Table of Contents

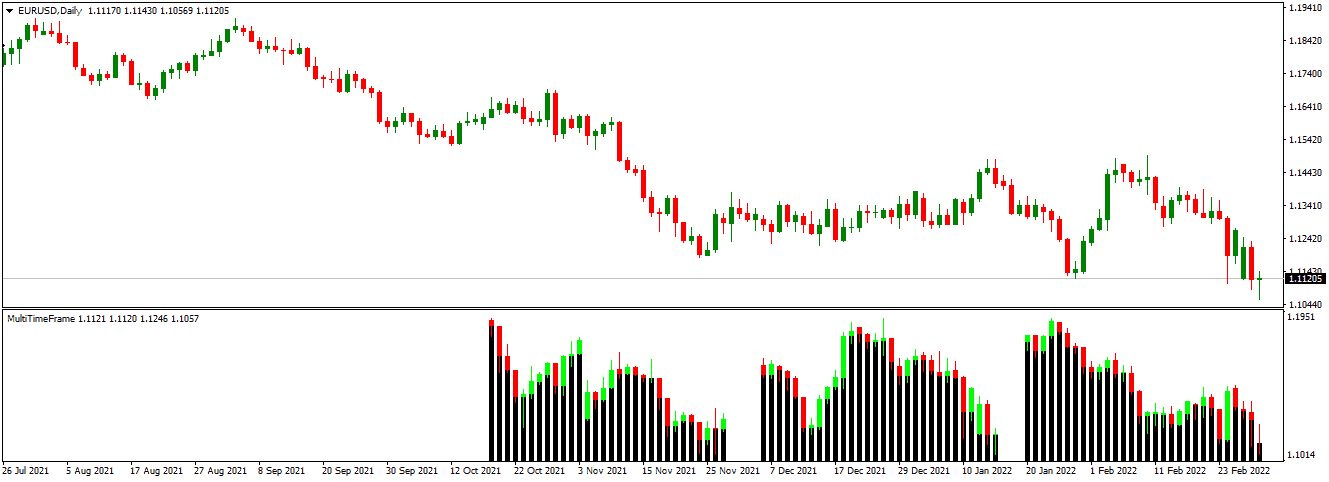

The Multiple Time Frame Trading MT4 Indicator is focused solely on the price action concept, which decides if a movement in price will exceed the support or resistance zone in the style of rising or declining trendline or whether it will revert to its direction.

This indicator is developed to assist the traders by removing the manual process of trendline plotting on the stock chart. Instead, the trendlines reflect the market stability—the indicator in the Mt4 system signals when a breakout arises. As a result, the trader can seize the moment to trade appropriately.

Best way to trade using Forex Breakout Indicator

After you’ve mastered the fundamentals and the goals of the indicator, the next step is to understand how to apply it to your trading. Let’s start by learning about the trading techniques that rely upon the indicator.

Download MT4 Time Frame Indicator

Below you can download MT4 Time Frame Indicator that will show a chart in several time frames. You can adjust in input.

Breakout buying techniques for Multiple Time Frames

- Set the popup notification option to true and observe the sinking trendline breakout.

- Get notified immediately whenever a breakout occurs, but hang on till the present candlestick’s value closes.

- After reaching the closing part of the candlestick, initiate the extended position. You can take a more conservative strategy by waiting for a change in the available trend to retest.

- Position your stop-loss beneath the lower swing.

- Arrange the profit-taking near the closest point of resistance.

Breakout selling techniques for Multiple Time Frames

- Allow the broken trendline to ascend before closing the candlestick.

- You can start a short position right away or sell it whenever there is a price retest for a broken trendline.

- Place the stop-loss trade right over the current highs to reduce your risk.

- Note the profit-taking level, which should be near the following support level.

Final Verdict

You can use the Multiple Time Frame trend indicator on several timeframes. Try experimenting with various financial products to see if you can improve the method. Unfortunately, there exists no flawless system; hence the possibility of risking a loss still exists. Search for a confirmative instrument such as an RSI or moving average to enhance your performance level. You can, however, also trade solely on retests if you want to be cautious. It also improves your chances of succeeding.