Table of Contents

Whenever a pattern builds, it leads to the most important moves in the capital markets. When a pattern takes root, it can always surpass general standards for just how long it can continue, enabling only the most professional traders to prosper to the full.

Thus, examining evolving market states correctly is a handy skill, which would be precisely why there are so many various tools that aim to do the same. This post would take a close look at one of the key indicators named the Parabolic SAR. The initial question is, what does one mean by Parabolic SAR? Put literally, it advocates as ‘stop and reverse parabolic.’

What is Parabolic SAR?

Parabolic Sar represents a technical indicator designed to identify the turning point in price movement, and J. Welles Wilder developed it. Parabolic Sar draws attention to when the price direction is changing. Abbreviation of SAR stands for “stop and reverse.”

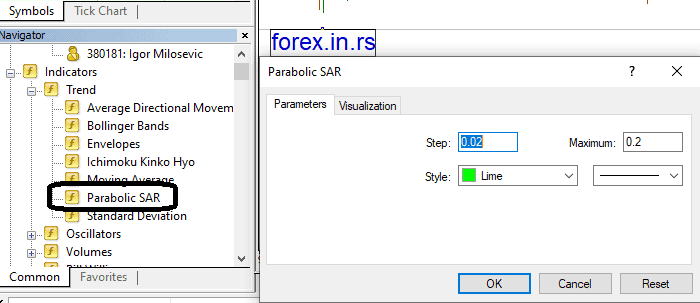

Parabolic SAR settings are step and step maximum values. Step represents the Parabolic SAR size of the acceleration factor that starts from 0.02 increases by the step size with each new high for buy positions or each new low for sell positions. Step maximum is 0.20 by default.

Parabolic SAR in MT4

With 30 major technical metrics, MT4 comes loaded. Thankfully, the Parabolic SAR also is such a predictor for our purposes, which ensures that as early as we launch MT4, we will have exposure to that same indicator.

You do not have to create a different download of a Parabolic SAR predictor in many other terms.

Parabolic SAR can be found in the ‘Trend’ subdirectory of MT4 in Navigator’s checklist. The dialog window begins by double click on the icon. As you’ll see in the settings, there have only been two primary settings.

The Parabolic SAR Indicator Settings

These are classified in MT4 as ‘Step’ and ‘Maximum.’ The momentum function is the volume of the phase. A default value of 0.02 is fixed. The momentum factor begins with that same value and afterward rises to the value specified by the maximum function by the step size in each record peak (as well as low for short trades).

The Best Parabolic SAR Settings

In the end, it’s a bit like wondering how long a piece of rope is. That is to conclude; your particular trading style may focus on the reply. There will all be a focus on the time period you are dealing with and the priorities and aims of your own trading plan. By experimenting, you will explore what model parameters fit well for you, although the default values are definitely a smart starting point.

Broadly speaking, the lower the momentum factor, the more tightly the price can be tracked. Alternatively, the larger the element of acceleration, the nearer this should travel to the value.

Subsequently, the greater the momentum factor, a turnaround is more possible. It is crucial not to get an AF too high, or you will reverse too much and then struggle to ride each pattern correctly.

Though, if you like a lower or higher sensitivity of value and thus less or more reversals, it would be linked to your investing objectives. The perfect Parabolic SAR scalping strategy, as an instance, would probably require more changes of direction than a long-term pattern so that a scalper may feel a higher AF more suitable.

Wilder felt that perhaps the 0.020 default value fit well enough for him, yet claimed that it would fit better with anything from 0.018 and 0.021. He proposed not establishing the limit as anything greater than 0.22. Still, experimentation is the safest way for you all to decide on your own optimal settings.

This would ultimately give you more faith in your strategies by checking multiple principles and finding yourself that yields the right outcomes in conjunction with your own approach. You ought to be willing to give it a whirl without losing cash to do otherwise, and that is why getting access to a trial brokerage account is so valuable.

We know, patterns are not only defined by the indicator; they also advise you when and how to shut your trade and change course. Feels extremely effective, huh? Among a handful of trading strategies produced by J Welles Wilder can be said the indicator. He was an oil broker and a top-rated technical analyst.

Any of the key elements of contemporary technological approaches, such as the Relative Strength Index, Average True Range, along with what he named the ‘parabolic time/price system,’ were presented in his book ‘New Concepts in Technical Trading Systems.’

For instance, one last thing is the indicator that we’re focused on, the indicator c called Parabolic SAR.

An indicator traces a curved sequence on a value graph that defines possible to stop and reverse rates. Wilder remembered this pattern and mirrored the famous parabolic curve seen in classic geometry and mechanics; that’s where the naming of the predictor derives across. We will look at how we quantify this indicator over the next segment.

Seeing the equations behind the indicator will allow you to learn how it functions, what the different parameters indicate, and how it can be used or can be changed. Note that it isn’t purely important, but it’s important to understand—the reason behind it so that your MT4 will do the needed calculations for your ease.

Parabolic SAR Steps Formula

Parabolic SAR Step represents the size of the acceleration factor that starts from 0.02 increases by the step size with each new high for buy positions or each new low for sell positions and can be calculated:

| SAR NEW = | SARCURRENT | + AF x (EPCURRENT – SARCURRENT) |

The description of this formula is as stated below.

| AF | Acceleration Factor | A shifting value increases in defined increments at each time in which the trade reaches a high mark (for long trades, or perhaps a low point for short trades). And for the original value of AF, Wilder suggested a rate of 0.02, which will then rise in stages by 0.02 before it hits a final value of 0.20. |

| EP | Extreme Point | The lowest and highest value seen during the present trend period (it would be maximum for an uptrend, and a downtrend would be minimum). |

As we said earlier, the indicator would help know the stop or reverse marks on the graph. It can also be calculated by implying the following formulas.

The indicator curve is meant to give a roadmap to a trending market. Wilder concluded that somehow a trending market would be extremely likely to stay under the curve’s limits on the graph. This implies that the movement might have lost steam if the market fails to do the same and only falls via the curve. This is at those points in history that the place can pause and reverse.

How to Trade Using Parabolic Sar Indicator?

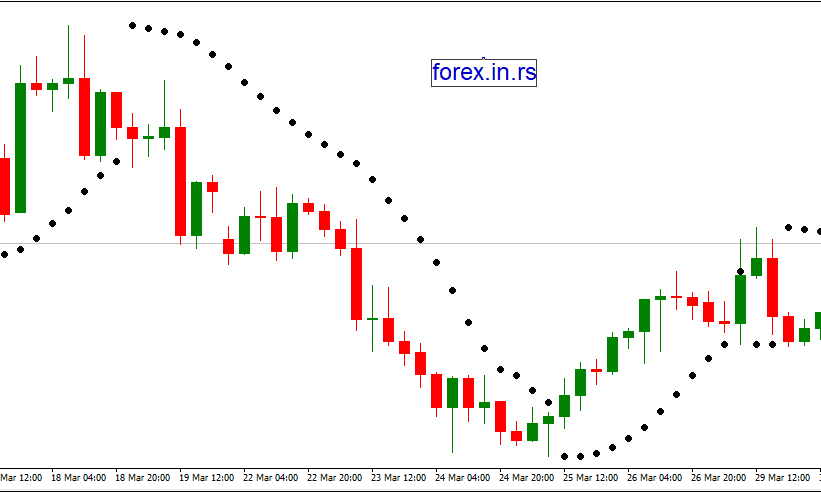

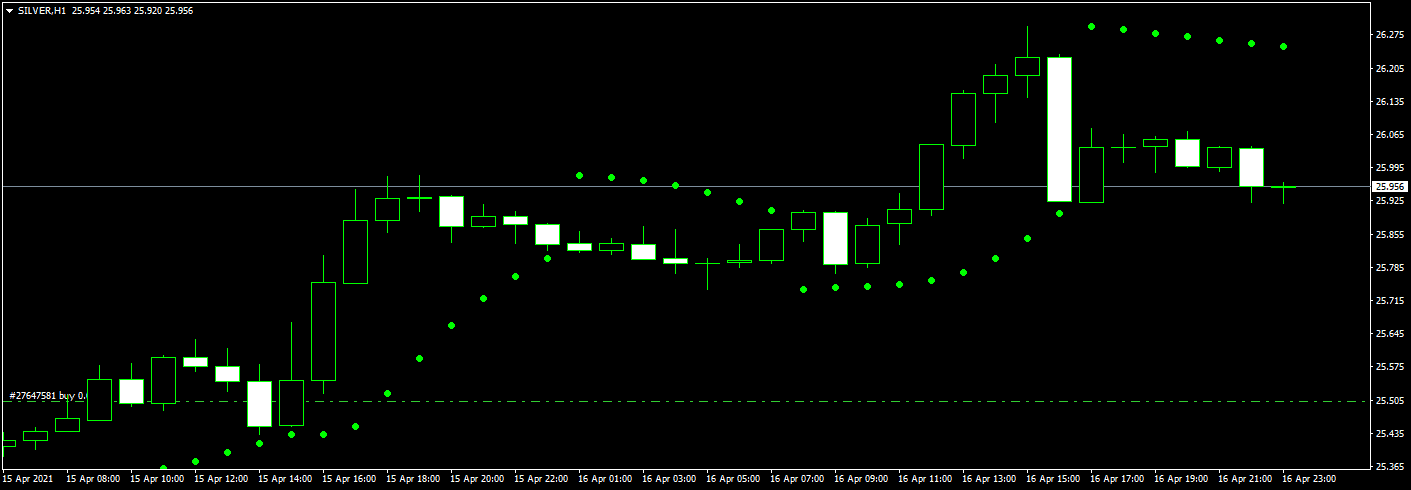

To trade the Parabolic Sar indicator signal, you need to determine a bearish trend when the price is below dots and a bullish trend when the price is above dots for a particular time frame.

The green dots indicate where your stopping level should also be positioned. Note how well the stop still matches the market’s motion; a stopping only goes closer to the forex market and just never moves farther forward. The increasing momentum factor implies that the stopping gets closer to the value as the trend follows.

The predictor advises you to pause and change when the market doesn’t really begin to move in your favorable direction. That’s also actually very straightforward, and it proceeds that Wilder’s SAR trading laws are not extremely difficult. The below are the instructions for Wilder’s Parabolic SAR strategic plan:

- The SAR points to that of an uptrend underneath the present market price range;

- SAR dot refer to a downward trend just above stock value;

- Trade if the value crosses over the SAR or sells if the value passes well below SAR. Reach a place whenever the price reaches the SAR.

Once the value again passes the SAR, stop and reverse the spot.

Using other measures as a helpful factor in your judgment, you can improve your Parabolic SAR indicator technique. E.g., to decide whether you have dive into a trending market versus a range-bound or sideways shifting market, it could be beneficial to use a particular pattern indicator, including the ADX. It is indeed important to keep in mind that perhaps the Parabolic SAR isn’t really intended to function in a market that goes sideways.

Recognizing the overall path of the long-term trend will then help position your open trade. You may find it useful to always position an open transaction in the path of the general trend, as described by some other trend tracker. The alternative way of investing, pushing this line of thought a bit forward, would be to only carry trades mostly in the course of the general pattern, shutting them out as the market hits the SAR instead of immediately correcting it.

You can consider it appropriate to choose from a broader range instead of the regular list of MT4 indicators while selecting which complementary predictor to use to help the Parabolic SAR technique. The MetaTrader Ultimate Version is an MT4 and MT5 plugin that lets the array of resources at your discretion be greatly extended. This also arrives with a versatile ‘Trading Simulator’ that helps one back-test the policies quickly and accurately evaluate their efficiency.

Conclusion

Welles Wilder reported that perhaps the Parabolic SAR “tries to squeeze higher income from an intermediary step, a move that lasts for around two or three weeks compared to any method I know.” Generations have gone; however, the method, which would be a testimony to its usefulness, persists commonly utilized. Also, the metric can be adapted to a broader cross-section of timescales than what the above quotation indicates.

There seems to be no tendency to presume that relatively short time periods, like tick graphs and even longer ones, including daily and weekly graphs, should not be applied using a stop and reverse technique. That basic theory stays the same in all, given you deal in a trendy market.