Table of Contents

Forex trading is legal, but forex traders can operate only through domestically licensed brokers in some countries. Forex traders are protected because laws are created for forex brokers, not for traders.

Our FAQ section in our email list often asks questions such as “Is forex illegal.” We repeat repeatedly – Forex trading is a legal business that must be regulated for forex brokers.

In which country will Forex trading be legal in 2024?

Forex trading is legal in all countries. However, in some countries, forex trading is not regulated, while brokers must be licensed under one or other of the regulatory laws.

For example, if a broker is licensed in the UK, Australia, the Middle East, Japan, and the European Union, that broker is highly reputable. However, if that broker has no license in Pakistan or Vietnam, we can not tell if the broker is illegal.

Each person can invest money in any company or forex broker. However, each broker has a list of allowed countries that are pretty different. You can invest money at any broker that will enable traders from your country. You should invest only in reputable, licensed brokerage companies with “A” or “B” licenses.

A-Grade brokers regulation

These are strong reputation brokers. This means high capital requirements, rigorous trading rules, laborious and high reporting standards, and more challenging (expensive) penalties for non-compliance. USA (Commodity Futures Trading Commission CFTC, NFA) – Japan (FSA Japan) – United Kingdom ( Financial Conduct Authority FCA) – Australia (Australian Securities and Investments Commission ASIC) – Singapore (Monetary Authority of Singapore MAS) – Hong Kong ( Securities and Futures Commission SFC) – Switzerland (Financial Services and Markets Authority FSMA) – Germany (Federal Financial Supervisory Authority BaFIN)

B-Grade brokers regulation

Capital requirements, physical presence rules, simplified reporting standards, fit and proper tests, and lower tax rates. – The Bahamas (Securities Commission of the Bahamas SCB) – Cyprus (Cyprus Securities and Exchange Commission CySEC) – Czech Republic (Czech National Bank CNB) – Latvia (FCMC) – Malta ( Malta Financial Services Authority (MFSA)) – New Zealand (Financial Markets Authority New Zealand FMA) – South Africa ( Financial Services Board FSB) – United Arab Emirates Dubai (Dubai Financial Services Authority DFSA)

C-Grade brokers regulation

There is little or no regulation compared to the other grades. – Belize (International Financial Services Commission IFSC) – British Virgin Islands (British Virgin Islands Financial Services Commission BVI FSC) – Cayman Islands (Monetary, Regulatory and Advisory Body of the Cayman Islands CIMA CIMA) – Mauritius (Financial Services Commission – Mauritius FSC) – Saint Kitts and Nevis (Financial Services Regulatory Commission – St. Kitts) – Seychelles (Seychelles Financial Services Authority SFSA) – Vanuatu (Vanuatu Financial Services Commission VFSC)

On many websites, I can read that in Belgium, Forex is banned, or in Pakistan, Forex is banned. But that is not true. Some brokers operate in those countries and have UK, Australian, European, and Middle East licenses.

Foreign exchange (Forex) is unregulated in many countries compared to the stock market and other markets. In many countries, forex trading is seen as the same as stock trading. With technological advances, there are significant changes compared to the Forex market a few decades ago. With the increase in internet usage and new technology development, there is more flexibility and much higher leverage in Forex trading. Now, it is possible to trade in Forex comfortably from home. Using the internet and high-speed electronic communication has made trading online possible.

Is Forex trading illegal?

Forex trading is a legal business like futures, stocks, or commodities trading. However, forex brokers need to be regulated in the countries where they are domiciled. While forex trading is legal, in the trading industry, there are shady, unregulated brokers, scammy marketing techniques, scams that promise quick fortunes through “secret trading formulas,” etc.

List of countries where forex trading is partially restricted

Some forex brokers do not allow trading for residents of these countries:

- Afghanistan

- Angola

- Antigua and Barbuda

- Belgium

- Bolivia

- Bosnia and Herzegovina

- Botswana

- Burma

- Burma (Myanmar)

- Cambodia

- Congo

- Cote d’Ivoire

- Cote d’Ivoire (Ivory Coast)

- Cuba

- Cyprus

- Democratic Republic of Congo

- Eritrea

- Former Liberian Regime of Charles Taylor

- France

- The Gambia

- Guinea

- Guinea Bissau

- Guinea Conakry

- Haiti

- Iran

- Iraq

- Israel

- Italy

- Japan

- Kosovo

- Kyrgyzstan

- Latvia

- Lesotho

- Liberia

- Libya

- Malaysia

- Mali

- Mauritius

- Myanmar

- Namibia

- Niger

- North Korea

- Northern Marianna Islands

- Palestine Occupied Territory

- Puerto Rico

- Saint Vincent and the Grenadines

- Senegal

- Sierra Leone

- Singapore

- Somalia

- South Sudan

- Sudan

- Syria

- Tanzania

- Togo

- Trinidad, Tobago, and Tunisia

- Turkey

- Turkish Republic of Northern Cyprus

- USA

- Vanuatu

- Yemen

- Zimbabwe

Some brokers allow trading in these countries, but most do not. You need to check with each broker if you can trade Forex if your country is on this list.

Reasons for banning Forex trading – forex ban

Safety and high-leverage risk

Trading in Forex is not safe and can cause losses. Data indicates that the Forex market is among the riskiest retail traders, with new traders most likely to lose. The statistics show that a majority of traders fail in Forex trading. Some estimates indicate that 96% of Forex traders make a loss and quit Forex trading. This proves that the market is hazardous. However, some traders can make massive profits with sound risk management skills and a clear trading strategy. Yet the harsh reality is that only 4% of the traders survive long-term.

Hence, many countries have made Forex trading illegal, while others have imposed restrictions on trading in Forex. Due to the high losses in Forex trading, many countries would not want their citizens to invest their hard-earned money in Forex and mostly lose it. Hence, many governments regulate forex trading and formulate new rules and regulations for trading. The restrictions are mainly imposed because it is precarious. Forex trading risk is considered similar to gambling risk. Hence, restrictions are imposed to protect their citizens and prevent financial losses.

Traders often believe they are in control since leverage is allowed in the Forex market. Traders can use leverage to trade in Forex without investing the money. One of the reasons why traders are allowed leverage by their brokers is that they have to pay for the losses. These leverage-related losses are one of the main reasons Forex trading is not permitted in some countries, while others have strict restrictions.

Fixed currencies – the minor reason

The exchange rate system in a country is either floating or fixed. The currency’s price varies depending on the supply and demand for the currency for the exchange rate floating. The price is not fixed; it changes rapidly based on various factors. Some countries have fixed exchange rate systems, and the government works with the central bank to stabilize the currency price. This fixed currency rate system is one of the reasons why restrictions are imposed on Forex trading. Usually, countries where the exchange rate is floating, will impose fewer restrictions while trading Forex than countries where the exchange rate is fixed since stable rates are essential for fixed exchange rates.

Is Forex trading legal in the US?

Forex trading is legal in the United States. The only problem is that most European and world forex brokers do not have a US trading license. US citizens need to use only American forex brokers. Forex trading in the US is no problem as a business. The US government wants to keep US citizens’ funds invested in America, not go out to Europe, Asia, Africa, etc.

Is Forex trading legal in Nepal? Yes, it is regulated and legal in Nepal, as it is in Malaysia and other Asian countries.

Countries that have imposed restrictions on Forex Trading

There are some countries where citizens are allowed to trade in Forex with some significant restrictions. A list of countries with restrictions is provided below.

Is Forex trading legal in China?

China allows for Forex trading. Chinese traders are not allowed to open their accounts with foreign brokers due to stringent controls on capital. The traders based in China can only open their accounts with Chinese brokers. International forex brokers can start their local branches in China to attract Chinese traders.

Is Forex trading legal in Japan?

There is a lot of competition for Forex trading in Japan for smaller traders, and the market is growing fast. The agency for financial services allows retail Forex traders in Japan to trade only through brokers licensed in Japan; they cannot register with other brokers. There are also restrictions on margin trading, typically 1:25 for significant currency pairs.

Is Forex trading legal in India?

Forex retail trading is allowed in India, though it should only be routed through registered exchanges. Indian traders are not legally allowed to finalize spot transactions for currency trading. Another restriction of Indian traders is that they can only trade in currency pairs with the Indian rupee (INR), for example, EU-INR, GBP-INR, JPY-INR, and USD-INR. This implies that Indian traders cannot trade in currency pairs without the INR. This is a significant disadvantage for Indian Forex traders.

Is Forex trading legal in South Korea?

The Forex restrictions in South Korea combine the restrictions of Japan and China. Due to capital controls, South Korean traders cannot open their Forex accounts with foreign brokers. Due to the strict government regulations, local brokers impose many restrictions on forex trading in South Korea. The maximum leverage allowed for Forex trading is reasonably low at 1:10

Is Forex trading legal in Turkey?

Turkey has recently changed the law (relatively new regulations having only been introduced in 2017) for Forex trading, and traders are not allowed to use non-regulated foreign brokers’ services. The local broker should also get a license for dealing in Forex from Turkey’s board for Capital markets. The trader should make a minimum deposit of at least 50,000 Turkish Lira.

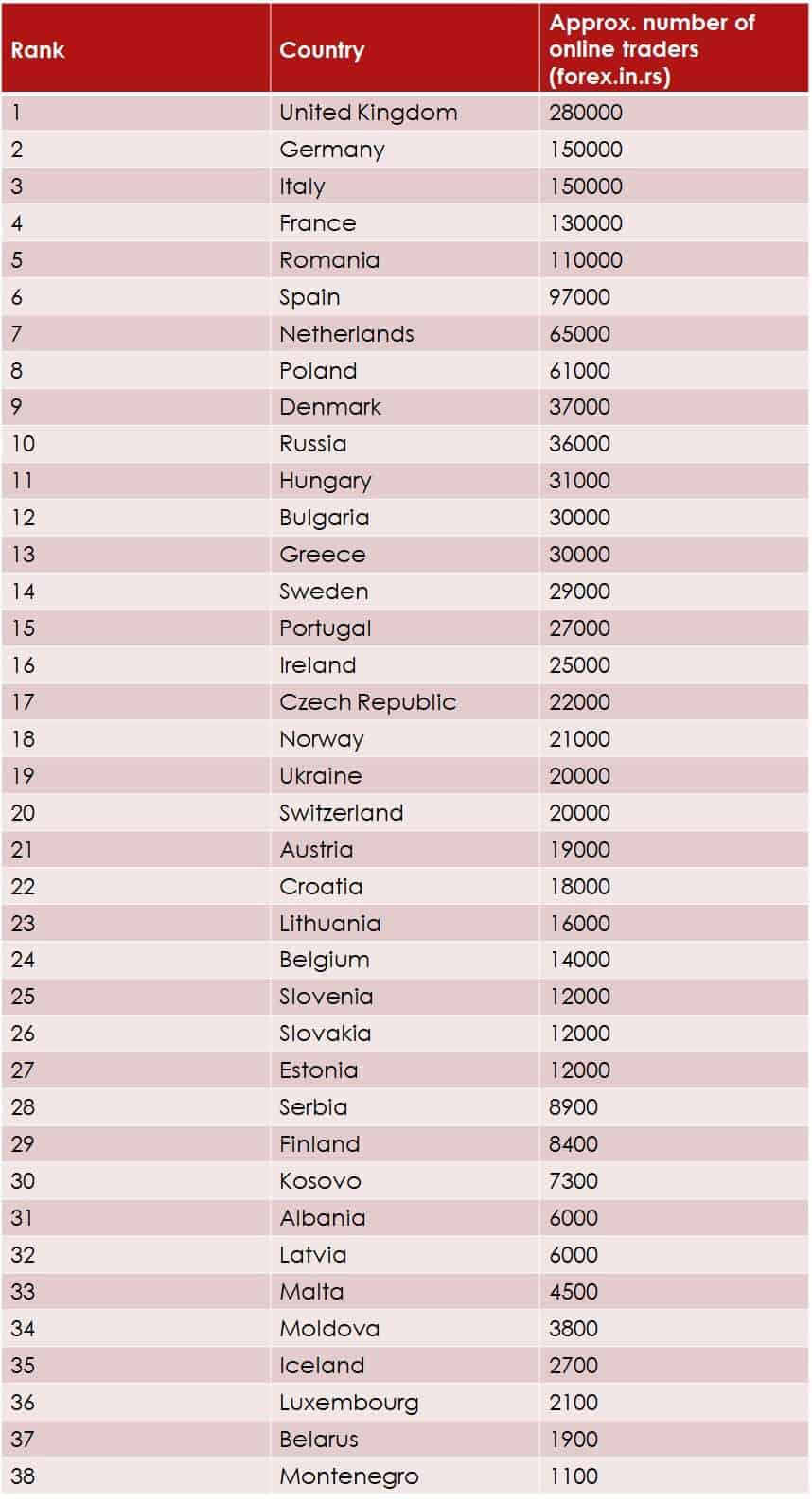

As we can see, trading is a massive business around the globe. For example, we can look at this table and stats – forex traders by country :

Forex traders by country in Europe by www.bis.org

Is Forex trading legal in Sri Lanka?

Forex trading is legal in Sri Lanka, and traders can trade and invest their money with any broker. However, The Central Bank of Sri Lanka (https://www.cbsl.gov.lk/) advises foreign exchange trading only with regulated FX brokers approved by the Department of Foreign Exchange (http://www.dfe.lk/).

Conclusion

Due to the high risk, it is advisable to understand the concepts involved before investing. Since forex trading offers high leverage and risk, many countries have imposed stringent regulations on Forex trading to prevent their citizens’ financial losses.

Forex trading is legal, but it is not regulated in all countries.