Table of Contents

When we talk about market timing, we mean it as a strategy. A strategy that traders and investors use to enter and exit the market. It helps them predict price movements to leverage their position over time.

What is Market Timing?

Market timing represents a trading strategy where traders buy and sell assets by predicting future market price movements. Usually, market timing strategies make assumptions about the price of a security at a particular time using past price values, predictive methods, technical indicators, and economic data. Market timings predict market fluctuations for profit.

- Application in Active Management: Typically a crucial aspect of actively managed investment strategies, traders almost always employ market timing. Predictive methods may include analyzing fundamental, technical, quantitative, or economic data.

- Debate on Feasibility: There’s a divided opinion on the possibility of successful market timing. While many investors, academics, and financial experts believe it’s impossible, active traders often rely on it. However, almost all professionals agree achieving consistent success over a long period is challenging.

- Key Takeaways:

- Market timing involves predicting market movements to profit from trading.

- It contrasts with the buy-and-hold strategy, where investments are held for long periods, regardless of market changes.

- Although feasible for professional traders and financial experts, it’s challenging for average individual investors.

- Focusing on long-term investment rather than market timing is often advised for most individual investors.

- Understanding Market Timing:

- Market timing isn’t impossible and can be successful for professionals like day traders and portfolio managers using various analytical methods.

- However, consistently outperforming the market to gain a significant advantage over long-term, buy-and-hold strategies is rare.

- Market timing differs from buy-and-hold strategies, but even long-term strategies may involve some timing due to changing investor needs or attitudes. The difference lies in whether market timing is an intentional part of the strategy.

Market timings help market participants in trading price movements of various financial assets. When a trader or investor adopts this strategy, he can buy when the market is at a dip and sell it when it peaks. This gives me the benefit of entering and exiting the market at the right time. Market timings can be used to choose from various asset classes for this purpose.

Market timing benefits active traders, portfolio managers, and professionals the most as they invest their time and effort in forecasting future price movements. They can predict market changes with their skills.

However, for average investors, that’s not the case. The best they can do is invest money, keeping the long-term goal in mind.

How to Analyse Market Timing?

As stated below, two main approaches exist for making buy or sell decisions under market timing terms.

Fundamental Analysis

In fundamental analysis, the analyst makes certain assumptions to predict the buy or sell process. For analyzing such changes, market timing is indeed crucial. Fundamental analysis can be used for mid to long-term time frames.

Technical Analysis

Regarding technical analysis, market timing refers to a stock or an asset’s historical performance. It is historic investor behavior. Technical analysis can be used for a short to mid-term time frame.

Advantages and Disadvantages of Using Market Timing Strategy in Forex Trading

Advantages of Market Timing

- Potential for Bigger Profits:

- Market timing can lead to significant profits if investments are made at the lowest points and sold at the peaks.

- Investors can outperform those following a more static investment strategy by capitalizing on short-term market fluctuations.

- Curtailed Losses:

- Investors can reduce potential losses by exiting the market or shifting assets during downturns.

- Market timing allows for reactive adjustments to avoid prolonged exposure to declining markets.

- Avoidance of Volatility:

- Timely shifts in investment can avoid periods of high volatility, reducing the risk of significant, unpredictable losses.

- Investors can focus on more stable investments during times of predicted market turbulence.

- Suited to Short-term Investment Horizons:

- It is ideal for investors with short-term goals or those requiring liquidity shortly.

- Enables taking advantage of rapid market changes, which aligns with short-term investment objectives.

Disadvantages of Market Timing

- Daily Attention to Markets Required:

- Requires constant monitoring of market trends and economic indicators.

- It demands significant time and effort to stay informed and react quickly to market changes.

- Increased Transaction Costs and Commissions:

- Frequent buying and selling increase transaction costs, which can erode profits.

- A higher frequency of trades results in more commissions paid to brokers.

- Tax-Disadvantaged Short-term Capital Gains:

- Profits from assets held for less than a year are subject to higher tax rates than long-term capital gains.

- The tax impact can significantly reduce net gains from short-term trading.

- Difficulty in Timing Entrances and Exits:

- Accurately predicting the best times to enter or exit the market is challenging.

- Misjudgment can lead to buying high and selling low, the opposite of the intended strategy.

- Risk of missing out on market recoveries or entering during a false market rally.

Key Points to Remember

- Market timing means a strategy that helps market participants enter and exit the market at the right time to maximize profit and minimize loss. It helps in predicting price movements.

- It helps gauge price movements and, as a result, aids in making timely buying and selling decisions for various asset classes.

- Many traders also implement fundamental and technical analysis and market timings to gain the maximum advantage.

For trading, a trading strategy is crucial. Sometimes, the system doesn’t have to be complex; it can be as easy as deciding a market timing to reap the profit.

Market timing can be termed entering and exiting the market or changing the type of asset you are trading. Various tools, such as economic data, technical indicators, etc., can help find perfect market timing. Individuals have different opinions on the possibilities of gauging market timing. Investors, financial academicians, and professionals believe it is impossible, while day traders or active traders believe the opposite.

One thing is for sure, and that is the fact that finding a market timing can be a little challenging. It is also called the opposite strategy of buy and hold.

Market timing is not an impossible phenomenon. Traders, portfolio managers, and even long-term investors can use charts, candlestick patterns, economic data, etc. It helps select an optimal time to enter or exit the security market. You can gain fantastic accuracy with practice and significantly benefit investors who apply the buy-and-hold strategy.

The Opportunity Cost

As per the report “Quantitative Analysis of Investor Behavior” by the Boston research firm Dalbar, if an individual investor had stayed invested in the S&P 500 index between 1995 and 2014, they would have earned an annual return of 9.85 percent. But if they miss the ten best days of the market between this era, the return would be reduced to 5.1 percent. It shows that the bigger jumps in the market happen when the volatility is high, but most investors flew away during this time.

The Transaction Cost

When mutual fund investors try to change funds and earn profit by entering and exiting the market frequently, they face high transaction costs, making them achieve 3 percent less than the indices. This happens mostly when the expense ratios for investing in mutual funds are more than 1 percent.

The Taxation Cost

Trading frequently and earning profits can often lead to taxes. Whether you buy at the dip and sell at a high or short position, if you generate profit, you generate taxes, too. The tax is a short-term capital gain if your investment is held for less than a year. It is generally higher than the long-term taxes.

As a result, market timing becomes less beneficial for the average trader or investor, and they can get better profit by staying invested in the market.

Market timing strategy example

Market timing terms state two things – timely buying and timely selling of an asset based on its future forecast. We can implement this strategy for the long and short term; ultimately, it depends on investors’ or traders’ preferences and risk appetite.

Investors generally go long for a stock when the market seems bullish and short a stock when the market is set to be bearish. The crucial thing is to predict when the market will shift its move. To know this, an investor must predict the future price hikes or dips that will occur.

Active traders are known to take advantage of price discrepancies in the market, while passive traders are invested for the long term regardless of volatility changes.

Skilled and competent traders know that seeing a stock’s outcome is impossible, as it can be anything. However, the debate about timing the market is not new. It is a favorite topic to discuss the time in the market vs. timing the market while discussing which approach to choose for investing. It is essential to time your entry and exit point and the time frame you want to invest in.

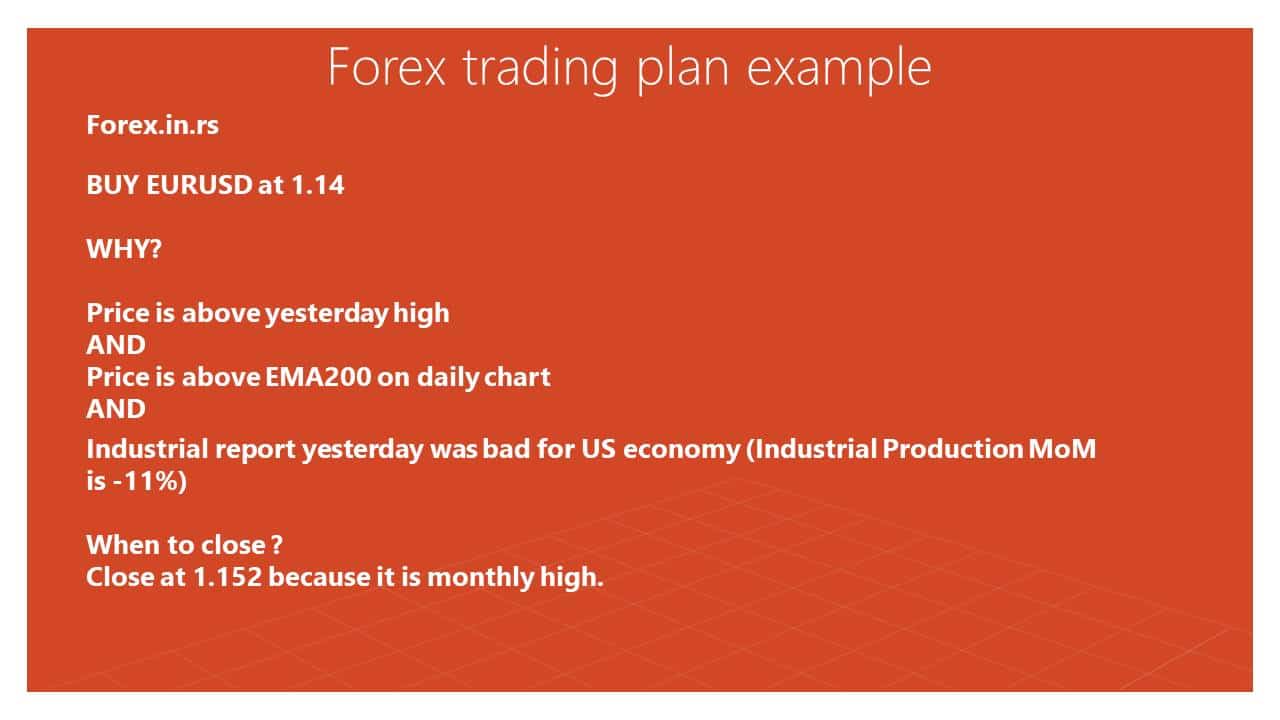

Let us see one market timing strategy example using technical analysis, the previous price values, and economic data:

The Best Market Timing System

The Best Market Timing System is a strategy that uses several triggers for entering into a position and transparent rules to exit from positions. A combination of technical and fundamental indicators significant price levels is the most used trading market timing approach. Predictive methods such as regression and classification machine learning methods and robust, simple regression systems can be used to determine entry and exit levels better.

Time in the market vs. timing the market

Time in the market represents a trading strategy where investors buy and hold an asset for a longer and do not predict the price. The central assumption is that time and patience in the market are better than a quick sale. Converlyhand, timing the market is based on forecasts and using economic and technical indicators.

In practice, time in the market can show excellent results in solid markets where stocks and indices rise yearly. However, time in the market strategy can create bad results in range and mixed markets.

There are specific backdrops of timing the market. For example, many trades increase commissions or fees with your brokerage house. The more transactions there are, the more the burden on your pockets. The critical thing here is that those trades don’t have to be winning trades to pay commission, which means even if you lose, you will need to pay the commission.

While it seems easy to buy at the low point and sell at a higher point, it will not happen every time as the market is uncertain and frequently changes. Thus, in the long run, there can be issues of accuracy. So, traders should be cautious while relying on timing the market. They are advised to apply their conscience and increase their knowledge and skills.

The Importance of Time in the Market

Time in the market compared to timing the market is a long-term thing. It is no longer about predicting short-term prices. Time in the market states the importance of time and being patient. Time in the market gives the benefit of compounding. Just imagine you investing in a stock for ten years and getting the growth in your investment. That is one significant profit compared to small short-term gains.

By that, you can eliminate the market’s volatility, and in the long run, good fundamental stocks will hike, so there is less risk. Just plan your financial goals and stay invested. It can also prove beneficial for fulfilling long-term goals like securing retirement or buying your house dreams. Remember that wealth is created over time and not overnight.

The Bottom Line

If you are confused between time in the market vs. timing, know that time has better pros than timing the market. By staying invested for the long term, you eliminate the short-term disturbance and get the benefit of compounding. It gives you a safe return compared to short-term trading.

You unlock the door of fortune in the long run by investing in your stock portfolio with a proper investment strategy. So, decide your goals and system, and be patient as the market rewards those with the strength to wait!

Key Points to Remember

- Market timing is when investors try to enter and exit the market to beat the benchmark by various methods and predict market movements.

- Market timing is the opposite of buy and hold – a passive strategy. Investors buy and keep an asset for a long time without considering the market volatility.

- Market timings can be easier to predict for traders and portfolio managers, but for an average investor, it is challenging as it requires skills, effort, and more time.