For many individuals entering the trading world, starting capital often remains limited, with the majority commencing their trading journeys with accounts of less than $1,000. Motivated by stories of rapid wealth accumulation and the allure of quick profits, many of these traders adopt a high-risk approach, willing to risk a substantial portion of their modest capital in pursuit of outsized returns.

Fueled by these wild tales of overnight riches and massive profits, many go all in, hoping to turn their small stash into a mountain of cash quickly. But here’s where things get sketchy: diving headfirst without understanding the risks is like trying to swim with sharks while wearing a meat suit.

This mindset, however, is fraught with pitfalls. The temptation to “gain a lot” can overshadow the foundational principles of prudent risk management and long-term wealth generation. Succumbing to the allure of high rewards without a deep understanding of associated risks often sets novice traders on a precarious path, where the likelihood of significant losses is just as pronounced as the potential for gains.

What is The Best Leverage For Small Accounts?

The best leverage for small accounts is 1:500 up to 1:1000. Usually, high leverage enables small account traders to control more prominent positions with a smaller amount of capital, potentially magnifying profits (but also magnifying losses). However, traders with small accounts must avoid margin calls and high-risk positions trading.

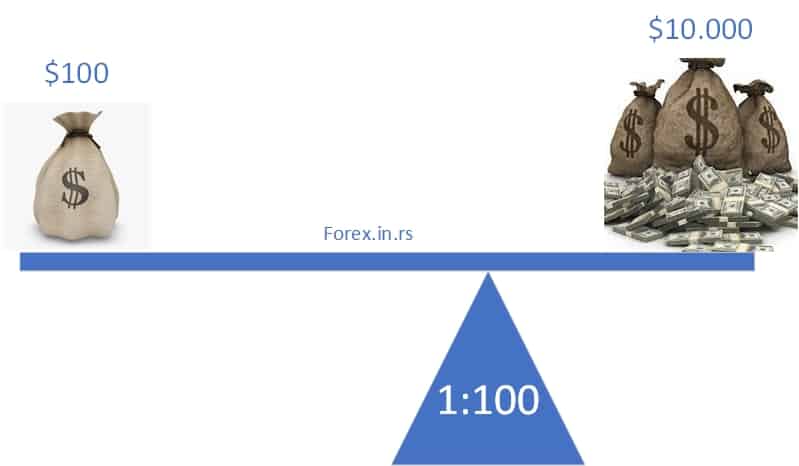

Leverage in forex trading allows a trader to control a more prominent position with less capital. Here’s a detailed explanation of how 1:500 leverage can be advantageous for small accounts:

- Greater Exposure with Minimal Capital: A 1:500 leverage means that for every $1 in a trader’s account, they can trade up to $500. For a small account holder, this can be incredibly beneficial. Let’s say you have $100 in your account. Without leverage, your buying power is limited to $100. However, with 1:500 leverage, your buying power increases to $50,000 ($100 multiplied by 500). This increased exposure can allow small account holders to profit from minor price movements in the forex market.

- Potential for Higher Returns: The primary allure of high leverage is the possibility of magnifying returns. Since small account holders can control more prominent positions with less capital, even tiny market movements can result in significant percentage gains relative to their account size.

- Flexibility in Position Sizing: High leverage allows traders to enter multiple trades or diversify their positions without using up all of their capital. This can be an excellent advantage for a small account holder, allowing for more strategic positioning.

- Buffer Against Margin Calls: While higher leverage can increase the risk of a margin call if a trade goes in the opposite direction, it can also provide a buffer. If a trader with a small account uses only a fraction of the available leverage, they can potentially avoid margin calls because they’d be operating well within their margin requirements.

Leverage is not always risk.

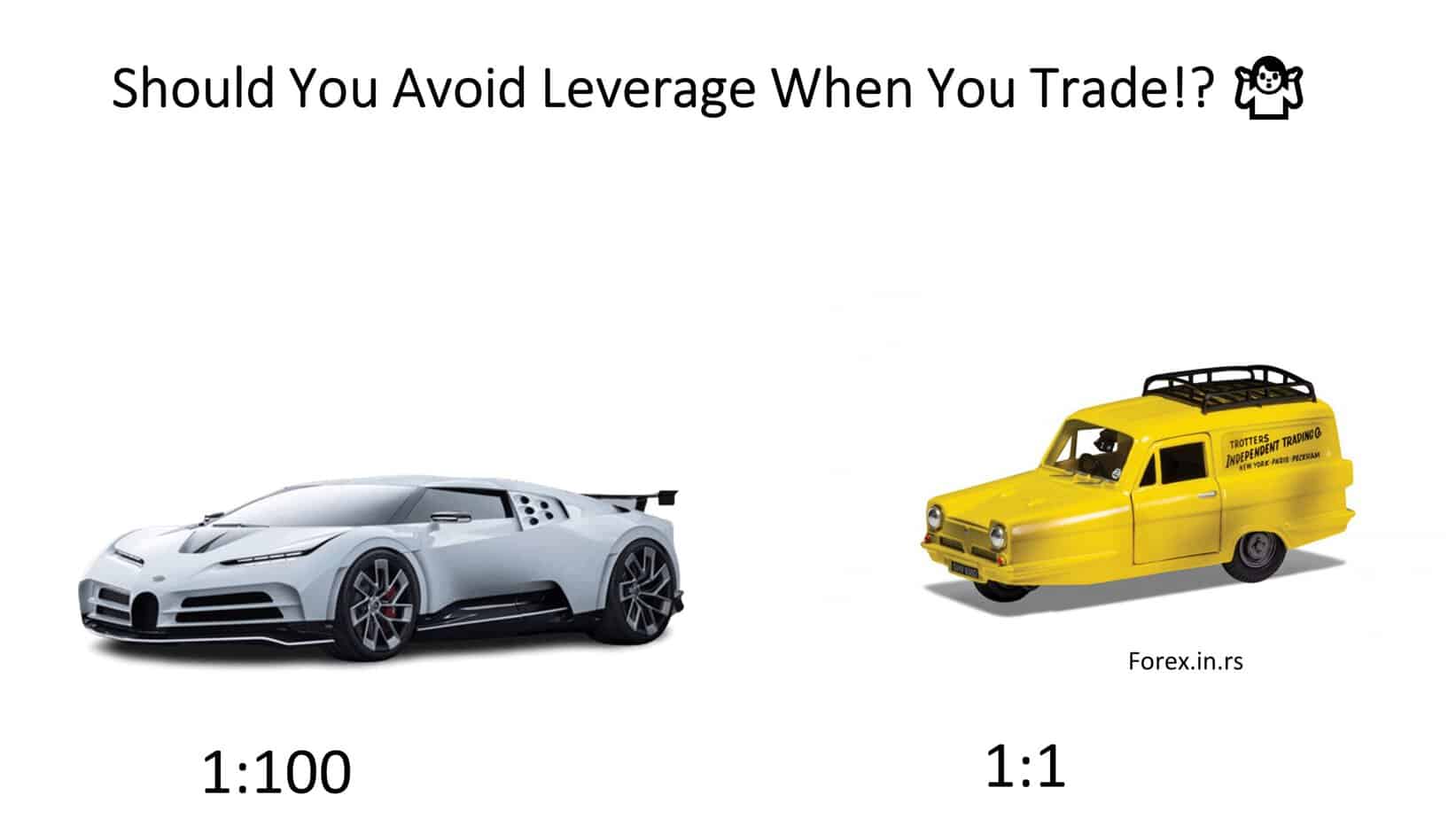

Imagine leverage in trading is like the speed of a car:

- Fast Car (High Leverage): A sports car (see image above) can accelerate quickly and reach high speeds in no time. It’s thrilling and can get you to your destination super fast. Similarly, high leverage can amplify your profits and make you a lot of money quickly. However, just as driving at high speeds can be risky if you’re not a skilled driver or if conditions aren’t ideal, high leverage in trading can lead to significant losses just as quickly as gains. The consequences can be dire if you lose control of a fast car, even for a split second.

- Slow Car (Small Leverage): Think of a regular sedan. It won’t reach your destination as fast as the sports car but is steadier and generally safer. With minor or no leverage, your profits won’t skyrocket quickly, but you won’t see massive losses overnight. As you have a lower risk of a severe accident in a slower car, especially if conditions are unpredictable, trading with less leverage provides more room for error and protects you from extreme market volatility.

So, just as choosing between a fast car and a slow car depends on your driving skills, the road conditions, and how much risk you’re willing to take, choosing your leverage in trading should be based on your trading skills, market conditions, and risk tolerance.

However, it’s crucial to underscore the inherent risks associated with high leverage. While it can amplify profits, it can equally magnify losses. For inexperienced traders or those without a robust risk management strategy, high leverage can quickly lead to significant losses beyond their initial deposit. Always approach high leverage with caution and a clear understanding of the potential downsides.

High leverage risk for small accounts

High leverage in trading amplifies both potential profits and losses, akin to a double-edged sword.

Here’s an explanation of how high leverage can lead to increased risk and, subsequently, significant losses:

- Amplification of Movement: Leverage allows a trader to control a more prominent position with less capital. For example, with 1:500 leverage, a 1% movement in the market can lead to a 500% change in the portion of your account exposed to that trade. This means both profits and losses can be magnified.

- Closer to Margin Call: High leverage can bring a trader closer to a margin call. A margin call occurs when the broker asks the trader to deposit more money to cover potential losses. As the leverage increases, a trader has a buffer before hitting a margin call since even minor adverse market moves can significantly impact the trader’s equity.

- Recovery Becomes Harder with Bigger Losses: Let’s delve into the mathematical reality of recovering from losses:

- 10% Loss: If you start with $100 and lose 10%, you’re left with $90. To get back to your initial $100, you need to gain approximately 11.1% of your current $90 (see image above)

- 50% Loss: If you start with $100 and lose 50%, you’re left with $50. To recover and return to your initial $100, you need a 100% gain on your current $50. (see image above)

This clearly illustrates that as losses increase, the percentage gain required to recover those losses grows disproportionately. In highly leveraged scenarios, more significant swings (both positive and negative) are more common, leading to scenarios where recovery becomes much more challenging.

- Emotional Toll & Poor Decision-Making: The heightened risk and more significant swings associated with high leverage can exert a considerable emotional toll on traders. This emotional strain can lead to poor decision-making, such as chasing losses or holding onto losing positions in the hope they’ll turn around, exacerbating the situation.

In summary, while high leverage offers the allure of significant profits on small market moves, it also comes with substantial risk. The potential for rapid and significant losses, coupled with the mathematical reality of recovery, means traders must approach high leverage with caution and a well-thought-out risk management strategy.