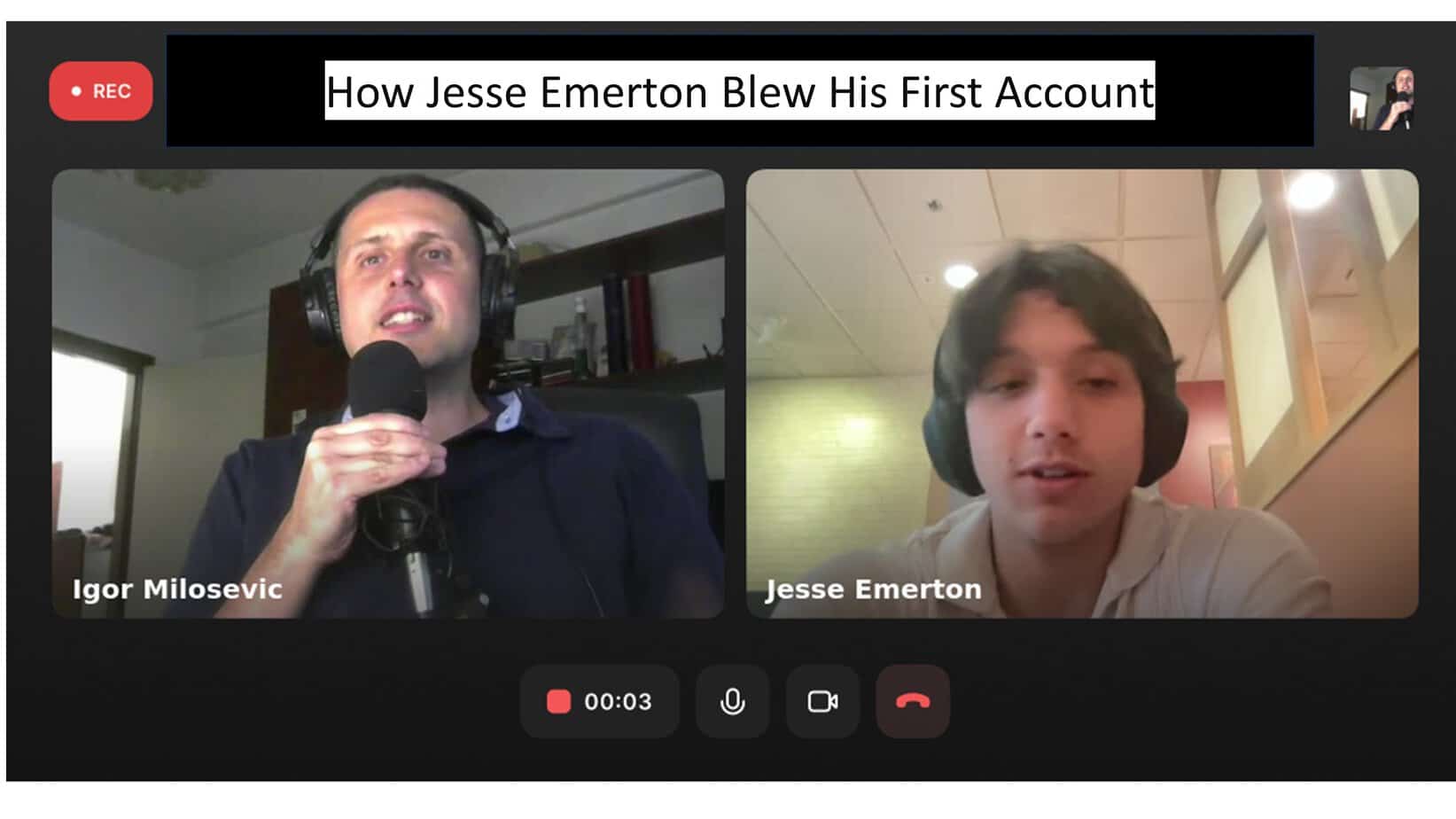

In a recent interview on the FXIgor YouTube channel, Jesse Emerton (Jesse Emerton’s Youtube channel ), a young funded trader from Boston, shared insights into his trading journey, strategies, and the challenges he faces in the competitive world of proprietary trading. This article reviews the critical points of that conversation, offering a comprehensive look at Jesse’s experiences and philosophy on trading.

Please see the whole interview in the YouTube video:

Jesse began by discussing his background and current situation. He is based in the Boston area but is planning a move soon. This detail set the stage for understanding his flexibility and adaptability—crucial traits in the trading world. Igor, the interviewer, was initially mistaken about Jesse’s location, thinking he was from England due to a post about visiting New England. This humorous mix-up highlighted the global nature of trading and the online presence that traders like Jesse maintain.

The conversation quickly moved to the theme of commitment in life and trading. Jesse emphasized the importance of fully committing to any endeavor to achieve success. He recounted how he sacrificed activities he enjoyed, such as boxing, to dedicate time to trading. He also had to make tough decisions about his education, knowing that trading was his future. Jesse’s commitment is a powerful reminder that success in trading, as in any field, requires total dedication and sometimes tricky sacrifices.

Jesse discovered trading during the GameStop and AMC stock surges during the COVID-19 pandemic. He started with a paper trading account and made significant virtual profits, which piqued his interest in stocks. However, due to the conflict between market hours and his school schedule, he transitioned to Forex trading, which offered more flexible trading hours. This adaptability allowed Jesse to find a niche that suited his lifestyle and commitments, showcasing his strategic thinking from an early stage.

Early in his trading journey, Jesse faced common challenges, such as understanding lot sizes, risk management, and avoiding the temptation to gamble. He shared a memorable story about a trade he placed in the school bathroom, which blew his account due to a lack of knowledge about stoppingping losses takingtaking profits. These experiences taught him the importance of education and preparation before engaging in the market.

One of the most significant lessons Jesse learned was the emotional toll that trading can take. When he first got funded, he struggled with the psychological impact of managing large sums of money. He learned to stick to his trading plan and execute trades like a robot, separating emotions from decision-making. This discipline is crucial for long-term success and for preventing costly mistakes driven by fear or greed.

Risk management emerged as a crucial topic during the interview. Jesse recounted a trade where poor risk management led to significant losses, underscoring the importance of setting strict risk parameters. For instance, on a $100,000 prop trading account with a 10% maximum drawdown, Jesse typically risks only 0.5% per trade. This conservative approach allows him to withstand losses without jeopardizing the entire account. He minimizes potential damage by reducing risk size during drawdowns and preserves capital for future opportunities.

The discussion on drawdowns delved deeper into how Jesse manages these inevitable setbacks. Based on his backtesting results, he defines drawdown and reassesses his strategy if losses exceed his historical maximum drawdown. This approach helps him stay grounded and confident in his methods, knowing that drawdowns are part of the process. Jesse aligns with the school of thought that adjusts risk size during drawdowns to protect the account and gradually recover.

Proprietary trading companies, or prop firms, have become integral to Jesse’s trading career. Despite the risk of these firms closing down, as happened with True Forex Funds, where he experienced blocked payments, Jesse views them as vehicles to increase his capital. He emphasized the importance of transferring profits from prop firms into personal accounts to build long-term wealth. This strategy mitigates the risk of relying solely on prop firms and ensures a stable financial foundation.

Jesse’s trading sessions and timeframes are also tailored to his lifestyle. Due to his location, he primarily trades the New York session but has a swing trading strategy that is not session-based. This approach allows him to maintain flexibility without being tied to specific market hours. He prefers the one-hour timeframe for its reliability and effectiveness in identifying strong support and resistance levels. This timeframe helps him avoid false breakouts and make more informed trading decisions.

Regarding chart analysis, Jesse uses concepts like swing highs and lows and focuses on liquidity sweeps and fair value gaps. His stop-loss placement varies depending on the timeframe, with a general preference for a 10-pip stop on the one-hour chart. This method helps him avoid being stopped by minor market fluctuations and maintain his position longer.

A critical aspect of Jesse’s success is his meticulous use of a trading journal. He uses TradeZella, a paid journal that logs all trades, calculates statistics, and provides detailed analyses. Jesse records entry and exit times and trade setups and includes screenshots of his charts. This practice allows him to review his trades comprehensively and identify patterns or areas for improvement. While primarily focusing on technical analysis, he notes significant news events that could impact market volatility, ensuring he is prepared for all eventualities.

Regarding handling news events, Jesse adheres strictly to his trading rules. He waits until after major announcements to enter trades on lower timeframes but remains in trades if already positioned based on his strategy. This disciplined approach prevents emotional reactions to market movements and keeps his trading consistent.

Reflecting on his emotional experiences in trading, Jesse shared stories of missed opportunities and trades that ran into significant profit before reversing. These experiences reinforced the importance of following a trading plan and not letting emotions dictate decisions. His ability to learn from these situations has strengthened his resolve and contributed to his growth as a trader.

Jesse trades almost exclusively EUR/USD and AUD/USD currency pairs. While considering trading indices or futures, he remains focused on Forex for now. He recognizes that learning new markets would require significant time and effort, so he prefers to invest in refining his Forex strategies.

Looking to the future, Jesse’s long-term goals include getting a million dollars in funded accounts, expanding his personal trading account to a substantial size, and growing his social media presence. He aims to document his journey and inspire other young traders by demonstrating that success in trading is achievable through dedication and hard work. Jesse envisions reaching hundreds of thousands of followers and becoming a prominent figure in the trading community.

In conclusion, Jesse Emerton’s interview with Igor offers valuable insights into the life of a young, funded trader. His journey is marked by commitment, discipline, and a constant drive to improve. By sharing his experiences and strategies, Jesse provides a roadmap for aspiring traders to navigate the complexities of the trading world. His story is a testament to the power of perseverance and the importance of a well-defined trading plan. As he continues to grow and achieve his goals, Jesse’s journey will undoubtedly inspire many in the trading community.

You can visit his YouTube channel: