Table of Contents

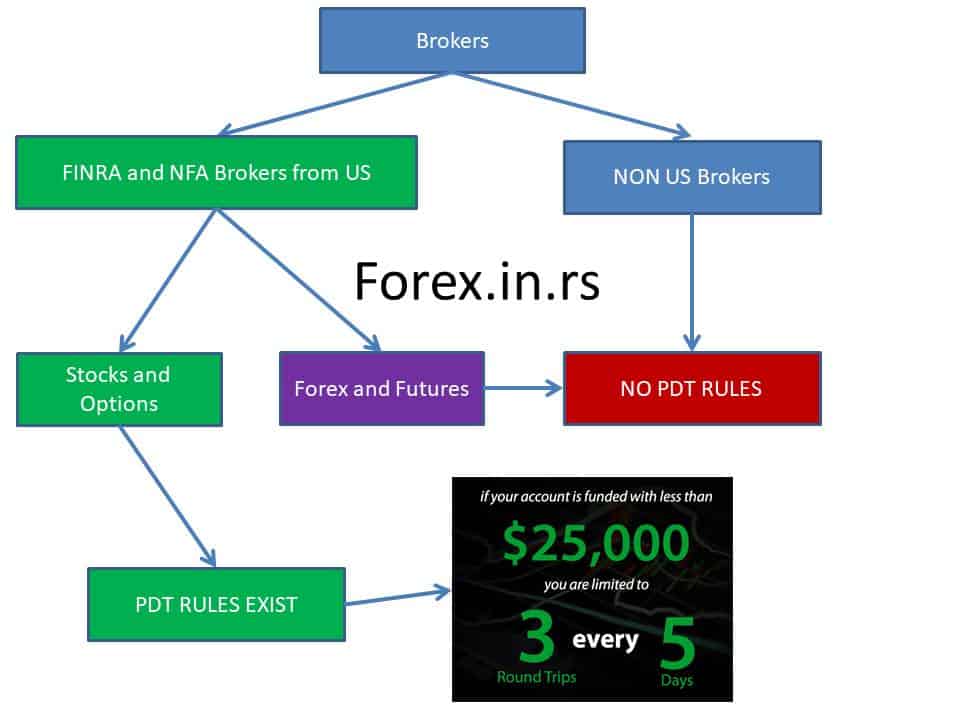

Pattern day trading rules, or PDT rules, are related to FINRA-regulated brokers.

What is the pattern day trading rule?

The pattern day trade or PDT rule refers to the FINRA and SEC guidelines, which state that a day trader must maintain minimum equity in a margin of $25,000. By the PDT rule, if a trader has less than $25000 in a margin account and creates four or more trades in 5 business days, the broker can freeze his account for 90 days. If the trader has a margin account of over $25,000 in equity, they can apply day trading as often as they want and trade without limitations as long as their margin account remains over $25,000.

So far, new traders must have at least $25,000 in cash to begin day trading. This can be overwhelming and prevent many people from getting started. Fortunately, you do not need this sum of money to begin; you only need to abide by this if you fit the criteria for a day trader.

So the main facts are:

- A day trade is an open and closed trade within the same trading session.

- If you make four or more day trades in five days, you will be flagged as a Pattern Day Trader.

- The PDT rule applies to stocks and options, while no rules exist for forex and futures.

- The pattern day trade or PDT rule applies only to all FINRA-regulated brokers.

Let us see PDF rules and stock trading.

The last part of the sentence is the critical piece of information “inside of a margin account.” The definition of a pattern day trader includes quite a few limitations.

Does the PDT rule apply to forex?

Pattern day trading rules do not apply to forex because NFA and FINRA do not have restrictions on day trading for forex, futures options, and futures. Because of NFA and FINRA regulations, covering margin on Futures, Futures Options, and Forex positions doesn’t count toward the $25,000 FINRA equity requirement.

Pattern day trading rules, defined by the Financial Industry Regulatory Authority (FINRA), apply to the U.S. stock market and stock options. These rules require that in the U.S., anyone who wants to partake in day trading of stocks and options must maintain a minimum account balance of $25,000. This regulation protects individual investors from taking on too much risk and potentially incurring significant losses they cannot afford.

However, different regulatory frameworks apply when it comes to forex (foreign exchange market), futures, and futures options. These markets are overseen by different regulatory bodies, which do not impose the same restrictions on day trading as FINRA does for stocks and options.

The National Futures Association (NFA) oversees futures and forex markets in the United States. Unlike FINRA, the NFA does not have a specific equity requirement for individuals who wish to day trade in these markets. Here are some key points to understand why pattern day trading rules do not apply to forex, futures options, and futures:

- Different Regulatory Bodies: The NFA and FINRA serve different segments of the financial markets. FINRA focuses on the stock and options markets, imposing rules like the pattern day trader rule. On the other hand, the NFA regulates futures, futures options, and forex trading, and it does not impose a similar equity requirement for day traders.

- Margin Requirements: In the context of futures, futures options, and forex trading, margin requirements are set by the exchanges or brokers and are generally lower than the $25,000 required for stock and options day trading. These margin requirements are designed to cover the potential losses on positions and vary depending on the market and the specific product being traded.

- Risk Management Practices: The forex, futures, and futures options markets have risk management practices and requirements which differ from those in the stock market. These practices include, but are not limited to, varying levels of leverage, margin requirements, and the use of stop-loss orders to limit potential losses.

- Market Accessibility: Forex and futures markets offer high liquidity and the ability to trade around the clock, which can be attractive to day traders. The absence of a strict regulatory equity requirement like the $25,000 FINRA rule for pattern day trading makes these markets more accessible to traders with smaller account balances.

- Regulatory Intentions: The regulatory frameworks for each market are designed with specific market characteristics and risks in mind. The pattern day trading rule by FINRA is tailored to address the risks associated with high-frequency trading in the stock and options markets. The NFA’s regulations for forex and futures are designed to manage the risks inherent in these markets, which can differ significantly from those in the stock market.

So, let’s summarize:

Is there a PDT rule for forex?

The pattern day trade or PDT rule does not apply to forex traders because they are created only for stock traders for FINRA-regulated brokers.

Can you day trade forex without 25k?

You can trade forex without 25K in the US because the PDT rule applies only to stocks and options. You need no minimum amount of money to trade forex or futures based on NFA and FINRA rules. However, most brokers suggest a minimum of $500 for forex trading.

First of all, what exactly is considered a day trader?

If you’re interested in day trading, you probably have at least a bit of knowledge of day trade, but you may not know an important piece of information. A day trade is when you purchase and sell a stock between the market opening and closing on the same day. If you were to hold your position overnight, the trade would no longer be considered a day trade; instead, it would be viewed as a swing trade.

Therefore, the pattern day trade rule does not limit you from making more than three weekly trades with a small account balance. The rule only limits you from making three intraday trades per week. You may be thinking that three intraday trades are not much at all. In my opinion, I would say that the pattern day trader rule is a good thing for new traders. In this impact, you would need to have a relatively small account size in the first place. This small account size is likely due to a lack of experience, hence the tiny balance. PDT rule will prevent you from making unnecessary trades and blowing your whole account, as many new traders have tried to trade between every dip and rise.

The second criterion of the pattern day trade rule

The second requirement to be considered a day trader is making at least 4-day trades weekly. This may not seem like a lot, but that is quite a bit.

Why does the PDT rule exist

Pattern day trade was created to ensure that more minor, inexperienced investors and traders don’t day trade until the value of their accounts is over $25,000. This amount for SEC represents enough risk capital to offset any self-inflicted damage trading might create financially. The SEC’s primary mission is to protect investors and maintain the integrity of securities markets (both formal exchanges and over-the-counter). The SEC considers day trading significantly higher risk than buy-and-hold strategies.

Leverage

If you’ve never heard of leverage, allow me to explain. Leverage is where the broker you are with will allow you to trade with more than you have. Some brokerages will put up a 4:1 ratio or even a 6:1 ratio. If you have $1000, you could trade with $4000 or even $6000 in some instances. Even though this may seem enticing, I would not recommend it. This is because you can lose much more than trading with your own money. This is because it will not feel like you are trading with your won money. Therefore, you will have a lot less emotional attachment to it. Using leverage is not recommended for this very reason. If you do not plan on using leverage, you will not need a margin account.

Margin account

The final part of the pattern day trader rule is that it only applies if you utilize a margin account. If you are using a regular cash brokerage account, then the rule will not impact you.

Day trading rules under 25k

By the PDT rule, if a trader has less than $25000 in a margin account and creates four or more trades in 5 business days, the broker can freeze his account for 90 days. Usually, the first trader will get a warning message, and then, if the trader does not stop day trading behavior, the account will be frozen.

If you have opened a cash or margin account under $25K and wish today’s trade, this is still possible; you must find loopholes with the rule.

As I stated, if you have a cash account, you can day trade without leverage without worrying about this rule. This is an excellent option since it will encourage you to be smart with your money and take calculated positions.

If that interests you, you can trade in foreign exchange markets and forex. You will be able to make more trades and utilize less money.

You have opened a margin account and wish to make over four intraday trades within a week. In this case, you must maintain a balance of at least $25k within your margin account to abide by the pattern day trade rule.

Day trading rules over 25k

If the trader has a margin account of over $25,000 in equity, they can apply day trading as often as they want and trade without limitations as long as their margin account remains over $25,000. PDT restrictions can be applied if the margin account drops below $25000 in equity.

PDT Rule Example (stocks market)

For example, let’s say you decide to open a margin account with a broker and deposit $15,000. On day 1 (Monday), you choose to buy and sell leveraged shares of stock XYZ. On day 2 (Tuesday), you acknowledge and sell stock ABC. On day 3 (Wednesday), you short-sell DEF. Finally, on day 4(Thursday), you buy and sell both ABC and XYZ shares. This would be counted as five trades in 4 days, placing you under a pattern day trader’s criteria. In this scenario, you have $20,000 in your brokerage account; to follow the FRNA guidelines, you must deposit an extra $5,000.

Tips for following the pattern day trade rule

In the beginning, this rule can cause a lot of frustration. It limits what you can do with your own money. Over time, you will find ways to work around it! It can be challenging to watch the market rise and fall and not take action. In this case, it would be a good idea to use a practice account t times. Paper trading is great for building your skills. I suggest you do your best to maintain profitability and not lose too much paper profits. Paper trading is far more comfortable than trading with real money. Paper trading will give you no emotional attachment as it is not real money. You’ve probably heard the statistic that 90%+ of day traders lose money. This is due to a lack of emotional discipline, which must be formed over time and practice.

Contrary to popular belief, you don’t need to make many trades weekly to achieve wealth. What’s more important is making the right trades. Keep reading to learn more tips on avoiding joining the 90% statistic!

Avoid using too much leverage.

Although I already mentioned this, it deserves to be repeated. Using leverage is a great way to lose a large sum of money. Why, may you ask? Because you are using someone else’s money on a position that may not work out. If you open up a cash account instead of a margin account, you don’t have to worry about this.

Don’t make more than three-day trades a week.

This is especially important for newbie traders. This is an excellent rule to follow whether you have a margin or a cash account. Buying shares of multiple stocks that interest you will hinder your concentration. It is essential to stay focused during day trading, so it is usually better to take fewer positions.

Focus on the 80-20 principle.

The 80-20 principle is probably something you’ve heard of before. The 80-20 code can be applied to various things. The stock market is a significant aspect that can be used in the stock market. The stock market means about 80% of your income will come from 20% of your trades.

Set goals

Goal setting is essential in general. Investing in the stock market is no exception. Goals are important in the stock market because, without defined plans, you won’t have anything to work toward. Think about what you would like to accomplish by trading stocks. Whether it’s financial freedom or buying a new Ferrari, setting goals is something you should practice.

Learn as much as possible.

If you are a newbie to the stock market, the best advice I can give you is to learn as much as possible. Understanding the stock market’s ins and outs will take time, but it will be worth it because it will give you the best chance at making it big in the stock market.

To repeat:

Does PDT apply to futures?

No, the PDT or Pattern Day Trading rule does not apply to futures day trading in the US. Because of NFA and FINRA regulations, covering margin on Futures, Futures Options, and Forex positions doesn’t count toward the $25,000 FINRA equity requirement.

Final thoughts

Now you know exactly what the pattern day trade rule is and who it impacts. Hopefully, you found this article informative as well as entertaining to read.

Pattern Day Trading Rules do not apply to forex, so all these article facts are essential only for stock traders in the US.