Table of Contents

The Nonfarm Payrolls (NFP) report is a critical indicator in the U.S. labor market, providing insights into employment trends that influence key economic policies and affect the value of the U.S. dollar against global currencies. October’s report surprised the market, as employment increased by only 12,000, significantly missing the anticipated 113,000 and falling far below September’s revised figure of 223,000.

October 2024 NFP Highlights

- Job Growth: Nonfarm Payrolls increased by 12,000 in October, well under the expected 113,000, indicating a slowdown in job creation.

- Unemployment Rate: Remained steady at 4.1%, aligning with forecasts and reflecting stability in the job market despite lower hiring.

- Labor Force Participation Rate: Decreased slightly to 62.6% from 62.7%, suggesting a slight decline in the number of people actively seeking employment.

- Average Hourly Earnings: Wage inflation rose modestly to 4% from 3.9%, indicating ongoing wage pressure, a crucial metric for inflation tracking.

Factors Influencing October’s NFP Data

The impact of recent hurricanes Helene and Milton affected the survey outcomes. Severe weather in the southeast U.S. disrupted some industries, limiting their hiring capacity. However, the Bureau of Labor Statistics (BLS) noted that quantifying these effects is challenging, as the establishment survey is not designed to isolate disruptions from extreme weather events.

Market Reaction: A Bearish Turn for the U.S. Dollar

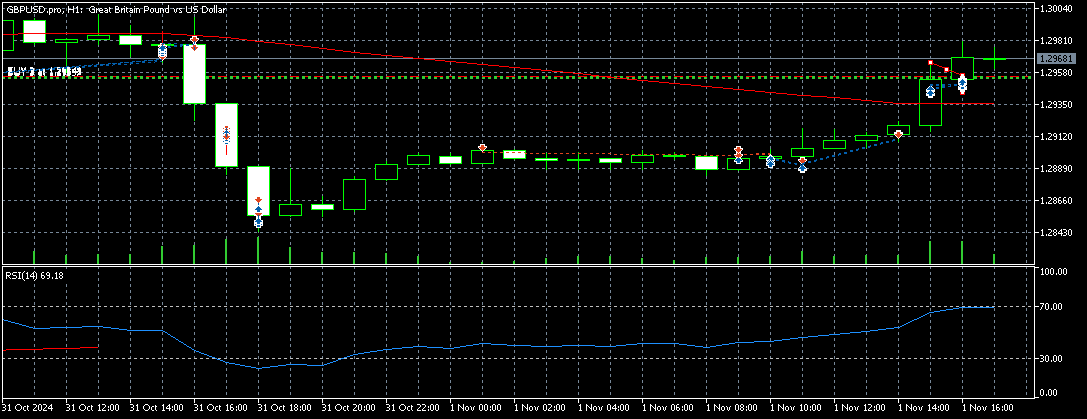

Following the NFP release, the U.S. dollar faced downward pressure, evidenced by the U.S. Dollar Index dropping by 0.1% to 103.80. The subdued job growth and a modest rise in wage inflation suggest the Federal Reserve may lean towards interest rate cuts to stimulate economic growth. The U.S. dollar weakened against several major currencies, notably the British Pound, which saw a 0.41% gain against the dollar.

Implications of NFP for Federal Reserve Policy and USD Performance

The NFP report’s weak job growth and stable unemployment rate complicate the Federal Reserve’s decision-making process regarding interest rate cuts. With hiring slowing but wage inflation remaining, the Fed might consider easing rates to support economic momentum, particularly if employment gains weaken. Any signs of consistent underperformance in labor data could prompt the Fed to adjust rates to prevent economic cooling, which would likely exert additional downward pressure on the USD.

Why the NFP Matters to Traders

Traders closely monitor the NFP report as it impacts short-term currency movements, especially in USD pairs. A lower-than-expected NFP number often results in USD weakening, as investors anticipate possible interest rate reductions. Conversely, strong NFP figures generally boost the USD, signaling economic health, which may prompt the Fed to consider tightening policy.

For traders, October’s NFP provides several key takeaways:

- Interest Rate Sensitivity: Weak employment growth could sway the Fed towards an accommodative stance, making USD-sensitive trades potentially advantageous.

- Currency Pair Volatility: GBP/USD, EUR/USD, and USD/JPY pairs showed noticeable movement post-release. GBP surged against USD by 0.41%, reflecting how the NFP report impacts major currencies differently.

- Long-term Strategy: If the Fed leans towards rate cuts, traders may consider positioning for further USD declines, especially in risk-on environments where currencies like GBP and EUR gain traction.

Historical Context and Seasonal Impact

The October report often sees variations influenced by seasonal factors, natural disasters, or political events, which can distort labor data. Comparing October’s NFP results to previous months helps contextualize how recent events, such as hurricanes, have influenced hiring trends. October’s significant miss relative to expectations underscores the importance of considering external influences like weather in interpreting labor data.

Conclusion

October’s NFP report reflects a complex labor landscape impacted by recent weather disruptions and a modest gain in wage inflation. This report signals a cautious approach for traders, with attention to the Fed’s reaction and potential rate adjustments. As USD faces bearish sentiment, strategies focusing on currency pairs where USD weakness can be capitalized, such as GBP/USD and EUR/USD, may offer opportunities.