What is a breakout?

Breakout represents a trend change in the trading time frame. For example, if the price rises last 24 hours on an hourly chart, a breakout occurs if the price breaks the last 24 hours trendline. Breakout is sometimes tricky to figure out because sometimes it is tough to distinguish between consolidation and breakout.

What is the London Breakout Strategy?

London breakout strategy represents a strategy where traders enter into the trade after finished the London exchange opening range. London forex session starts at 7 a.m. GMT and after half-hour up to 1-hour, opening range will be finished. If the price breaks the London opening range high, you can make a buy position, and if it breaks low, you can make a sell position.

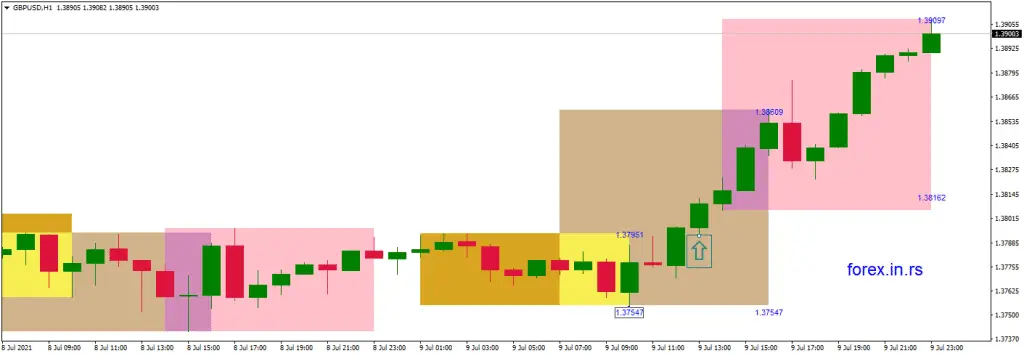

In the image above, rectangles present a trading session. The yellow rectangle is the London session opening range, where the highest price was 1.37951, and the lowest price was 1.37547. Green bullish candle close (green arrow) is above the highest high of the London opening range session and represents the entry point for BUY trade.

London breakout strategy can be applied in several variations:

- First, define high and low price levels from 7 a.m. GMT to 7.30 a.m. (or 8 a.m.). Buy above high price breakout, sell below low price breakout.

- Define high and low price levels from the Asian sessions. Buy after 7.30 a.m. above high price breakout; sell below low price breakout.

The London Breakout Forex trading strategy is defined as a technique used by brokers to trade at the London Forex session during the peak hours at the commencement of the Forex market in London. These are known as the simplest and least complicated trading strategies that can be utilized for a productive outcome. The London Breakout strategy focuses on maximum productivity through the availability of increased volume observed during the start of the London trading session.

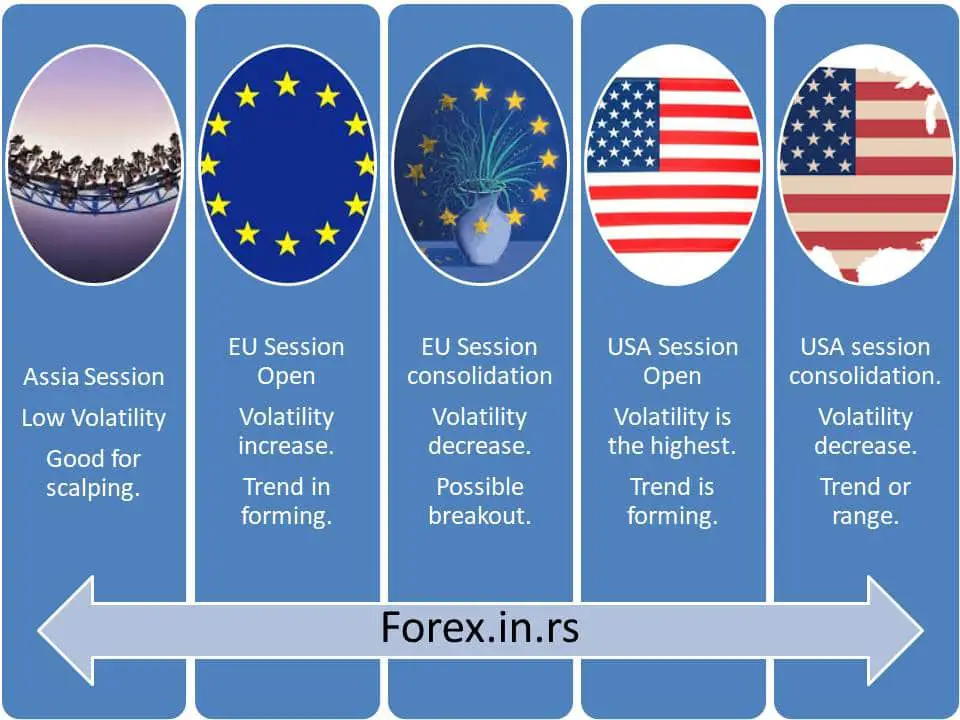

Forex trading is categorized into three significant trading time zones. Traders follow the Tokyo session, the London session, and the New York session. However, the first hour of reading is the big hour where there is a high volume of trading activity. This volume tends to overlap and argument, particularly due to the closing of the Tokyo station and the commencement of the London session. The concluding phase of the Tokyo session and the commencement of the London session are overlapped in terms of the Asian and European trading session. These two sessions are combined therefore making it extremely powerful, rendering high volume four international traders.

Utilizing the London Breakout strategy allows the traders to benefit from the increased unpredictability observed in their Forex market. By just dedicating a few hours of the day to the London Breakout strategy, the end product can be extremely money-spinning, and a consistent feeding pattern can be developed. However, in theory, the London Breakout strategy is not always successful despite its practicality and convenience.

One of the notable features and advantages of using the strategy is customization depending on the trader’s preference. Only the trading trends during the Asian session are highlighted during the London trading session, but other indicators and time zones can be amalgamated to customize personal trading tendencies. However, sellers need to be mindful of the short-term aspects and characteristics of the price fluctuations noted within this trading technique. This methodology is ideal for intra-day traders enforcing the London Breakout strategy will to be effective as the position does not need to be open throughout the night. As the day comes to an end, the trading also concludes.

Apart from learning the technicalities of the strategy, certain characterization and customization of discipline along with trader’s needs should be observed for successful results.

The crossover of the Asian and London session makes it one of the biggest Forex markets in the world. The momentum is observed in the Forex market due to the sudden increase in volatility in the London market. Traders are advised to take advantage of this deep spike observed during the first hours of the London session.

To be proficient in utilizing the strategy, you need to draw horizontal lines and dedicate a couple of first hours during the London session. This strategy allows trading to happen within a one-hour time frame and consists of GBPUSD and other currencies. If trade requires an indicator for the London Breakout strategy, then the MT4FX starting session indicator could be utilized and performed. As far as risk management is concerned, traders are advised to keep the risk per trade between 1 to 2% of total funds.

This strategy is complemented with E mini Dow Jones futures from the Chicago Board of trade. It will also accompany well with your Euro, Pound Sterling, Swiss franc, US, UK, and European futures instruments.

Before applying it to the authentic platform, it is important to perform the strategy on a simulated page before investing the money.

To perform the London Breakout strategy, draw support and resistant lines surrounding the concluding three candlesticks that have emerged during the Asian session for the particular hour being traded. This may include GBPUSD. Stop order around 2 to 5 pips above the resistance zone and stop order approximately 2 to 5 steps below the support zone. Once the order has been considered active, cancel the additional pending order. Finally, traders can place the stop loss in the place of the previous order.

If the London Breakout strategy does not involve the native indicators, it is especially user-friendly and convenient to implement. However, there is a risk of getting caught up in the beer or the bull trap. In addition, some of the techniques may appear complicated and fail to trade with the London Breakout strategy on Monday or Friday. These are the days when some of the odd prices are observed during the open and closing hours of the market.