Table of Contents

One of the most liquid trading sessions in the Forex market is the New York session. Its high liquidity makes it popular amongst traders across the world. The most liquid session of the day happens when the US session overlaps the London Forex session.

New York session forex

The official hours of the New York Forex Session are from 8:00 AM EST to 5:00 PM EST. In GMT, the New York forex session runs from noon to 9 PM (GMT).

Winter and Summer trading times are different, so:

New York session time is from 12-21 GMT during spring or 13-22 GMT during winter. The New York session time is from 8-17 EST during spring or 9-18 EST during winter.

The official hours of the London Forex Session run from 3:00 AM ET to 12:00 PM ET. New York and London have different time zones but overlap once daily, creating the most liquid session. This happens between 8:00 AM and 12:00 PM (ET).

During this overlap, the US session can very well trade like its European counterpart.

The opening hours of the New York session witness more volatility than the other half of the day. You can employ different methods to capitalize on these different volatility levels.

Trading the Overlap: The NY Breakout Strategy

The US and the London Forex sessions are the big guns in Forex trading. When they overlap, they create several opportunities. During their shared four hours, the two markets witnessed fast and large movements because high liquidity was present.

The most successful strategy that a trader can employ during this overlap is the break-out strategy. This strategy allows you to reap the maximum benefits of this period.

The New York Session: Trading in the Other Half of the Day

As soon as the London session is over, the volatility decreases drastically. Traders spend fewer hours in the market, which also reduces liquidity. Along with decreased hours registered by the traders, the moves also become smaller. Even though the other half of the NY session is not as lively and volatile as the first half, there are still ways to profit. All you need to do is to change your strategy.

Instead of using the break-out strategy, move ahead with strategies like the range trading strategy. With a system like this, you can use the resistance and support levels to your advantage.

Strategies like range trading are more successful in the other half of the trading day because as the volatility lowers, it becomes tough to break the support and resistance levels. Because of this, range trading is more likely to benefit you.

There are several pairs that you can successfully trade during the NY session. Given that the NY and London sessions overlap for four hours, most major currency pairs have USD, EUR, and GBP.

The best forex pairs to trade during the New York session

The best pairs to trade during the New York Session are USD-related forex pairs because of US market-related news, higher volume and volatility, and possible trend-following direction. The best US session pairs for trading are:

- USD/JPY

- USD/CHF

- EUR/USD

- GBP/USD

These pairs become more liquid during the US session and EU session overlap.

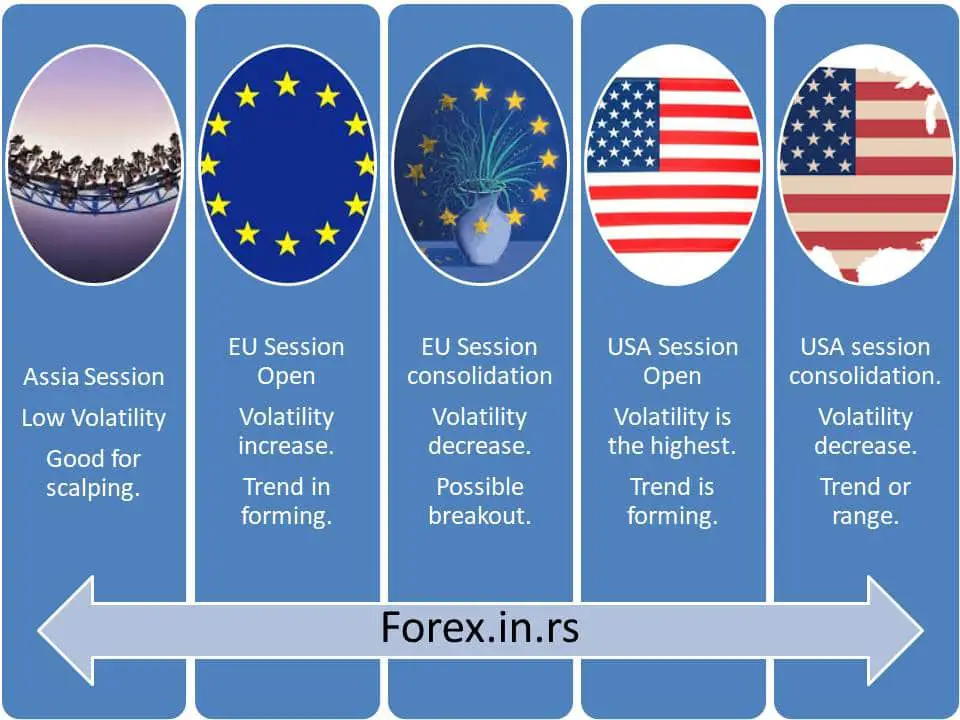

Every Forex trading session comes with its share of unique characteristics. The market begins with the NY session, chased by the London session. Finally, the London session is tracked by the Asia session.

Trading will be lower when the market has high liquidity because of the reduced spreads. Since the overlap witnesses a combination of high volatility and liquidity, traders find plenty of opportunities to make profits.

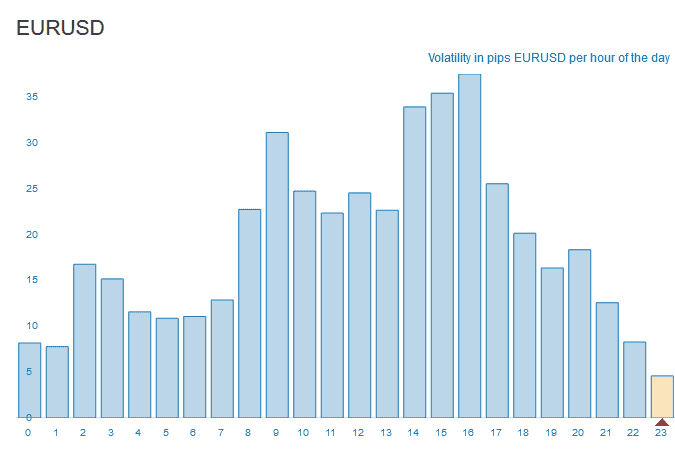

EURUSD forex Pair during US session

The EUR/USD is a forex pair well suited for trading during the US sessions due to its high liquidity and availability of trading opportunities. With European traders and financial institutions frequently participating in the market during this time, there is always a strong underlying demand for buying and selling the currency pair.

Below is my chart showing the number of pips per hour for EURUSD.

Additionally, the US session often overlaps with the opening of major Asian markets, further increasing volatility and market activity. This makes the EUR/USD ideal for traders looking to capitalize on short-term price movements in one of the world’s most liquid markets. Whether you are a seasoned trader or just starting, the EUR/USD offers plenty of opportunities to profit from rising and falling prices. So if you’re looking for a forex pair that is perfect for US trading hours, look no further than the EUR/USD!

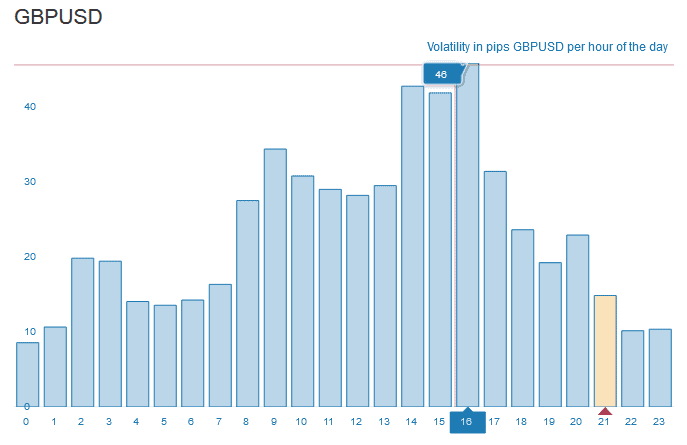

GBPUSD forex pair during US session

GBP/USD is an excellent forex pair for trading during the US sessions because it provides a window into the relative strength of the economies of the United Kingdom and the United States. This pairing is closely correlated with broader economic health and can therefore be used as a barometer to assess the overall state of these two giant economies.

Below is my chart showing the number of pips per hour for GBPUSD.

Traders will typically watch this pairing very closely, paying particular attention to any significant changes in sentiment that could potentially impact global trade and investment flows. Given its close correlation with broader economic trends, GBP/USD tends to be heavily affected by major geopolitical or economic events.

For this reason, traders who can successfully predict these changes can profit from significant market movements by positioning themselves on either side of the pairing. Whether looking for short-term scalping opportunities or longer-term trend trades, GBP/USD is a great forex pair to consider trading during US trading hours.

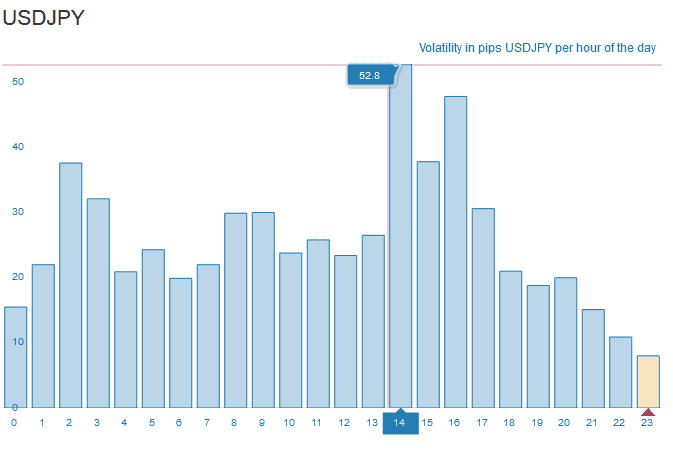

USDJPY forex pair during the US session

The US Dollar/Japanese Yen (USD/JPY) is one of the best forex pairs to trade during the New York session because this is when traders worldwide actively buy and sell it.

One of the main reasons USD/JPY is such a good forex pair to trade during this time is that it tends to move very aggressively, making it an ideal asset for traders looking for volatility in their trades.

Below is my chart showing the number of pips per hour for USDJPY.

Another reason that makes USD/JPY so popular among traders is that it is considered a haven currency, meaning that it tends to see increased levels of activity whenever there are signs of risk in the markets. This means you can make money even when other assets are falling in value, giving you plenty of profit opportunities.

With all of these factors combined, it’s easy to see why USD/JPY is an excellent choice for those trading during the New York session. So if you’re looking for an exciting and profitable way to trade during these hours, consider adding USD/JPY to your trading strategy today!