Table of Contents

In previous articles, we analyze backtesting in the MetaTrader platform. Forward testing and backtesting in MetaTrader 5 (MT5) are the methods of evaluating the performance of a trading system. This involves running a trading system on historical data and comparing the results. This comparison provides valuable insight into a trading system’s potential success or failure in actual conditions, giving traders an idea of what kind of trades they should expect when using the system in real time.

What is MT5 Forward Testing?

Forward testing in the MetaTrader 5 platform allows you to split your data set into two sets and get two result reports to compare. For example, if you choose the testing period to be 2022, and the forward testing date is July 2. 2022. Then, your data set will be split precisely into half, and you can compare the EA performance in the first and second part of the year.

Please see my video from the Fxigor YouTube channel where I described forward testing example:

Forward testing is typically used by professional traders and investors seeking to determine whether a particular strategy has merit. It also is an essential tool for assessing the risk associated with any given system, allowing users to adjust their trade sizes accordingly. The process can also be part of an overall portfolio optimization strategy.

How To Use MT5 Forward Testing?

To use MT5 forward testing, do the following steps:

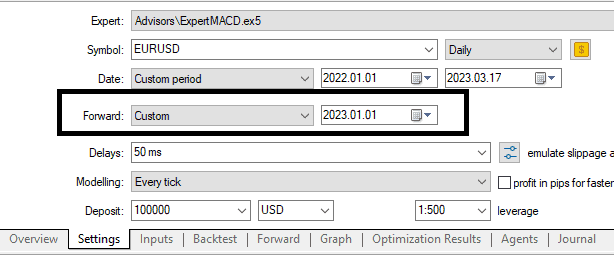

- Choose Expert Advisor, and choose a symbol (EURUSD, Gold, GBPUSD, etc. )

- Define the testing period. For example, from January 1.2022, up to March 17. 2023.

- Define the forward testing date by choosing any date in the past from the testing period range (between January 1.2022, and March 17. 2023.). For example, I will select January 1. 2023.

- Press the “Start” button to test

- You will get two results of testing. In our case, you will see results from January 1.2022, up to January 1. 2023. as the backtesting period and for January 1. 2023. up to March 17. 2023, as a forward testing period.

Please see the video above for all details.

As you can see, the Backtest and Forward data sets are two sets from the past that we can use in testing.

Forward testing using “Complete optimization.”

You can use the “Complete optimization” option for advanced Ea developers. In that case, you will analyze and optimize inputs in the first data set (backtesting set). In the second data set (forward testing), you will test new data sets we didn’t use for optimization to see our performance on the unseen test data set.

I do not use Forward testing a lot. Usually, I use parametric optimization on all backtest periods.

There are two ways to use forward testing and optimization when using the MT5 platform: manual and automated. Manual forward testing involves analyzing the past performance data of a trading system and manually adjusting parameters such as risk management rules and position sizing according to the analysis results. In contrast, automated forward testing uses computer algorithms to analyze past data and automatically adjust parameters without human input. Both methods have pros and cons, so traders must understand which one best suits their needs before deciding which type of forward testing they’ll use with their MT5 account.

When setting up forward tests with MT5, users must select which currency pairs they’d like to test and define the specific trading rules or strategies they would like to evaluate with these currency pairs over time.

Once this has been done, they can configure their test period settings such as time frames, entry/exit levels, lot sizes, stop loss levels, take profit levels, etc., along with other parameters such as trailing stops and hedging options if desired. Once all settings have been configured, the trader can run a backtest simulation on the previously defined data set to get an idea of how successful their chosen strategy could be in real-time market conditions.

After obtaining results from their backtest simulations, traders can use these results with other analysis techniques, such as technical indicator analysis or chart pattern recognition, to further refine and optimize their chosen strategies where needed before applying them in real-time markets.

Conclusion

Forward testing in MT5 can be used to compare the performance of EA in different periods. Additionally, it can be used in an advanced way as another test on optimized inputs in your EA for unseen data.

Please read our article about free backtesting software to learn more about how you can develop an excellent Expert Advisor. Do not forget to use Money Management Expert Advisor.