Table of Contents

About Paypal trading account service

The e-wallet is safe for paying through gateways and has been used on recurring frequency worldwide. Many e-commerce websites are known for their inclination towards PayPal as a secured mode of payment. The various advantages have confirmed PayPal as one of the widely favored payment processors globally. Forex Brokers gradually gravitate towards PayPal for completing the transaction, thanks to the convenient process. Besides payment, cash transfer and maintaining e-wallets are pretty straightforward on this platform. Users can maintain the highest privacy of their credit card and bank details while engaging in ceaseless transactions. Using PayPal is synonymous with saving a lot of time with just one click with the tip of a finger.

Owing to the several perplexing restrictions that International Anti-Money Laundering laws have initiated, FX brokers find PayPal more flexible. Their trust in PayPal has elevated the platform to a higher pedestal than other traditional electronic payment gateways.

To learn more about this topic, visit our page: Which forex brokers accept PayPal.

How to trade using PayPal?

To trade forex, stocks, commodities, or other CFD using the PayPal payment option, you need to open a trading account using one of the PayPal brokers. PayPal brokers list is presented below.

Forex Brokers that accept deposit and withdrawal PayPal trading account

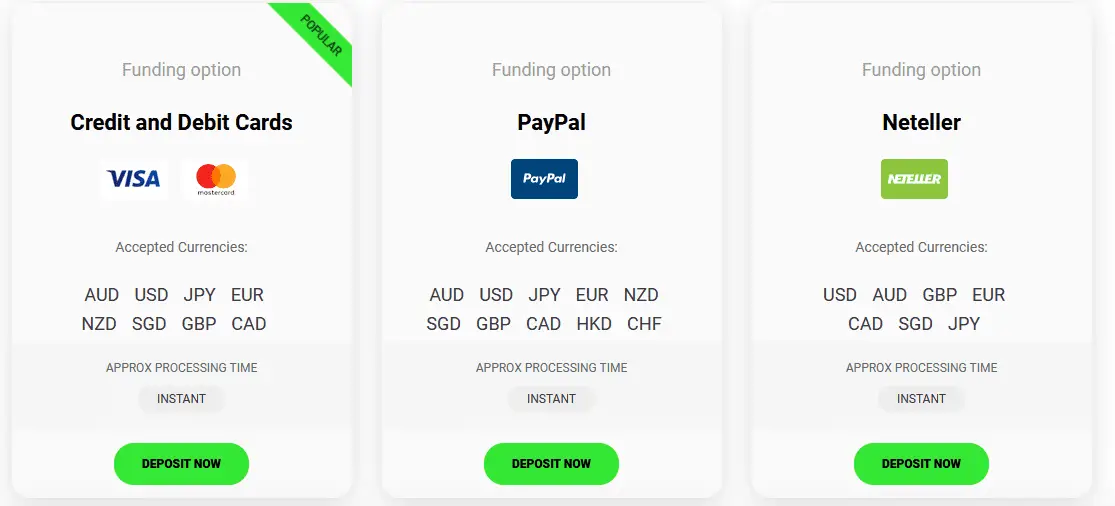

We made a list of 3 brokers who are regulated and offer a Paypal payment option :

1) Fxpro forex broker allows a PayPal payment option: This is a famous global and UK forex broker and one of the very rare brokers who offer a Paypal account as a payment method.

2) You can open an IC Markets PayPal trading account very quickly and use a very tight spread. This is an excellent choice for scalping traders.

Basic Background Information on PayPal

PayPal Holdings Inc. was founded 20 years ago in December 198 and had its headquarters in California. Coincidentally, 1998 also spearheaded the rise of the internet in the United States. eBay acquired PayPal in 2012, promoting its popularity amongst many eBay users. Since PayPal is a virtual payment processor, it is bereft of any central regulatory status. However, the company has possession of the required papers, licenses, and credentials to operate in local and international markets, sanctioned by local authorities and law. The client funds are stored in interest-incurring commercial bank accounts, the interest of which the account holders cannot access. In 20017, Luxembourg granted a banking license to PayPal, and since then, PayPal has transferred its operation from the United Kingdom to Luxembourg.

The Pros And Cons Of Using Paypal For Forex Transactions

Flexible in the process, the PayPal Forex brokers have numerous advantages. Steal a glance at some of the essential benefits and drawbacks of developing a comprehensive idea-

Pros WithPaypal Trading Account

High security with a deposit, transferring, and withdrawal of funds. The account furnishes your bank details with maximum reliability. User-friendly interface that does not delay or result in technical glitches during operation. The accounts can be deposited with money via credit cards, and bank transfer is easy for completing payments through the app. In the future, funds from PayPal accounts can be relocated to the credit card, and bank accounts within a limited span of trading accounts can be supplied with money using less capital. It can be as less as $5.PayPal has unbeatable popularity in around 100 countries that assure an unhindered transfer of money anywhere.PayPal has zero membership charges, service, and processing fees, unlike some of the other payment gateways available. It is simple and hassle-free.

Have you heard about Paypal brokers? Irrespective of whether you have heard this term, you are requested to look at the following sections. Here, you will reveal all the nitty-gritty of Paypal brokers.

To start with, as you already know that Paypal is widely considered to be one of the most popular and well-established platforms for online payments. Isn’t it? Do you even know Paypal accounts can also be used in Forex trading? Paypal Forex trading has nowadays been prevalent among traders due to various reasons. For example, Paypal trading is safe and secure. On top of that, the platform allows quick and easy fund deposit and withdrawal methods. Keep reading and learn more about the advantages, drawbacks, and FAQs on Paypal trading.

Here’s what you need to know about Paypal brokers:

Paypal is the world’s biggest and largest digital wallet system with an endless number of active accounts. So, if you have an active Paypal account, you can use it for trading. Many brokerage firms have already accepted Paypal for trading. However, please remember that you must abide by Paypal’s stringent rules and guidelines before you start trading with them.

PayPal Advantages:

Let’s now talk about the advantages of Paypal trading.

- Quick payments: One of the most significant advantages of Paypal trading is its prompt, speedy, and quick fund transfer options. Whether depositing money into your trading account or withdrawing funds to your bank account, Paypal ensures fast, secure, and reliable fund transfers.

- Easy to use: Your Paypal broker account can be accessed via their website and mobile apps. Moreover, you can link multiple debit cards and credit cards to one Paypal account and complete the transactions smoothly and seamlessly whenever required.

- Vast support: According to Paypal, it allows as many as fifty-six different currencies.

- Secure and reliable: As mentioned above, Paypal is widely acknowledged to be one of the famous and most popular eWallets. It’s undoubtedly a safe, secure, reputed, and trustworthy platform for trading.

- High transfer and withdrawal limit: Paypal supports a high transfer and withdrawal limit of as much as $60,000.

- Other benefits include a free-to-open account and no additional charges for the unused account.

PayPal Drawbacks:

In the previous sections, you have revealed the advantages of day trading with Paypal. Let’s now discuss some of its drawbacks and disadvantages.

- Paypal foreign transfer fees are incredibly high, i.e., 4.5%.

- Paypal puts charges on every trading transaction.

- Paypal has high transfer fees, which are apparently between 4%-12%.

PayPal fees

PayPal has fixated fees and commission on each transfer that can amount to 3% of the total amount being transacted. This charge is increased due to add-ons. The prices remain comparatively high than the other e-payment options. Chargebacks are not feasible with intangible goods like Forex brokers. The chargebacks are allowed with tangible services and goods. The e-payment processor has imposed several rules and limitations concerning the payment. The other e-wallet options, such as Skrill and Neteller, have outnumbered the number of Forex brokers on PayPal.

How To Make Your Way To A Dependable Paypal Forex Broker

Most brokers who accept PayPal will readily grant the choice to use their payment gateway through heavy advertising of the logo on their timelines. However, we have considered a brief list of reliable and upright brokers to help you choose wisely. Although accepting the e-payment gateway as a viable platform, many brokers do not believe in marketing the PayPal logo. In many cases, you will scarcely find any advertisement by brokers. At this juncture, communicate with the customer support team to know the payment methods, especially PayPal. The amount you are depositing initially will differ according to how you pay it. You can expect a higher fee from some brokers, while others set a negligible limit for the same.

FAQs

- Is there any Paypal bonus?

No, even if you put deposits into your Paypal account for a long time, it doesn’t accrue any interest.

2. In which countries is Paypal allowed?

Paypal is allowed for around 203 global countries as of now.

3. Is the Paypal account location-specific?

The Paypal account is country-specific. Users of any particular country can only link their bank accounts to that country. However, there’s an exception for the US Paypal account holders. US customers can link any bank account (of other countries) with their Paypal wallet.

As an e-wallet that hoards your fund, PayPal permits payment for products or services through dependable gateway methods. Merchants install the gateways on their official pages or through POS vents. The accounts on PayPal are in sync with the usual bank accounts. However, the only noteworthy difference is that PayPal is ultimately a virtual system. PayPal users have the liberty to link their credit cards and accounts to their respective accounts. This can initiate the payment process. The representatives and PayPal personnel could always sort you through payments to the Forex brokers. The return amount is quite a lump sum, and brokers are not liable for the transaction’s loss or failure.

On the other hand, many brokers are rigid in using PayPal as the sole payment gateway option. Under these circumstances, consider transferring funds through credit cards without accessing PayPal. You will not be required to open your account on PayPal. With withdrawals, the amount is redirected to the credit cards initially used to complete the payment. Due to the prevalence of Anti-Money Laundering, the traders are accorded to withdraw funds to the original payment gateway used for the account.

What Are The Important Factors To Consider While Collaborating With PayPal?

Since PayPal has been placed centrally amidst allegations and controversies, further burdened by regional restrictions, PayPal cannot be accessed in a few countries. Japan, India, Crimea, and Turkey do not fall under the list since they have legal issues with the payment processor. It is one of the significant points to consider before prepping up to use PayPal or using it for dealing with Forex payments.