Table of Contents

In the olden times, stockbrokers held a respectable position in the investment field. It was a job that people greatly desired. SStockbrokerjobs were ideal for people with a negligible or no investment history in the past. The primary role is to purchase and sell the stocks in the market on behalf of investors; they earn commissions for successfully conducting a transaction. However, do the stockbrokers still hold their prowess in the field, or is it just a dying career?

Do Stockbrokers Still Exist?

Old fashion stockbrokers no longer exist, like twenty or forty years ago. Then, stockbrokers were individual agents or companies that used to charge a fee or commission for orders executed for investors. Today former stockbrokers are financial consultants, planners, analysts, or work in wealth management.

To be clear, forex and stock brokerage companies exist today and provide trading platforms for traders. However, today traders execute orders alone.

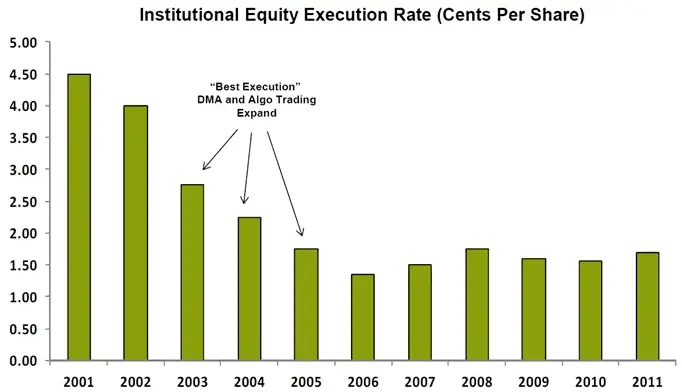

In 1975, the U.S. began to allow negotiated commissions, a shift that many global markets eventually adopted. This ignited an era of heightened competition and hurdles for brokers, which only intensified in the past decade.

This period saw the capital markets undergo a significant transformation, mainly by technological advancements and major shifts in the market landscape.

The rise of electronic trading was game-changing. It led to a surge in trading volumes and improved liquidity, made market access more widespread, and significantly reduced the costs linked to intermediation. Meanwhile, the demutualization of exchanges lessened the importance of being an exchange member. Consequently, access to liquid assets became more equal and open to many.

Interestingly, the dynamics between brokers and exchanges began to blur. Brokers started to handle order executions in-house and considered options outside of traditional exchanges, including dark pools. Conversely, conventional exchanges began offering “direct market access” (DMA), placing themselves more prominently in the investment chain from the initiation to the conclusion of a trade.

Today we have different StocksBrokers classifications:

Institutional Brokerage Business Models

- Traditional Brokers:

- Provide total service intermediation.

- Offer investment banking, research, trading and sales, and asset management.

- Execution and “Quant” Brokers:

- Feature low-cost, high-speed, high-tech execution platforms.

- Cater to passive investors looking for low-cost execution.

- Also serve highly sophisticated, tech-savvy entities.

- Research Firms:

- Specialize in analysis and investment insights.

- Compensation can be through commissions or hard dollars.

- Service Providers:

- Offer services or technology for the investment process.

- I typically paid through commissions.

- Disintermediators:

- Innovators are introducing new business models.

- Examples include Liquidnet.

- They bridge the gap between the buy-side and exchanges.

The stockbrokers have no influence in the market now, and their breed is slowly bleeding and becoming invisible. Investors are more aware of and are as eloquent in investing as brokers because of the vast information bank on the internet, passive investments, and the financial tools in the market. So let’s dig deeper into why this breed is declining and what other avenues the future holds for stockbrokers.

Is stockbroker a dying industry?

Yes, stockbroker is a dying industry because traders do not call their agents (stockbrokers) and ask them to execute trades. Instead, today traders use trading platforms and execute trades themselves. In 2000. there were 5400 stockbrokers, and in 2021, only 3600.

For the year 2000, there were closer to 5,400 broker-dealers registered with FINRA’s predecessor, the National Association of Securities Dealers (NASD), at the start of the 2000s. As of 2021, there were roughly 3,600 broker-dealer firms registered with FINRA. This is a significant reduction from previous years, reflecting consolidation in the industry, among other factors. This number has declined over the years due to industry consolidation, increased regulations, technological advancements, and changing business environments. Stockbrokers’ role morphed into financial, investments, and wealth advisors. Unfortunately, these people’s demolition has picked up rapidly in the last 25 years. In a blink, revenue generation, cold calling, and stock picking skills have becomsirable. Hence, the traditional brokers proficient in stocks and gold mines no longer held a significant position in the market.

Some main contributing factors to eliminating this job title include technology, competition, and emerging discount brokerage firms.

1. Evolution of Institutional Brokerage:

- Increased Regulation: Post the 2008 financial crisis, stricter regulations were enforced upon institutional investors, leading to increased compliance costs and reduced profit margins for institutional brokers.

- Technological Advancements: With the rise of algorithmic and high-frequency trading, many institutional traders have in-house teams that directly execute trades on exchanges, reducing their reliance on traditional institutional brokers.

- Consolidation: As margins have become thinner, there’s been a trend of mergers and acquisitions in the institutional brokerage space, resulting in fewer but more prominent players.

- Disintermediation: Platforms that directly connect buy-side and sell-side players, bypassing traditional brokers, have become more prevalent.

2. Growth of Retail Brokerage:

- Democratization of Finance: The rise of user-friendly platforms has made investing more accessible than ever for everyday individuals. Apps and online platforms have opened the stock market to a broader audience.

- Financial Education: With the proliferation of online resources, blogs, videos, and seminars, more people are learning about investing and entering the stock market.

- Lower Costs: Many retail brokers now offer zero-commission trades, making it cost-effective for individual investors.

- Fractional Shares: Some platforms allow users to buy fractional shares, so even if an individual can’t afford an entire share of a high-priced stock, they can still invest a smaller amount of money.

- The trend of Individual Investing: Cultural phenomena, like the rise of Reddit trading communities and the popularity of financial influencers, have sparked increased interest in individual stock trading.

- Global Expansion: Many retail brokerages are expanding into emerging markets, where growing middle classes show an increased interest in stock investing.

- Robo-Advisors: For those who are not confident in picking their stocks, robo-advisors offer automated, algorithm-driven financial planning services with little to no human supervision. This attracts a segment of the population who want to invest but prefer a hands-off approach.

What is a discount brokerage firm?

A discount broker is an online stock broker that does not charge a commission for buying or selling stocks or offersmeagerw commissions. However, a discount broker does not perform analysis and provide investment advice on a client’s behalf.

The creation of these firms has overrun the path for stockbrokers. These brokerage firms have been exploiting the profit margin of brokers since 2005. The prosperous clients desire personal attention, henwell-versewell-versewell-versewell-versedrininininkers, and the onset of a trend that only leads to their demise.

These brokerage firms reduce the need for stockbrokers as they render knowledge and experience to investors via technology and the wonders of the internet. The discount brokerages have the upper hand because they provide similar services to the stocker brokers but at a discounted price. Hence, bagging a large number of customers. Anyone who wants to indulge in trading will instantly think about approaching a discount brokerage instead of a stockbroker because of the reduced expenses. However, with the evolution of the investment industry, it has become evident that clients want a more optimized service. Hence, stockbrokers have adapted to the situation as advisors who are well versed with the nitty-gritty of financial, insurance, and estate planning.

What is a passive investment?

Passive investing is another eroding factor for stockbrokers. The term passive investment has been around since 1980. This was triggered by the book “A Random Walk Down Wall Street” by Burton G. Malkiel. Unfortunately, the book’s originality fixated on the many issues related to active investment management, indirectly putting a blot on the role of stockbrokers.

Malkiel’s crafty book oozes with imperial studies proving that stockbrokers are not experienced in the skills that recognize the patterns and help invest in profitable stocks in the long run. He even made a sly comment indicating that a monkey making gibberish assumptions with a wet towel can provide better results than the experts using shiny statistics and formulas.

Passive investment is more convenient for many investors and provides several benefits to enticing the public. These passive investments expand as index funds and facilitate reduced expenses. It also helps save on investment taxes due to the purchasing and selling cap.

The unfolding of the financial advisor role

Due to the declining demand and negligible profits, stockbrokers learned to evolve with time. Hence, expanding their scope to consultations and naming their role as financial advisors. They want to place themselves as a neck-to-neck competitor with discount brokerages, which is more delicate.

Cold-calling and pitching stocks is a tactic of the past. Instead, the stockbroker of the modern era is more focused on developing a comprehensive and effective strategy for their client’s financial goals. Their advice includes mortgage, tax evaluation, retirement plans, life insurance, and estate planning. subjects

SStockbrokersrealize the threat that discount brokerages pose to their careers. Hence, the brokers are using their knowledge for stock analysis as well. It makes sense because they do not need extra training as they are already seasoned financial experts.

What is the Wall Street meltdown?

Wall Street had to face downsizing due to recurring financial crashes. In 29009, CNBC mentioned how letting go of stockbrokers left them in despair. With the falling demand for their role, it is tentative if their need will arise.

Even though the Wall Street jobs also include roles of fund managers, investment bankers, etc. The stockbrokers still went through a pretty rough ordeal. The downsizing in 1985 was the worst situation for the employees there.

Are stockbrokers still relevant?

Stockbrokers are not relevant anymore, like in the 20 century. Today former stockbrokers are financial consultants, planners, analysts, or work in wealth management.

All their life, stockbrokers have been financial advisors underneath the title, where they only guided investors in making decisions. However, since they know the financial jargon, they are now switching to advisors and sustaining the role with the demand.

According to the data and statistics released a significant amount every day, the stockbroker job title is slowly disappearing. Hence, people longer aim to become stockbrokers, and there are no aspirants in the industry. Therefore, the future of jobs in stock brokerage remains a foggy issue for some.

The future for the role of stockbrokers seems blurry and gloomy. The data supports everything that contradicts the existence of the people with this title. A glance at the stock brokerage clarifies that it is changing, and so are the needs in the investment world.

The future without the existence of stockbrokers is clear that stockbrokers are not here for the long run. Wall Street has not trained any brokers in a long time, and the existing ones are rapidly shifting to a more befitting title for the modern world. The new and reformed stock broker accumulates the client’s assets and invests them through third parties while collecting the fees.

On the other hand, many investors are still concerned that their privacy is diminishing as the stockbrokers are out of existence. Now, investors must choose between low-index funds or supervisors in mutual funds, hedge funds, or single account management. However, they also realize that active management is also not as fruitful as it seems.

Can they intersot managers and diversify their portfolios without any help? Can they buy bonds and mutual funds from firms? Even if the discount brokerage is convenient, many investors are still not sold, considering it their top alternative.

Many people are walking away from investing in the stock and bond market without stockbrokers. People are even hesitant about day trading. In addition, most investors are not sure about the security of their funds anymore.

Since stockbrokers are nearing the end, stockholders need to be in the front seat to direct their security collections. They need to learn how to diversify their portfolio with stocks and bonds. With the technology surrounding us everywhere, it is more accessible, and hence one does not need to rely on a stockbroker.

Conclusion

The future is here, and it does not require an investor or firm to worry about recommendations from any broker. Instead, the new and emerging advisory firms and advisors are taking over and helping people to build a profitable investment portfolio for the long run. Hence, the role of stockbrokers has transformed.