In this article, we will analyze the long term forex trading strategy concept. In addition, we will give examples of how to build your long-term forex trading.

How to trade long term forex strategy and Plan an Effective Long-Term Forex Trading Strategy in 2021?

In the forex world, it would be essential to have different trading strategies for the short term. Along with it, long term planning is equally essential. With the forex trading strategy for the long run, you aim towards larger prospective profits with minimal capital investments. Also, these wouldn’t translate to premature stop losses, unlike trade approaches that are short term.

Long term forex trading strategy is usually based on important daily and weekly price levels, COT report, fundamental news (Industrial production, GDP, and major indicators), and technical trading patterns. Entry positions need to have several triggers before execution.

Now there is one important question. There are many intraday traders in the market these days, and long-term trading is not lucrative enough for most traders. However, long-term traders have better winning ratio and risk-reward ratio and, on the other side, smaller trading costs.

Is long term forex trading better?

Long term forex trading is better for traders who rely on fundamental analysis and do not like to manage trades each hour or day. Long term trading strategies give traders peace of mind, show better performance during strong trends, decrease trading cost.

For example, a day trader can trade EURUSD, create 300 trades with position size 1 mini lot during the year. Trader’s commission cost is $300 ($1 per trade). Long term trader will create 30 trades per year, and he will have 10 times smaller cost. But this not all.

When a day trader makes 20 pips profit, the day trader’s commission is 5% of the profit size. When a long term trader creates 100 pips profit, his commission is 1% of the profit value.

Long term forex system example

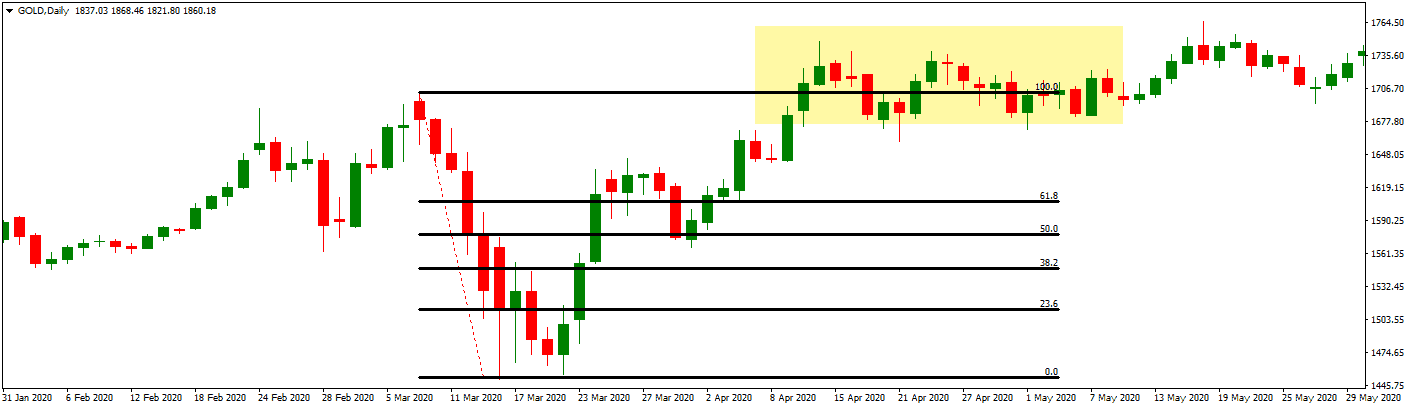

At the end of March, we have mixed fundamental results for USD. Crisis because pandemic Covid 19 is a fundamental trigger for gold price rise.

So, I choose to buy GOLD at the end of March 2020. But I waited to see price action above March month high:

March high is broken at the beginning of April. I decided to buy GOLD:

BUY Gold at 1706 price level. Stop loss is 38.2 Fib. The level price level of 1549.

Target is open.

I closed my BUY trade at price level 1900 (round number, and I waited for price reaction).

MY entry position triggers for the long term strategy entry position were:

- Weekly price high level

- USD economy recession

- Gold price rising trend.

Making an efficient trading strategy for the long term

Recently we created the article Forex Weekly Strategy. Traders need general advice about How to Plan an Effective Long-Term Forex Trading Strategy because trading rules are not only important things. Traders need to see the bigger picture.

It’s better to have a clearer picture of what you would like to have from the forex market. The target has to break down the following.

Fundamental analysis and long term system and COT report

The term would refer to proper tracking of commanding economy heights while known as fundamentals that would go along with the aforementioned idea. Fundamentals would be things such as interest rates, employment, CPI, along politics.

While trading in the big picture, you would have to know about the involved currencies’ fundamentals. It’s much better not to avoid interest rates when trading a bigger picture. Upon holding currency trade for higher than a day, you’ll also notice a thing known as rollover. This depends on the involved currencies with the trade direction; you would also pay little interest or earn interest. If a country pays the ideal amount of interest, the world traders purchase currency against weak currencies while forming trends.

Interest rate, Industrial production, GDP, and current high important news are the most important information that I check before any new long term trade. For example, if I want to trade EURUSD, I need to know these important facts about the European Union and the US economy. Daily chart and Fundamental analysis need to show the same direction of the trade before any trade execution.

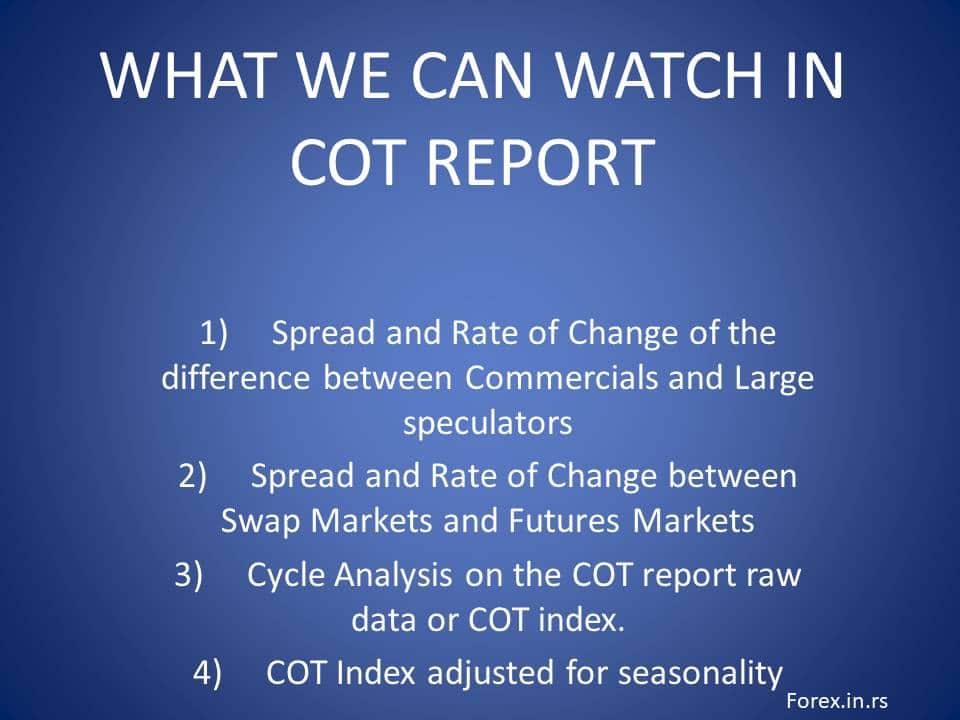

I like every Tuesday to check the COT report. How to use the COT report in forex trading? The COT report is most important in figuring out Reversals Type One or Reversal Type Two and using knowledge to assume the next long-term movement in the forex market.

What we can see in the COT report :

Try to see Reversals Type One – When the spread between commercial traders and large investors is big, then we should expect a market reversal.

or

Reversal Type Two – When large traders start to reverse their positions (i.e. the large investor’s line’s trend starts reversing), we can expect a market reversal most of the times.

Weekly charts and price levels

In step 2, traders need to see the big picture using the weekly chart to get Long Term Forex Strategy. On the weekly chart, the trader needs to analyze important levels, last month and last year high and low, close prices, important Fib. Levels. Important price levels are the trader’s edge, an important trigger for any trade.

So, if you’re not grasping the happening on currency pairs, it is better to view all weekly chart details with a step back. This would stop you from making uneducated guesswork.

Larger weekly based charts make a move on your daily chart appear trivial while providing you with a better feeling about the data you’re analyzing. With a step back, you can minimize second-guessing.

With such items, you also make strong decisions for trading for supporting positions that you hold. You must never make trades just for making these. Also, you must easily be able to explain all of these to third parties upon having. If you follow the rule, it will help in avoiding boring trade. With real trading, especially larger picture trading, it gets slow and boring. Many traders get brought in and trade quickly, and due to this, there are many failing forex traders.

Forex Trading Technical analysis for long term strategy

The technical analysis takes a lot of forms while you’re putting this into practice. If you’re saying technical analysis for a single trader, they would also think about moving averages, while another market operator would think of MACD while mentioning technical trading.

Except for price levels, technical analysis can show divergence, supply and demand areas, Pivot point areas, oscillators levels such as RSI levels, Stochastic levels, MACd, etc.

There are no perfect rules for trading orders which can tell you when to buy or sell the asset with high probability. Trading is like signature unique, and traders need to develop an original trading and market understanding methodology.

While forex trading strategy with a bigger picture, you look out for different technical aspects for supporting trade. So, if you’re concerned about purchasing a currency pair, it shouldn’t be technically overbought.

Am I true or wrong?

And true and wrong. Momentum traders can buy overbought assets very easily, but the mean reversion trader will sell. Both can be on the right side.

Some technical analyses must be involved in supporting the decision. This helps with timing while helping to avoid getting within a bad time. Overall, you would also get the right idea, but with technical analysis, you’re also able to reduce associated risks in the future.

Trading with long term forex trading strategy is all about taking all essentials into account while making an informed decision. This is one of the best available methods of forex trading that has been utilized by experts.

What is my Best Long Term Forex Strategy? I like when fundamental news and technical chart show the same. For example, the strong engulfing pattern on the daily chart or weekly chart with strong industrial production for rising currency is the best trading opportunity.