Having a plan for retirement is essential for anyone who wants to ensure financial security later in life. One such plan is the Roth Individual Retirement Account (IRA), which offers tax-free withdrawals during retirement. However, what happens when you want more than one Roth IRA account? Is it allowed, and what are the benefits and drawbacks of having multiple Roth IRA accounts?

Can you Have More Than one Roth IRA Account?

Yes, you can have more than one Roth IRA account. The IRS allows individuals to open and contribute to multiple Roth IRAs if they don’t exceed the annual contribution limit and meet the eligibility requirements.

Multiple Roth IRA accounts can provide more investment flexibility, allow for easier tracking of contributions and withdrawals, and potentially provide more diversification in your retirement portfolio. However, it’s important to note that the annual contribution limit applies across all Roth IRAs, so you can’t contribute more than the limit in total, even if you have multiple accounts.

Firstly, the good news is that there is no limit to the number of Roth IRA accounts a person can have. This means you can have multiple Roth IRA accounts from different financial institutions or even the same institution. However, while the IRS does not prohibit multiple Roth IRA accounts, there are some guidelines that you must adhere to when opening various accounts.

For instance, the contribution limits for all your Roth IRA accounts remain unchanged. If you have multiple Roth IRA accounts, your total contributions in a year should not exceed the annual contribution limit of $6,000 for individuals below 50 or $7,000 for individuals over 50. Therefore, to maximize your contributions, you need to ensure that the total contribution across all your Roth IRA accounts does not exceed the contribution limit.

Another factor to remember is that while you can open multiple Roth IRA accounts, you can only contribute from your earned income. This means that if you have multiple sources of income, you can distribute your contributions across your various Roth IRA accounts. Additionally, you can choose to invest in different assets across your various Roth IRA accounts, including stocks, bonds, mutual funds, and ETFs.

Multiple Roth IRA accounts can also give you more flexibility in tax planning. For instance, if you want to have tax diversification and avoid the impact of future tax law changes, you may decide to open a Roth IRA account with a Roth 401(k) conversion. Alternatively, if you plan to withdraw your contributions before retirement, you may consider opening a separate Roth IRA account specifically for this purpose to avoid penalties on early withdrawals.

However, while having multiple Roth IRA accounts has its benefits, it also has some drawbacks. For instance, you may find it challenging to keep track of your investments and contributions across multiple accounts. Additionally, having too many Roth IRA accounts may lead to higher fees and administrative costs, affecting investment returns.

Practical Example of Two Roth IRA Accounts.

Here’s a practical example of how you can have two Roth IRA accounts for different purposes:

Let’s say you are 30 years old and have a long-term retirement goal of saving for retirement, but you also have a short-term goal of saving for a down payment on a house in the next few years.

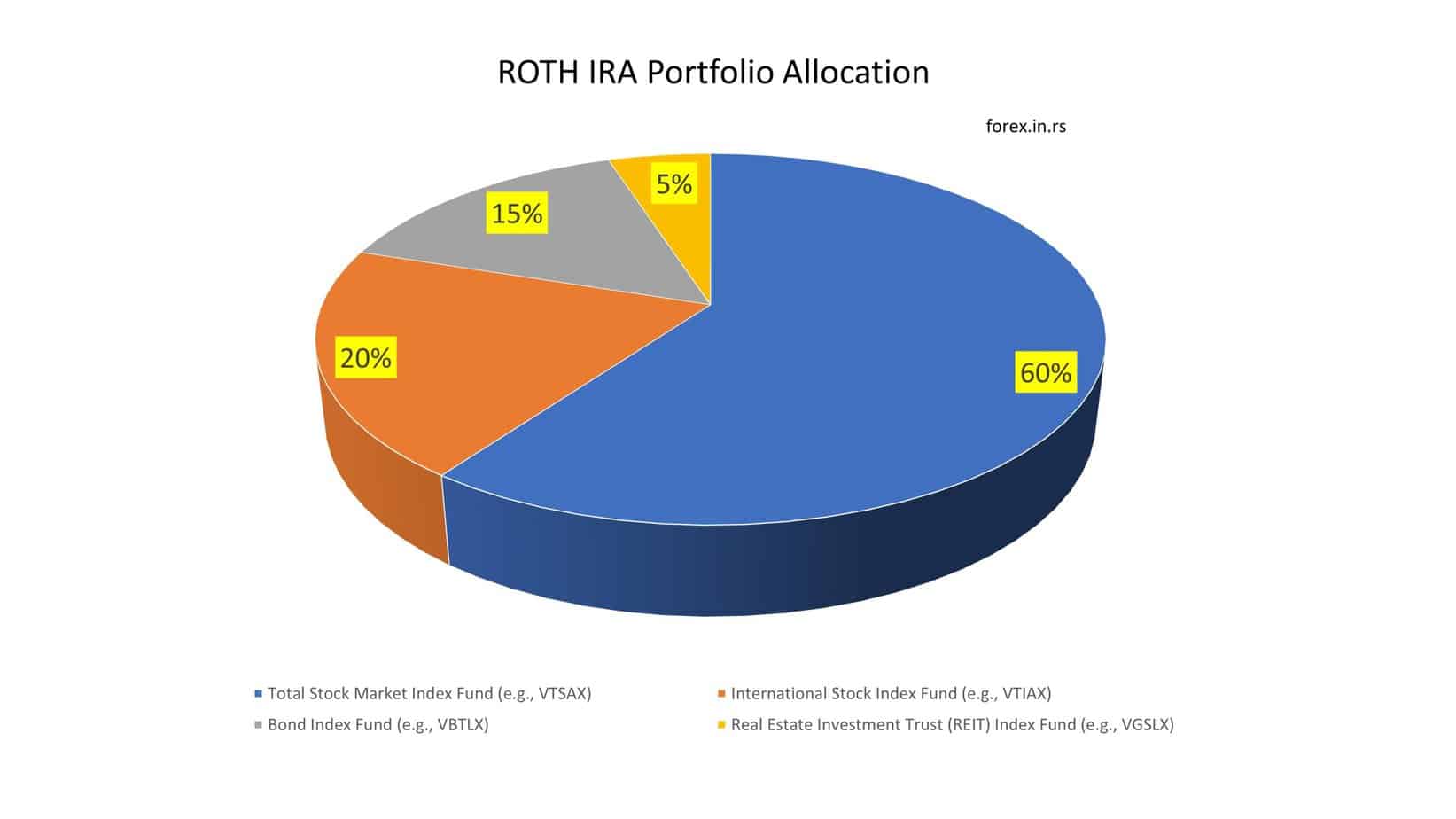

You might decide to open two separate Roth IRA accounts to achieve these goals. For your long-term retirement goal, you might open a Roth IRA account with a brokerage firm and invest in a diversified portfolio of stocks and bonds. You plan to contribute the maximum annual amount to this account every year until you retire, more than 20 years away.

You might open a second Roth IRA account with a high-yield savings account provider for your short-term savings goal. You plan to contribute a smaller amount to this account every month to save up for a down payment on a house in the next few years. Because this account is meant for short-term savings, you invest in low-risk options such as a savings account or a money market fund.

By opening two separate Roth IRA accounts for different purposes, you can better manage and track your progress toward each goal while also taking advantage of the tax-free growth and withdrawals the Roth IRA offers.

In conclusion, yes, you can have multiple Roth IRA accounts. Various Roth IRA accounts can maximize contributions, diversify investments, and ensure tax planning. Nonetheless, it is crucial to adhere to the guidelines established by the IRS and understand the benefits and drawbacks of having multiple accounts before embarking on this investment strategy. As always, consulting a financial advisor before making any significant investment decisions is highly recommended.

You can protect your retirement fund if you invest in IRA precious metals. For example, investors with Gold IRAs can hold physical metals such as bullion or coins. Get a free pdf about Gold IRA.

GET GOLD IRA GUIDE