Table of Contents

Every forex trader is for once worried about market patterns along with the volume behind those patterns. The Average True Range Indicator is quite handy as it knows the exact volume present as a support for each trend, and it assists with sifting through minor patterns from significant ones. This information has driven numerous expert forex brokers to go to the average true range (ATR) indicator of value.

This ATR volatility indicator has turned into an irreplaceable apparatus for such errands, including MT4 trades. The clear indicator displayed here is a convenient version of the ATR indicator, which is well established in the terminal of MT4. It has its very own set of benefits that you should know!

What is the Average True Range Indicator?

The Average True Range indicator or ATR represents the market volatility indicator that shows on the chart how much an asset moves during a given time frame. For example, if the daily EURUSD ATR shows 0.0092, that means the average EURUSD difference between daily low and daily high is 92 pips.

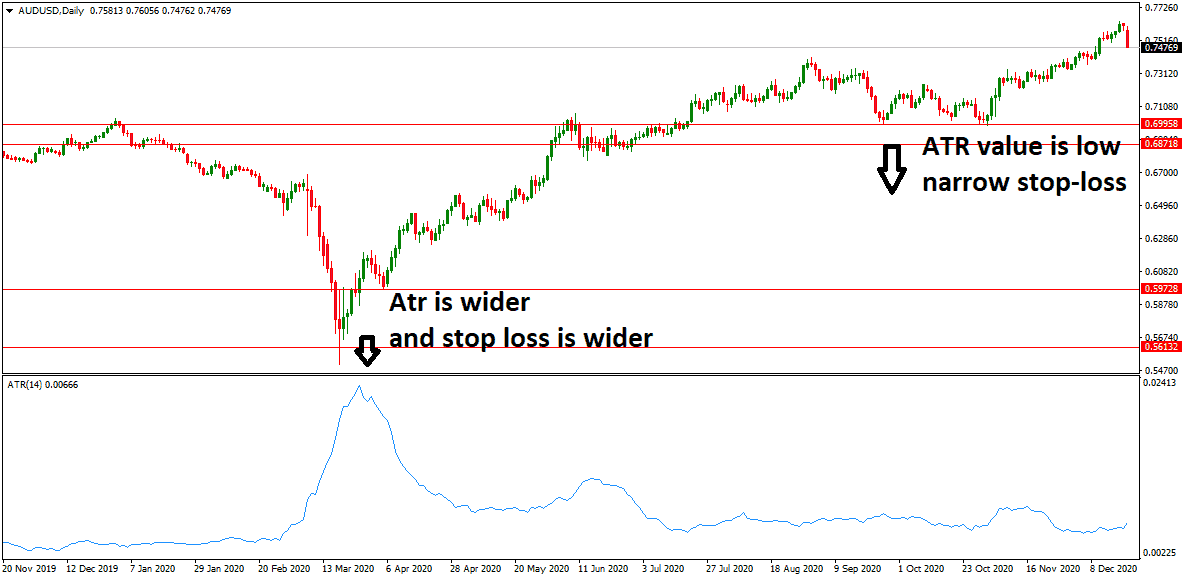

ATR Indicator determines the approximate size of the price movement for a particular period. Once you begin to utilize the true average range on MT4, it shows as a line that goes here and there the indicator’s window. As the ATR value goes higher, the market seems to be riskier. Similarly, as the value of ATR drops down, the market depicts a lesser volume.

One of the most common mistakes is when a trader attempts to trade according to the trends with the ATR. There is also a possibility they could be doing other impossible things present in the world. Every trader needs to know that the ATR pointer cannot tell the market trend. There have been certain moments when the market moves one way, but the ATR inclines the other way.

In case you’re wondering about the use of the trend range indicator, then here’s to know what it can be put to use for:

- A trading person can utilize the average true range strategy to decide an ideal opportunity to initiate trading. The ATR can assist you with determining whether there is sufficient volume in the sector for you to trade. It likewise keeps you out of dead or inert trading sectors.

- You can also utilize the ATR indicator to identify stop loss position.

- The method can be used for depicting exit indicators.

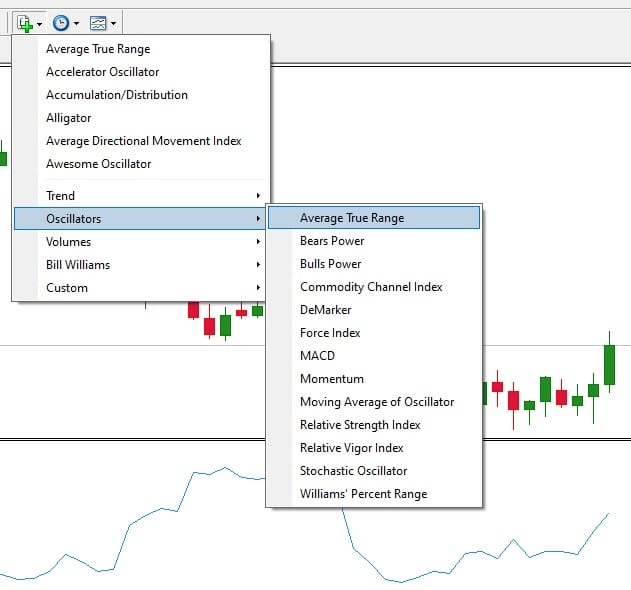

How to install ATR indicator

To install the ATR indicator, you need to choose an indicator list, go to Oscillators and pick Average True Range. ATR indicator or Average True Range is premade indicator, and all MT4 traders already have this indicator in their list.

ATR formula

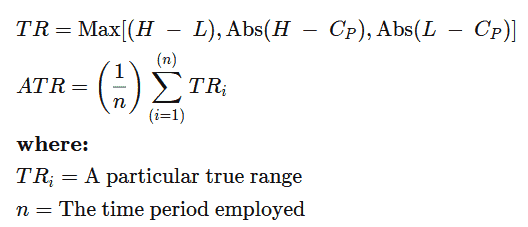

It is clearly understood that the Average True Range is the average of the values of the price range of a particular asset for a designated time frame. In any case, there are three unique ways of calculating the genuine scope of an asset”.

How to calculate the ATR?

- Find the difference between past low and current high.

- Find absolute value as the difference between past close from the current low.

- Find absolute value as the difference between the current low and the current high.

- Find TR as the maximum value between the previous three values.

ATR calculation code:

The ATR computes the true ranges and utilizes the best among them as the true range for that particular moment. Please understand that the ATR doesn’t consider the negative or positive value of the number. Say, for example, a Negative 23 (- 23) holds the same value as a positive 23 (+23).

As you now know the format and formula for calculating the true range for every period, you should also know that the average true range indicator MT4 simply midpoints these numbers over a given span. The default ATR period on Metatrader 4 stage of trading, for instance, is 12. In this way, the ATR computes the average and goes back to all 12 candlesticks to find the actual numbers for forming a line.

How to Use ATR Indicator?

ATR indicator you can use to determine to stop loss and target value and essential breakouts on the chart. Using ATR, you can involve volatility in stop loss and target price calculation. For example, your stop loss and target can equal 1 Daily Average True Range instead of 100 pips.

Let us assume that in the last 24 days average daily ATR is 150. In that case, when volatility is high, your stop loss can be 150 pips. On the other hand, if next month’s volatility is low and equals 80 pips, your stop loss and target can be 80 pips.

This point intrigues numerous merchants, and there’s genuinely a reason behind it. It is essential to know how you execute the ATR indicator in your trades:

Use ATR to determine Explosive breakouts

There are times when the market is volatile and different occasions when it isn’t. You can utilize this ATR trading procedure to exploit breakouts from lower to riskier periods.

To begin with, you need to pull up your ATR indicator on the week-by-week outline and be patient that the pointer will hit multi-year lows. Then, to simplify, you stand by till the market is essentially unpredictable, and the ATR line is nearest to the floor. Then, at that point, you find the resistance and support levels inside that period on your chart and await the breakout to happen.

One can also depend on the FXSSI resistance and support indicator to assist in finding the crucial levels on the chart.

Use ATR to Set stop-loss price.

Have you at any point witnessed the market fall to hit the stop loss before promptly glancing back toward the path you imagined it to be in at the first point? This ATR ratio indicator strategy can be heavily helpful when avoiding such situations.

Check the current worth by multiplying the value at present with another multiple. The most mutually utilized multiples are 1.5, 2, and 3. Then, you add or deduct the determined value to the current amount to facilitate your stop loss.

You can likewise adjust this exchanging technique to assist you with getting the best out of moving business sectors. Toward the end of every period or candle, you trail your stop misfortune by the determined worth.

Coincidentally, you can figure out how to trade without a stop loss, assuming you need to kill its existence from trading.

Use ATR to set Take profit.

As the Average True Range identifies the price movement for a particular asset for a pre-defined number of timeframes, you could fix your profits with this information.

For instance, if the GBPNZD everyday range chart MT4 has a present ATR worth of 140, this lets you know that the pair of currency shifts approximately 140 pips by and large. Along these lines, you can put your take profit anywhere around almost 140 pips from your entrance cost. Moreover, it generally works conveniently when merged with other market structures, like swing lows and highs, resistance and support levels, etc.

These are a couple of systems for trading with ATR. You could bring up convenient methods for your ATR to take profit indicator MT4.

In Conclusion

It is best for forex traders to use ATR, regardless of their expertise, as it doesn’t promote the sale of patterns. Additionally, the indicator can squeeze into the trading frameworks of anybody, despite their style of trading. Finally, as should be obvious, the indicator is stunningly better than every other standard set objective. It saves space for the work area for target investigation of the chart depicting the price.