Table of Contents

For investors, leveraged ETFs give them a chance to reap more rewards. They outperform popular indices by two or three times. On the other hand, Leveraged ETFs can potentially cause investors to lose more than they originally invested. Leveraged ETFs can cause you to lose more money than you originally invested. Due to the nature of short-term leveraged ETF trading. Only compounded losses can cause you to lose more money than you invested.

Regarding mutual funds, exchange-traded funds (ETFs) are pooled investment assets. Like mutual funds, ETFs, like real stocks, may be bought and sold on the stock market. An ETF can track commodity prices, as can the values of many different types of assets. Some ETFs may be designed to match specific investing plans. This post will acknowledge everything regarding Can you lose more than invest in ETFs?

What Types Of ETFs Are There?

There are various types of ETFs:

- passive and active ETFs,

- bond ETFs,

- industry/sector ETFs

- commodity ETFs

- leveraged ETFs

- currency ETFs

- leveraged ETFs,

ETFs can be passively or actively managed, depending on how they are run. Passive ETFs are created to mimic the performance of either a broader index, such as the S&P 500, or a more focused target sector or trend. There are now eight ETFs in this category (AUM). There are now eight ETFs in this category (AUM). Regarding ETFs that focus on gold mining firms, there are now eight ETFs in this category (AUM). 3. In actively managed ETFs, portfolio managers decide which equities to include in their portfolios rather than tracking an index of assets. As a result, they offer advantages over passive funds, although they are more expensive for investors. Actively managed ETFs are discussed in detail below.

Investors may rely on bond ETFs to deliver a recurring stream of income. The distribution of their earnings is linked to the performance of the underlying bonds they own. Government, corporate, and municipal bonds (sometimes municipal bonds) may all be included in this category. In contrast to their underlying assets, Bond ETFs do not have an expiration date. As a result, a premium or a discount on the actual bond price is standard. Stock (equity) ETFs track a specific industry or sector by combining a group of equities. ETFs for stocks might, for example, follow the performance of automobiles or overseas stocks. The goal is to expose investors to a broad cross-section of a particular industry, including established players and up-and-comers, with room to develop. Stock ETFs are less expensive than mutual funds and do not require investors to own stocks.

ETFs that focus on a single industry or sector is known as “industry or sector ETFs.” For example, companies in the energy industry are likely to be included in an ETF focused on this area. Investing in sector ETFs is a way to obtain exposure to the industry’s potential upside by monitoring the performance of firms in that area. One example is the recent rush of money into the technology sector. On the other hand, ETFs limit the downside of erratic stock performance because they do not entail direct ownership of shares. You can also utilize industry ETFs to move in and out of different sectors of the economy at various points in time. Crude oil and gold are the only commodities in which commodity exchange-traded funds, or ETFs, invest. Commodity ETFs that invest in commodities have various advantages.

To begin with, they help diversify a portfolio, making it simpler to hedge against market declines. Commodity ETFs, for example, might provide a safety net during a stock market downturn. Second, investing in a commodities ETF is less expensive than buying the commodity outright. The former does not require the expenditure of money for insurance and storage.

How Does A Leveraged ETF Work?

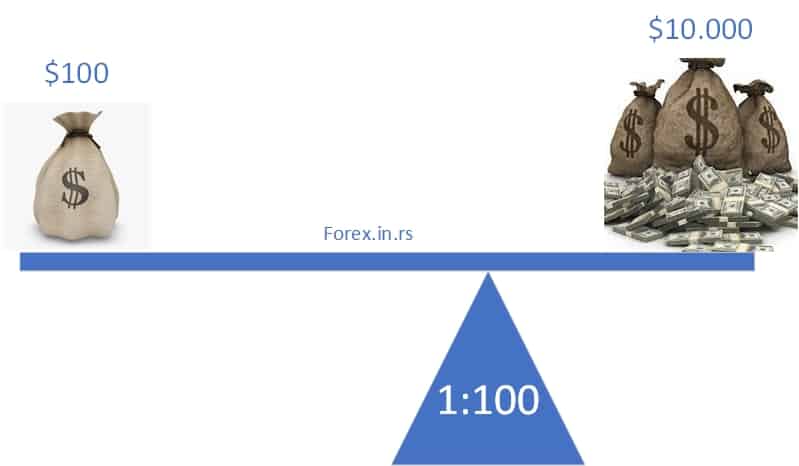

A leveraged ETF works as an exchange-traded fund to use money and debts as leverage. This ETF then multiplies the returns of the index.

There is a risk that you can lose more than you invest in ETFs, especially if you use leverage in one of these three ways: decreasing the margin requirement to open a trade, increasing the leverage on a trade to improve profit potential, or shorting an asset. These strategies can expose investors to greater risks and losses if market conditions change suddenly and unexpectedly. Additionally, many people do not fully understand the risks associated with leveraged trading strategies, which can lead them to make unwise decisions that ultimately result in significant financial losses. Therefore, investors should be cautious when using leverage in ETFs and consider working with a financial advisor who can help manage their risk exposure and guide them through potentially unfavorable market conditions.

For every one percent increase in the NAS100 index on a trading day, you’ll gain around three percent in return from the 3x leveraged ETF with the underlying asset, the NAS100 index. After costs and interest on the leverage are subtracted, the actual profit might vary from broker to broker. However, the return would be more significant than that of a non-leveraged ETF investor on the same day. Due to daily resets built into these instruments, most leveraged ETF holdings are liquidated after each trading day. Assume your broker allows you to borrow $500 at 2% interest and make a 10% deposit from your account.

Your investment will be worth $566.5 if the NAS100 gains 1% in a single trading day (3% for leveraged ETFs). You’ll have $56.50 in your name following repayment and interest if the underlying asset moves by 1%; your initial $50 investment returns $6.5, a 13% profit on the original $50 investment. Such returns can explain leveraged ETFs’ attraction. You’ll have to pay back the broker $510 (the borrowed capital plus 2% interest) yet still bear the equivalent of a 3 percent loss ($16.50) if an underlying asset drops 1% in the investing window. The net balance is $33.5, a loss of 13% overall.

Can you lose more than you invest in ETFs?

Yes, you can lose more than you invest in ETFs. Usually, if you trade leverage ETFs, there is the probability that you trade on margin and lose more money than that you invested. In that case, you need to repay the borrowed money plus interest.

You can lose more money than you invested if you use one of these 3 types of leverage:

- Decreasing the margin requirement to open an ETF trade

- Increasing the leverage on ETF trade to improve profit potential

- Short ETFs

The broker effectively lends you money, and you pay interest on that loan. It’s not only a matter of losing money due to a fall in the share price; you’ll also have to pay back the money you borrowed plus interest. If you’re a novice investor, familiarizing yourself with two types of brokerage accounts will help you decide which is ideal.

You would wipe out your $X investment if you suffered a string of losses, and you would be liable for the interest on the last borrowed cash. Investing in a leveraged ETF is a surefire way to lose more money than you put in. Even if the underlying asset performs spectacularly over the long run, your investment in a leveraged ETF will eventually zero out. It is essential to keep in mind that your trading profits or losses are directly related to the daily fluctuations in the market. Leveraged ETFs invested in losing assets will compound their losses when held for many trading days.

Short selling of ETF is the act of selling securities you do not own in the hope that their prices will fall and you can purchase them at a lower price. Short selling is a leveraged process product because you borrow money from a broker to sell ETFs you didn’t buy. This strategy is typically used by investors who believe that the market or a particular asset is overvalued and want to profit from falling prices by borrowing the security and selling it at its current price. However, short selling can also be used as a hedging strategy to protect against potential losses from falling prices. Ultimately, short selling is a risky investment strategy that should only be used by experienced investors who understand the risks and potential rewards.

What is the level of interest and transactions in ETFs?

A transaction in an ETF is a basket of securities that trade on an exchange like a stock.

Because they are not separate line items, interest and transaction charges can be challenging to detect and quantify. Instead, you may compare leveraged ETF performance to its underlying index’s performance over time to see how predicted returns compare to actual returns. For example, a small-cap ETF two times leveraged has $500 million in assets, and the suitable index trades for $50. Using a mix of index futures, index options, and equity swaps, the fund acquires derivatives to mimic $1 billion in exposure to the right small-cap index, approximately 20 million shares.

What are some safer alternatives to leveraged ETFs?

Investing in blue-chip companies and mutual funds that track a well-diversified index, such as the S&P500, are better alternatives to leveraged ETFs.

A large, well-known corporation is called a “blue-chip stock.” Companies that have been in business for a long time and have a steady source of income, such as dividends, are generally considered safe investments. In addition, the market capitalization of a blue-chip stock often exceeds $1 billion, and the company in question is either the market leader or one of the top three in its industry. Blue-chip stocks remain popular with investors for all of the above reasons. IBM Corp., Coca-Cola Co., and Boeing Co. are just a few examples of blue-chip stocks.

You may have better odds of outperforming the market by investing in stocks and bonds and then letting compounding work its magic. Investing in vehicles that enable both buy-and-hold and short-selling is safer than taking on more risk. All major bitcoin trading platforms have embraced this strategy. You may profit from such a strategy regardless of the market’s movement. You can go short if you feel the underlying asset will grow in value on a particular trading day. However, it does not eliminate all risks of loss. Your analysis or prognosis might be utterly incorrect on any given trading day. Your stock portfolio will only benefit from “poor” trading days when they occur.

Are leveraged ETFs suitable investments?

Yes, leveraged ETFs are suitable investments. Leveraged ETFs can be a solid investment if you know the risks and can consistently earn risk-adjusted returns over time. However, these investments should not be part of a long-term, diversified portfolio. They aren’t meant to be held for long periods for the most part.

Leverage is increasing an investment’s potential profit by taking out a loan. Because of this, both gains and losses might be more likely to occur. Buying on margin is a systematic method of leveraged stock investment. Some ETFs come pre-loaded with leverage, aiming to outperform the underlying index or sector two or three times. All forms of leveraged investing carry a high level of risk for investors. 3x ETFs, on the other hand, have a higher level of risk due to the use of additional leverage to boost returns. Leveraged ETFs may be advantageous for short-term trading objectives but carry significant long-term risks.

Leveraged ETFs can be a solid investment if you know the risks and can consistently earn risk-adjusted returns over time. However, these investments should not be part of a long-term, diversified portfolio. They aren’t meant to be held for long periods for the most part. In most cases, you may exchange them in less than 24 hours. In the end, long-term solutions are no less dangerous. It’s also important to remember that the returns aren’t always as good as they appear on paper. Investing costs and interest rates are more than 1% (sometimes up to 4%). In addition, because of their short-term nature, your gains are subject to a substantially higher rate of income taxation. Speak to your adviser if you have any questions regarding leveraged ETFs. Based on your overall financial condition, you’ll be able to tell whether this is a good choice for you.

Whether you can lose more than investing in ETFs has recently been a hot topic in the financial world. There seems to be a lot of confusion and uncertainty surrounding this issue, as many investors are unsure about how ETFs work and their risks and benefits.

At its core, an ETF is a type of investment fund that tracks the performance of a particular asset or group of assets. Like other types of investments, such as stocks and mutual funds, there is always some risk involved in investing in ETFs. However, it is essential to remember that just because you can potentially lose more money than you invest in an ETF does not mean this outcome is inevitable.

Several factors determine an ETF’s riskiness, including its underlying assets, the level of diversification within its portfolio, and fee structure. Lower expense ratios, greater diversification, and larger capitalizations tend to lower risk for individual investors.

If you are considering investing in ETFs, it is essential to do your research beforehand to understand these funds and how they work. With careful planning and prudent investment decisions, you should be able to minimize your risks while maximizing your potential returns when investing in ETFs.

Conclusion

Leveraged ETFs may be suitable if you’re looking for returns that outperform the market. However, like with any leveraged investment, there’s a possibility of more significant losses than you would expect. You might lose even more money if interest and management costs are considered. However, the likelihood of such a loss is highly remote. The broker’s terms and conditions may contain detailed information about potential losses over your investment. Before you begin trading leveraged ETFs, consult your financial advisor.

Like other ETFs, leveraged ETFs are easy to use but conceal a great deal of complexity. Fund managers buy and sell derivatives regularly to sustain the target index exposure. Due to daily rebalancing, the index’s exposure might fluctuate significantly, resulting in high interest and transaction costs. As a result, it is difficult for these funds to return twice as much as the index over the long term. Understanding the ETF’s daily returns about their track index is essential for setting reasonable performance expectations for such products. We hope you must have acknowledged everything regarding leveraged ETFs.