The Non-Farm Payroll (NFP) report is one of the most closely watched economic indicators in the financial world, providing critical insights into the health of the U.S. labor market. Released monthly, it measures the number of jobs added or lost in the economy, excluding the farming sector. It is crucial in shaping market expectations for interest rates and economic growth. The data often leads to heightened market volatility, particularly in the forex market, as traders adjust their positions based on the report’s findings. Substantial employment numbers generally signal a healthy economy and can lead to a stronger U.S. dollar, while weaker data may raise concerns about a slowdown.

Please watch my video about this day’s NFP projection and price of EURUSD, GBPUSd, and Gold:

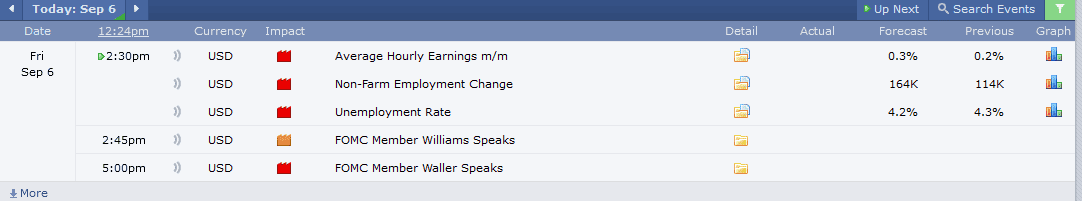

As markets brace for the upcoming Non-Farm Payroll (NFP) report, set to be released in two hours, traders and analysts anticipate vital insights that could shape the direction of the US dollar. The report, a critical gauge of the health of the US labor market, will include data on Average Hourly Earnings, Non-Farm Employment Change, and the Unemployment Rate—all of which are expected to impact currency markets significantly.

The consensus forecast for Average Hourly Earnings is a 0.2% increase, a critical figure that traders closely watch. If the actual data exceeds this estimate, it could indicate rising wage inflation, putting pressure on the Federal Reserve to consider more aggressive interest rate hikes. A higher-than-expected increase in wages would likely boost the US dollar, as investors anticipate tighter monetary policy to control inflation.

Fornon-farm employment change, the market expects a gain of 114,000 jobs. This figure is particularly important, as more substantial job growth would signal a robust labor market, reinforcing confidence in the US economy. If the actual figure significantly surpasses the forecast, it could fuel expectations of faster economic recovery and lend further support to the US dollar. Conversely, a lower figure might dampen dollar strength, as it could raise concerns about a potential slowdown in the labor market.

The Unemployment Rate is projected to come in at 4.3%, a slight improvement from previous levels. A lower unemployment rate would suggest a tightening labor market, often leading to higher wages and increased consumer spending. This would be another positive indicator for the US dollar, as it could further solidify expectations of future rate hikes.

The upcoming NFP report is expected to be a pivotal moment for the US dollar. Stronger-than-expected data across these critical indicators could bolster the greenback, while disappointment in the numbers might trigger a short-term pullback. Markets are poised for significant volatility as they await the report’s release.