Table of Contents

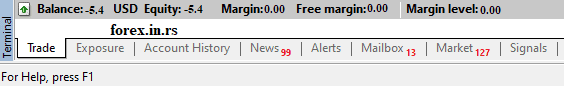

The balance in MT4 is the account balance calculated with all closed positions and does not include the floating loss or profit. Conversely, equity in MT4 is the floating balance, including the current floating loss or profit and equity changes in response to the open positions’ market price.

What is Metatrader 4 Negative Balance?

MT4 Negative Balance is a negative money account that occurs at the moment when, during a volatile market, funds in your Forex broker account fall below zero.

MT4 Negative Balance is usually a temporary problem in the MT4 account. Suppose you deposit money in an account with a negative balance. Your current balance will be no less than your deposit amount because MT4 accounts usually have a negative balance-protected system.

What happens if your forex account goes negative?

If your forex account goes negative, two scenarios can happen. If your broker offers negative balance protection when your account goes negative after a few minutes balance will be zero. However, if your broker does not offer negative balance protection, you need to deposit money to make the balance positive if you want to continue to trade.

If you have a negative balance and do not deposit money, your account will be disabled. You are not obligated to continue to trade with the broker or to pay the broker if you have a negative balance.

The negative balance on the forex trading account could happen if traders do not appropriately set a stop loss (ignored by some traders) to stop excessive losses. By applying Margin Call and Stop Loss levels, the forex trader can avoid a negative balance in most cases. In some cases, the negative balance will appear during high volatility because the price changes and goes below/above the stop loss quickly. You can cover the exceeded loss by making a new deposit.

Simply put, negative balance forex protection is a preventive measure brokers take to safeguard their clients. Negative balance protection guarantees that traders will not lose more money than deposited if their account goes into a negative balance due to their trading activity.

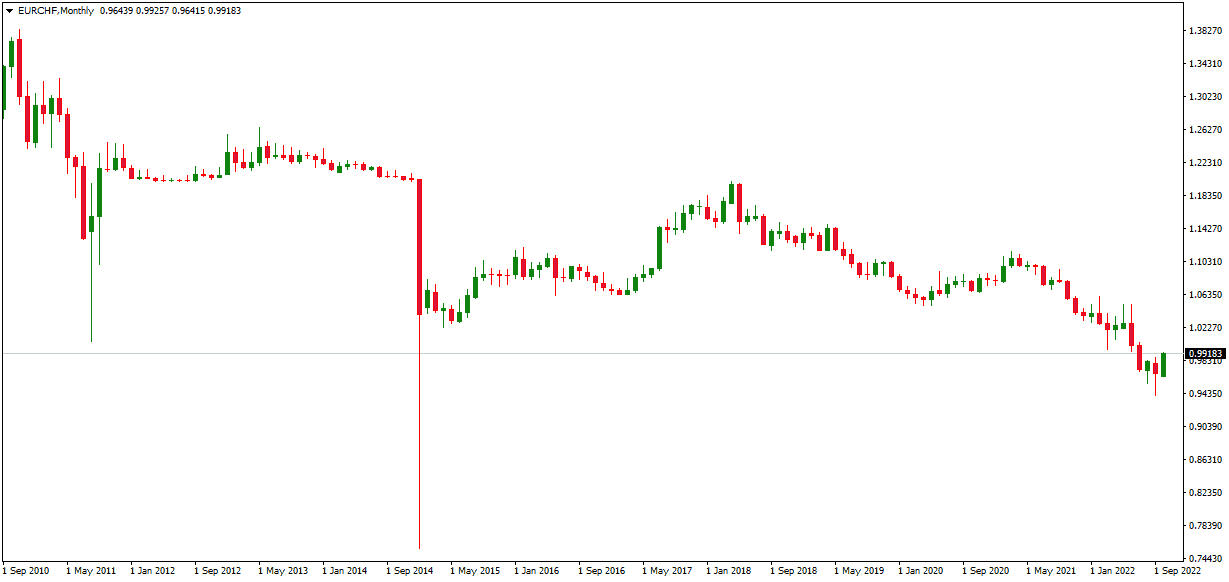

For example, USDCHF dropped 2780 pips in 30mins on 15 January 2015, and my account had a negative balance. Franc jumps 30 percent after the Swiss National Bank dumps the euro ceiling (read our article USD CHF 15 January 2015). All my trades had stopped loss, but volatility was so intense that my broker couldn’t exchange currency pairs. My trading account had a negative balance.

If your forex account goes negative, you are losing money on your trades, and your broker may decide to close out some or all of your positions to minimize the losses. This is known as a margin call, and it can be a very stressful experience for traders who cannot meet the required margin. In some cases, traders may be forced to liquidate their position at a loss, resulting in significant financial losses for those involved in the forex market.

Though the SNB decision on floor removal resulted in many forex accounts having a negative balance simultaneously, there are other instances when the MetaTrader accounts for forex had a negative balance. If the volatility for a particular forex pair changes rapidly, the trading platform mt4 could negatively balance. Even a large gap in the prices of different currencies could reduce the balance below zero. Trading in Forex is now widely linked to having a below-zero balance. Though precautions like stop-out levels and margin calls are taken to prevent this problem, many forex traders continue to face it.

However, Forex is often advertised as an online money-making option where the trader cannot lose more money than he deposits in the forex account. Some forex brokers like FXTM offer negative balance protection to all forex traders who have opened their accounts. This is a marketing strategy of the forex broker. Even if the balance is negative, if the forex trader deposits the amount, he will trade with the entire amount deposited with FXTM; the negative balance is not deducted from the amount deposited. In some cases, the amount in the account may be slightly lower than the deposited amount, and this is because of the payment processor fees.

In many cases, forex traders are mentally prepared for the loss and are willing to take the risk of investing more money since they may have made good profits earlier. So, in this case, they may replenish the negative balance. In other cases, the forex broker has lawyers who will contact the forex trader whose balance has become negative. These traders are now debtors of the forex broker, owing him money. Like all lenders trying to recover money from debtors, the forex broker will also try to recover money from the forex trader, especially if it is large.

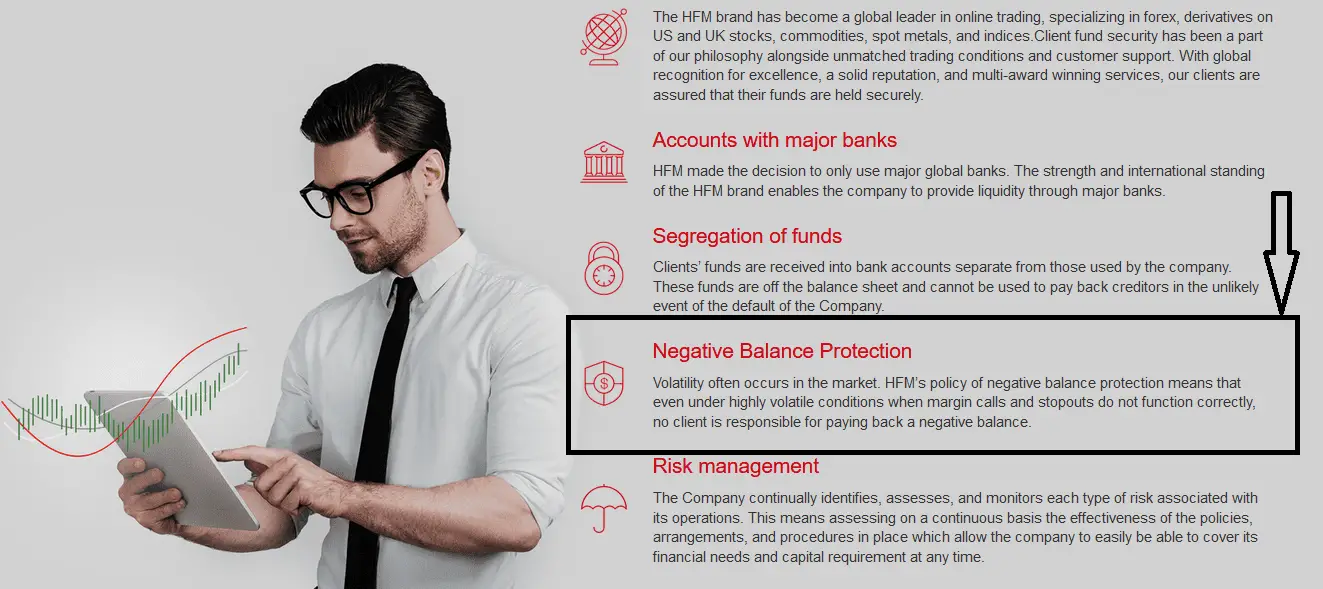

HFM Negative Balance protection

HFM broker offers negative balance protection for all traders. Below you can see how HFM secures funds:

You can visit HFM broker and check how they protect forex trading accounts from negative balance:

Avatrade Negative balance protection

AvaTrade offers negative balance protection for forex traders, which means you will never lose more than the capital in your account. AvaTrade provides this protection to help protect traders from experiencing any adverse financial market movements that could cause them to incur losses beyond their initial investment. If this were to occur, AvaTrade would refund the difference through a Negative Balance Adjustment, helping to ensure that you can continue trading confidently.

FxPro Negative balance protection

FxPro offers negative balance protection to all forex traders, regardless of their trading experience or jurisdiction. This means you cannot lose more than the total amount of your deposits when trading with FxPro. To protect our clients from incurring losses greater than their deposits, we have implemented several risk management measures, including strict position limits and leverage restrictions, a comprehensive order execution policy, and negative balance protection. These measures ensure that our clients can trade safely and confidently, knowing they are protected from potential losses.

Overall, by offering negative balance protection to traders worldwide, FxPro strives to keep its clients’ trading experience as profitable and risk-free as possible. If you are interested in learning more about our services and how we can help you achieve success in the forex markets, contact us today for further information.

XM Negative Balance Protection

XM.com offers negative balance protection to forex traders by deploying a system that takes on clients’ losses when the loss exceeds their equity. This protection is triggered when there is a volatile movement in the market, and the loss cut does not meet the timing for forced settlement. With this protection, traders can be assured that their accounts will never go into negative balances, even in extreme market volatility.

Conclusion

People with less experience invest money in forex trading because they are lured by the advertising and promises of quick money. When they find that their account’s balance has become negative, they become discouraged and may stop forex trading in the future. The forex mt4 account will be abandoned with a negative balance. If the negative balance is small, it may also not be feasible for the forex broker to initiate legal action against the trader to recover the amount.

MT4 Negative Balance is a temporary problem in the MT4 account. When you deposit a new amount of money, the current balance will be no less than the amount you deposited – so you are protected as a trader.