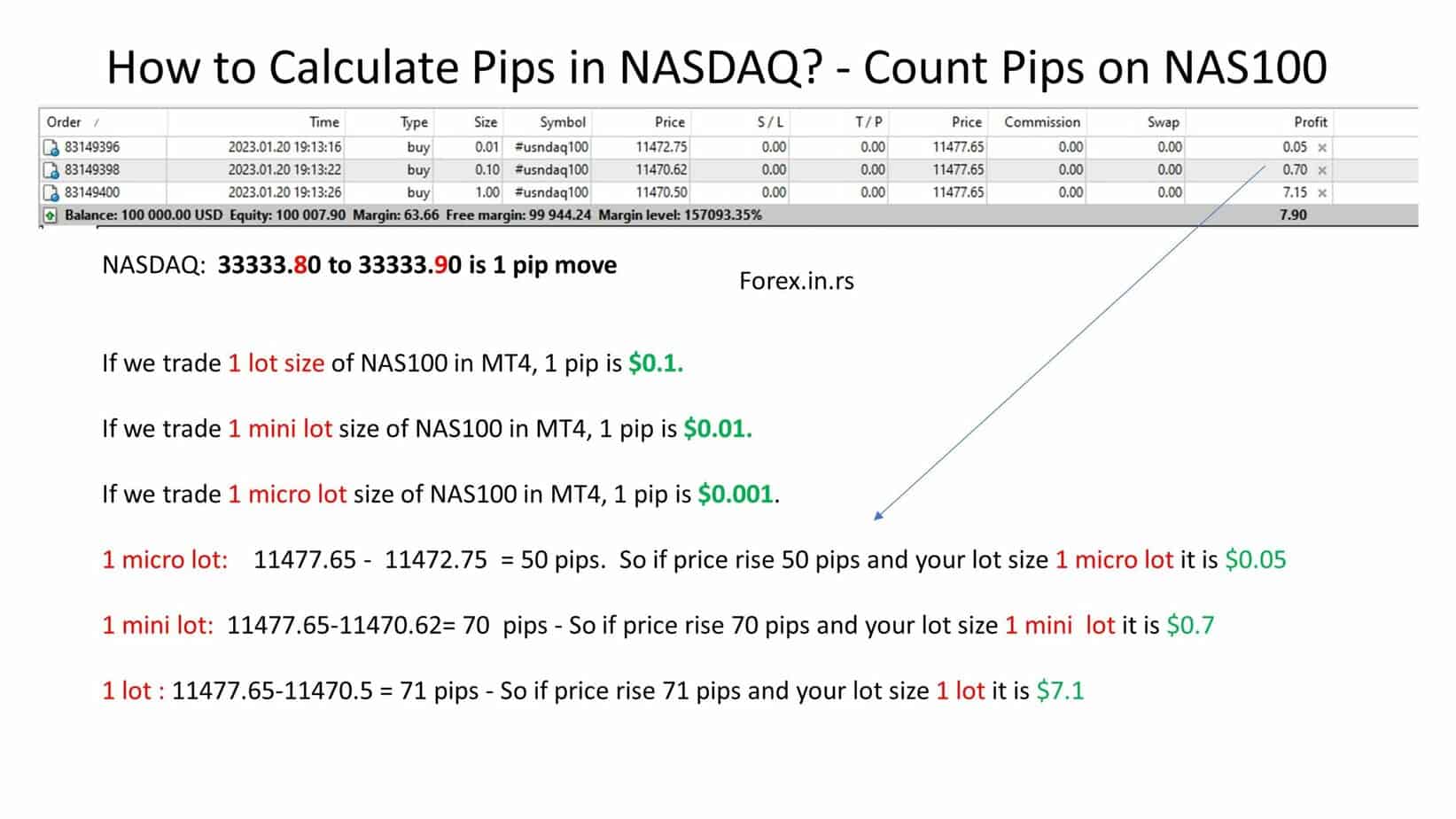

To calculate the number of pips on NAS100 or NASDAQ, it’s crucial to understand that a 0.1 difference in price typically represents one pip on the Metatrader platform for many CFD brokers. For instance, if the NAS100 price advances from 11750.00 to 11750.10, that signifies a one-pip difference for NAS100. If you add 25 pips to a 11750.00 NAS100 price, the result would be 11752.50.

In the MT4 platform, the value of a pip varies depending on the lot size you choose to trade for the NAS100. When trading a standard lot size, which is typically 100,000 units of the base currency, a single pip movement in the NAS100 corresponds to a $0.1 change in value.

See my video:

If you choose to trade a mini lot size, which is 10,000 units, the value of a pip is reduced tenfold to $0.01. Meanwhile, trading a micro lot size, equivalent to 1,000 units, means that the value of a pip is even smaller, at $0.001. Traders must understand these pip values as they directly impact potential profit or loss, depending on the size of the trade and the magnitude of price movement.

Example:

One micro lot: 11500.55 – 11495.55 = 50 pips. So if the price rises 50 pips and your lot size is one micro lot, it is $0.05.

One mini lot: 11500.55 – 11493.35 = 70 pips. So if the price rises 70 pips and your lot size is one mini lot, it is $0.7.

One lot: 11500.55 – 11493.24 = 71 pips. So if the price rises 71 pips and your lot size is one lot, it is $7.1.

In MT4, pip calculation for indices like the NAS100 can sometimes be confusing because, unlike forex pairs, indices are quoted in whole numbers with decimals. For NAS100, one pip is usually defined as a 0.01 movement in price. This means that if the index moves from 11500.55 to 11500.65, that is a 1 pip change.

The monetary value of that pip depends entirely on the contract size (lot size) chosen:

-

Standard lot (1.0 lot, 100,000 units) – 1 pip = $0.10

-

Mini lot (0.1 lot, 10,000 units) – 1 pip = $0.01

-

Micro lot (0.01 lot, 1,000 units) – 1 pip = $0.001

This scaling system makes it easier for traders to adjust position sizes according to their risk tolerance. For example, scalpers often prefer micro or mini lots to keep risk small while testing short-term movements, whereas swing traders may use standard lots to maximize profit from larger price swings.

It’s also important to note that brokers may differ slightly in how they define a pip for NAS100. Some classify a 1.0 movement in the index price (e.g., from 11500.00 to 11501.00) as one pip instead of 0.01. Traders should always confirm their broker’s pip definition inside the MT4 contract specifications.

Another factor that influences pip value is leverage and margin requirements. While the pip value itself does not change with leverage, your effective exposure to price movements does. A higher leverage setting allows you to control a larger position with less margin, magnifying both profits and losses from the same pip movement.

Finally, spreads and commissions play a role in how pip values translate into real trading results. For example, if the NAS100 spread is 3 points (equivalent to 300 pips in 0.01 terms), a trader must first overcome that cost before entering a profit.