Table of Contents

A trader can use numerous indicators and tools when trading Forex. Each tool has its features and methods. When combined with other indicators, these tools can help Forex traders achieve their goals.

However, the difficult task here for traders is to understand and select the indicator or tool to help them with their trading plan and benefit their trading style. Traders want a tool that requires minimal effort and provides as much support as possible.

There are multiple reasons for which traders need an indicator. One such reason is to determine the buy-sell signals in the market. The MT4 Buy Sell Indicator is a tool that can help traders get answers to many questions with just one tool. This indicator is trendy amongst Forex traders because it is easy to apply to the MT4 chart and does not require the trader to use multiple lines or data charts to derive any signals.

Read this article to understand more about the buy-sell indicator and how Forex traders can use this indicator.

Download Buy Sell Magic MT4 Indicator

Download BUY SELL MAGIC INDICATOR

What Is The Buy-Sell MT4 Indicator?

As the name suggests, the Buy-Sell Indicator is an indicator that tells traders when to take the buy and sell position on the Forex price chart. Many traders prefer this tool because it can provide solid indications of the trend and its reversals. In addition, it helps them simplify the hassle of choosing one or more indicators because this one tool alone is enough to provide them with a straight answer.

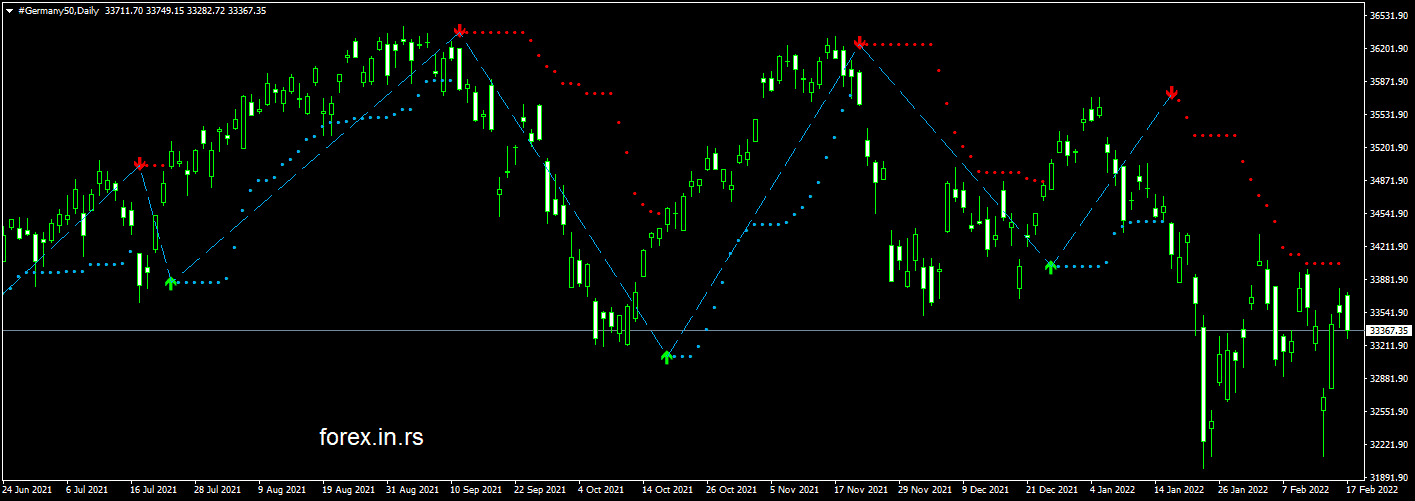

When you apply this indicator to your MT4 terminal chart, you will not see any complicated lines, charts, or histograms on the terminal screen. Instead, it uses a filter of custom price action and a mixture of three different indicators. In addition, it indicates the exit-entry points through red and green arrows. This convenient feature makes it suitable for both experts and beginners.

How To Use the Buy-Sell Indicator While Trading Forex

This indicator can identify the buying and selling points in the currency pair chart. You can also trace down the exit-entry points by using this indicator. Furthermore, this indicator is more suitable when the market is highly volatile, generally when the New York and London sessions are active. However, a trader must ensure this indicator is unsuitable for significant economic news.

This indicator is used to identify the buy and sell signals for two purposes. First, to simplify it for the trader, the indicator represents these signals with green and red arrows. So, let’s understand briefly how a trader can identify these signals through the arrows.

Red Arrow or Sell Signal

The indicator displays a red arrow and dotted lines at the upper part of the chart, indicating the sell signal. This intimates to traders that the market may take a bearish trend, and it is time for them to take a short position. The dotted lines on the chart act as a resistance level, and according to their judgment, traders can place a take-profit level near these lines. However, it is advisable to know how to use this indicator or other indicators to help confirm the signals.

Green Arrow or Buy Signal

The green arrow at the bottom of the chart indicates the buy signal. These green arrows inform traders that the market may take a bullish trend, and it is safe for them to take a long position. The dotted lines act as a support level. With this indicator, you can choose your stop loss level, or it can automatically calculate it for you. If you put your stop loss level manually, you can use the dotted lines to help identify it better.

Conclusion

Any trader who wishes to make their forex trading hassle-free can opt for this indicator. This indicator is free to use and download and the least complicated to work with. Any trader, expert or novice, can conveniently use it. The best part about this indicator is that it does not require complex information analysis. You can apply this indicator to your MetaTrader4 and start trading with the help of the arrows and dotted lines.

A market is an unpredictable place and changes without warning. So, traders are advised to be aware of such changes and not make quick decisions. Instead, they must conduct a careful analysis using a set of indicators and tools.