Table of Contents

The main aim of traders in any financial market is to make a profit and large profits whenever possible. They look for trades that can give them 2X, 5X, 10X, and more profit. Getting such traders is possible, but in search of those trades, it is also possible that you may get the same X losses.

Thus, to avoid wiping off your capital, placing position sizing techniques are important. It helps in avoiding major losses in a single trade. The bigger the risk you take, the bigger the loss-making chances. That is why all successful traders, regardless of their domain like forex trading, equity, or index trading, prefer having position sizing methods in place.

What is position sizing?

Position sizing represents the procedure that determines the number of units invested in a particular security. In simple words, position sizing calculates how much capital traders or investors allocate to a given trade within a particular portfolio. Optimal position sizing reduces the portfolio’s risk, and it is a crucial procedure in trading risk management.

Most successful traders believe that it is also better to minimize your risk than to take more risks. This article discusses four methods that would help you understand position sizing techniques and how you can implement them.

Mostly used position sizing methods are: contract size value or fixed lot size value, fixed dollar value, fixed percentage risk per trade, volatility-based position sizing, Kelly Criterion, averaging down, maximal drawdown position sizing, Monte Carlo simulation position sizing, and custom position sizing technique.

The best position size method based on most traders is the Kelly criterion technique. It calculates position size based on past performance and uses the calculation’s winning rate and risk-reward ratio.

Trading position sizing strategies

Position sizing techniques are

- Contract size value. The fixed lot size value

- Fixed Dollar Value

- Fixed Percentage Risk

- ATR position sizing

- Kelly Criterion position sizing

- Averaging down

- Maximal drawdown position sizing

- Monte Carlo simulation position sizing

- Custom position sizing technique

Contract size value. The fixed lot size value

A lot of commodity traders and index traders utilize this position sizing method. You can easily mitigate your risk and also take advantage of the fast-moving market.

Commodity traders very often have fixed contract values that use in trading. In forex trading, traders often use a fixed lot size (fixed micro-lots or fixed mini lots or fixed lots). This is the simplest position sizing method. The fixed lot sizing method disadvantageous because it doesn’t calculate the current risk, investment value, and volatility.

As per your trading exposure and experience, you can increase your portion size eventually. You can start with a mini contract and then reach the label of standard contracts.

Fixed Dollar Value

Fixed dollar value is a position-sized technique where traders choose a fixed dollar amount for risk in each trade and represent the easiest position sizing technique.

This is one of the easiest position sizing methods. If you are new in the trading realm, this technique will help you even if you have limited trading amounts. All you have to do in this method is fix a particular amount for each trade you take up.

Let us take an example. If the trader has $5,000 trading capital, he can decide to trade $100 per trade.

Fixed Percentage Risk

Fixed percentage risk per trade represents a position-sized method where traders define risk percentage for each trade and fixed percentage risk for the whole portfolio.

Just like fixed dollar position sizing methods, this method is also straightforward to use. In this method, traders decide a certain percentage of their total capital to take each trade. It depends on the financial market you are trading in, but having a risk of around one or two percent is ideal. For forex, this kind of anti-martingale position sizing method is beneficial.

Position sizing example: If a trader has a trading capital of $100,000 and 1% risk per trade, he can risk $1000 using this position sizing technique. If a trader has a trading capital of $100,000 and 1% risk per the whole portfolio, then he can risk, for example, two trades per 0.5% ($500 per trade) or four trades per 0.25% ($250 per trade), etc. using this position sizing technique.

In this method, you focus more on percentage instead of dollar value. If you increase your trading capital, your risk-taking appetite would automatically increase. And in case you decide to reduce your capital, it would adjust automatically. Thus, it’s also an anti-martingale strategy.

ATR position sizing

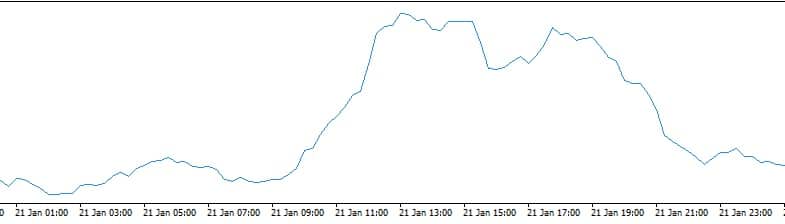

ATR position sizing or Volatility-based position size represents the position sizing method where position size is calculated based on volatility measures such as the Average True Range.

Position size =f (ATR)

On image is presented EURUSD ATR, volatility measure. A higher volatility means lower position size, and low volatility means higher position size.

Kelly Criterion position sizing

Calculate position size using Kelly criteria represents a method where traders can calculate position size based on winning rate and risk-reward ratio.

Traders can calculate how to increase position size based on past performance using the equation:

Position size = Winrate – ( 1- Winrate / Risk Reward Ratio)

Averaging down

Averaging down is the process of buying more shares or more fx lots of a position (scale-in) when the price of the underlying asset is dropping (or sell when price rising). In this position sizing method, the average down technique means that traders keep adding contracts/shares/lots if the market moves against them.

This method can be dangerous if the risk is too high when the traders’ uncontrolled trade against the main trend. However, this strategy can decrease loss.

Famous trader Joel Kruger, often in his strategies, builds position using several smaller positions at different trading times.

For example, a trader can buy EURUSD at 1.3, buy 5 mini lots at 1.3, and later 5 mini lots at 1.298. In this case, he will decrease loss and increase the profitability of trades.

Maximal drawdown position sizing

Maximal drawdown position sizing is a technique where traders calculate position size based on maximal drawdown. There are various formulas, but the goal is to create a large profit with a small loss.

Monte Carlo simulation position sizing

Monte Carlo simulation is a position sizing method used to model different outcomes when the algorithm repeated random sampling to obtain numerical results. Usually, using maximum drawdown calculates the likelihood that a future drawdown will stretch to a certain dollar amount. This technique is just one continuation of the maximum drawdown position size technique.

Custom position sizing technique

Prop companies and traders create special formulas to calculate position size based on volatility, drawdown, past performance. There are a lot of money management equations, models that calculate position sizes and portfolio risk.

For example, “The Fama and French Three-Factor Model” is most used in prop companies and corporations.

Position sizing and leverage

In forex trading, having leverage is one of the biggest advantages. Leverage is a double-edged sword in trading. It gives you wings to fly high. Most of the trading platforms give the leverage of around 50:1, 100:1, and even 200:1.

You have to keep in mind that as leverage would give you large profits, you will have the same losses if the trades move against you. And also, having leverage doesn’t mean that you have to use it.

It would help if you used a lower level of leverage to reduce the risk you take.

How many pips per day is good?

There is no exact rule on how many pips per day is good. However, each currency pair has different volatility values, so the only solution is to calculate the number of pips for your target and stop-loss using position size strategies.

For example, 30 pips can be in some moment 10% of the daily average true range, and some other day when volatility is low, 30 pips can be 50% daily average true range.

The Bottom Line

While traders always want to earn big and become millionaires, it is always advisable to have position sizing techniques to save capital in trading. No day should be your last day of trading because of taking large-size trades.

You may have heard the phrase that does not put all your eggs in one basket, right? Diversification is the key, and position sizing is the risk management tool to do so.

At the closing, let us quote one famous saying, “If you can’t sleep at night thinking about your open position, you are risking too much.”