Islamic accounts in finance refer to banking or investment accounts that comply with the principles of Islamic law (Sharia), particularly the prohibition of charging or paying interest (riba). These accounts are designed to ensure that all financial transactions are conducted in a manner that is ethical, transparent, and equitable, promoting risk-sharing between the bank and the customer. Instead of interest, Islamic banks may earn profit through equity participation, which requires a customer and the bank to share the risk of investment and its profits or losses. Islamic accounts cater to the needs of Muslim investors who wish to adhere to their religious values while engaging in financial activities. Still, they are also available to non-Muslims seeking ethical banking options.

I wrote several articles about this topic. To read about the best Islamic account broker, visit my review. I explained that HF Markets’ broker is Halal. Additionally, I explained in detail what Riba is. I tried to share my opinion about whether forex is halal or haram (personal view) and whether stocks are trading haram. I also tried to answer a similar question about whether investing in stocks is haram or halal (long-term). For Islamic readers, I wrote about Murabaha financing, too.

What is an Islamic Account in Forex?

Islamic forex accounts represent special trading accounts without swap fees (rollover fee) to comply with Islamic Sharia law, which prohibits transactions involving interest. These accounts allow Muslim traders to participate in forex markets without compromising their religious beliefs by avoiding interest in trades that remain open overnight.

Please see my video about Islamic accounts:

The calculation of swap fees involves the interest rate differential between the two currencies in the pair, whether the position is long (buying the currency pair) or short (selling the currency pair), and the size of the position. For example, suppose a trader goes long on a currency pair where the base currency has a higher interest rate than the quote currency. In that case, the trader may receive swap fees, effectively earning interest on the position. Conversely, if the base currency has a lower interest rate, the trader will pay swap fees, reflecting the cost of holding the position overnight.

These fees are critical to forex trading, as they can affect the profitability of trades that remain open for more than one trading day. Different brokers have varying methods of calculating and applying swap fees, and some offer Islamic forex accounts that waive these fees to accommodate traders who must adhere to Sharia law, which prohibits transactions involving interest.

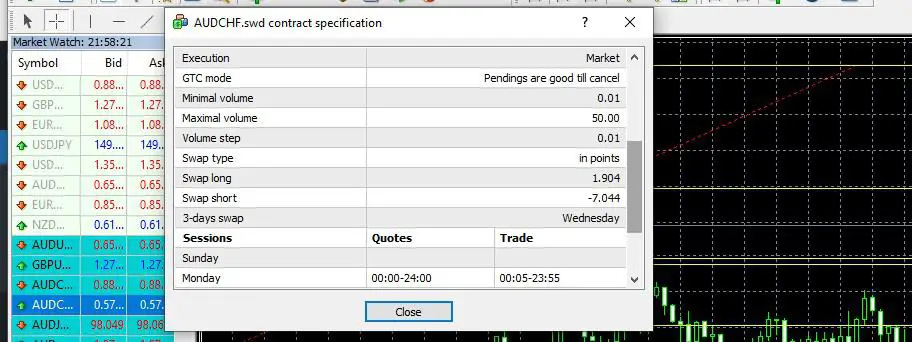

To see your swaps fee rollover fees in Islamic accounts, you can go to any symbol and press “Specifications,” like in this image below:

When you get specifications, check the “swap long” and swap short” values in your account currency to see the value. It is a different value for long or short trades:

Swap values for long and short positions in forex trading differ due to the interest rate differential between the two currencies involved in a currency pair and the nature of the trader’s position (buying or selling). Here’s a detailed explanation:

- Interest Rate Differential: Every currency has an associated interest rate set by the country’s central bank. When a trader enters a forex trade, they essentially engage in a transaction involving two currencies, each with its interest rate. The difference between these rates influences the swap fee.

- Long Positions (Buying): When a trader goes long on a currency pair, they buy the base currency and sell the quote currency. Suppose the interest rate of the base currency is higher than that of the quote currency. In that case, the trader may receive swap fees because they hold an asset (the base currency) that pays higher interest than the cost of borrowing the quoted currency. This scenario can result in the trader earning interest on the trade, reflected as a credit in the swap column of their account.

- Short Positions (Selling): When a trader goes short, they sell the base currency and buy the quote currency. Suppose the interest rate of the base currency is lower than that of the quote currency. In that case, the trader will pay interest because they are borrowing an asset (the base currency) with lower interest to buy one with higher interest. This results in a debit in the swap column of their account.

The fundamental reason for the difference in swap values between long and short positions lies in the interest rate differential and the direction of the trade. Essentially, traders are either rewarded or charged based on the economic principle of borrowing one currency to buy another and the relative value of holding one currency over another, influenced by global interest rates. This mechanism ensures that forex trading accounts for the movement of global interest rates and the cost of carrying positions overnight, making swaps a vital element in forex trading economics.

By eliminating swap fees, Islamic accounts offer a unique solution for traders adhering to Islamic Sharia law, which prohibits transactions involving interest (riba). These accounts ensure Muslim traders can participate in the forex market without compromising their religious beliefs, fostering an inclusive financial environment. The absence of swap fees removes the concern over earning or paying interest on trades left open overnight, aligning trading activities with ethical and religious principles. Consequently, Islamic accounts not only broaden the forex market’s accessibility to a broader audience but also highlight the financial industry’s adaptability in accommodating diverse cultural and religious values, promoting ethical trading practices across global financial landscapes.