Table of Contents

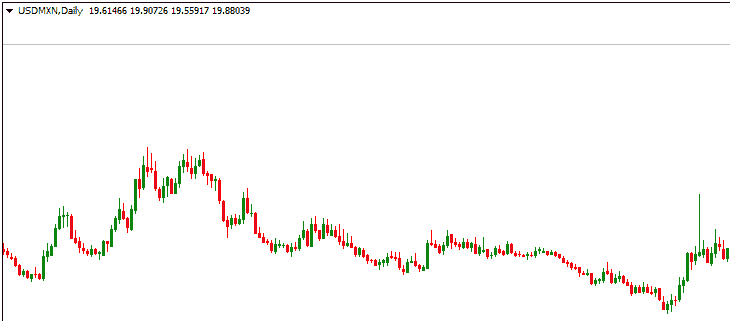

When the US dollar weakens relative to the Mexican peso in the USD/MXN currency pair, the Mexican peso is getting stronger. This strengthening can be attributed to various factors influencing the U.S. dollar and the Mexican peso.

Here are some key reasons why the Mexican peso might strengthen when the U.S. dollar weakens:

1. Interest Rate Differentials

- Higher Mexican Interest Rates: If Mexico’s central bank (Banco de México) maintains or raises interest rates. At the same time, if the U.S. Federal Reserve keeps rates low or lowers them, the interest rate differential can attract investors to the Mexican peso. Higher interest rates in Mexico offer better returns on investments denominated in pesos, leading to increased demand for the currency.

- Carry Trade: Investors may engage in carry trades, where they borrow in a currency with lower interest rates (like the U.S. dollar) to invest in a currency with higher interest rates (like the Mexican peso). This increases and strengthens demand for the peso.

2. Economic Performance

- Strong Mexican Economy: If the Mexican economy performs well, with robust growth, low inflation, and strong exports, the peso might strengthen as investors gain confidence in the Mexican market. A weaker U.S. dollar can also make Mexican exports more competitive, further boosting economic growth and supporting the peso.

- Weak U.S. Economic Data: Conversely, if the U.S. economy shows signs of weakness, such as lower GDP growth, higher unemployment, or lower consumer spending, the dollar may weaken. This relative weakness can make the peso appear firmer in comparison.

3. Commodity Prices

- Rising Oil Prices: Mexico is an oil-exporting country, and rising global oil prices can increase Mexico’s revenue. As oil prices rise, the peso often appreciates because higher revenues strengthen the country’s economy and improve its balance of payments.

- U.S. Dollar Correlation with Commodities: The U.S. dollar often has an inverse relationship with commodity prices. When the dollar weakens, commodity prices (including oil) often rise, benefiting commodity-exporting countries like Mexico.

4. Foreign Investment

- Increased Foreign Direct Investment (FDI): If foreign companies and investors see Mexico as a promising investment destination, they may increase their investments. This capital inflow can increase demand for the peso, leading to its appreciation.

- Remittances: Mexico receives significant remittances from Mexicans working abroad, particularly in the U.S. If the U.S. dollar weakens, the value of these remittances in peso terms increases, providing additional support for the peso.

5. Political Stability

- Stable Political Environment: Political stability in Mexico compared to uncertainty in the U.S. or other major economies can make the peso more attractive to investors. A stable government and sound fiscal policies can boost confidence in the peso.

- U.S. Political Uncertainty: Political uncertainty or instability in the U.S. can weaken the dollar as investors seek safer or more stable alternatives, potentially strengthening the peso.

6. Market Sentiment

- Risk-On Sentiment: When global investors are willing to take on more risk (risk-on sentiment), they may favor emerging market currencies like the Mexican peso over safe-haven currencies like the U.S. dollar. This shift in sentiment can lead to a stronger peso.

- Speculation: Currency markets are influenced by speculative trading. If traders anticipate a weaker U.S. dollar due to specific economic indicators or policy changes, they may buy the peso, increasing its value.

In summary, the strengthening of the Mexican peso when the U.S. dollar weakens in the USD/MXN pair can be attributed to factors such as interest rate differentials, economic performance, commodity prices, foreign investment, political stability, and market sentiment. These dynamics interact to create shifts in demand for both currencies, leading to fluctuations in their exchange rates.