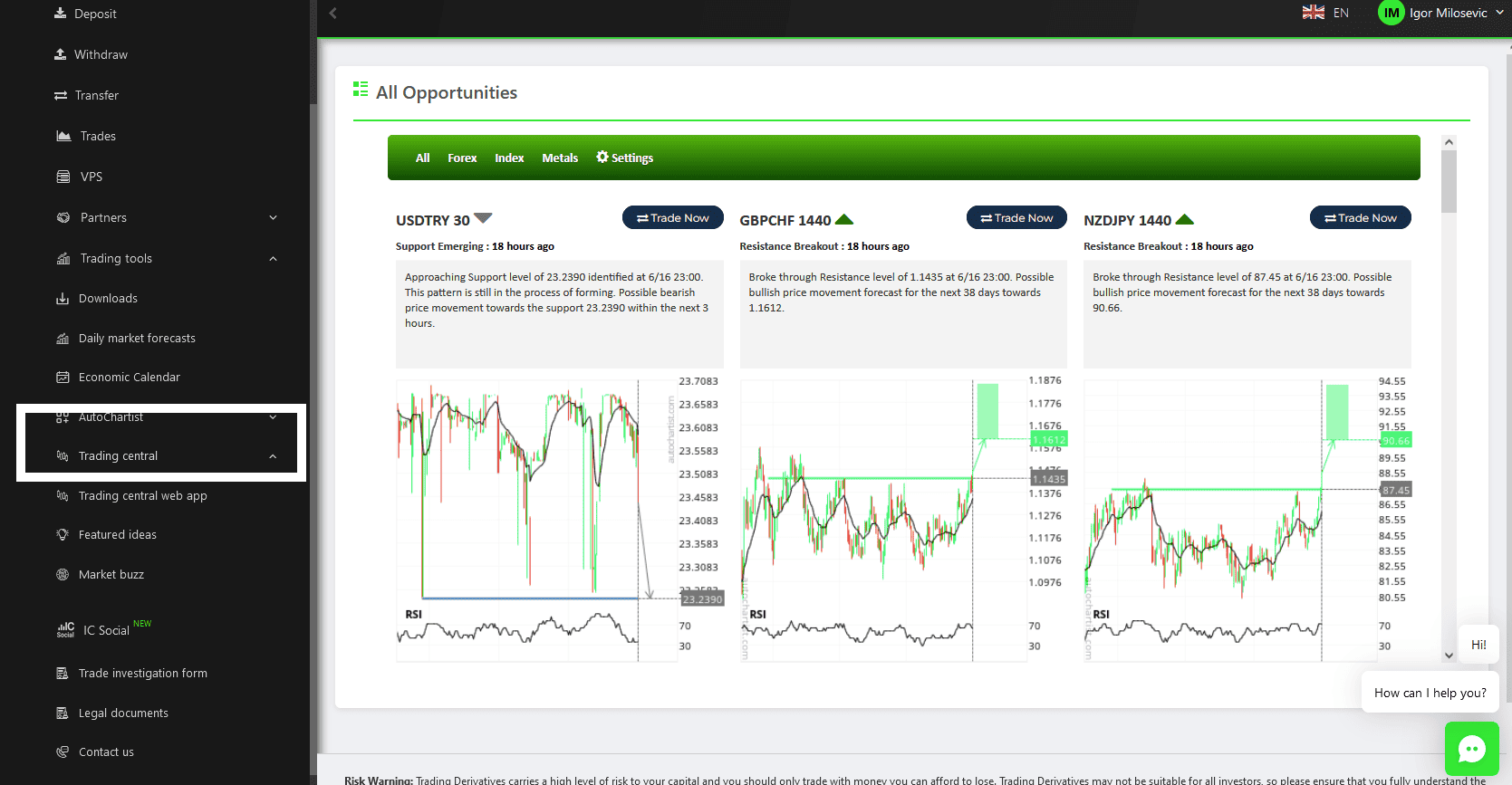

IC Markets provides access to three of the most powerful trading platforms: MetaTrader 4, MetaTrader 5, and cTrader. These platforms are equipped with advanced charting tools, multiple indicators, and other analytical tools to aid traders in making informed decisions. They also support algorithmic trading and offer a vast library of Expert Advisors (EAs). IC Markets provides clients with free access to Autochartist and Trading Central trading tools.

My IC Markets Review opinion

IC Markets offers excellent tight spreads, zero-spread accounts, good customer support, and fast payments. For example, the brokerage company makes withdrawals to your account each day at the same time (early morning in European time), so you usually must wait less than 24 hours. The user dashboard is simple; you can access all the features you need in the left vertical menu.

I prefer this broker for scalping and Autochartist and Trading Central tools. Please see the screenshot:

Account Types and Trading Conditions

IC Markets offers several account types to suit various trader preferences and needs. These include the Standard Account, Raw Spread Account (MetaTrader), and cTrader Raw Account. Each account type has a unique set of trading conditions, allowing traders to choose based on their trading style and strategy.

In particular, the broker is well-regarded for its raw spreads, starting from 0.0 pips on the Raw Spread Account, which are highly competitive compared to industry standards. The Standard Account, while having slightly wider spreads, offers commission-free trading. Leverage up to 1:500 is available, depending on the regulatory jurisdiction and the trader’s experience level.

IC Markets Standard Account

IC Markets is a reputable forex broker that offers different account types to suit various trading styles. The Standard Account is one such type, designed to provide a user-friendly and flexible trading environment for new and experienced traders. Here’s a closer look at the key features of the IC Markets Standard Account.

Raw Pricing

One significant characteristic of IC Markets’ Standard Account is offering raw pricing. Raw pricing refers to direct market quotes without any broker markup. It results in the tightest possible spreads, which can be especially beneficial for traders who frequently enter and exit the market, such as day traders and scalpers.

Read my zero spread (raw spread) article about IC Markets, where a commission is only $3.5 per lot.

Commission-Free Trading

The Standard Account provides the advantage of commission-free trading. While some brokers charge a commission on trades in addition to spreads, IC Markets does not impose any such fees on their Standard Account. The only cost to the trader is the spread, making the trading costs more predictable and straightforward.

Fast Order Execution

Fast order execution is critical for effective forex trading, especially in fast-moving markets where prices change rapidly. IC Markets ensures swift order execution, which can help prevent slippage (the difference between the expected price and the price at which the trade is executed) and potentially enhance trading results.

High Leverage

IC Markets offers high leverage of up to 1:500 in its Standard Account. Leverage allows traders to control prominent positions with relatively little capital. This can magnify profits if the trade goes in the predicted direction but also amplify losses if the trade goes against the prediction. Therefore, using leverage carefully and considering risk management strategies is essential.

Deep Liquidity

IC Markets provides deep liquidity, implying that large orders can be executed quickly without significantly impacting the market price. This profound liquidity results from IC Markets’ relationships with top-tier liquidity providers, ensuring traders get the best possible prices and fast execution.

MetaTrader 4 & 5 Support

The Standard Account is compatible with MetaTrader 4 and MetaTrader 5, two of the most popular and widely used trading platforms in the forex industry. These platforms offer advanced charting tools, numerous indicators, automated trading options, and more, enabling traders to execute and manage trades efficiently.

IC Markets’ tight spreads

The tight spreads offered by IC Markets on both their Raw Spread Account and Standard Account across various currency pairs are outlined below:

- EURUSD (Euro vs. United States Dollar): The minimum spread on the Raw Spread Account is 0, with an average spread of 0.02. On the Standard Account, the minimum spread starts from 0.6 with an average spread of 0.62. The EURUSD pair is one of the most heavily traded pairs in forex, and such tight spreads can lead to cost savings over time.

- GBPUSD (British Pound vs. United States Dollar): The minimum spread for the Raw Spread Account is 0, with an average spread of 0.23. For the Standard Account, the minimum spread is 0.6, with an average spread of 0.83. The tight spreads for GBPUSD can benefit traders who are focusing on the UK and US markets.

- USDCAD (United States Dollar vs. Canadian Dollar): The Raw Spread Account has a minimum spread of 0 and an average spread of 0.25. The Standard Account offers a minimum spread of 0.6 and an average spread of 0.85. These tight spreads benefit traders of this North American pair.

- USDCHF (United States Dollar vs. Swiss Franc): On the Raw Spread Account, the minimum spread starts at 0 with an average spread of 0.19. The Standard Account provides a minimum spread of 0.6 and an average spread of 0.79. This is advantageous for traders looking at the US and Swiss markets.

- USDJPY (United States Dollar vs. Japanese Yen): The minimum spread for the Raw Spread Account is 0, with an average spread of 0.14. For the Standard Account, the minimum spread is 0.6, with an average spread of 0.74. The tight spreads on the USDJPY pair can result in substantial savings for traders focusing on the US and Japanese markets.

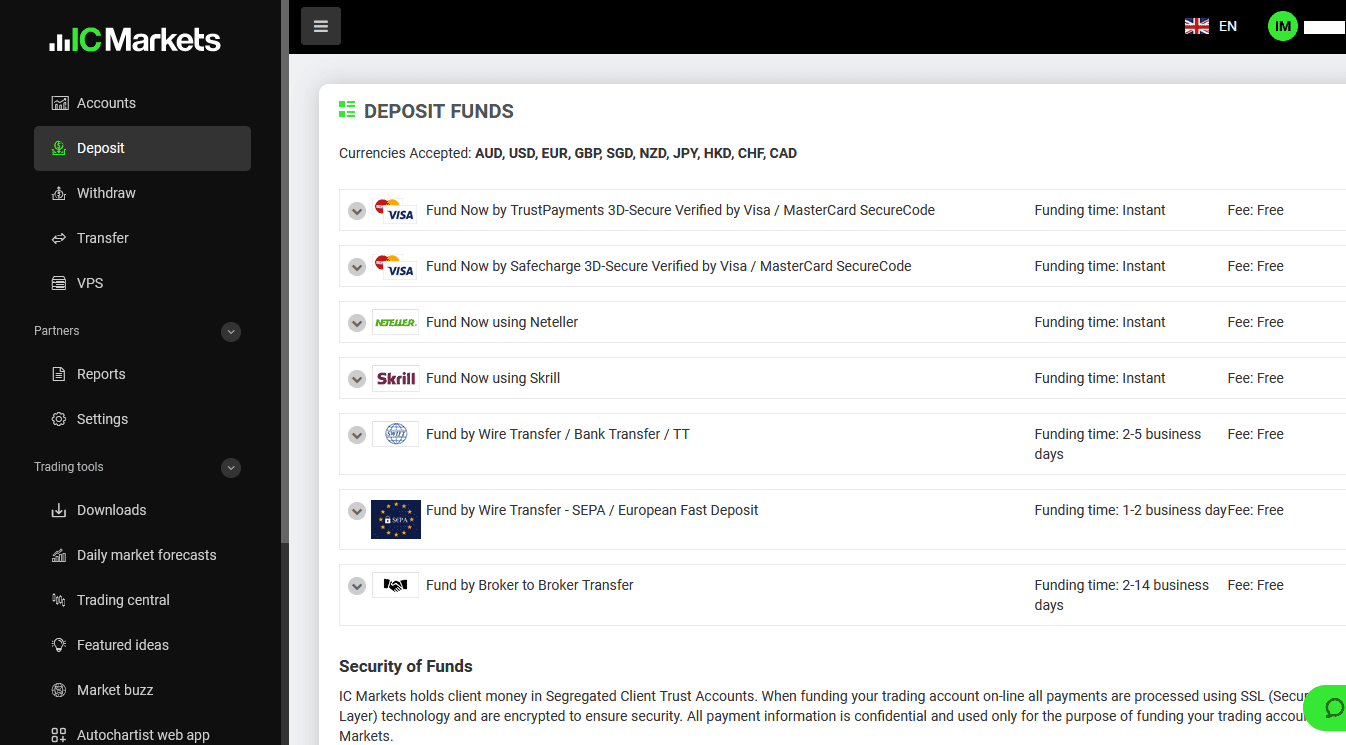

IC Markets’ payment methods

You can deposit or withdraw money using the following methods:

- Bank or wire transfer

- Paypal (Australian clients)

- Credit card

- Skrill

- Neteller

- UnionPay

- Bpay

- FasaPay

- Poli.

If you live outside Australia, not all payment methods are available. Credit Cards, Bank Wire, and Skrill are the most reliable payment options.

Users have an excellent trading dashboard, and below, you can see my IC Markets dashboard and payment methods:

IC Markets restricted countries list

- Afghanistan

- Angola

- Antigua and Barbuda

- Bolivia

- Botswana

- Burma (Myanmar)

- Canada

- Cambodia

- Cote d’Ivoire (Ivory Coast)

- Cuba

- Democratic Republic of Congo

- Former Liberian Regime of Charles Taylor

- The Gambia

- Guinea Bissau

- Guinea Conakry

- Israel

- Iran

- Iraq

- Japan

- Kyrgyzstan

- Lesotho

- Liberia

- Libya

- Mali

- Namibia

- Niger

- North Korea

- New Zealand

- Senegal

- Sierra Leone

- Syria

- Tanzania

- Togo

- Yemen

- Zimbabwe

IC Markets broker bonus

IC Market does not offer bonuses at this moment. Many believe that bonuses might be an advertisement for a broker, but it mainly is nothing in favor of the user. It usually has a catch written in small letters that by taking a bonus, you must give more than you get or get a bonus of a dollar; you must trade there for a year, with millions of transactions per day, etc., so by having no bonuses, clients have no worry that their “extra” money would be impossible to withdraw.

IC Market has lately been focusing on Asian markets; it has Chinese and Japanese websites that trade with Russian and Chinese currencies.

What is the minimum deposit for IC Markets?

The minimum deposit for IC Markets clients is $200. This broker is trying to set a minimum deposit so clients can not lose their equity fast during market volatility if they trade using micro-lots.

Does IC Markets company allow hedging?

Yes, hedging is allowed at IC Markets because you can create buy and sell orders for the same asset during the trading. In addition, IC Markets is not a US broker, so hedging is allowed.

This forex broker offers excellent education videos. For example, see How to Hedge an Order in MetaTrader 4 :

Leading Forex websites give good reviews to clients. Considering IC Markets’ operational years, they have many reviews, meaning they have plenty of clients and earned trust and confidence by doing good work. It is worth noting that the Forex administrator points out that there are unusually many reviews, which IC Markets explains by asking their clients to leave comments if they are satisfied with the services. Minor numbers of words reflect technical bugs.

Users are generally happy with the IC Markets, with no reports of price manipulation; nobody has complained about withdrawal issues yet. In addition, users posted no reports on unfair broker conduct.

The fact that users have many positive reviews only shows that IC Markets’ marketing is strong and that they put much effort into it. That is a sign of service business in general, and as they manage to keep clients satisfied, it shows that they stand behind their words.

Another indicator of IC Market’s seriousness is that they offer a platform mainly for ECN trading – cTrader and MetaTrader4- which could be used successfully in ECN trading. And, importantly, they are very transparent about their liquidity providers and technology. Good conditions for the traders are provided with what they

offer.

Customer Service and Education

IC Markets prides itself on its superior customer service, which is available 24/7. Traders can contact the support team through live chat, email, or phone. The customer service team is known for its quick response times and professional assistance.

IC Markets provides extensive educational resources, including webinars, tutorial videos, market analysis, and a comprehensive forex course. These resources can benefit beginner and experienced traders looking to sharpen their knowledge and skills.

Conclusion

In summary, IC Markets is an exceptional forex broker offering an efficient and transparent trading environment. Its regulated status, sophisticated trading platforms, competitive trading conditions, and excellent customer service make it an excellent choice for traders of all experience levels. As always, it’s important to remember that trading involves risks and is crucial to trade responsibly.

This Forex broker is excellent because it offers tight spreads and excellent PAMM and MAMM accounts.

Can a US citizen deposit money into IC Markets?

The IC Market CFD broker does not allow US citizens to become clients because of US CFD regulations.

Besides the US, IC Markets has a restricted countries list: Canada, Israel, New Zealand, Iran, and North Korea (Democratic People’s Republic of Korea).

If you are interested, you can visit IC Markets broker below:

Please check other excellent brokers: