Table of Contents

In Forex trading, a “lot” represents a standardized trade unit. It is one of the fundamental concepts that traders must understand to execute their trades effectively. A lot size determines the number of currency units a trader is willing to buy or sell in a single trade. The standard size for a lot is 100,000 units of currency.

However, there are also smaller lot sizes: a mini lot, which is 10,000 units; a micro lot, which is 1,000 units; and even a nano lot, in some cases, which is just 100 units of currency. This tiered structure allows traders of all levels and financial capacities to participate in the Forex market, providing the flexibility to manage risk and exposure with greater precision. By choosing the appropriate lot size, traders can tailor their trading strategies to their risk tolerance and account size, making lot selection a critical decision in Forex trading.

How Much is 0.1 Lot Size in Dollars?

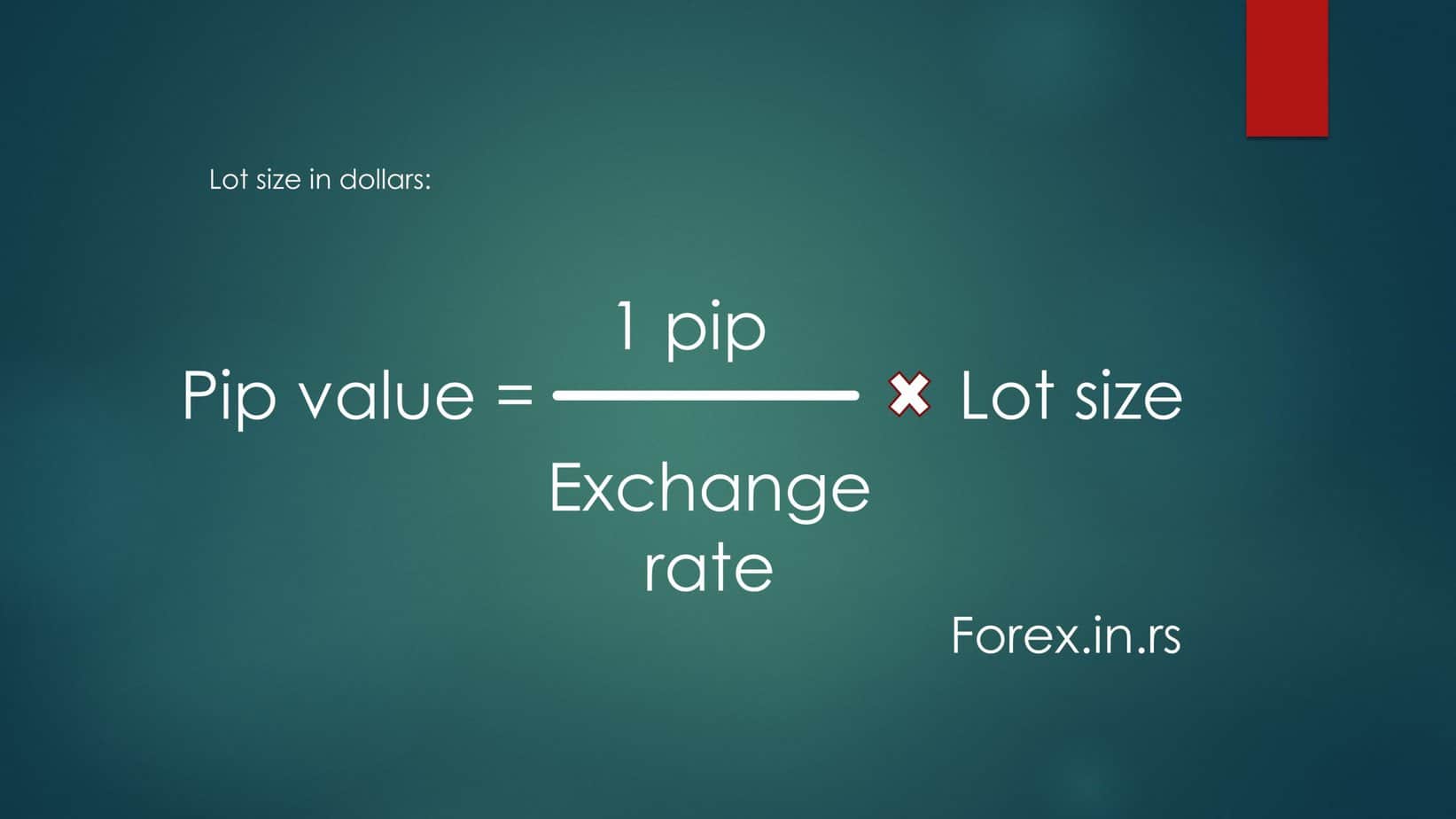

0.1 lot size for currency pair where the secondary currency is USD is always $1. However, to calculate other currency pairs’ lot sizes in dollars, you must use the formula (1 pip/exchange rate)* lot size. In this case, a 0.01 lot size for EURUSD is $1, while for EURGBP, it can be around $1.2, and for USDJPY, it is $0.8.

Example 1: Mini Lot for EUR/USD (Secondary Currency is USD)

For currency pairs where the USD is the secondary (quote) currency, such as EUR/USD, the value of a mini lot size (0.1 lot) is straightforward:

- Lot Size: 0.1 (mini lot, which is 10,000 units of the base currency, EUR in this case)

- Value in USD for 0.1 Lot Size: $1 per pip

In this scenario, trading a mini lot means that each pip movement in the EUR/USD currency pair is worth $1. This simplification arises because, with USD as the quote currency, the calculation directly reflects the pip value in USD without needing further conversion.

Example 2: Mini Lot for EUR/GBP (Converting to Dollars)

When dealing with a currency pair where the USD is neither the base nor the quote currency, like EUR/GBP, you need to convert the value of the mini lot into USD. This requires using the formula:

- Exchange Rate for EUR/GBP (E): 0.86

- Lot Size for a Mini Lot (L): 0.1, which represents 10,000 units of the base currency

- Formula for Value in USD, expressed without direct fractions: Value in USD = (1 pip / Exchange rate) * Lots

Calculation Steps:

- Identify the Value of 1 Pip: For EUR/GBP, like most currency pairs, 1 pip equals 0.0001. But we’re focusing on its monetary value in this context.

- Apply the Formula

- Use the given exchange rate for EUR/GBP, Exchnage rate= 0.86.

- The lot size (L) is 0.1, representing 10,000 units of the base currency for a mini lot.

- Perform the Calculation:

This expression simplifies to:

(approximately)

Understanding lot sizes in Forex trading is essential for effectively managing risk, as the lot size directly influences the amount of capital at stake in each trade. By selecting an appropriate lot size, traders can tailor their exposure to their comfort level and risk tolerance, ensuring that they do not overextend themselves financially.

The lot size is intimately linked to the calculation of margin requirements, with larger lot sizes necessitating higher margin deposits, thus impacting the leverage a trader can utilize. Furthermore, the lot size determines the pip value in a currency pair, meaning that it affects the potential profit or loss from price movements. Ultimately, a deep comprehension of lot sizes enables traders to make informed decisions, balance their risk, and optimize their trading strategy in the volatile Forex market.

Conclusion

To convert the value of 0.1 mini lots into dollars for Forex currency pairs, one must use the formula: (1 pip / exchange rate) * lot size, where the lot size represents 10,000 units of the base currency. This calculation provides the value per pip movement in USD, allowing traders to understand the dollar equivalent of their trades.