Table of Contents

The forex industry, known for its vast liquidity and round-the-clock trading, remains a robust and dynamic financial market. A daily trading volume exceeding $6 trillion attracts traders globally, seeking opportunities to capitalize on currency fluctuations. Traders leverage their knowledge of economic indicators, technical analysis, and market sentiment to identify profitable trades. This constant flow of capital and information creates a fertile ground for traders aiming to earn substantial returns on their investments.

How Can I Make Money From Forex Trading?

You can make money from forex trading using two main approaches: individual forex account money management and scaling money using forex prop companies. As a forex trader, you should trade both types of accounts and use knowledge to develop strategy, discipline, and risk management.

Read more our article: How to Trade Forex and Make Money

When trading an individual account, risking 1-2% per trade, the trader has more flexibility to potentially achieve higher returns but also faces greater risk of significant losses.

This higher risk tolerance can lead to more substantial profit opportunities, yet it requires a well-defined strategy and disciplined risk management to prevent substantial drawdowns. In contrast, when trading for a prop company and risking only 0.5% per trade, the risk is minimized, aligning with the firm’s strict risk management protocols designed to protect its capital.

This lower risk per trade ensures more sustainable and consistent growth but also means the potential returns per trade are smaller. However, trading for a prop company often provides access to more considerable capital, which can amplify returns despite the lower risk per trade. The disciplined risk approach in prop trading fosters a more stable and professional trading environment, reducing the likelihood of significant capital erosion.

Make money risking 1%

Growing a forex account by risking 1% per trade and analyzing one trade simultaneously involves a disciplined and systematic approach. First, the trader identifies a potential trading opportunity through thorough analysis, focusing on technical indicators, chart patterns, and relevant economic news. Upon deciding to enter a trade, the trader calculates the position size to ensure that only 1% of the account balance is at risk. This means setting precise stop-loss orders to limit potential losses and preserve capital.

Once the trade is placed, the trader monitors its progress, adjusting the strategy if necessary while adhering to the pre-defined risk parameters. By risking only 1% per trade, the trader minimizes the impact of any single losing trade on the overall account balance, ensuring long-term sustainability. As trades are executed and closed, profits are added to the account balance, and the 1% risk is recalculated based on the new balance, allowing for compounding growth over time.

The process requires patience and consistency, as each trade is analyzed individually, ensuring that only high-probability setups are taken. This meticulous approach helps build the account steadily, reduces the emotional stress associated with more significant risks, and enables the trader to focus on quality rather than quantity. Over time, with disciplined execution and effective risk management, the account gradually grows, reflecting the cumulative effect of successful trades and prudent risk control.

Risk Reward: An Essential Component for Consistent Trading Profits

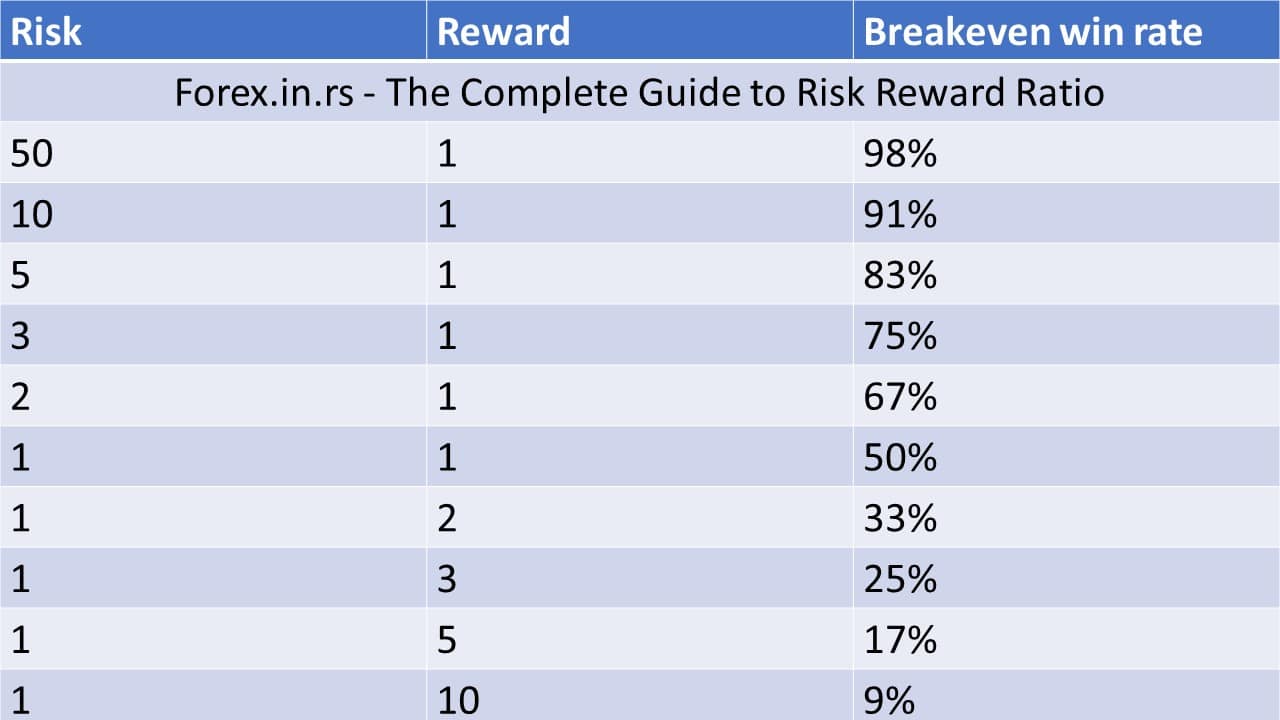

The risk-reward ratio is a measure that compares a trade’s potential loss (risk) to its potential gain (reward). Traders use it to evaluate a trade’s potential profitability and manage risk effectively.

Let’s break down the concept with some examples:

Example 1: High Risk, Low Reward

If you risk 50% of your capital to gain 1%, your risk-reward ratio is 50:1. For every dollar you risk, you only aim to gain two cents. To break even, you need to win 98 out of 100 trades (98% accuracy). This is because a loss of 50% would require 50 successful trades at a 1% gain each to recover.

Example 2: Low Risk, High Reward

If you risk 1% of your capital to gain 10%, your risk-reward ratio is 1:10. For every dollar you risk, you aim to gain 10. You must win just one out of ten trades (10% accuracy) to break even. This is because each winning trade can cover the losses of ten losing trades.

Example 3: Balanced Risk-Reward

Consider a scenario where you risk 1% of your capital to gain 2%. Here, the risk-reward ratio is 1:2. To break even, you must win just over 33% of your trades. For every three trades, winning one would cover the losses of the other two.

Example 4: Moderate Risk-Reward

If you risk 1% of your capital to gain 5%, your risk-reward ratio is 1:5. You must win 17% of your trades to break even. Even with a relatively low win rate, you can still be profitable because the winning trades significantly outweigh the losing trades.

Practical Application:

- Risking 2% to Gain 4% (1:2 Risk-Reward Ratio): You need a win rate of 34% to break even.

- Risking 3% to Gain 6% (1:2 Risk-Reward Ratio): You need a win rate of 34% to break even.

- Risking 5% to Gain 10% (1:2 Risk-Reward Ratio): You need a win rate of 34% to break even.

The key takeaway is that a favorable risk-reward ratio can significantly reduce the pressure to have a high win rate. Traders can focus on quality setups with an excellent risk-reward profile, knowing that even a lower win rate can lead to profitability. Conversely, high risk for low reward demands an exceptionally high accuracy, which is difficult to achieve consistently. Therefore, aiming for a risk-reward ratio that balances risk and reward while maintaining a realistic win rate is crucial for long-term success in forex trading.

5 Important Steps to Start Making Money From Forex

Education and Research

- Understand the Market: Learn about the forex market, including how currency pairs work, market participants, and key economic indicators.

- Study Technical Analysis: Familiarize yourself with charts, patterns, indicators, and tools that help predict market movements. Read university books like Muprhy’s Technical Analysis.

- Learn Fundamental Analysis: Understand how economic news and events affect currency prices.

2. Choose a Reliable Broker

- Regulation: Ensure a reputable financial authority regulates the broker.

- Trading Platform: Use a platform like MT4 or MetaTrader 5 (MT5), which offers comprehensive tools for analysis and trading.

- Spreads and Fees: Compare spreads, commissions, and other fees.

3. Develop a Trading Plan

- Define Your Goals: Set realistic and achievable financial goals such as 2% or 5% per month.

- Risk Management: Decide your risk tolerance and set rules for how much you are willing to risk per trade. For example, trade two trades, one in the EU and one in the US session, and define how much money you can spend in each session.

- Trading Strategy: Develop a strategy that suits your trading style, such as scalping, day trading, swing trading, or long-term trading.

4. Start with a Demo Account

- Practice Trading: Use a demo account to practice your trading strategy without risking real money.

- Refine Your Strategy: Adjust your strategy based on your demo trading results.

5. Live Trading

- Start Small: Begin with a small amount of capital to minimize risk.

- Use Leverage Wisely: Leverage can amplify gains and losses. Use it cautiously.

- Keep Emotions in Check: Avoid making impulsive decisions based on emotions. Stick to your trading plan.

- Apply for prop company.

6. Continuous Learning and Adaptation

- Stay Informed: Keep up with market news, economic events, and developments.

- Review Your Trades: Regularly analyze your trades to identify what worked and what didn’t.

- Adapt Your Strategy: Be willing to adjust your strategy as market conditions change.

7. Networking and Mentorship

- Join Trading Communities: Participate in forums, social media groups, and trading clubs.

- Learn from Experienced Traders: Seek advice and mentorship from successful traders.

8. Risk Management Techniques

- Stop Loss and Take Profit: Use these tools to manage risk and lock in profits.

- Diversify Your Trades: Avoid putting all your capital into one trade or currency pair.

- Position Sizing: Adjust the size of your trades based on your risk tolerance and account size.

Making money in forex trading requires knowledge, strategy, and disciplined risk management. Consistent profits come from thorough market analysis, calculated risk-taking, and emotional control. By adhering to a well-defined trading plan and managing risks prudently, traders can achieve sustainable growth. Success in forex is a continuous learning journey and adaptation to ever-changing market conditions.