Table of Contents

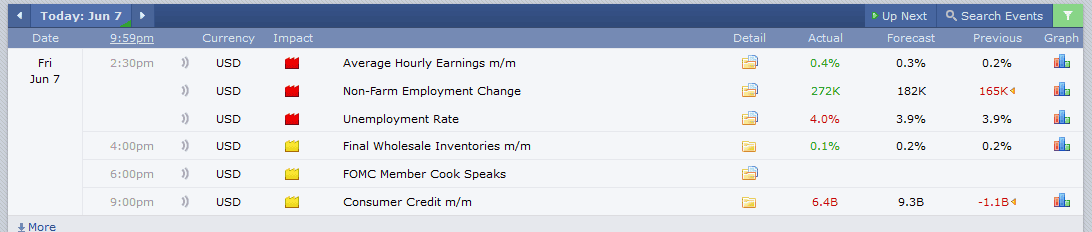

The US Bureau of Labor Statistics (BLS) reported a significant rise in Nonfarm Payrolls (NFP) in May, with an increase of 272,000 jobs. This figure surpassed market expectations of 185,000 and followed a revised increase of 165,000 jobs in April, initially reported as 175,000.

Key Details of the Report:

- Unemployment Rate: increased to 4% from 3.9%.

- NFP: Expected 182K, and it was 272K.

- Average Hourly Earnings: Increased by 4.1% year-over-year, up from a revised 4% in April (originally reported as 3.9%).

The BLS also revised employment changes for the previous months, with March’s figures adjusted down by 5,000 (from +315,000 to +310,000) and April’s by 10,000 (from +175,000 to +165,000), resulting in a combined decrease of 15,000 jobs from prior reports.

Market Reaction:

The immediate market response saw the US Dollar strengthening against its rivals. At the time of reporting, the US Dollar Index had risen by 0.5% to 104.60.

Impact on Precious Metals:

Following the stronger-than-expected jobs report, expectations for US interest rate cuts this year diminished, contributing to a decline in gold prices.

- Gold: Spot gold dropped about 3% to $2,304.54 per ounce, and US gold futures settled 2.8% lower at $2,325. This marks the third consecutive decline for gold, with nearly a 1% fall this week.

- Silver: Fell 6.6% to $29.25 per ounce.

- Platinum: Decreased by 3.6% to $967.05 per ounce.

- Palladium: Dropped 2.2% to $909.06 per ounce.

Tai Wong, a New York-based independent metals trader, remarked, “We will find out today whether gold has the stomach to absorb the one-two punch of a strong employment report and a pause in Chinese buying.”

Broader Economic Implications:

The robust jobs report, indicating a resilient US economy, has led to traders adjusting their expectations for Federal Reserve interest rate cuts. Bets for rate cuts by the end of December decreased to 37 basis points from 48 basis points before the NFP data, with the first cut now anticipated more likely in November rather than September.

Phillip Streible, chief market strategist at Blue Line Futures, noted that the gold market and other metals are experiencing some liquidation as the robust economic data suggests a potential delay in the Fed’s first rate cut. Higher interest rates typically increase the opportunity cost of holding non-yielding assets like gold.

China’s Gold Purchases:

Adding to the bearish sentiment in the gold market, data showed that China, a top consumer, held off on gold purchases in May after 18 consecutive months of buying. Given the recent price-run-up, analysts at TD Securities suggested that this pause might indicate a more price-sensitive approach.

In summary, the stronger-than-expected NFP report has significant implications across various markets, particularly impacting the strength of the US dollar and the prices of precious metals.

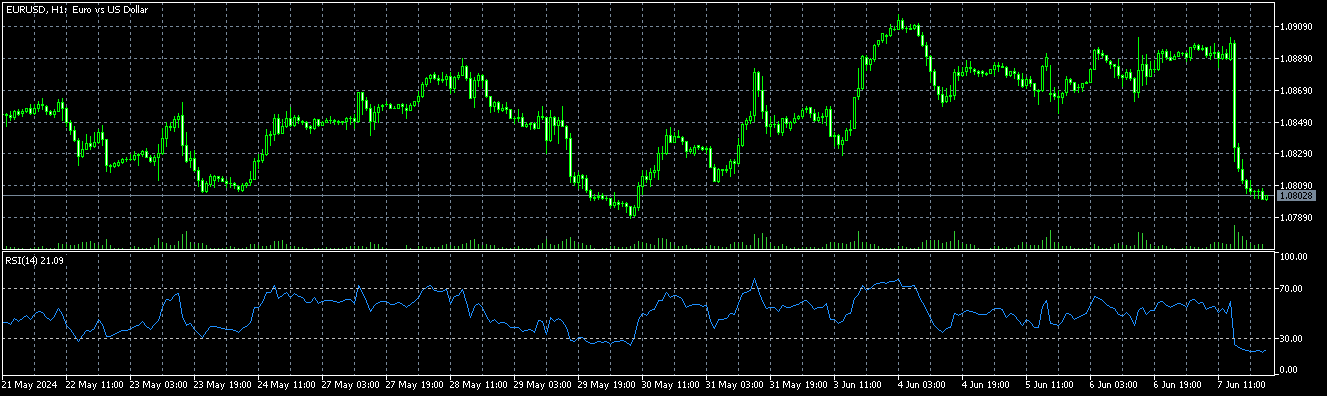

For example, today, GBPUSD went from 1.281 to 1.272. EURUSD went 100 pips down:

The economic data underscores the resilience of the US economy and has led to a reassessment of future Federal Reserve monetary policy actions.