Table of Contents

If you live in Europe, you probably trade during the London session.

What is the London session?

London session represents one of the most active forex trading times, covering a busy period of the London stock exchange and the most liquid period of the forex trading market. London’s forex time starts from 3 a.m. to 12 p.m. EST (7 a.m. to 4 p.m. GMT).

What are the best currency pairs to trade during the London session?

Most traded London session forex pairs in 2022 are EUR/USD, GBP/USD, USD/CHF, EURJPY, and GBPJPY. Currency pairs such as EUR/USD, GBP/USD, USD/CHF, EURJPY, and GBPJPY represent the best pairs for trading in the London session based on low spreads, volatility, and trading news impact. However, based on your analysis, any currency pair showing an extensive rise or downtrend can be traded in this session.

EURUSD and USDCHF trading in the London session

The EUR/USD pair is among the most popular trading pairs in the London session due to its low spread and relatively stable market conditions. This makes it an excellent choice for forex traders looking to make smaller, more frequent trade profits. Additionally, USDCHF, as a highly opposing correlated pair to EURUSD (usually when EURUSD rises, USDCHF falls), is perfect to trade during the London session.

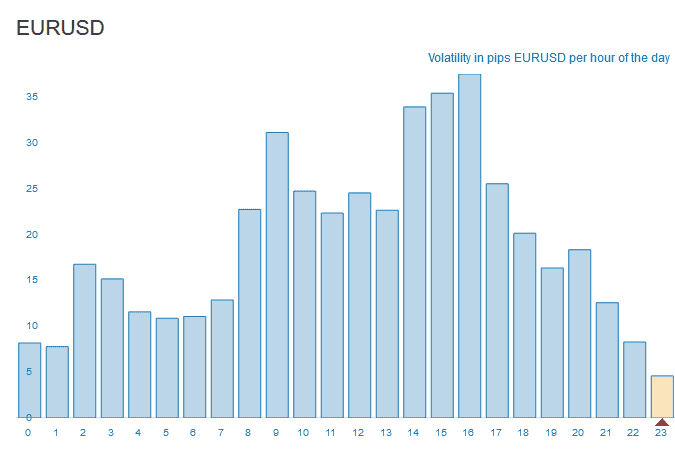

EURUSD has the highest volatility during the London session :

With a variable spread that typically ranges from 0.1 to 2 pips (up to 3 pips during the news), this pair is well suited for scalping strategies and other short-term trading methods. Additionally, the EUR/USD tends to be less volatile than many different currency pairs, making it easier for traders to manage risk and find entry and exit points effectively.

Banks and other big investment companies trade EURUSD, entering position trade and keeping them sometimes for several months. However, the London session is perfect for entering into a trade because, in this period, a trend is forming, and essential news usually increases or decreases the price.

Overall, the EUR/USD pair is a popular choice for traders in the London session due to its favorable conditions and potential for high returns on investment. If you’re looking to start trading in this market, it’s essential to research and choose a broker with low spreads, reliable service, and reliable trading education resources to help you get started.

GBPUSD trading in the London session

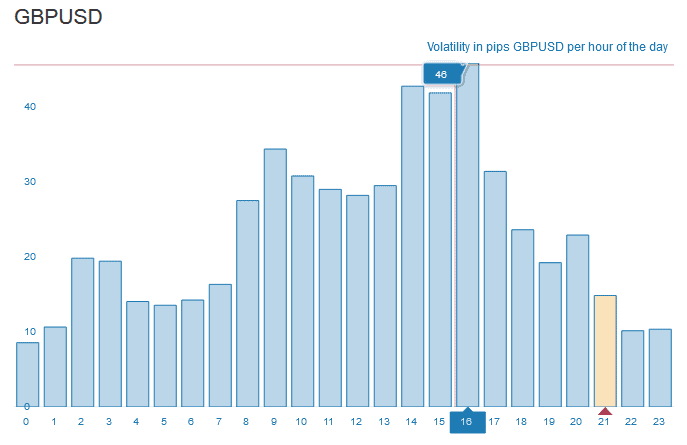

The GBP/USD pair is one of the most popular trading pairs in the forex market due to its high volatility and low spreads. During the London session, GBPUSD tends to make bigger bullish and bearish trends than EURUSD.

This makes it ideal for day traders who wish to take advantage of the rapid price fluctuations during the London session. Because this pair is characterized by frequent price movements and more significant pip movements, it can be a good option for those looking to make large profits from their trades. However, it also has a higher risk than other trading pairs due to its high volatility. Therefore, it is essential to carefully analyze market trends and technical indicators before entering any trades involving the GBP/USD pair in the London session.

The most significant volume and volatility for GBPUSD are during the London session:

Overall, the GBP/USD pair offers many opportunities for successful traders who understand market trends and can analyze price movements effectively. If you are interested in trading this pair during the London session, research and have a solid trading strategy before you begin!

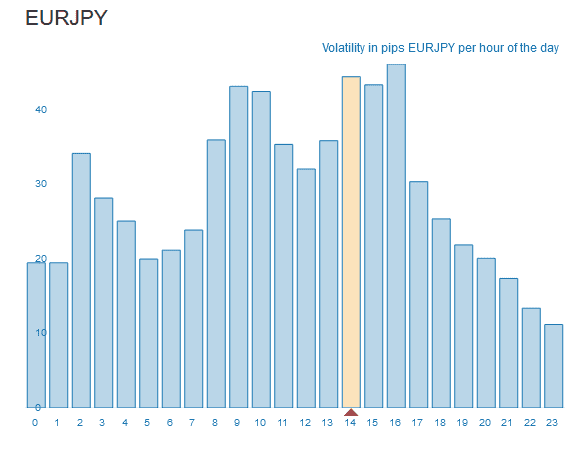

EURJPY and GBPJPY trading in the London session

EUR/JPY and GBPJPY are popular trading pairs in the London session because they are non-USD pairs with low spreads. This makes them ideal choices for traders who are more familiar with the two economies these currencies represent.

The EUR/JPY pair is susceptible and can experience significant price shifts, which can result in large gains or losses for traders. However, one of the main advantages of this pair is that it has relatively low spreads, which helps to minimize the losses that traders may encounter due to market volatility.

Overall, EUR/JPY is an excellent choice for traders looking to take advantage of this pairing’s extensive daily range and low spreads.

No currency pairs can expressly be excluded as the best for the London forex session. However, specific pairs can aid by having low spread cost because of high volumes, proving beneficial. The currency pairs are usually traded in high importance in the London forex market. Moreover, the inter-bank activities between London and the United States affect specific currency pairs during the overlap. These currency pairs include EUR/USD, GBP/USD, and USD/JPY. This can work best for traders using volatility-friendly trading strategies since these currency pairs become extremely liquid in times of overlap.

What time does the London session open?

London forex session opens at 7 GMT (springtime) or 8 GMT (wintertime). London forex session opens at 3EST (springtime) or 4EST (winter time).

What time does the London session close?

London forex session closes at 16 GMT (springtime) or 17 GMT (wintertime). London forex session closes at 12 EST (springtime) or 13 EST (wintertime).

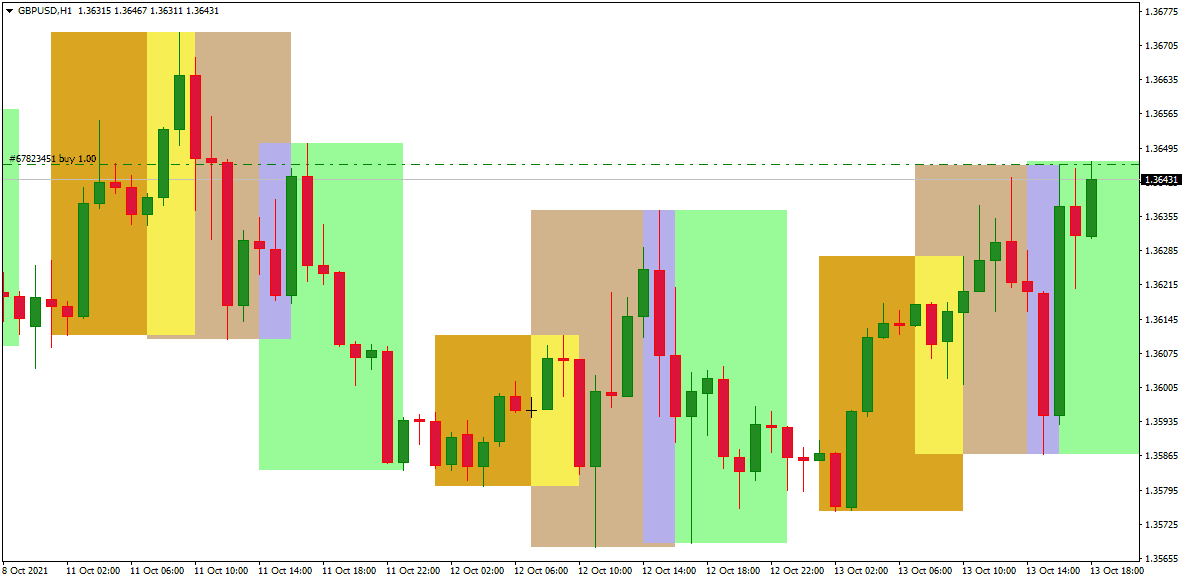

Trading session indicator

If you want to see a trading session better on your MT4 chart like the one below, please download the MT4 session indicator.

Visit the Forex Session Times page for trading session opening and closing times.

The London forex market occupies a superior position in the foreign exchange market, with its total average forex turnover being 35%. The London session, therefore, makes for the most significant amount compared to its fellows—moreover, the session overlaps throughout the year with the New York session. Read with us to know all the basic facts about the London forex market, such as the best currency pairs to be traded, how to trade breakouts, and how to get hold of certain tricks to have the best experience trading.

What Are the Timings of the London Forex Market?

The London Forex session is functional from 33:00 a.m.Eastern Time to 112:00 p.m.Eastern Time. As a result, this market session experiences the maximum forex volume out of all the forex markets. Let us now study the factors that stand behind such incredible market functioning.

London Session Characteristics

Following listed are the major factors in the functioning of the London foreign exchange:

1. The London forex session is speedy and active: The Tokyo forex market leads into the London forex marketing. As the prices shift from liquidity providers, one can witness increased volatility. Since the price commences from London, an increased average hourly move on several major currency pairs can be seen. Cracking the support and resistance becomes easier than in the Asian session, where the volatility is relatively lower. By considering the volatility, traders can take advantage of breakouts and learn these concepts well. Traders generally always look for more volatile moves that extended periods more extended periods.

2. Keep an eye on the overlap: The moment the London forex session and the US forex session overlap is termed an overlap. This occurs between 88:00 a.m.European Time to 112:00 p,.m.European Time. Since, in these 4 hours, major markets are at play, there is an increase in volatility. Further, with increased volatility, big and fast moves can be seen in the market. The volatility is at its peak when the takerkets overlap. To take advantage of this volatility, traders can employ the breakout strategy and make the most of their trading.

3. More liquidity: The London forex market qualifies as one of the most liquid trading sessions in the market. Trade can occur even at a low spread with a constant high volume of buying and selling currency pairs. Small or day traders can capitalize on short moves by looking for trends and breakouts for short-term trading, reducing the cost incurred in spreads.

Trading Breakouts in the London Forex Session

Trading with breakouts in the London session is more or less similar to being breakouts in other sessions, with the plus of experiencing volatility and liquidity right from the start. While aiming at trade breakouts, traders have an eye for support and resistance when plotting their trades. It helps in risk management more than anything else.

The traders should have close stops and keep them in sync with the trend line. If this is done, the chances of facing losses are reduced, and even if the support and trend line break, the loss will be limited. However, if the strategy holds on tight, then in all cases, the trader will have a favorable ratio of risk and reward. With increased volatility and liquidity, the chances of using breakout strategies become favorable.

Having acquainted you with the basics of the London forex session, we will now provide specific tips to further your success in the trading session.

Strategies and Tips for Trading in London Session

To make the maximum out of London forex trading, it must be well-versed in functioning the foreign exchange market. In addition, to capitalize appropriately on the volatility and liquidity of the London forex session, you must employ appropriate leverages while trading.

Since the London Forex session works with the New York and the Asian Forex sessions, you must acquaint yourself with the characters of these markets. Finally, to conclude and emphasize the article’s key points, reiterate them for you.

- In the London session, there would be an increase in volatility and liquidity.

- Therefore, there will be more options for using breakouts in the session

- Keep your eyes on the overlap of the London Forex session and the New York trading session to capitalize on the increased volatility and liquidity