Table of Contents

One of the reversal candlesticks is the morning star candlestick pattern. As we know, reversal candlesticks are trading patterns that suggest a possible change in future trends trend reversal.

What is the Morning Star Forex Pattern?

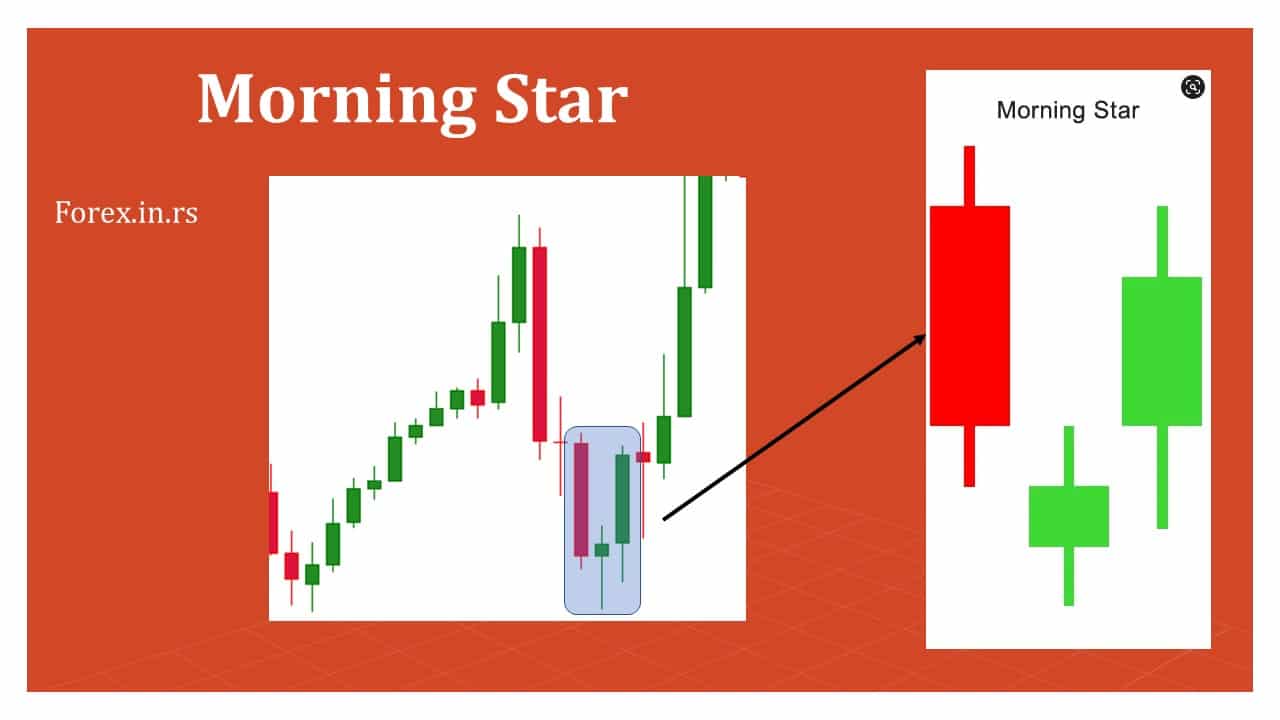

Morning Star Forex Pattern represents a reversal candlestick pattern that predicts hypothetical future price reversals to upside. The morning star pattern consists of three candles: a large bearish candlestick, a small candle, and a large bullish candle.

The morning star pattern consists of 3 candles:

- Large bearish candle

- Small bullish or bearish or Doji candle

- Large bullish candle

The second candle can be any small candle. Usually, it is a doji candle or a small bearish candle, but sometimes it can be a small bearish candle.

Morning star patterns can be seen in any part of the trading industry, such as stocks trading, forex trading, indices, ETF, commodities, etc. It is part of reversal candlestick patterns analysis that analysts use in technical analysis.

The opposite candlestick pattern for the morning star is the evening star candlestick pattern. It is a bearish version of the bullish evening star pattern.

There are no such calculations involved in the morning star; it is just a visual representation. You’ll find it either performing after three sessions, or it won’t be happening at all, but there are specific other formats as well where you can see that the star is forming. Some of the instances would be identifying the price action providing support or the relative strength indicator showing the excessive sales of that very stock.

How do you trade with morning star? A general example

Morning star candlestick pattern stocks are great for visual signs, displaying the trend from bearish to bullish and vice versa. It might not hold much importance generally, but supporting indicators can make a huge difference. The volume coming in for the formation of the pattern also matters a lot, and usually, most traders wish to see most of the volume at its highest on the third day, after up to three sessions of patterns in the making.

The bigger volume appears as a confirmation regardless of what the other indicators attested to the same display. So a trader who uses this pattern will tend to take a bullish position as the pattern tends to form in the final session going along with the upward trend and keep on having the same until the stocks with morning star pattern indicate any other reversal.

The difference between evening star and morning star candlestick

The morning star and evening star have a tad bit of difference, and the morning star has a flatter center candlestick, forming the Doji. There are no typical signs displaying anything, and it can show the pattern more clearly than a thick middle candlestick. When a Doji is formed with a black candle, the volume will go up in more significant frequencies, with the white candle becoming longer, indicating that the star is set to be forming.

In Conclusion: Are there any limitations that the Morning Star Doji Candle possesses?

It is a suitable format identified by the technical analysts, but trading based on a visual sign might not be the best decision they’d make. Morning stars have the best backup of indicators and function in their best way with their support. If not for them, it would be effortless to identify the formation of a morning star every time a candle starts going towards the downtrend.