Private equity firms are known for their active involvement in the companies they invest in, often working closely with management teams to implement strategic changes, improve operations, and foster growth. This hands-on approach can significantly improve a company’s performance, making private equity a powerful tool for unlocking value and driving business success.

The private equity market is diverse, encompassing various strategies, including venture capital, growth equity, leveraged buyouts, and distressed investments. Each strategy caters to different stages of a company’s lifecycle, from early-stage startups seeking capital to established businesses looking for expansion opportunities or undergoing restructuring.

In recent years, private equity has gained prominence as an asset class, attracting significant attention from investors seeking higher returns and diversification in their portfolios. However, the private equity landscape is not without its challenges, including the need for careful due diligence, navigating complex transactions, and managing the risks associated with investing in privately held companies.

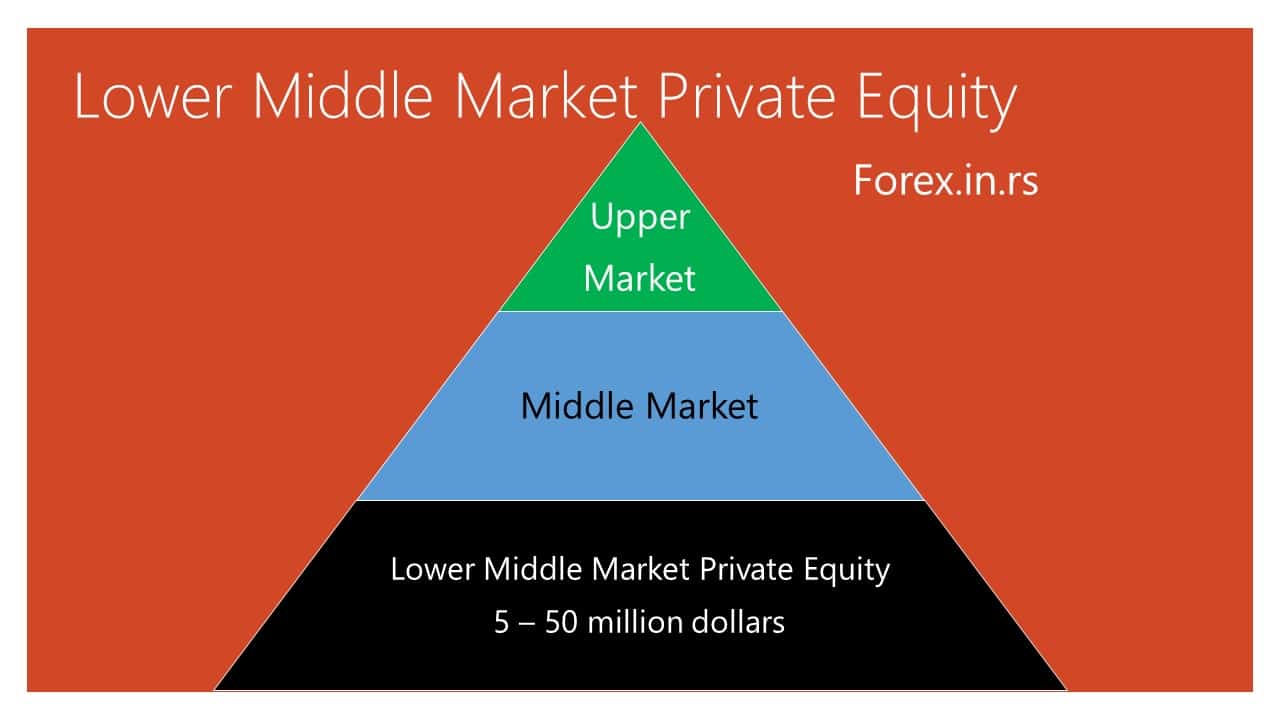

Lower middle-market private Equity refers to companies with annual revenue between $5 million and $50 million. These companies are small to medium-sized entities and typically represent a large middle-market segment in many world economies.

Lower Middle Market Private Equity: Definition Explained in Bullet Points

- Lower Middle Market (LMM): Refers to companies typically smaller than larger middle-market or upper-market companies.

- Revenue Range: Lower middle-market companies usually generate annual revenues between $10 million and $100 million, although the exact range can vary by firm or region.

- Enterprise Value: These companies generally have an enterprise value (EV) between $5 million and $250 million.

- Investment Focus: Private equity firms that focus on the lower middle market target these companies for investment, often due to their potential for growth, operational improvement, or market expansion.

- Strategic Value Creation: Private equity firms aim to add value through strategies like operational enhancements, management team strengthening, and market expansion.

- Less Competition: There tends to be less competition for deals in the lower middle market than more significant deals, allowing for potentially better entry valuations.

- High Growth Potential: Lower middle-market companies are often in a growth phase and have significant upside potential, making them attractive to private equity investors.

- Exit Strategies: Private equity firms typically exit their investments in lower middle-market companies through strategic sales, secondary buyouts, or initial public offerings (IPOs) as they mature and grow in value.

- Risk and Return Profile: Investments in the lower middle market can offer higher returns due to the increased risk of investing in smaller, less established companies.

- Hands-On Involvement: Private equity firms may take a more active, hands-on approach to managing and operating lower middle-market companies than larger investments.

Lower Middle Market

Lower middle-market companies: Lower-middle markets typically get ranked above medium and small enterprises (SMEs), mainly the ones reporting revenues below $5 million. Although the general criteria are the annual revenue required for such classification, various other metrics also get used in such cases, mainly including the number of employees and capital assets employed.

The lower middle market typically remains a larger segment in many world economies, with several representatives and companies above 90% of all middle market companies. Firms remaining in the lower middle market typically have a vital role in the national and global economy.

Managing and Investing in Companies That Are in the Lower Middle Market

Many boutique investment banks and private equity firms have most of their focus on a lower middle market segment for improvement of proficiency while conducting deals within such segments. Typically, visitors require a classification for the asstoiassesstegory’s overall high growth prospect against the involved risk for Orrin to arrive at a strategic outcome. Prospective buyers are primarily searching for low- and middle-market acquisition targets as multiples of valuations in such markets typically remain low.

Low, middle-market companies are highly likely to grow and become a vital part of a high segment normally commanding a valuation premium. Therefore, such classification would result in normal divestment market expansion.

Though this wouldn’t always be the case, low- and middle-market companies are family-owned businesses with many senior management ranks that family members occupy. To become a successful business owner in a low-middle market, you’ve got to learn ways to work well with others.

Capital Sources Required by Companies in Lower Middle Market Cap

In the current economic environment, middle-market companies require many capital sources for growth and working capital requirements.

1. Bank Debt

Banks typically seek an operating history of at least five years, with recent years of profitability.

2. Lending on Assets

Lending on an asset basis is a capital source offering a credit financing line with company assets used as security. Asset lending usually is 85% on accounts receivable and 60% on inventory, and the advancement of a lot of funds is also done against capital assets.

3. Mezzanine Debt

By Mezzanine Debt, we mean a debt group with equity-like features. Low- and middle-market companies typically use mezzanine finance as capital sources for acquisitions, even though this is also required for growth capital and other financial requirements.

4. Government or Public Sponsored Companies

Government-financed entities and public companies are ideal places to search for different capital sources for growth acquisitions, expansion buyouts, recapitalization, etc.

Business owners must know how to manage, set standards, and inspect to ensure that the standards are met. There are many alternative sources from which low- and middle-market companies can select appropriate capital structures that remain favorable to their finance requirements.

Lower middle market private equity (LMM PE) firms are known for their ability to rapidly enhance the value of their portfolio companies by leveraging their extensive networks, resources, and operational expertise. These firms often target small—to mid-sized companies with strong potential that may lack the necessary resources, management experience, or strategic direction to achieve their next phase of growth.

Real Example: Sentinel Capital Partners and MB2 Dental

- Background: Sentinel Capital Partners is a private equity firm specializing in the lower middle market. In 2017, Sentinel acquired a majority stake in MB2 Dental, a dental service organization (DSO) that partners with dentists across the United States to provide non-clinical services such as HR, finance, and marketing, allowing dentists to focus on patient care.

- Network Utilization: Sentinel leveraged its extensive network of industry professionals and advisors after the acquisition to help MB2 Dental refine its business model and operational strategy. They introduced MB2 to a broader network of dental practices, which helped expand its reach and grow its business rapidly.

- Operational Expertise: Sentinel brought in operational experts who worked closely with MB2’s management team to streamline operations, optimize financial processes, and enhance overall efficiency. They implemented best practices in procurement, human resources, and technology, leading to significant cost savings and improved service delivery.

- Resource Allocation: Sentinel invested in MB2 Dental’s infrastructure, upgrading its IT systems and expanding its support teams. This enabled MB2 to scale its operations more effectively and provide better services to its affiliated dental practices.

- Strategic Growth: With Sentinel’s guidance, MB2 Dental pursued an aggressive growth strategy, expanding its footprint through strategic acquisitions of additional dental practices. Sentinel’s mergers and acquisitions (M&A) expertise allowed MB2 to navigate these transactions smoothly and integrate new practices effectively.

- Outcome: Within a few years, MB2 Dental experienced substantial growth in revenue and the number of affiliated practices. Sentinel’s involvement helped the company strengthen its market position and significantly increase its value. In 2021, Sentinel successfully exited its investment by selling MB2 Dental to a more prominent private equity firm, marking a profitable exit.

Conclusion: This example demonstrates how lower middle market private equity firms like Sentinel Capital Partners can create instant value by utilizing their network, resources, and operational expertise. By addressing the specific needs of their portfolio companies and implementing strategic improvements, LMM PE firms can unlock significant growth potential and drive long-term success.