Table of Contents

Mirror trading is a type of automated trading where traders can copy the trading strategies of other trades to execute the trades themselves manually trades themselves. This several offers several benefits to traders, including the ability to learn from more experienced traders, save time and effort on research and analysis, and potentially generate consistent profits over time. Beneficial is particularly useful for novice traders just starting in the market and may not have the knowledge or experience to develop their trading strategies. By copying the trades of more experienced traders, they can gain insights into the market and potentially have to invest significant time and effort in research and analysis.

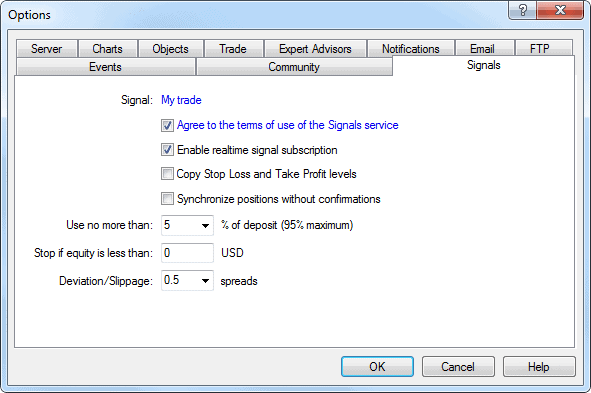

The most used mirror trading software is the “Signals” option in MT4 and MT5 platforms, where each trader can receive paid or free signals from mql5 signals providers:

In addition, mirror trading can be a valuable tool for traders looking to diversify their portfolios. By copying the trades of other traders who specialize in different markets or have different trading styles, they can potentially increase their chances of success and manage risk more effectively.

What is mirror trading software?

Forex mirror trading software or MT4 trade copier are scripts that copy trades (trading time, trading size, position stop loss, and position target) from the master account to the client’s MT4 account. Scripts were named “mirror trading software” to copy positions the same (like in a mirror) from one account to another. Using these scripts, traders can trade the same places on several trading accounts.

MT4 copy trade software works by allowing traders to copy the trades of other traders directly within the MetaTrader 4 platform. Here are the main steps involved in how MT4 copy trade software works:

- Find a suitable signal provider: The first step is to find one whose trading strategies you want to copy. This can be done within the MT4 platform or through external websites that offer signal provider listings.

- Subscribe to the signal: Once you have found a suitable signal provider, you can subscribe to their signal within the MT4 platform. This will allow you to copy their trades in real time automatically.

- Configure the settings: After subscribing to the signal, you can configure the settings to specify how the trades should be copied. For example, you can set the lot size, stop loss, take profit levels, and other parameters.

- Start copying trades: Once the settings have been configured, the MT4 copy trade software will automatically copy the trades of the signal provider as they are executed in real-time. This allows you to benefit from the trading strategies of the signal provider without having to run the trades manually.

It’s important to note that while MT4 copy trade software can be a convenient and potentially profitable way to trade; it also comes with certain risks. Therefore, it’s essential to carefully evaluate the performance of signal providers and consider the risks and benefits of any trading strategy before implementing it.

Many traders are using MetaTrader 4 (abbreviated as MT4) for trading in foreign exchange (forex). These traders often manage different clients’ investment accounts for a fee. Hence if they are confident that they will make a profit, they would like to replicate their trade in each of the funds they manage. However, repeating the trade manually is a time-consuming process. Hence they are interested in using copy trading software to quickly and easily duplicate forex trades. Any person with experience with MT4 could install the client and master apps in five minutes or less. They could then begin copying the trades immediately, taking very little time. The software includes instruction manuals, and the stepwise procedure for copying trades is also described below. Videos with instructions are also available.

The local trade copier is a software developed explicitly for the Metatrade4 platform. It is designed to increase the productivity of forex account managers and retail traders. Instead of manually duplicating trades in each account, the software allows the trader to automatically replicate trades between many accounts on the computer or VPS he is handling. This allows the trader to manage multiple MT4 accounts at the same time. The trader does not have to risk dealing with Forex brokers who are not regulated and can convert a losing Forex strategy into a profitable one. The trader can create his investment portfolio with many MT4 accounts or become an account manager independently without signing contracts or paying the broker large amounts for PAMM accounts. Mirror trading software or copy trading software can download for

Mirror Trading Software list

- Tradency – https://www.tradency.com/

- ZuluTrade – https://www.zulutrade.com/

- Myfxbook Autotrade – https://www.myfxbook.com/autotrade

- Signal Trader – https://www.signaltrader.com/

- MetaTrader 4 – https://www.metatrader4.com/

- eToro – https://www.etoro.com/copytrader/

- DupliTrade – https://www.duplitrade.com/

- Collective2 – https://www.collective2.com/

- Darwinex – https://www.darwinex.com/

- RoboForex CopyFX – https://copyfx.roboforex.com/

- Ayondo – https://www.ayondo.com/

- Mirror Trader – https://www.mirrortrader.com/

- FX Junction – https://www.fxjunction.com/

- Social Trader Tools – https://socialtradertool.com/

- SwipeStox – https://www.swipestox.com/

- FxStat – https://www.fxstat.com/

- MyDigiTrade – https://www.mydigitrade.com/

- ForexCopy – https://www.instaforex.com/forexcopy_system

- NinjaTrader – https://ninjatrader.com/

- cTrader Copy – https://ct.spotware.com/copy-trading/

Mirror trading platforms

Mirror trading platforms such as ZuluTrade allow traders to copy the trades of other traders directly within the platform. Here are the main steps involved in how a mirror trading platform like Zulutrade works:

- Find a suitable signal provider: The first step is to find one whose trading strategies you want to copy. This can be done within the mirror trading platform or through external websites that offer signal provider listings.

- Subscribe to the signal: Once you have found a suitable signal provider, you can subscribe to their signal within the mirror trading platform. This will allow you to copy their trades in real time automatically.

- Configure the settings: After subscribing to the signal, you can configure the settings to specify how the trades should be copied. For example, you can set the lot size, stop loss, take profit levels, and other parameters.

- Start copying trades: Once the settings have been configured, the mirror trading platform will automatically copy the trades of the signal provider as they are executed in real-time. This allows you to benefit from the trading strategies of the signal provider without having to execute the trades manually.

In addition to copying trades, mirror trading platforms like Zulutrade may offer other features, such as social trading, where traders can connect, share strategies and insights, and collaborate on trades. They may also provide tools and resources to help traders analyze market data and identify potential trading opportunities.

It’s important to note that while mirror trading platforms can be a convenient and potentially profitable way to trade, they also come with certain risks. Therefore, it’s essential to carefully evaluate the performance of signal providers and consider the risks and benefits of any trading strategy before implementing it.

Now let us see how to mirror trading software (scripts) work:

Preparing the terminals

The first step involves preparing the MT4 terminals for trading. This can be done on any laptop, desktop PC, or VPS with a Windows Operating system. The procedure for Mac computers is slightly different. The trader should know that all the MT4 terminals should be installed on the same computer if trades are copied between the Metatrader 4 accounts. If the MT4 runs on the client’s computers, the trader should use a trade copier for remote computers like Signal Magician. Guidelines for installing multiple MT4 terminals using one or more forex brokers are provided.

Installing Mirror Trader Server EA

The trader copies the trades from the Master MT4 accounts, and these accounts should have the Mirror Trader server Expert Advisor (EA) running. The number of master accounts depends on the processing power of the computer. These master accounts may also be called provider, server, or sender accounts. The auto-installer of the Mirror Trader can be used to automatically install server EA on multiple accounts. Alternatively, the files may be copied manually to the data folder of each mt4 account. If Mirror Trader EA is appropriately installed, restarting or refreshing will show EA in the expert advisor list. If server EA is started on an MT4 account, it becomes a master accoFinally, the. The trader decides on the master and client MT4 account.

Installing Mirror Trader client EA

The MT4 accounts to which the trades are copied are called client accounts, and they should have Mirror Trader client EA installed. The CPU processing power determines the number of client accounts on a computer. These accounts are also called receiver, follower, or slave accounts. The Mirror Trader auto-installer will automatically install client EA to selected accounts, or the trader can manually copy the relevant files to the data folder of each MT4 account. After installation, the client EA will appear in the expert advisor’s list after restarting MT4 or refreshing the window. A client account can also be configured as a master account to provide trades for different client accounts.

Launching Mirror Trader server on master accounts

First, the Mirror Trader server EA should be attached to the master MT4 accounts from which the trades must be copied. The master accounts can be changed at any time. For running the Server, the license key for Mirror Trader should be used for activation. The server EA can be attached to any chart, with EUR/USD highly recommended. Experts recommend that the traders use the default settings of the Mirror Trader initially. The Signal-provider-id is set at one as default, and all clients having the same id will receive the trades. Other master accounts will have different group ids. After the Mirror Trader server is started, it will continuously scan the master account for new forex traders and changes in trades to send these details to client accounts.

Using Mirror Trader client on client MT4 accounts

The Mirror Trader client has attached to all the client MT4 accounts to which the trades are copied. These client accounts may be removed or added as required. No license key is required for activation; only one chart must have Client EA attached, with EUR/USD recommended by experts. Default settings should be used initially. Multiple account groups may be on the same computer, and the master account list may be configured. The default settings make the client copy the trades for similar amounts in percentage, based on the amount deposited and currencies. The risk factor for every client account may be configured separately for each client account. It has five options for managing risk. The Mirror Trader client will monitor all the Mirror Trader servers continuously. If there are any changes in existing trades or new trades, they will be applied.

Testing the Mirror Trader server, client installation

After setting up the Mirror Trader server, the client, to test the system, and a pending order should be placed on the master account at a price that is not likely to get triggered. Next, the Mirror Trader client should be checked to ensure that it is copied, and ideally, this should be completed in less than one second. After the trade is copied, the client account can be checked for any error message. Sell, buy, pending orders, trade close signals, modifications, and partial works are some of the many trades which will be coFinally, thed. The master account’s trade-in can be opened manually or remotely by the person managing the transactions elsewhere using multiple methods, like a script or expert advice.

Forex copier or mirror trading software can work differently, but these are the primary and most common steps.