Table of Contents

A select group of currencies dominates the landscape of global finance, each playing a pivotal role in international trade, investment, and economic stability. The US dollar (USD) is at the forefront, the backbone of international trade, and the primary reserve currency worldwide. The Euro (EUR) follows closely, uniting 19 European nations under a single monetary regime, facilitating trade and financial transactions across one of the largest economic blocs.

The Japanese yen (JPY) represents Asia’s financial might, reflecting Japan’s status as a major exporter and its significant role in global finance. The British pound sterling (GBP) holds a legacy of financial prestige, embodying the United Kingdom’s extensive global banking and finance history. Together with the Australian dollar (AUD), Canadian dollar (CAD), Swiss franc (CHF), Chinese renminbi (CNH), Hong Kong dollar (HKD), and New Zealand dollar (NZD), these currencies form the foundation of the forex market, driving international economic dynamics and influencing global financial trends.

In our article What is the largest forex market in the world, we analyze the forex market and see the forex pairs list. In another article, we wrote about the volume of the forex market, and here, we will analyze only the most traded currencies.

So to resume:

Most traded forex Pairs

The most Traded Currencies in The World are :

- US dollar (USD): The primary reserve currency globally, widely used in international transactions and considered a benchmark in the forex market.

- Euro (EUR): The official currency of the Eurozone, which includes 19 of the 27 European Union member states, making it one of the most significant currencies for trade and finance in Europe.

- Japan’s official currency, the currency of Japan, is due to Japan’s significant industrial exports and its role as a global financial hub.

- Pound sterling (GBP): The oldest currency still in use, representing the United Kingdom and the UK’s substantial financial services sector.

- Australian dollar (AUD): Australia’s currency is commonly traded due to Australia’s stable economy and significant commodity exports.

- Canadian dollar (CAD): Canada’s currency, often involved in forex trading, reflects Canada’s substantial natural resources and trade relations, especially with the United States.

- Swiss franc (CHF): Switzerland’s currency is considered a “safe-haven” currency due to Switzerland’s stable economy and financial system.

- Chinese renminbi (CNH): The official currency of the People’s Republic of China, increasingly involved in global trade and investment activities.

- Hong Kong dollar (HKD): Hong Kong’s official currency is pegged to the dollar and is significant for its role as a global financial center.

- New Zealand dollar (NZD): New Zealand’s currency, often called the “Kiwi,” is notable for trade, investment, and investment influenced by its agricultural and tourism sectors.

Please watch my video about this topic with tips:

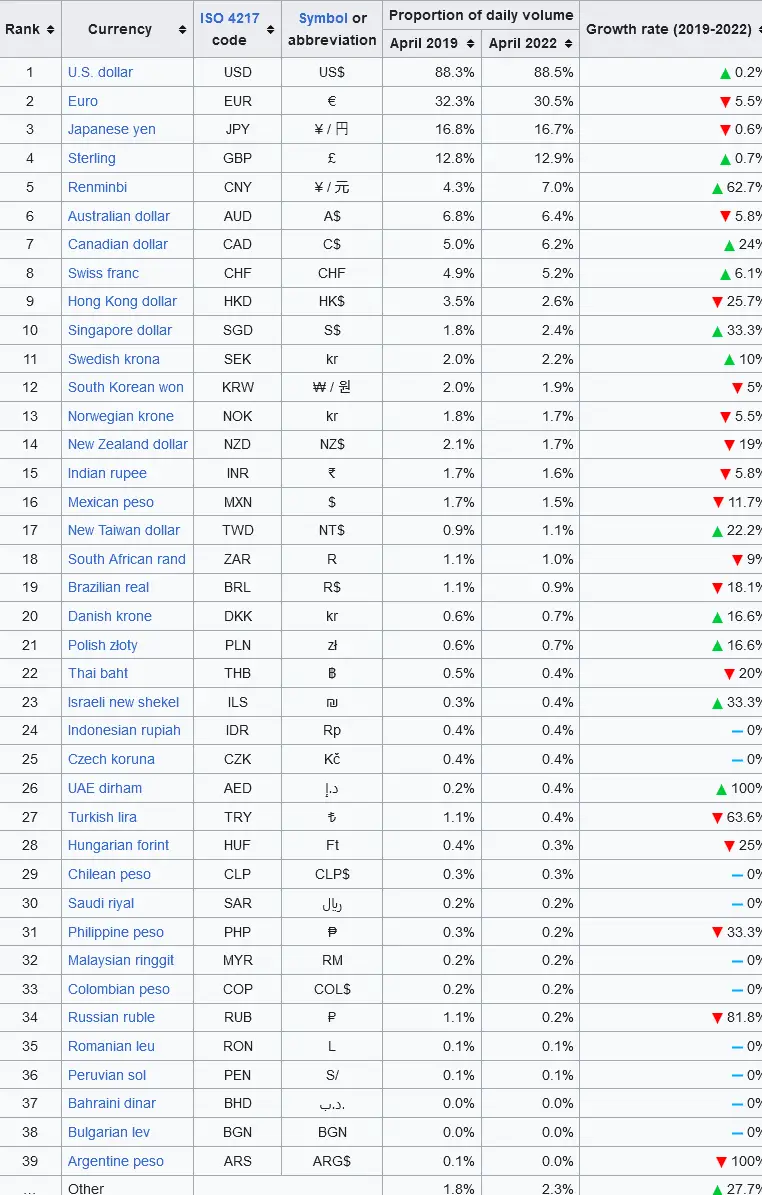

See the top 39 currencies in the world:

The US Dollar is the most traded currency

- The U.S. dollar, often called the greenback, is the most traded currency worldwide, forming the cornerstone of the foreign exchange (forex) market.

- It features in currency pairs with all other major currencies, frequently serving as the intermediary in triangular currency transactions due to its status as the de facto global reserve currency held by virtually every central bank and institutional investment entity.

Global Reserve Status and Dollarization

- The universal acceptance of the U.S. dollar has led some countries to adopt it as their official currency, a practice known as dollarization, bypassing the need for a local currency.

- Additionally, it is widely accepted as an informal alternative form of payment in other nations, even as they retain their official local currency.

Influence on Foreign Exchange Rates

- The U.S. dollar is a benchmark or target rate for countries that peg or fix their currencies to their value, affecting other currencies’ foreign exchange rate market.

- Countries like China have pegged their currency, the yuan or renminbi, to the dollar, which has sparked considerable debate among economists and central bankers.

Standard Currency for Commodities

- Commodities such as crude oil and precious metals are priced in U.S. dollars, and their values change in the dollar, changes, information, and U.S. interest rates.

Dominance in Forex Markets

- With a global daily average trading volume of approximately $6.6 trillion, the U.S. dollar dominates the forex market. It features all the ‘major’ countries and constitutes about 85% of all FX trades.

- The rise to dominance was cemented post-World War II when the U.S. accounted for 50% of the global economic output, leading to the widespread use of the dollar in international trade.

Role in International Reserves and Currency Pegs

- The U.S. dollar constitutes most of the currency reserves the central bank holds. These reserves are used worldwide for international trade to back up their currencies’ value.

- Several countries have pegged their currency’s value directly to the USD, maintaining a fixed exchange rate to ensure economic stability and requiring substantial foreign currency reserves to support the peg.

Dollarization Beyond U.S. Borders

- In addition to U.S. territories, countries like Ecuador, El Salvador, the Marshall Islands, Micronesia, Palau, East Timor, and Zimbabwe have officially adopted the U.S. dollar as their legal tender, embracing dollarization for economic stability and integration into the global market.

Euro (EUR)

- The Euro, introduced to world markets on January 1, 1999, with physical banknotes and coins circulating three years later, has become the second most traded currency, trailing only behind the U.S. dollar.

- Serving as the official currency for most nations within the Eurozone, the Euro is pivotal in minimizing currency conversion risks, thereby fostering economic activity and growth among EU countries.

Stabilization and Reserve Currency Status

- Many nations within and outside Europe peg their currencies to the Euro to stabilize the exchange rate, mirroring practices seen with the U.S. dollar.

- This strategic alignment has elevated the Euro to the world’s second-largest reserve currency, underscoring its significance in global finance.

Euro in Forex Trading and Political Influence

- The Euro’s liquidity and widespread use make it a favorite among speculators, who view it as a measure of the Eurozone’s overall health and political stability.

- Political events, particularly in countries like Italy, Greece, Spain, and Portugal, which experienced significant interest rate drops with the Euro’s inception, can lead to heightened trading volumes.

Economic Integration and Challenges

- By adopting a single currency, eurozone member states avoid currency conversion risks, potentially enhancing economic cooperation and growth.

- However, this integration presents challenges, particularly when economic downturns in one member state necessitate financial support from others, posing risks to the Eurozone’s stability.

Trading Opportunities and Liquidity

- The interconnected economies of the Eurozone offer abundant trading opportunities and liquidity for euro currency pairs in the forex market.

- Economic indicators and political events within the Eurozone, including ECB announcements, GDP rates, employment data, and national elections, heavily influence the Euro’s value.

Global Reserve and Pegging Practices

- As the world’s second most significant reserve currency, the Euro comprises roughly 20% of global reserves by volume, reflecting its broad acceptance and stability.

- Currency pegs, especially by African nations with strong trade ties to Europe, underscore the Euro’s role in facilitating international trade, highlighting its influence beyond the European Union.

Economic and Political Determinants of Value

- The Eurozone’s economic performance and political climate significantly impact the Euro’s valuation, with events such as ECB meetings and national elections closely watched by traders and economic member states’ collective economic polio. The Eurozone’s member states, cities, and health play a crucial role in shaping the Euro’s strength and stability on the global stage.

Japanese yen (YEN)

The Japanese Yen: Asia’s Dominant Currency

- The Japanese yen stands as the premier currency of Asia and is often seen as a measure of Japan’s manufacturing and export-oriented economic health.

- It serves as a crucial indicator for the Pan-Pacific region’s overall well-being, incorporating the economic conditions of South Korea, Singapore, and Thailand, despite these currencies being less prevalent in global forex markets.

Role in the Carry Trade

- The yen is central to the carry trade strategy, where traders borrow it at minimal cost due to Japan’s low interest rates, investing in higher-yielding currencies globally to capitalize on interest rate differentials.

- Historically, this widespread borrowing practice has made appreciation of the yen challenging, highlighting its unique position in the forex market influenced by international interest rates.

Economic Indicators and Value Determinants

- The yen’s valuation is closely tied to Japan’s economic performance, especially its manufacturing sector, with key exports driForex traders closely monitor economic value.

- Economic indicators include BoJ meeting announcements, GDP data, industrial production indices, the Tankan survey, and enemy forex traders.

International Comparisons and Oil Prices

- The strength of the Chinese renminbi and oil prices significantly impact the yen, affecting Japan’s competitiveness and economic balance due to its reliance on oil imports.

- Japan’s status as a significant oil importer means global oil price fluctuations can heavily influence its economy and, by extension, the yen’s value.

Japan’s Economic Landscape and Safe Haven Status

- With Japan’s significant GDP and robust economy, the yen is a favored haven currency, attracting investors during times of uncertainty.

- The Bank of Japan’s policy of low to negative interest rates, aimed at stimulating inflation in a low-demand economy, further cements the yen’s role in carry trades.

Intervention and Market Influence

- The Bank of Japan occasionally intervenes in the forex market to stabilize the yen, employing tactics that result in a ‘dirty float’ rather than a strict currency peg.

- Other critical factors influencing the yen include Japan’s production capabilities in key industries and its heavy reliance on Middle Eastern oil, with geopolitical or price changes in oil markets posing economic risks.

Pan-Pacific Economic Health Indicator

- The yen also acts as a barometer for the economic health of the broader Pan-Pacific region, reflecting the interconnectedness of Japan’s economy with those of other Asian nations heavily engaged in trade with Japan.

Pound sterling (GBP)

The Distinctive Status of the Great British Pound

- The Great British Pound, or pound sterling, is the fourth most traded currency in the forex market, a testament to its enduring significance and liquidity.

- Despite the United Kingdom’s historical membership in the European Union, it chose to retain the pound sterling instead of adopting the Euro, driven by national pride and the desire to maintain control over domestic monetary policy.

Economic and Political Drivers

- The valuation of the British pound is closely tied to the UK’s economic health and political stability, with forex traders scrutinizing these factors to predict currency movements.

- Its substantial value relative to other currencies makes the pound a crucial benchmark for numerous nations and a key reserve currency, buoyed by its historical strength.

Influence of Economic Indicators and Brexit

- The pound’s value is significantly influenced by the UK’s economic indicators, such as inflation rates, the Bank of England’s monetary policies, GDP, and employment data.

- The UK’s decision to leave the EU, known as Brexit, has introduced volatility. Ongoing negotiations are outcomes likely to impact the pound’s future value and trading dynamics.

Historical and Financial Significance

- With a history that stretches back to Anglo-Saxon times, the pound sterling is one of the world’s oldest continuing currencies, highlighting its deep-rooted importance in global finance.

- The Bank of England plays a pivotal role in steering the pound, employing various monetary tools to ensure economic stability—London’s status as a leading financial hub further amplifies the currency’s global watchfulness.

Global Reserve Currency and Benchmark Status

- The pound sterling’s role as a primary reserve currency, constituting a significant portion of global reserves by value, underscores its international reliability and worth.

- As a benchmark currency for many countries, particularly those formerly under British colonization, sterling’s influence extends beyond its immediate economic indicators, reflecting a broader historical and financial legacy.

Australian dollar (AUD)

The Australian Dollar: A Commodity Currency of the Asia-Pacific

- Known affectionately as the Aussie, the Australian dollar is a leading currency within the Asia-Pacific region, playing a critical role in global forex markets.

- As a commodity currency, the Australian dollar’s value is intrinsically linked to the price fluctuations of Australia’s key exports, making it sensitive to global commodity market dynamics.

Significance in Forex Trading

- The AUD-USD trading pair has emerged as a significant player, surpassing the trading volumes of the Swiss Franc and the Canadian Dollar and highlighting the prominence of the Australian dollar on the global stage.

- Ranking as the fifth most traded currency worldwide, the Australian dollar boasts a daily trading volume that underscores its liquidity and importance in forex markets.

Reserve Currency Status and Economic Influences

- As the sixth most common reserve currency, the Australian dollar accounts for a notable percentage of global reserves, reflecting its stability and reliability.

- The Reserve Bank of Australia (RBA) plays a pivotal role in managing the currency, with its monetary policies and interest rate decisions directly influencing the Australian dollar’s value.

Commodity Prices and Terms of Trade

- Australia’s status as a major exporter of coal, iron, copper and a significant oil importer means that shifts in commodity prices and trade volumes can profoundly impact the AUD.

- The ‘terms of trade,’ or the ratio of export prices to import prices, is a crucial determinant of the Australian dollar’s strength, with favorable terms often leading to currency appreciation.

Foreign Liabilities and Interest Rate Differentials

- The size of Australia’s foreign liabilities can affect the Australian dollar’s value against the currencies of its major trading partners, with increases potentially leading to depreciation.

- Interest rate differentials between the RBA and other central banks also influence the flow of capital, attracting investments to higher-yielding environments and affecting the AUD’s exchange rate.

Economic Indicators and Commodity Export Dependency

- Economic factors such as GDP growth, unemployment rates, and RBA’s monetary policy settings are critical indicators of the Australian dollar’s performance.

- The close correlation between the Australian dollar and commodity prices reflects Australia’s dependency on its natural resources. Protectors, with price movements in iron ore, are coal and gold, which are particularly influential on the currency’s valuation.

The Australian dollar’s unique position as a commodity-linked currency in the Asia-Pacific region and its significant role in global forex trading make it a vital component of the international financial landscape, influenced by a complex interplay of domestic economic indicators, global commodity prices, and international trade dynamics.

Canadian dollar (CAD)

The Canadian Dollar: A Commodity Currency in the Global Market

- The Canadian dollar, known affectionately as the loonie, is closely tied to the commodities market due to Canada’s significant exports of crude oil, precious metals, and minerals.

- As a commodity currency, the loonie’s value often mirrors the fluctuations in commodity prices, with crude oil prices having a particularly pronounced impact.

Forex Market Presence and Reserve Currency Status

- The Canadian dollar is the sixth most traded currency globally and commands a substantial presence in the forex market. Its daily trading volume highlights its liquidity as the fifth most commonly held reserve currency worldwide, reflecting its state and global confidence in Canada’s economy.

Influence of Commodity Prices on CAD’s Value

- Canada’s wealth in natural resources means that shifts in commodity prices significantly influence the Canadian dollar’s valuation, with increases in these prices generally leading to a stronger CAD.

- The currency’s sensitivity to commodity price movements makes it a popular choice for traders looking to speculate on commodities or hedge against commodities market volatility.

Economic Interdependence with the United States

- The United States is Canada’s largest trading partner, with vast exports heading southward, making the Canadian economy and the loonie highly responsive to U.S. economic performance and policies.

- Interest rate differentials between the Bank of Canada (BoC) and the Federal Reserve (Fed) also play a critical role in determining the CAD’s exchange rate, with higher BoC rates relative to the Fed’s potentially leading to CAD appreciation and vice versa.

Bank of Canada’s Role in Economic Stability

- The Bank of Canada oversees the issuance of the Canadian dollar. It employs various monetary policy tools to ensure economic stability and growth, further influencing the effective management of monetary policy; the BoC helps stabilize the Canadian dollar, making it an attractive currency for international traders and investors.

Impact of U.S. Economic Conditions on CAD

- Given the extensive trade relations with the United States, the Canadian dollar is susceptible to changes in U.S. economic conditions, including GDP growth, employment data, and monetary policy shifts.

- This economic interdependence means that factors affecting the U.S. economy can directly and significantly impact the value and stability of the Canadian dollar in forex markets.

The Canadian dollar’s role as a commodity currency, its interplay with global commodities markets, and Canada’s economic relationship with the United States make it a unique and vital player in the international financial landscape. Its value and stability are influenced by a complex mix of domestic commodity prices, international trade dynamics, and cross-border economic policies, highlighting the interconnected nature of global currencies and economies.

Swiss franc (CHF)

The Swiss Franc: A Beacon of Stability in Forex Markets

- The Swiss franc, the seventh most traded currency, serves as Switzerland’s official currency, upheld by its longstanding reputation for stability and reliability in the global financial landscape.

- Managed by the Swiss National Bank (SNB), the franc is distinguished by its role as a preferred haven currency for traders and investors, especially during geopolitical uncertainty and global economic instability.

Switzerland’s Neutrality and Financial Secrecy

- Switzerland’s historical stance of neutrality and its renowned banking secrecy have cemented the franc’s status as a haven currency, attracting capital flows in turbulent times.

- The country’s closed-door financial system and conservative banking practices contribute to the fra. They offer a degree of security and confidentiality that is highly valued in the financial world.

Trade Relations and the Euro Connection

- Despite not being a member of the European Union, Switzerland’s economy is closely tied to the EU through trade, making the franc sensitive to shifts in the Eurozone’s economic health.

- Switzerland’s past efforts to peg and then unpeg the franc to the Euro reflect its attempts to balance national economic interests with the need for stable international trade relations.

Global Reserve Currency Status

- The Swiss franc is also recognized as the eighth most commonly held reserve currency globally, a testament to its perceived value and stability among the world’s central banks.

- Switzerland’s robust financial services sector supports its role as a reserve currency, prudent monetary policies, and low debt levels, enhancing its appeal during periods of economic uncertainty.

Influence of Eurozone Economics

- The value of the Swiss franc is significantly influenced by the Eurozone’s economic performance, given that a substantial portion of Swiss exports is destined for EU coun-strength of the Euro’s strength and the economic health of eurozone member states play critical roles in determining the franc’s exchange rate, highlighting the interconnectedness of Switzerland’s economy with that of its European neighbors.

Safe Haven During Economic Turmoil

- In times of global financial distress, the Swiss franc typically experiences an uptick in value as investors seek shelter in its stability and security.

- This phenomenon underscores the franc’s unique position in the forex market as a currency that benefits from economic uncertainty, attracting inflows of capital seeking refuge from volatility elsewhere.

The Swiss franc’s enduring appeal as a haven currency, combined with Switzerland’s economic policies and the SNB’s management, ensures its prominent status in the forex markets. Its relationship with the Euro and the broader European economy further influences its valuation, making it a currency closely watched by traders and analysts alike for signs of global economic shifts.

Chinese renminbi (CNH)

The Chinese Renminbi: An Emerging Market Currency on the Rise

- The Chinese renminbi, colloquially known as the yuan, is the official currency of the People’s Republic of China, ranking as the eighth most traded currency with a significant daily trading volume that underscores its growing presence in global finance.

- Despite its classification as an emerging market currency, the renminbi has become the seventh most-held reserve currency globally, a testament to its increasing acceptance and confidence among the world’s central banks.

Monetary Policy and International Trade Dynamics

- Historically pegged to the US dollar, the People’s Bank of China (PBoC) has recently allowed the renminbi more flexibility, managing its value against a basket of major currencies within a controlled range, signaling intentions towards greater exchange rate liberalization.

- Critics argue that China has historically favored a weaker renminbi to boost its export competitiveness, leading to skepticism about its commitment to a fully free-floating currency regime.

Impact of Trade Relations and Global Events

- The renminbi’s valuation is closely tied to China’s terms of trade and its economic interactions with key global players, notably the US and EU. This reflects its status as a significant exporter of commodities and manufactured goods. Geopolitical events, such as the trade tensions initiated by the Trump administration, have significant implications for the renminbi, influencing US-China relations and broader international trade dynamics.

Navigating Future Challenges and Opportunities

- The renminbi’s journey towards becoming a more freely traded currency is fraught with challenges, including balancing domestic economic goals with international expectations and managing the impacts of global geopolitical shifts.

- As China continues to grow its economy and expand its global influence, investors, policymakers, and economists will closely watch the trajectory of the renminbi worldwide, marking it as a currency of crucial importance in the evolving landscape of global finance.

The evolution of the Chinese renminbi from a tightly controlled currency to one with aspirations for greater freedom in international markets represents a critical aspect of China’s broader economic strategy. Its role in global trade, combined with the PBoC’s monetary policies and international economic relations, will continue to shape the renminbi’s future, offering a unique window into the complexities of global economic integration and the shifting balance of economic power.