Table of Contents

The British Pound Sterling (GBP) is one of the world’s oldest currencies and is still in use. Its rich history dates back over a millennium. The term “pound” originates from the Latin word “pondus,” meaning weight, reflecting the currency’s origins as a measure of silver.

If you check the GBPUSD price, you will see that GBP has always had a more considerable price value in the last few decades than the US dollar. For example, right now, GBPUSD is 1.25. I gave a similar answer in the previous article: why is Eur worth more than the dollar?

Why is the Pound Worth More than the Dollar?

The strength of the GBP (British Pound) compared to the USD (U.S. Dollar), indicated by an exchange rate of 1.25, means that 1 GBP is equivalent to 1.25 USD. This suggests that the GBP is more vital than the USD. The exchange rate reflects various economic factors, including supply and demand dynamics, interest rates, inflation, economic growth, and trade balances.

Here’s a breakdown of why GBP might be more potent than USD:

- Supply and Demand:

- High Demand for GBP: If there is a high demand for GBP relative to USD, the value of GBP will rise. This could be due to investors wanting to invest in the UK or the high demand for British goods and services.

- Limited Supply of GBP: If the supply of GBP is relatively limited compared to USD, this scarcity can drive up its value.

- Interest Rates:

- Central Bank Policies: The Bank of England (BoE) and the U.S. Federal Reserve set interest rates. Higher interest rates in the UK compared to the U.S. can attract foreign capital as investors seek higher investment returns. This increased demand for GBP can strengthen its value.

- Inflation Levels:

- Low Inflation in the UK: Lower inflation in the UK compared to the U.S. can increase the purchasing power of GBP, making it stronger relative to the USD. Conversely, higher inflation in the U.S. can erode the value of USD, contributing to a stronger GBP.

- Economic Growth:

- Economic solid Performance: If the UK economy performs well with solid GDP growth, it can boost investor confidence in GBP. Economic stability and growth attract foreign investments, increasing demand for GBP.

- Weaker U.S. Economic Performance: Conversely, if the U.S. economy is experiencing slower growth or economic instability, it can weaken the USD relative to GBP.

- Balance of Trade:

- Trade Surplus in the UK: A positive trade balance (exports exceeding imports) can strengthen GBP. This means the UK sells more goods and services abroad, leading to higher demand for GBP.

- Trade Deficit in the U.S.: A negative trade balance (imports exceeding exports) can weaken the USD, as it suggests the U.S. is buying more from abroad than it is selling, leading to higher demand for foreign currencies over USD.

- Investor Perception and Confidence:

- Political Stability and Economic Policies: Perceptions of political stability and sound economic policies in the UK can boost investor confidence in GBP. Conversely, political uncertainty or unfavorable economic policies in the U.S. can weaken confidence in USD.

- Global Economic Conditions: Global economic events and conditions can influence currency strength. For instance, if global investors perceive the UK as a haven during economic turmoil, demand for GBP might increase.

GBP Strenght

The GBP exchange rate to USD does not directly indicate that the UK economy is stronger than the US. Many factors beyond economic strength influence currency exchange rates, and interpreting them solely based on the exchange rate can be misleading.

- Currency Value and Economic Strength:

- The fact that 1 GBP equals 1.25 USD does not mean the UK economy is stronger or weaker than the US economy. Exchange rates reflect the relative value of one currency compared to another, influenced by factors such as interest rates, inflation, trade balances, and market sentiment.

- Purchasing Power and Trade Impacts:

- Purchasing Power: A stronger GBP means that UK residents can buy more goods and services from abroad for the same amount of GBP. This makes imports cheaper, benefiting consumers who purchase foreign products.

- Export Costs: Conversely, a stronger GBP makes UK exports more expensive for foreign buyers, potentially reducing demand for UK goods and services in international markets.

- Comparative Currency Values:

- Comparing currency values, such as 1 USD worth approximately 100 Japanese yen, does not imply that the US economy is 100 times stronger than Japan’s. Similarly, the Thai baht worth 4.25 Japanese yen does not mean the Thai economy is 4.25 times stronger than the Japanese economy. Different inflation rates, monetary policies, and other economic factors specific to each country influence currency values.

- Factors Influencing Currency Values:

- Market Perceptions: Investor confidence and market perceptions can significantly influence currency values. Positive sentiment towards a country’s economic stability and growth prospects can strengthen its currency.

- Inflation Rates: Lower inflation rates can enhance a currency’s value, as it maintains purchasing power over time. Conversely, higher inflation can weaken a currency.

- Monetary Policies: Central bank policies, such as interest rate decisions, are crucial. Higher interest rates can attract foreign investments, increasing demand for the currency.

- Units of Measurement:

- Currencies act as units of measurement and do not directly correlate to economic power. The strength of an economy is better reflected by indicators such as GDP, productivity, employment rates, and the overall size and complexity of the economic system.

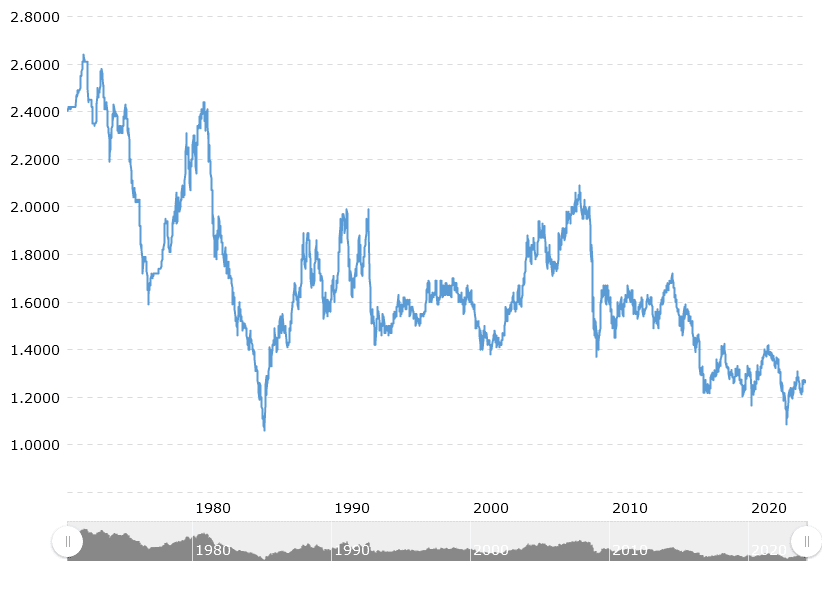

GBP Price Value in the Last 20 Years

Early 2000s to Late 2000s:

- Early 2000s (2000-2007):

- Strong Pound: The GBP was relatively strong against the USD, with the exchange rate often above 1.80 USD per GBP. This period was characterized by strong UK economic performance and relatively low inflation.

- US Economic Challenges: The US faced economic challenges, including the aftermath of the dot-com bubble burst and the 9/11 attacks, leading to a weaker USD.

- Financial Crisis (2007-2009):

- Global Financial Crisis: The 2008 financial crisis significantly impacted global currencies. The GBP/USD rate plummeted as investor confidence in the UK economy dropped, and the USD strengthened as a safe-haven currency.

- Exchange Rate Drop: The GBP/USD rate fell from around 2.00 in 2007 to below 1.40 by early 2009.

2010s:

- Post-Crisis Recovery (2010-2015):

- Slow Recovery: The UK and US economies began recovering from the financial crisis at different paces. The USD remained relatively strong due to the US Federal Reserve’s policies.

- Exchange Rate Fluctuations: During this period, the GBP/USD rate fluctuated between 1.50 and 1.70, influenced by various economic data and monetary policy decisions.

- Brexit Referendum (2016):

- Brexit Impact: The 2016 Brexit referendum profoundly impacted the GBP. The uncertainty surrounding the UK’s decision to leave the EU caused the GBP to weaken significantly.

- Sharp Decline: The GBP/USD rate dropped from around 1.50 before the referendum to below 1.30 after the vote, reflecting market concerns about the UK’s economic future outside the EU.

Late 2010s to Early 2020s:

- Post-Brexit Negotiations (2017-2019):

- Continued Volatility: The GBP remained volatile as Brexit negotiations continued. Political uncertainty and economic concerns kept the GBP/USD rate under pressure.

- Range Bound: The exchange rate generally ranged between 1.25 and 1.40 during this period.

- COVID-19 Pandemic (2020-2021):

- Pandemic Impact: The COVID-19 pandemic caused significant economic disruptions worldwide. The GBP and USD experienced volatility as governments implemented various measures to combat the crisis.

- Initial Drop and Recovery: The GBP/USD rate dropped to around 1.15 in early 2020 but recovered as the UK’s economic outlook improved and vaccination programs were rolled out.

2022 and Beyond:

- Post-Pandemic Recovery and Global Events (2022-2024):

- Economic Recovery: As economies recovered from the pandemic, central banks adjusted their monetary policies. The Bank of England and the Federal Reserve made various interest rate decisions that influenced the exchange rate.

- Global Events: Other global events, such as geopolitical tensions, trade policies, and inflation concerns, also impacted the GBP/USD exchange rate.

- Recent Trends: As of 2024, the GBP/USD rate is around 1.25, reflecting a balance of economic recovery, interest rate differentials, and ongoing market dynamics.

Key Factors Influencing GBP/USD Over 20 Years:

- Interest Rates: Differences in interest rates set by the Bank of England and the Federal Reserve significantly affect the exchange rate.

- Economic Data: GDP growth, employment figures, and other UK and US economic indicators influence investor sentiment.

- Political Events: Major political events, such as Brexit, elections, and policy changes, create uncertainty and volatility in the exchange rate.

- Global Economic Conditions: Global financial crises, pandemics, and other macroeconomic events impact GBP and USD.

Conclusion

Currency values, including the exchange rate between GBP and USD, provide insights into the relative value of currencies but do not serve as direct indicators of economic strength. A broader range of economic indicators and factors must be considered when assessing the comparative strength of different economies.